[ad_1]

U.S. equities don’t have a monopoly on acronyms.

Earlier than there was the Magnificent 7, it was the FAANGS. Europe has been persistently ignored by U.S. buyers over the dearth of its personal basket of tech-enabled, high-growth shares.

Goldman Sachs just lately highlighted a basket of 11 European corporations it calls “internationally uncovered high quality progress compounders” with surprisingly comparable returns to the Magnificent 7 during the last three years.

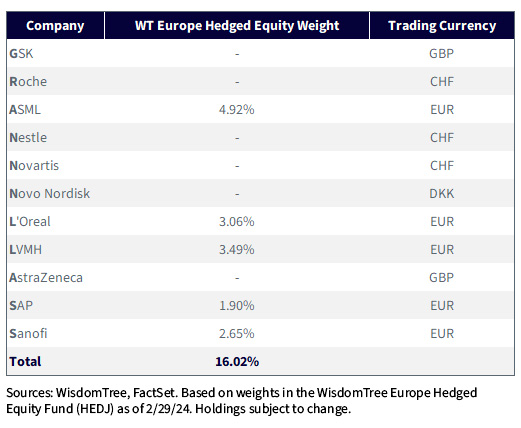

Regardless of Europe’s status for lagging the U.S. as a result of it lacks the massive tech stars of the U.S., the GRANOLAS (GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP, Sanofi) rivaled the Magnificent 7 (Microsoft, Apple, Alphabet, Meta, Tesla, Nvidia, Amazon) during the last three years.

Trailing 3-12 months Returns: A Lifeless Warmth

Of the 11 GRANOLAS, 5 are traded in euros, which makes them eligible to be held within the WisdomTree Europe Hedged Equity Fund (HEDJ). In complete, these names make up 16% of the burden of the Fund.

HEDJ Fund Weight

It may be a enjoyable train to cluster collectively securities right into a catchy acronym. There may be, nonetheless, some arbitrariness and hindsight bias concerned. In spite of everything, if these securities hadn’t outperformed, the analysis wouldn’t be grabbing headlines, proper?

However this basket isn’t the one assortment of European equities with a return profile that will maybe shock some U.S.-centric asset allocators.

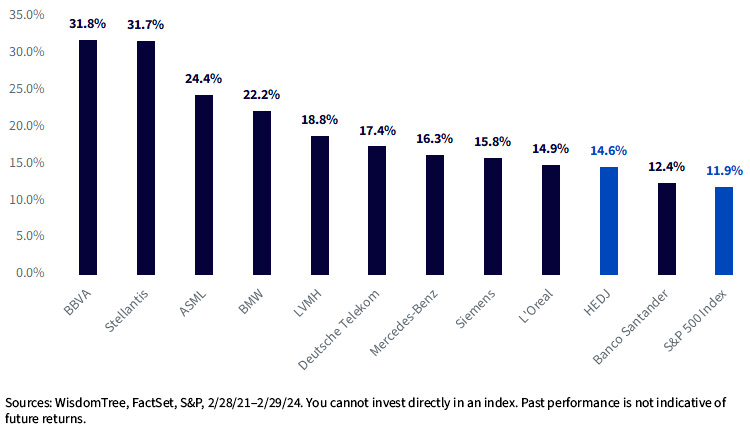

Take the present high 10 holdings of HEDJ. These securities comprise simply over half of the Fund (55%).

Now guess what share of those securities have outperformed the S&P 500 during the last three years?

If you happen to’re reply was 100%, you’d be proper!

Exterior of Banco Santander, which outperformed by 50 basis points, the returns weren’t even significantly shut. The easy common return of this basket was 20.6%, properly forward of the 11.9% returns for the S&P 500 Index.

Each Fund goes to have its outliers—as an entire, HEDJ returned 14.6%. This return benefit of over 250 foundation factors would additionally shock many.

Annualized Trailing 3-12 months Returns: HEDJ Prime 10 Holdings, as of two/29/24

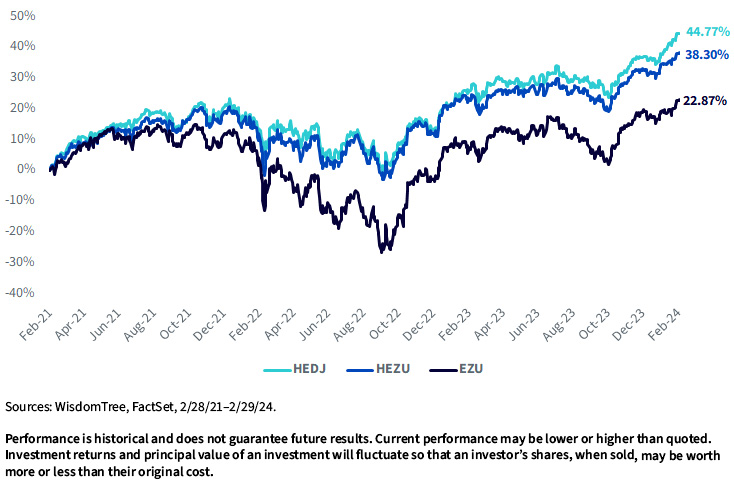

The iShares MSCI Eurozone ETF (EZU) returned 22.87% to buyers during the last three years, representing U.S. greenback returns. The iShares Currency Hedged MSCI Eurozone ETF (HEZU), which tracks the MSCI EMU Index in native forex phrases, fared higher, returning 38.30%.

The distinction between the 2 returns is attributable to the weakening of the euro relative to the U.S. greenback; because the euro weakens, USD returns naturally decline and vice versa.

The WisdomTree Europe Hedged Equity Fund can be forex hedged and tracks the WisdomTree Europe Hedged Equity Index. HEDJ returned 44.77% over the identical interval.

Efficiency, HEDJ vs. HEZU vs. EZU

For the latest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on the related ticker: HEDJ, HEZU, EZU

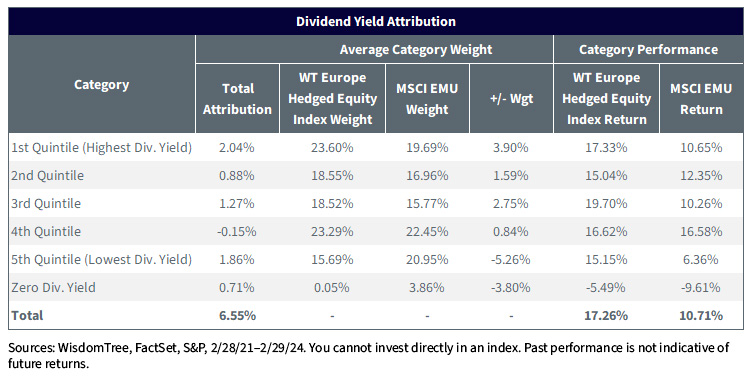

The efficiency distinction between the 2 hedged ETFs will be attributed to the inventory choice course of driving HEDJ. The desk beneath exhibits HEDJ’s Index’s allocations to the assorted dividend yield quintiles during the last 12 months since January 2024—the Index is over-weight within the highest dividend payers within the eurozone in comparison with the MSCI EMU Index.

One-12 months Returns: Dividend Yield Attribution

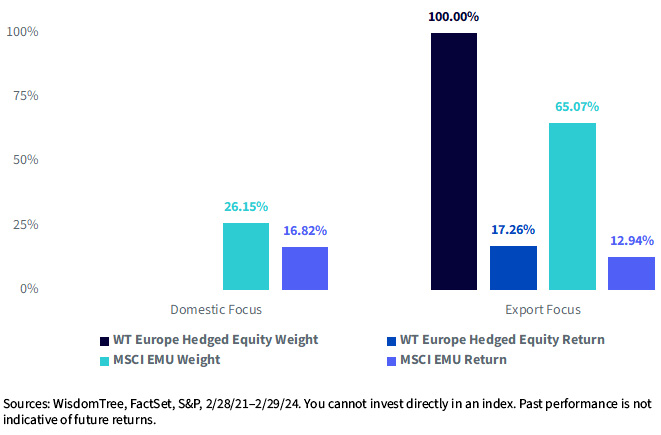

Along with dividend payer weighting differentials, the affect of the WisdomTree Europe Hedged Fairness Index’s exporter tilt can’t be understated in driving outperformance in comparison with the hedged benchmark index.

One-12 months Index Returns: Export-Centered vs. Home

Outperformance with Decrease Valuations

Every time there’s outperformance, buyers surprise if they’re late to the commerce.

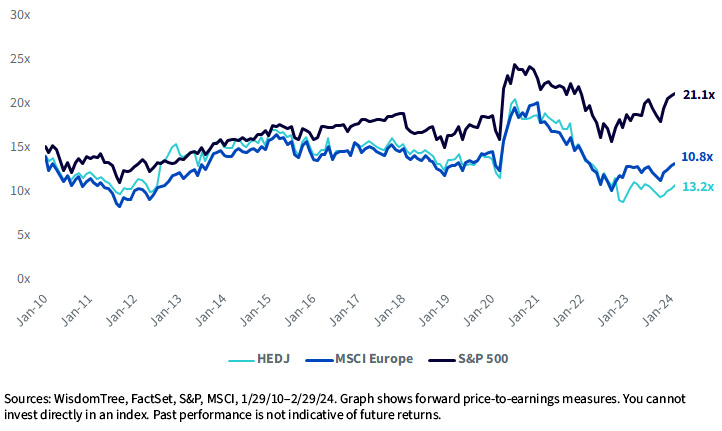

When it comes to valuations, HEDJ has been buying and selling at a reduction to its broad Europe benchmark for over a 12 months.

In comparison with U.S. equities which are traded properly above long-term common valuations, European equities are nonetheless low-cost relative to historical past.

HEDJ vs. MSCI Europe vs. S&P 500 Historic Valuations

What in regards to the Euro?

A variety of buyers imagine the case to go worldwide depends on currencies just like the euro appreciating. We at WisdomTree imagine buyers have an excessive amount of publicity to a weak greenback inherent within the S&P 500. When the greenback is powerful, U.S. corporations face earnings headwinds. Traders can add higher diversification to their portfolios by including hedged strategies in lieu of unhedged.

We additionally imagine Warren Buffett’s tackle currencies is the precise one for many buyers to undertake. Referring to his buy of Japanese corporations, Buffett wrote in his latest shareholder letter: “Neither Greg nor I imagine we will forecast the market costs of main currencies. We additionally don’t imagine we will rent anybody with that capacity.”

If one among best buyers of all time suggests it’s robust to foretell currencies and goes on to explain how he carried out an efficient FX hedge, buyers ought to keep humble of their views on including in FX bets to their inventory choice.

We have seen some analysts make the decision that truthful worth of the euro to be at or beneath parity to the greenback (presently at $1.08). Any such forex transfer could be useful to exporters in HEDJ, however buyers would wish to hedge the euro. Going a step additional, we predict buyers ought to hedge the euro over the long term as a strategic baseline fairly than simply as a tactical commerce for a weak euro view. Hedging forex usually results in a smoother experience in returns, because it mitigates a key supply of added volatility of worldwide investments.

Necessary Dangers Associated to this Article

For present Fund holdings, please click on here. Holdings are topic to danger and alter.

There are dangers related to investing, together with the attainable lack of principal. Overseas investing includes particular dangers, resembling danger of loss from forex fluctuation or political or financial uncertainty. Investments in forex contain extra particular dangers, resembling credit score danger and rate of interest fluctuations. Spinoff investments will be unstable and these investments could also be much less liquid than different securities, and extra delicate to the impact of assorted financial situations. As this Fund can have a excessive focus in some issuers, the Fund will be adversely impacted by modifications affecting these issuers. Because of the funding technique of this Fund it might make increased capital acquire distributions than different ETFs. Dividends aren’t assured, and an organization presently paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

[ad_2]

Source link