[ad_1]

In case you solely targeted on the returns of the MSCI Emerging Markets (EM) Index, you’d assume EM was lifeless cash. In case you appeared on the MSCI Rising Markets Ex-China Index, you’d mainly be at breakeven during the last two years. However in case you take a look at the WisdomTree India Earnings Fund (EPI), you is perhaps shocked to see what’s potential in India. On this piece, we focus on the basic drivers of Indian fairness efficiency and why these drivers could also be poised to proceed.

China Dominates EM Benchmarks

During the last decade, China has made a concerted effort to broaden entry to its capital markets. Because of this, main benchmarks just like the MSCI Rising Markets Index have seen China rise in weight from lower than 5% within the early 2000s to just about 30% at this time. Whereas China is a big market that deserves consideration from buyers, the problem now’s that essentially the most generally adopted rising markets benchmark is sort of utterly beholden to Chinese language fairness market efficiency. As we present within the chart under, Chinese language shares have languished during the last two years, dragging down benchmark returns. Nonetheless, even methods that exclude China are barely decrease. We distinction these returns with Indian equities, which have delivered sturdy returns, notably during the last 12 months.

EM Fairness Efficiency: 12/31/21–2/9/24

For definitions of phrases within the graph above, please go to the glossary.

What’s Driving Returns

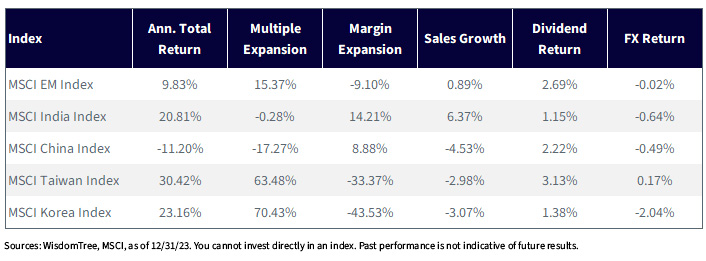

For buyers who’re open to the thought of not utilizing a one-size-fits-all/broad-index-based method to EM investing, your three greatest single-country choices during the last 5 years have tended to be India, Taiwan and South Korea. Nonetheless, what’s putting is the differentiation in drivers of complete return.

One Yr

For definitions of phrases within the desk above, please go to the glossary.

As we talked about earlier than, as the most important weighting in rising markets, focus in China is weighing down broad index returns on account of dramatic a number of contraction as gross sales development recedes. In contrast, India has skilled sturdy efficiency resulting from its sturdy fundamentals efficiency with a number of contraction during the last 12 months. Though Taiwan has delivered practically 1,000 basis points of extra returns, a lot of it has been pushed by a number of growth from its largest index holding, Taiwan Semiconductor. Whereas TSMC has been a giant beneficiary of the market’s concentrate on AI/the U.S. Chips Act, the query many buyers face is: Are some of these outcomes sustainable or repeatable going ahead?

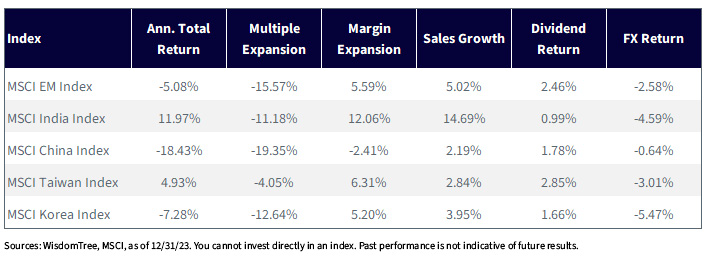

Three Years

During the last three years, India has delivered best-in-class efficiency even when multiples have continued to contract. Regardless of this headwind, Indian corporations have skilled double-digit gross sales and margin growth. Moreover, FX headwinds in India could possibly be abating, which may start to unwind the practically 5% erosion in complete returns for U.S.-based buyers.

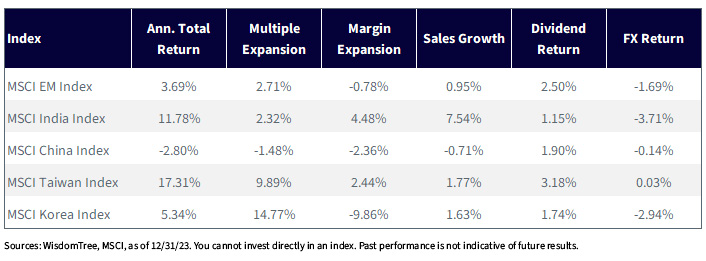

5 Years

During the last 5 years, India has delivered sturdy basic efficiency, rising gross sales by practically 8% per 12 months. Whereas multiples have expanded by 2.3% per 12 months over throughout this era, they’re removed from overvalued, in our view. So long as India can proceed to ship strong development versus different markets, we consider we could also be within the early innings of a dramatic repricing of Indian belongings versus China. We really feel that China is at present on the verge of experiencing a misplaced decade. For a lot of buyers, India could also be a powerful choice to counter a difficult macro setting and self-inflicted wounds from Chinese language coverage makers.

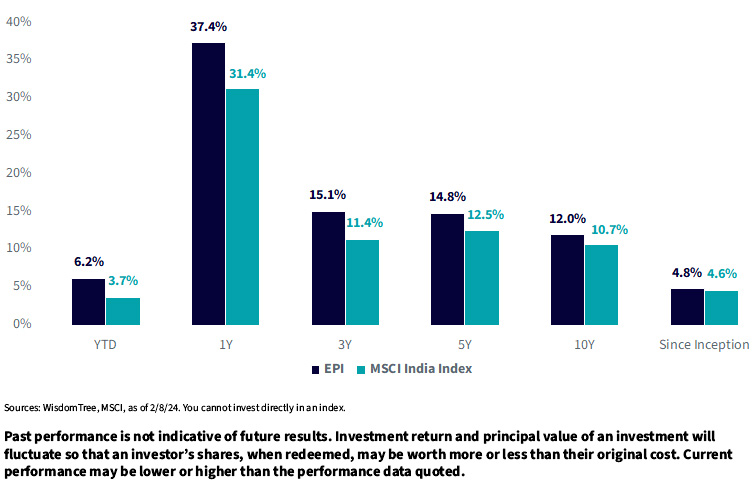

EPI vs. MSCI India Index Efficiency

For the latest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on here.

Including Worth vs. MSCI India

One in every of our main views of investing is that market cap weighting is flawed. In India, that is no totally different. By focusing solely on worthwhile corporations, EPI tends to commerce at a decrease P/E multiple than MSCI India. Over time, this has had the affect of delivering extra returns throughout practically each interval we examined. Whereas there aren’t any ensures that these traits will proceed, we proceed to advocate that methods anchored to fundamentals can ship long-term worth to buyers looking for development from Indian fairness publicity.

Essential Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. International investing includes particular dangers, resembling threat of loss from forex fluctuation or political or financial uncertainty. This Fund focuses its investments in India, thereby rising the affect of occasions and developments related to the area that may adversely have an effect on efficiency. Investments in rising, offshore or frontier markets resembling India are typically much less liquid and fewer environment friendly than investments in developed markets and are topic to further dangers, resembling dangers of opposed governmental regulation and intervention or political developments. As this Fund has a excessive focus in some sectors, the Fund might be adversely affected by adjustments in these sectors. As a result of funding technique of this Fund, it might make greater capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link