[ad_1]

Head of Fastened Revenue Technique

Indisputably, one of many extra noteworthy developments within the monetary markets of late has been the plunge in U.S. Treasury (UST) yields. Solely a month or so in the past, traders had been taking a look at 5% yield ranges, or near it, alongside a lot of the UST maturity spectrum. In truth, some prognosticators had been even mentioning {that a} 6% UST 10-Yr yield shouldn’t be dominated out. So, the pure query to ask is: what occurred in such a brief time frame?

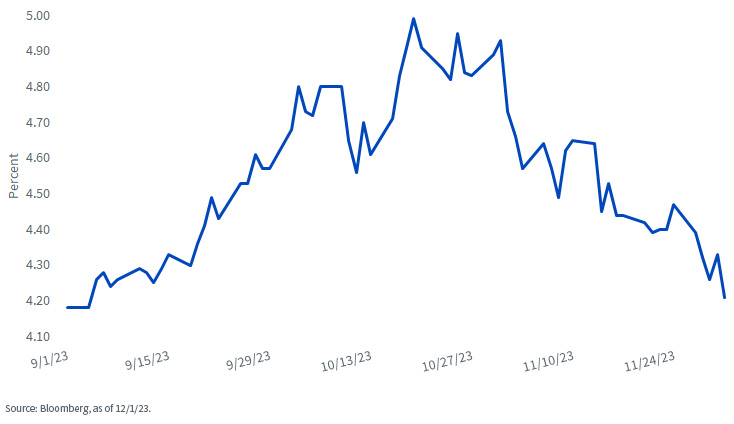

U.S. Treasury 10-Yr Yield

Let’s go to the videotape for some perspective. Because the graph highlights, the UST 10-Yr yield has now basically reversed your complete enhance it skilled in September and October. Simply what did that entail, precisely? A transfer of roughly 80 basis points (bps), first to the upside, and now to the draw back. Bear in mind, how I blogged about volatility in the bond market last week? Properly, it doesn’t get extra unstable than that in bond-land.

Sometimes, a reversal in yields of the magnitude we’re discussing, particularly in such a comparatively brief interval, would require a sea-change in some key ingredient such because the financial system, inflation and/or monetary policy. Whereas the tempo of financial progress does seem like slowing from Q3’s strong studying of 5.2%. Based mostly on the St. Louis Fed GDP Nowcast estimate, it appears to be like like actual GDP for This autumn might nonetheless be coming in just below 2%, or not too far faraway from the primary six months of 2023. With respect to inflation, progress continues on this entrance as effectively, however the latest annualized studying on the Fed’s most popular inflation gauge, the core PCE Price Index, got here in at 3.5%, or nonetheless visibly above the coverage maker’s 2% goal.

So, that leaves us with the financial coverage quotient and, little question, that is the place the outlook has shifted dramatically. The cash and bond markets have now moved up the timeframe for the primary Fed price minimize and elevated the cumulative quantity of anticipated decreases for the Fed Funds trading range for 2024. To supply perspective, March of subsequent yr is now being seen as the start of the speed minimize cycle fairly than June/July beforehand. As well as, the implied likelihood for Fed Funds Futures has now priced in 5 or 6 price cuts for 2024, for a complete of about 125 to 150 bps. Compared, as not too long ago as October 31, expectations had been geared towards three price cuts value roughly 75 bps in whole.

Conclusion

Arguably, one could make the case that the UST market has already priced in a number of excellent news, so as a way to preserve yields at present ranges (and even decrease), validation shall be vital. What does that imply? Financial/labor market knowledge must reveal a visual slowing in progress whereas inflation should proceed to point out indicators of additional cooling. These two forces shall be vital for the Fed to start their ahead steering towards price cuts, not to mention really reducing the Fed Funds price. For my part, the cash and bond market’s newfound optimistic financial coverage outlook could also be ripe for some disappointment.

[ad_2]

Source link