[ad_1]

Two widespread inquiries from purchasers relating to an rising markets portfolio are the suitable weight for China and the extent of foreign money hedging required. In our most actively managed rising markets multifactor technique and corresponding ETF, we handle these considerations.

China’s Weight

The load of China in a cap-weighted portfolio has considerably decreased from over 30% to round 22%, as a result of aftermath of its extremely leveraged housing bubble bursting and the growing fear over continued crackdowns on non-public companies since 2021. Regardless of its decrease weight in widespread benchmarks, China continues to dominate headlines because the U.S. identifies it as a serious competitor, and we see little signal of main enhancements coming for the U.S.-China relationship.

Whereas China is exploring fiscal and financial coverage treatments, we’ve beforehand mentioned that it’s unlikely to pursue stimulated growth. Concurrently, the U.S. continues to impose destructive tech and commerce restrictions.

To deal with this ongoing rigidity and uncertainty for China publicity, we provide quite a lot of choices for purchasers, starting from utterly excluding China, as seen in our growth-oriented ex-China Fund (XC) and EM Quality Dividend Fund (DGRE), to the dividend-weighted Funds like DEM and DGS that observe an element technique and decide China’s weight accordingly.

However in our most lively multifactor technique, EMMF, China’s weight is about 10%, which is an under-weight place however nonetheless vital sufficient to seize some upside.

Varied Rising Markets Funds with China Weights from 0% to Full Index Weight

The under-weight place in China in 2023 benefited EMMF, because it outperformed the benchmark by roughly 14%. Nonetheless, China isn’t the first cause for EMMF’s outperformance.

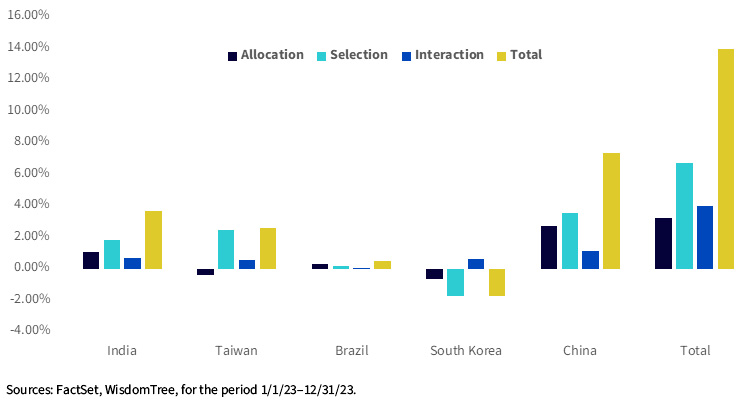

About 2.7% alpha resulted from the Fund’s under-weight in China and three.54% got here from inventory choice amongst Chinese language shares. The allocation and inventory choice for India/Taiwan additionally added worth, indicating the effectiveness of the issue mannequin. On internet whole, inventory choice accounts for twice as a lot outperformance than lively nation allocations.

EMMF Attribution for 2023: China accounts for half of outperformance, and greater than half got here from inventory choice, not simply allocation

Forex Hedging

Hedging rising markets currencies is often expensive. Nonetheless, as a result of increased relative rate of interest within the U.S., hedging in a number of currencies, reminiscent of CNY and TWD, now yields a constructive carry.

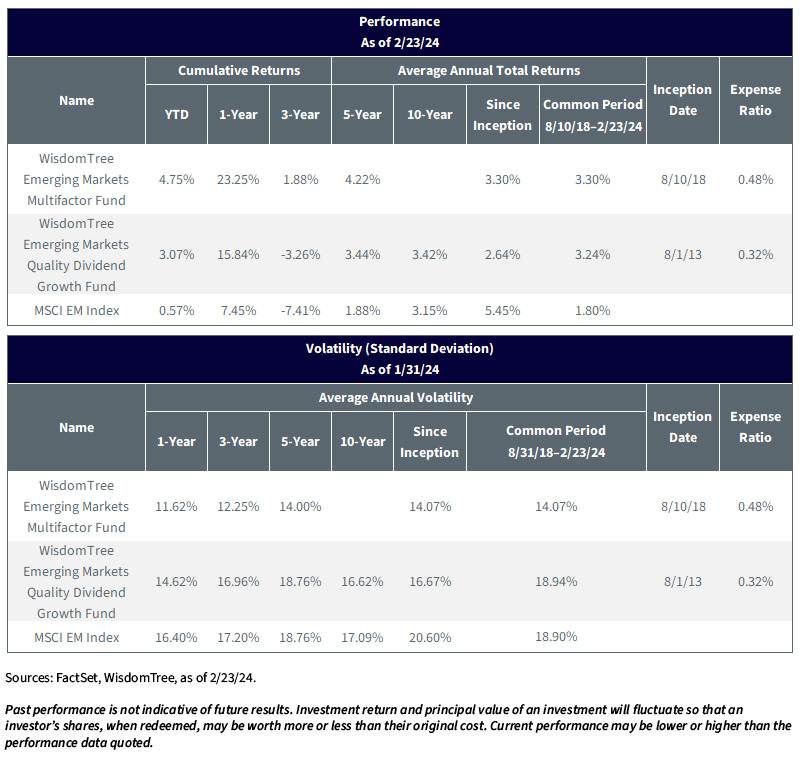

We make use of a factor-based dynamic currency model which usually lowered portfolio danger by about 1% yearly.

Because the beneath efficiency traits reveals, under-weight allocations to China, issue bets on momentum and correlation, not simply high quality and worth, which was implicit within the different technique (DGRE), and dynamic foreign money hedging has labored to considerably decrease danger.

Previous efficiency isn’t indicative of future outcomes. Funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when redeemed, could also be value roughly than their unique price. Present efficiency could also be decrease or increased than the efficiency knowledge quoted.

For the latest month-end and standardized performances and to obtain the Fund prospectus, click on here.

For definitions of phrases within the tables above, please go to the glossary.

Issue Fashions in Inventory Choice

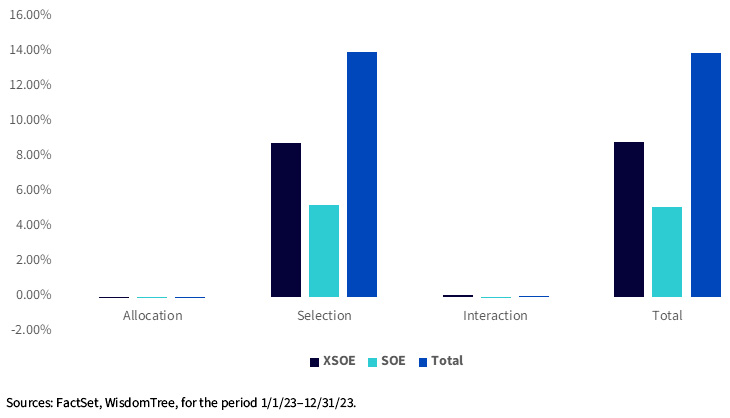

Within the rising markets, whether or not an organization is a state-owned enterprise (SOE) significantly impacts its revenue margins. For the EM Multifactor Fund, we keep a impartial weight in SOEs. In 2023, the factor-based inventory choice mannequin added worth for each the SOE and non-SOE universe, with increased impact within the non-state-owned universe.

EMMF 2023: Most outperformance got here from inventory choice, not allocation between SOE/XSOE

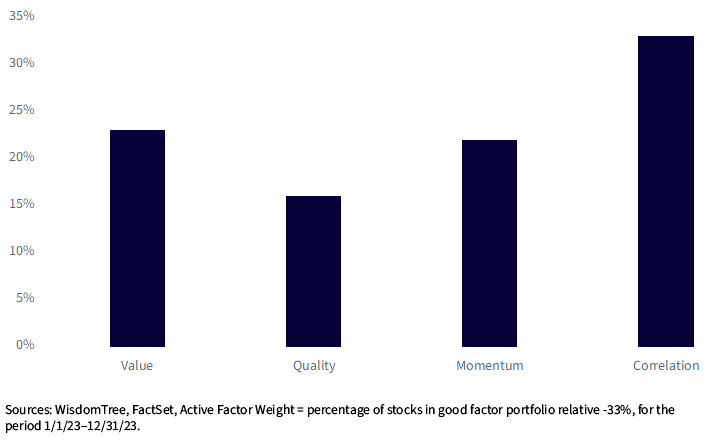

EMMF’s multifactor technique is over-weight in conventional elements (worth, high quality, momentum and correlation) from a bottom-up strategy. The portfolio is often over-weight in all 4 elements from the mannequin that features each deep number of a multifactor rating after which a weighting course of that tilts weight to those elements and away from simply market cap and dimension.

EMMF 2023: Energetic Issue Weight

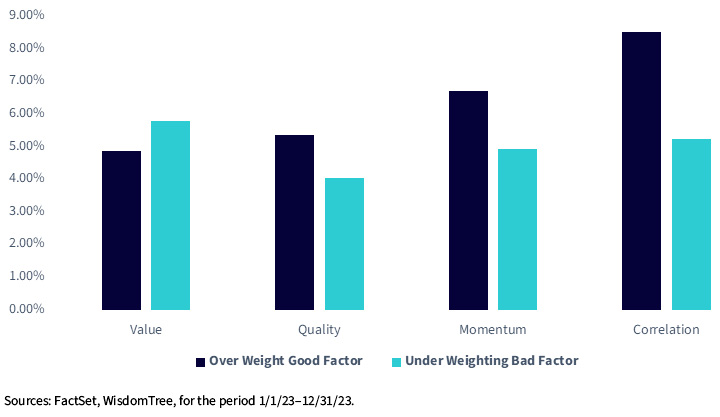

The allocation impact of all 4 elements added worth. Extra importantly, the inventory choice results of the elements have been much more vital for 2023. Throughout all elements, and from each ends, from the over-weight allocation of excellent issue shares, and the under-weight allocation of dangerous issue shares, all of it added worth.

2023: Outperformance from each the over-weight in good issue and under-weight in issue rating shares

In Conclusion

In 2023, our most actively managed rising markets portfolio had a profitable yr. Nearly all fashions carried out favorably, aside from the foreign money mannequin, although it did cut back the general portfolio danger on high of the fairness mannequin.

Because the portfolio carries vital lively weight, its efficiency could be wonderful, as seen in 2023, or it will possibly underperform considerably. Nonetheless, we imagine that over the long term, issue investing in each fairness and foreign money will yield returns, and a average weight in China is interesting to traders involved about geopolitical danger.

Essential Dangers Associated to this Article

Investing includes danger, the together with doable lack of principal. Investments in non-U.S. securities contain political, regulatory and financial dangers that is probably not current in U.S. securities. For instance, international securities could also be topic to danger of loss as a consequence of international foreign money fluctuations, political or financial instability, or geographic occasions that adversely influence issuers of international securities. Derivatives utilized by the Fund to offset publicity to foreign exchange might not carry out as meant. There could be no assurance that the Fund’s hedging transactions will probably be efficient. The worth of an funding within the Fund might be considerably and negatively impacted if foreign exchange recognize on the similar time that the worth of the Fund’s fairness holdings falls. Whereas the Fund is actively managed, the Fund’s funding course of is anticipated to be closely depending on quantitative fashions and the fashions might not carry out as meant.

Further dangers particular to EMMF embrace however should not restricted to rising markets danger. Investments in securities and devices traded in growing or rising markets, or that present publicity to such securities or markets, can contain further dangers referring to political, financial or regulatory circumstances not related to investments in U.S. securities and devices or investments in additional developed worldwide markets. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link