[ad_1]

Over the previous two years, rising interest rates reversed a number of longstanding market relationships so considerably that they defy historic precedent.

Essentially the most damning proof is discovered within the fairness market, the place newly constructive correlations between inventory and bond returns get rid of the diversification profit that existed when the historic relationship was persistently adverse. Market commentary has rightfully targeted on this, because it newly challenges the conventions of portfolio development.

However different relationships have been upended as properly.

Over the past 20 years, equities maintained steadily constructive correlations with adjustments in U.S. Treasury yields, as regular financial development propelled fairness markets greater and offered upward, but not prohibitive, strain on charges. This pattern was exacerbated by the very nature of a low rate of interest atmosphere since yield adjustments from one interval to the subsequent contained an upward bias.

Although it fluctuated all through the financial cycle, the connection remained persistently constructive for each massive caps and small caps. The pattern was constant throughout all 9 U.S. fairness measurement and elegance mixtures as properly, with small caps and value types sustaining barely stronger relationships than massive caps and growth.

Median Rolling 36M Correlation of Russell U.S. Index Household vs. 10-Yr Treasury Yield (since 2005)

For definitions of indices within the desk above, please go to the glossary.

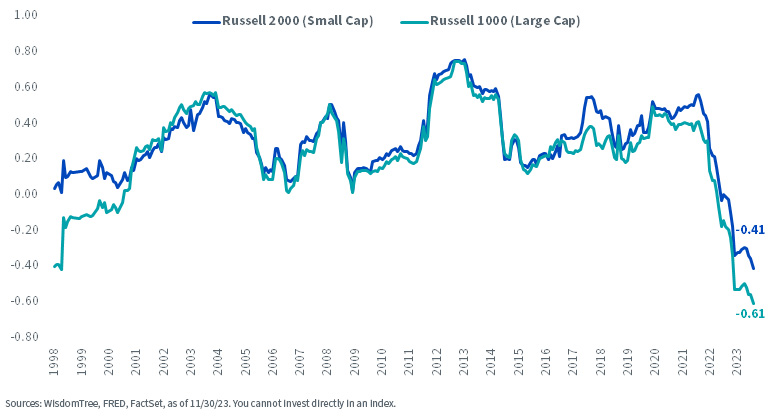

However after greater than 500 basis points of cumulative fee hikes over the previous two years, the connection started to interrupt down in late 2021. Two years later, large- and small-cap equities at the moment are deeply negatively correlated with adjustments in rates of interest for the primary time in our 25-year information historical past.

Rolling 36M Correlation: Giant Cap & Small Cap Returns vs. Adjustments in 10-Yr U.S. Treasury Yield

Regardless of the shift, these correlations could counsel near-term upside for equities within the prevailing rate of interest atmosphere.

Though rate hikes impeded danger sentiment and embedded most U.S. fairness indexes in adverse territory for the previous two years,1 an eventual monetary policy pivot could revitalize broader optimism. The Federal Reserve has insinuated that it plans to carry interest rates regular over the close to time period, and that its subsequent coverage fee determination is could probably be a fee minimize versus one other hike, offered there are not any constructive financial surprises that disrupt the current pattern of softening information.

Meaning markets are probably atop the rate of interest plateau and eagerly await the descent. As soon as the pivot to coverage easing commences, we predict a contemporary injection of danger urge for food shall be swift and pronounced.

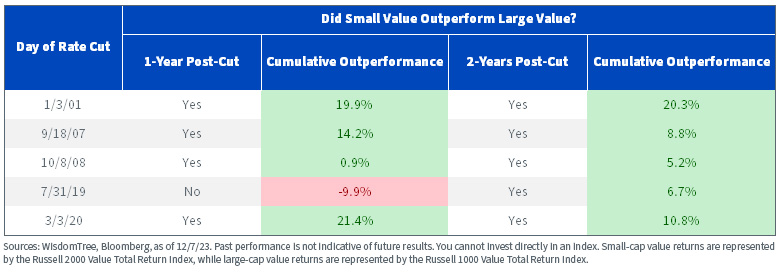

In that state of affairs, we surmise that conventional risk-on darlings like small cap equities could catch an overdue tailwind. Small-cap worth, specifically, has a powerful file of outperformance over large-cap worth as soon as the FOMC initially pivots to accommodative coverage.

Over the previous 20 years, the Fed minimize charges after extended durations of excessive, or regular, charges on 5 events. Through the one- and two-year durations following these reductions, small-cap worth outperformed massive cap worth in 9 of ten observations to a compelling extent.

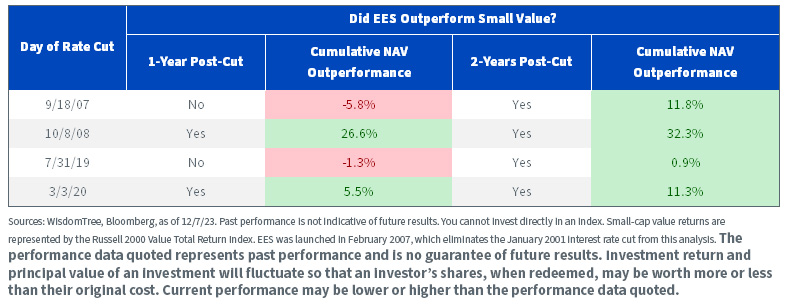

The WisdomTree U.S. SmallCap Fund (EES) recorded even higher success over the latter 4 cuts proven above, outperforming broad small-cap worth over the next one- and two-year durations in six of eight observations.

For the latest month-end efficiency, standardized efficiency, and 30-day standardized yield click on here.

Three of the 4 observations throughout the two-year subsequent returns additionally notched double-digit outperformance over broader small-cap worth.

It additionally trades at an analogous valuation to the broader market,2 which can create a gorgeous entry level for potential allocations. It presently has an 11.0 occasions estimated price-to-earnings (excluding adverse earners) a number of versus 13.8 occasions for the Russell 2000 and 11.4 occasions for the Russell 2000 Value.

Total, we’re inspired by the historic monitor file for small-cap worth within the coverage atmosphere instantly earlier than and after fee cuts and assume the WisdomTree U.S. SmallCap Fund (EES) could also be in an acceptable place to think about.

1 Supply: Bloomberg, as of 12/7/23, masking the interval 12/31/21–12/7/23.

2 Sources: WisdomTree, FactSet, as of 12/7/23. You can not make investments straight in an index.

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. Funds focusing their investments on sure sectors and/or smaller corporations improve their vulnerability to any single financial or regulatory improvement. This will likely lead to larger share value volatility. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link