[ad_1]

The WisdomTree International Quality Dividend Growth Index (WTIDG) and the WisdomTree International Hedged Quality Dividend Growth Index (WTIDGH) may have their 10-year anniversary on the finish of November.

WTIDG is tracked by the WisdomTree International Quality Dividend Growth Fund (IQDG), whereas WTIDGH is tracked by the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), which hedges publicity to worldwide currencies for a USD-based investor. The inventory portfolio of each Indexes is identical, with WTIDGH hedging forex publicity utilizing ahead forex contracts.

Since its inception, the funding goal of the technique has remained constant, offering traders with publicity to corporations that look enticing throughout measures of profitability, like return on equity (ROE) and return on assets (ROA), and earnings development prospects. Weighting is by Dividend Stream® preserve valuations in verify.

WisdomTree’s approach of assessing an organization’s high quality (profitability) and its capacity to develop dividends has allowed WTIDG to outperform the MSCI EAFE Index by 1.22% yearly over these nearly 10 years. WTIDGH has outperformed the MSCI EAFE Local Index by 2.55% yearly throughout the identical interval.1

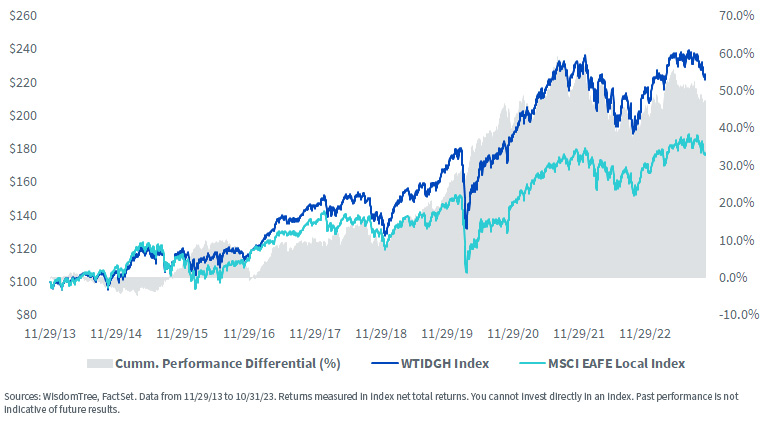

Using forex hedging throughout this era had a major affect on efficiency, given USD power. WTIDGH was up 8.48% yearly, whereas WTIDG was up 4.22%. Together with doubling efficiency, WTIDGH’s annualized volatility was nearly 2 share factors decrease (13.02% vs. 14.98%) in comparison with WTIDG.

For a deeper dive into the impact of currency hedging, refer to a recent blog post by my colleague Bradley Krom.

USD Returns: Progress of $100

For definitions of phrases within the chart above please go to the glossary.

Hedged Returns: Progress of $100

WTIDG is a part of WisdomTree’s High quality Dividend Progress household, whose oldest index, the WisdomTree U.S. Quality Dividend Growth Index, also turned 10 in April of this year.

Index Methodology

The methodology for WTIDG’s annual rebalance, which occurred on November 8, may be defined within the following phases:

1. Beginning Universe: The Index’s beginning universe consists of dividend-paying developed worldwide2 equities that meet WisdomTree’s liquidity necessities and whose market caps exceed $1 billion. Firms whose dividend protection ratios are lower than 1 (i.e., dividends exceed earnings) are eliminated, as are corporations flagged as dangerous by WisdomTree’s Composite Risk Score (CRS).

2. Composite Rating Choice: Firms are then ranked primarily based on an equally weighted composite rating of development and high quality. Progress is outlined as consensus estimated earnings development over the following one to a few years, whereas high quality is calculated as a 50/50 rating of the corporate’s common three-year ROE and ROA. The highest 300 corporations are chosen for the portfolio.

3. Ultimate Portfolio: The 300 corporations chosen are weighted by Dividend Stream to replicate the proportionate share of mixture money dividends. A person holding cap of 5% is utilized previous to a 20% nation cap and a 20% sector cap for all sectors besides Actual Property (15%).

The chart under highlights the phases of WTIDG’s newest rebalance in November 2023 and compares portfolio traits with these of the MSCI EAFE Index (teal).

For definitions of phrases within the charts above, please go to the glossary.

Rebalance Highlights

WTIDG’s beginning universe already exhibits a top quality tilt coming from eradicating non-dividend payers and corporations whose dividends exceed earnings or are prone to slicing their dividend funds as recognized by the CRS rating (increased mixture ROE than the MSCI EAFE and better/decrease publicity to highest/lowest ROE quintiles).

Upon deciding on the 300 best-ranking corporations on the composite rating of development and high quality and Dividend Stream weighting the basket, the portfolio displays stronger high quality and development traits. Mixture ROE exceeds the MSCI EAFE by greater than 12%, and the median estimated development of the portfolio is 2% increased. Virtually two-thirds of the load is allotted to the highest-ROE corporations. The valuation of the portfolio is increased than the MSCI EAFE, exhibiting a premium that a few of these worthwhile growers have. And the dividend yield of the basket is consistent with the market.

Sectors like Well being Care and Shopper Discretionary are over-weights, whereas Financials are under-weight. The portfolio additionally over-weights Spain, Switzerland, Netherlands and the UK and under-weights Japan and Germany.

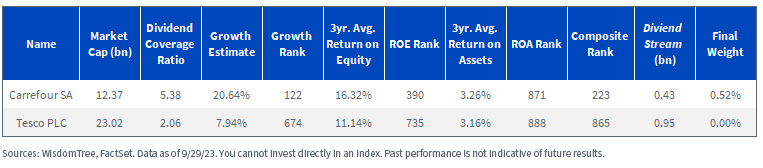

Exhibiting additional granularity into the Index methodology, under is an instance of the parameters used within the 2023 rebalance for 2 comparable corporations, Carrefour SA and Tesco Plc. Each are Shopper Staples that function bodily and on-line supermarkets.

Tesco’s revenues are concentrated within the UK, with greater than 90% coming from that market. Carrefour’s enterprise is primarily positioned in France however is extra diversified, producing 27% of income from the remainder of Europe and north of 20% in Latin America.

Carrefour made it into the ultimate portfolio rebalance, whereas Tesco was not included because it didn’t rank within the prime 300 names on the composite rating of development and high quality.

As seen under, Carrefour’s development estimate over the following three years far exceeds that of Tesco, and together with the next three-year common ROE, it made it into the highest 300 names.

Carrefour’s $430 million of trailing 12-month dividends represents 0.42% of the whole $101.26 billion of all 300 names chosen into the basket. Thus, its last weight after single inventory, nation and sector changes was 0.52%.

For definitions of phrases within the charts above, please go to the glossary.

The best way to Incorporate IQDG/IHDG into Portfolios

Regardless of the view is on forex hedging, we consider that WisdomTree’s methodology of choosing worthwhile dividend growers in IQDG/IHDG generally is a good core publicity for an investor’s worldwide portfolio. A complementing publicity to the WisdomTree Japan Hedged Equity Fund (DXJ) would assist handle a few of the valuation premium that exists for high-quality names and enhance publicity to the Japanese market, which we consider has room for further growth. An 80/20 publicity to IQDG/IHDG and DXJ would lead to an over-weight to Japan and cut back the place’s trailing P/E to 16.2x.

1 Sources: WisdomTree, FactSet. Knowledge from 11/29/13 to 10/31/23.

2 Developed worldwide nations: Japan, the 15 European nations (Austria, Belgium, Denmark, Finland,

France, Germany, Eire, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom), Israel, Australia, Hong Kong and Singapore.

Necessary Dangers Associated to this Article

For present Fund holdings, please click on the respective ticker: IQDG, IHDG, DXJ. Holdings are topic to threat and alter.

IQDG: There are dangers related to investing, together with potential lack of principal. Overseas investing entails particular dangers, reminiscent of threat of loss from forex fluctuation or political or financial uncertainty. Heightened sector publicity will increase the Fund’s vulnerability to any single financial, regulatory or different growth impacting that sector. This will likely lead to larger share worth volatility. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit, and the Fund doesn’t try to outperform its Index or take defensive positions in declining markets. As a result of funding technique of this Fund, it could make increased capital acquire distributions than different ETFs. Dividends will not be assured, and an organization at the moment paying dividends could stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

IHDG: There are dangers related to investing, together with potential lack of principal. Overseas investing entails particular dangers, reminiscent of threat of loss from forex fluctuation or political or financial uncertainty. To the extent the Fund invests a good portion of its property within the securities of corporations of a single nation or area, it’s more likely to be impacted by the occasions or situations affecting that nation or area. Dividends will not be assured and an organization at the moment paying dividends could stop paying dividends at any time. Investments in forex contain extra particular dangers, reminiscent of credit score threat and rate of interest fluctuations. Spinoff investments may be unstable and these investments could also be much less liquid than different securities, and extra delicate to the impact of assorted financial situations. As this Fund can have a excessive focus in some issuers, the Fund may be adversely impacted by modifications affecting these issuers. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit and the Fund doesn’t try to outperform its Index or take defensive positions in declining markets. As a result of funding technique of this Fund it could make increased capital acquire distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

DXJ: There are dangers related to investing, together with potential lack of principal. Overseas investing entails particular dangers, reminiscent of threat of loss from forex fluctuation or political or financial uncertainty. The Fund focuses its investments in Japan, thereby growing the affect of occasions and developments in Japan that may adversely have an effect on efficiency. Investments in forex contain extra particular dangers, reminiscent of credit score threat, rate of interest fluctuations, by-product investments which may be unstable and could also be much less liquid than different securities, and extra delicate to the impact of assorted financial situations. As this Fund can have a excessive focus in some issuers, the Fund may be adversely impacted by modifications affecting these issuers. As a result of funding technique of this Fund it could make increased capital acquire distributions than different ETFs. Dividends will not be assured, and an organization at the moment paying dividends could stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link