[ad_1]

The publish 11/1 Fed assembly bull rally has been very spectacular. The S&P 500 (SPY) is knocking on the door of the all time highs. Nevertheless, small caps are nonetheless a good distance away from their previous peak. Uncover why funding veteran Steve Reitmeister is pounding the desk on small caps within the weeks and months forward. Plus he shares his hand picked picks. Learn on beneath for extra.

Everyone knows why the market is rallying. Dovish tilt by the Fed solidifies the probability for a smooth touchdown earlier than they decrease charges and economic system picks up steam. That’s about as bullish of a recipe as you’ll be able to have.

With that shares are sprinting in the direction of their all time highs to shut out 2023. Thus, I believed it could be attention-grabbing to evaluation the three key inventory indices to see how distant from their all time highs…and what which may inform us about worth motion going into 2024.

Let’s begin with the S&P 500 (SPY) centered on massive cap shares:

Right here the index peaked on January 3, 2022 with a closing excessive of 4,796. Shares have been flirted with that degree on Wednesday earlier than dramatic intraday dump ensued. But on Thursday as soon as once more traders purchased that dip resulting in closing the Thursday session at 4,746.

The purpose is that that is the healthiest wanting index rising +23.63% this yr and solely about 1% away from the all time highs. Little question we are going to eclipse that mark pretty quickly. Only a query of whether or not that occurs by the tip of 2023 or early within the New 12 months.

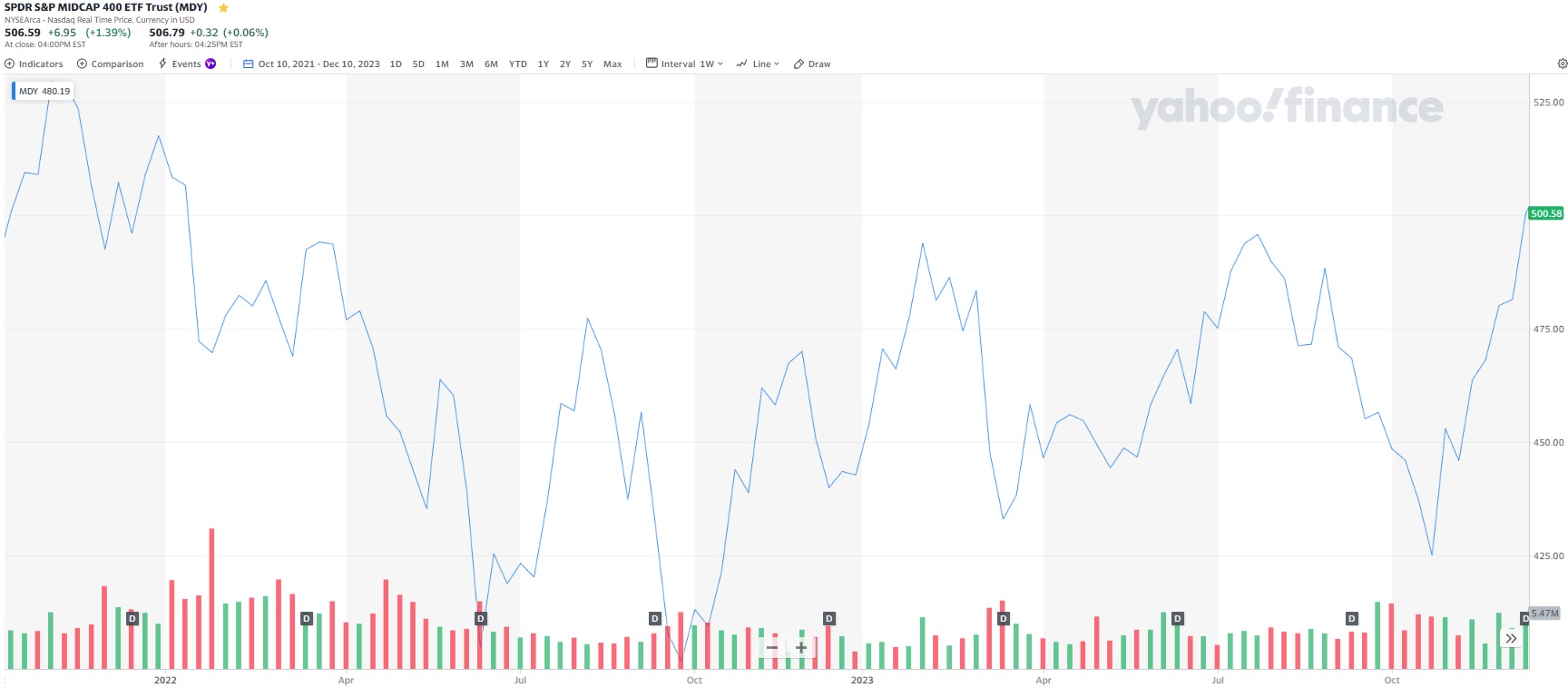

Subsequent let’s downshift to a view of the midcap shares as represented by S&P 500 Midcap ETF (MDY).

Right here we now have a closing excessive made about 2 months earlier than the big caps on November 16, 2021 at 515.53. MDY was effectively beneath that mark a lot of the yr, however has performed lots of catch up for the reason that November 1st Fed assembly that sparked this finish of the yr rally that broadened out past the big caps.

This index is simply lower than 2% beneath its all time highs. Good odds to eclipse within the days remaining in 2023. But when not then straightforward hurdle to make early in 2024.

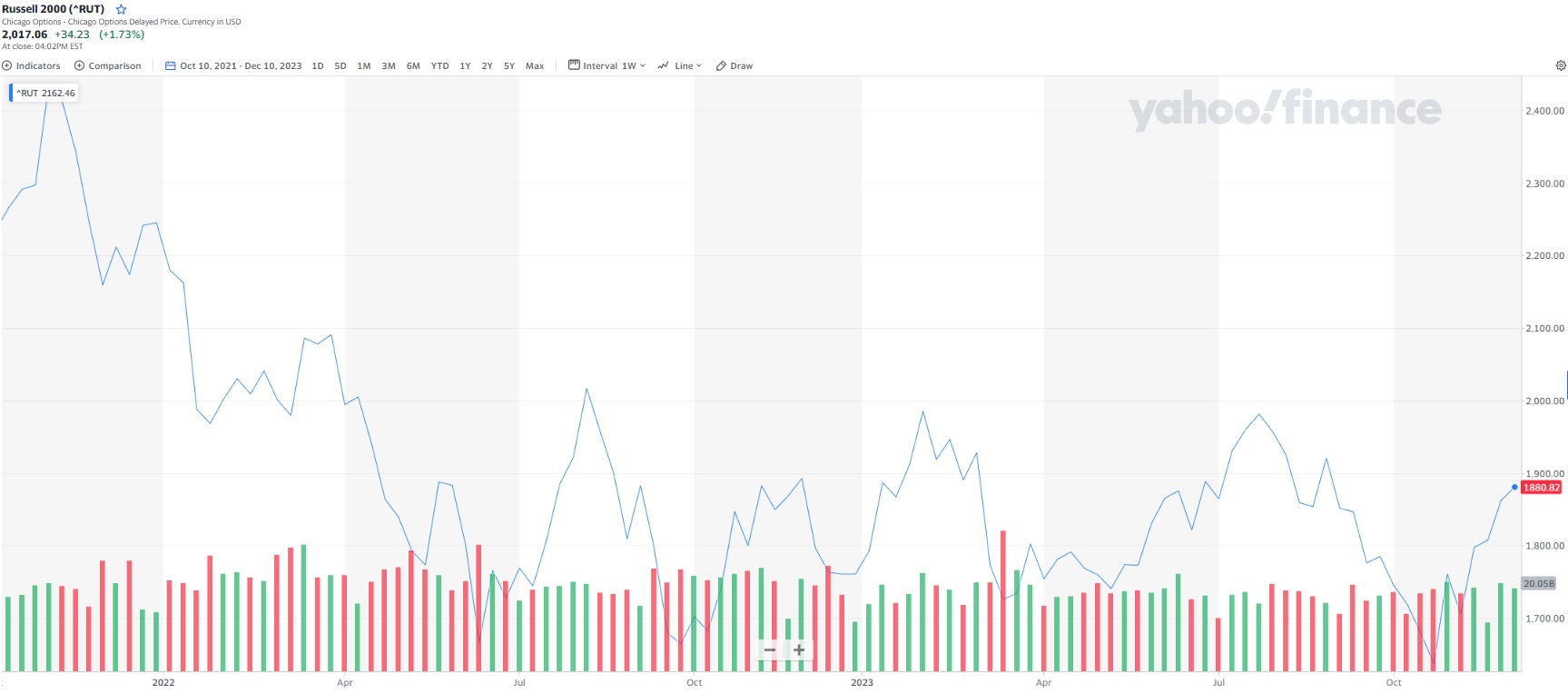

Lastly, we are going to take a gander on the small cap shares greatest represented by the Russell 2000 index:

This index topped out at 2,442 all the best way again on November 8, 2021. Even with the rotation to small caps of late, the index solely closed at 2,017 on Thursday. Meaning we’re nonetheless 17% beneath the all time highs.

This underperformance by small caps isn’t a latest phenomenon. Moderately you might actually return 4 years with pretty constant outperformance of enormous cap shares.

But the additional we return in time…the extra we perceive that small caps sometimes outperform massive caps by a pleasant margin. Very true throughout bull markets as traders concentrate on development and upside potential.

The purpose being that this latest rotation to small shares has legs and never too late to hitch the get together. The secret’s WHICH small caps have the most effective alternative to outperform?

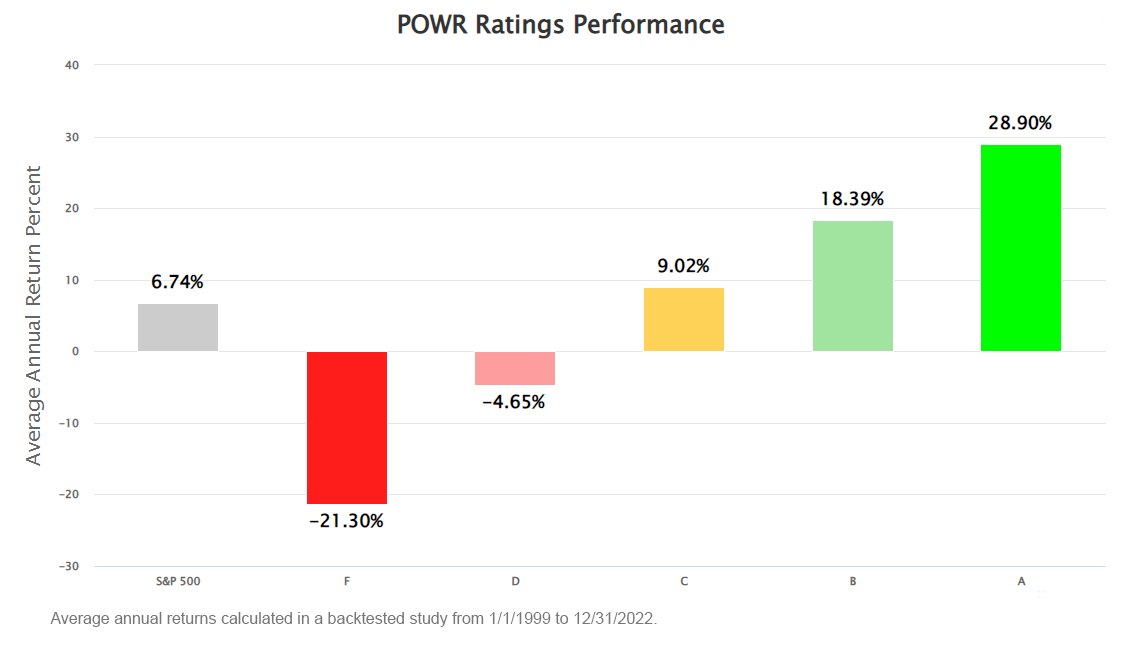

That could be a great benefit we now have with the POWR Ratings system that analyzes 118 components for each inventory. That means it does as deep of a dive on a mega cap like Apple because it does on a hidden gem beneath $1 billion market cap.

Having these 118 components of the corporate in our favor is what results in great outperformance. Like 4X higher than the S&P 500 for our A rated POWR Shares going all the best way again to 1999.

Lengthy story brief, you’ll want to lever up on small caps with the most effective POWR Scores. And that’s exactly what you can find within the subsequent part…

What To Do Subsequent?

Uncover my present portfolio of 11 shares packed to the brim with the outperforming advantages present in our unique POWR Scores mannequin.

This consists of 4 small caps not too long ago added with great upside potential.

Plus I’ve added 2 particular ETFs which can be all in sectors effectively positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and every little thing between.

In case you are curious to study extra, and need to see these 13 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.15 (+0.03%) in after-hours buying and selling Thursday. 12 months-to-date, SPY has gained 25.48%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Total Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish When Will Stocks Break to New Highs? appeared first on StockNews.com

[ad_2]

Source link