[ad_1]

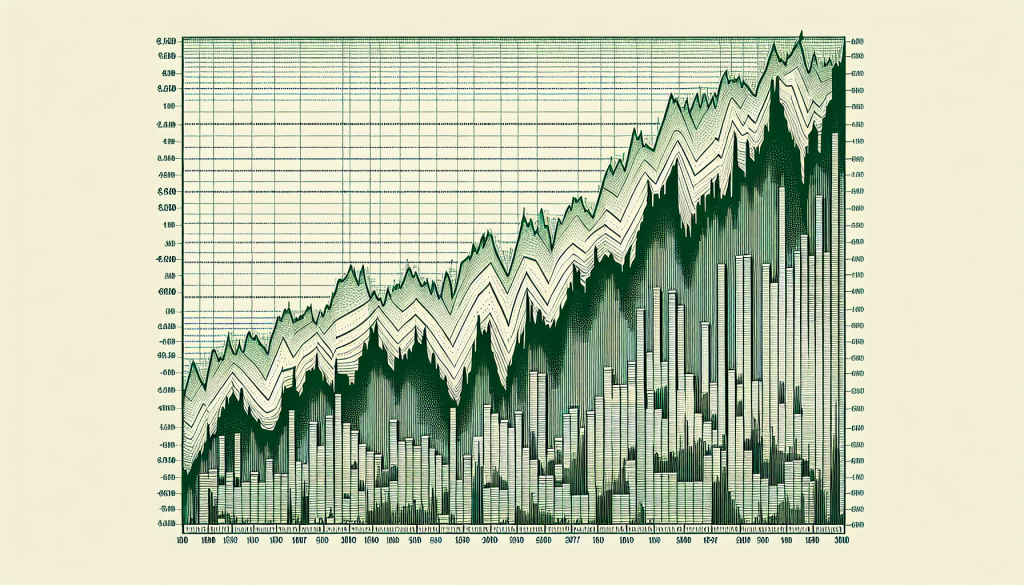

The S&P 500, a inventory market index that measures the inventory efficiency of 500 massive corporations listed on inventory exchanges in the USA, has elevated considerably by 25% over the previous 5 months. This surge may be attributed to the financial coverage selections made by the Federal Reserve, the nation’s central banking system.

The Federal Reserve, or the Fed, as it’s generally recognized, has been enjoying what may be metaphorically known as “occasion music’ for the monetary markets, creating an surroundings conducive to progress and prosperity.

The function of the Federal Reserve

The Federal Reserve’s function within the financial system is to handle inflation, stabilize costs, and maximize employment. It does this by manipulating rates of interest and the cash provide. When the Fed lowers rates of interest, it turns into cheaper for companies and customers to borrow cash, encouraging spending and funding and resulting in financial progress. Conversely, borrowing turns into dearer when the Fed raises rates of interest, slowing down financial exercise.

The affect of low rates of interest

Over the previous 5 months, the Fed has maintained low-interest charges, successfully “beginning the occasion music’ for the monetary markets. This has resulted in a positive surroundings for businesses and investors, resulting in a surge within the S&P 500. Nevertheless, the query on everybody’s thoughts is, will the Fed cease the occasion music?

At all times anticipating the Fed’s determination

Market analysts and buyers are keenly awaiting every Federal Reserve announcement as a result of these bulletins can probably affect the inventory market’s path. Nevertheless, it’s extensively anticipated that the Fed won’t transfer charges. This expectation is predicated on the Fed’s latest monetary policy selections and the present state of the financial system.

The affect of the Fed’s October determination

In October, the Fed had a chance to boost interest rates however selected to not. This determination was made in a recovering financial system to encourage additional progress. The Fed’s determination to keep up low-interest charges was seen as a vote of confidence within the financial system’s capacity to proceed its restoration regardless of ongoing challenges such because the COVID-19 pandemic.

The constructive impact on the inventory market

The choice to not elevate rates of interest in October has positively impacted the inventory market, as evidenced by the 25% enhance within the S&P 500 since then. This implies that the Fed’s “occasion music’ has successfully stimulated financial exercise and boosted investor confidence.

Wanting forward

Wanting forward, it’s anticipated that the Fed will proceed to keep up low-interest charges within the close to future. It’s because elevating rates of interest may probably decelerate the financial restoration, which remains to be fragile as a result of ongoing pandemic. Due to this fact, it’s probably that the Fed’s “occasion music’ will proceed to play, offering a positive surroundings for companies and buyers.

Conclusion

In conclusion, the Federal Reserve’s financial coverage selections considerably affect the inventory market, as evidenced by the latest surge within the S&P 500. The Fed’s determination to keep up low-interest rates has created a favorable economic growth and funding surroundings. Wanting forward, the Fed is anticipated to proceed to keep up this stance to help the continued financial restoration. Nevertheless, buyers ought to hold an in depth eye on the Fed’s bulletins, as any adjustments in financial coverage may probably affect the inventory market’s path.

Incessantly Requested Questions

Q. What’s the S&P 500?

The S&P 500 is a inventory market index that measures the inventory efficiency of 500 massive corporations listed on US inventory exchanges.

Q. What has triggered the latest enhance within the S&P 500?

The latest surge within the S&P 500 may be attributed to the Federal Reserve’s financial coverage selections, which have created a positive surroundings for companies and buyers.

Q. What’s the function of the Federal Reserve?

The Federal Reserve’s function within the financial system is to handle inflation, stabilize costs, and maximize employment. It does this by manipulating rates of interest and the cash provide.

Q. How do low-interest charges affect the financial system?

When the Federal Reserve lowers rates of interest, it turns into cheaper for companies and customers to borrow cash, encouraging spending and funding and resulting in financial progress.

Q. What’s the anticipated determination of the Federal Reserve this week?

It’s extensively anticipated that the Federal Reserve won’t transfer charges. This expectation is predicated on the Fed’s latest financial coverage selections and the present state of the financial system.

Q. What was the affect of the Federal Reserve’s determination in October?

The choice to not elevate rates of interest in October has positively impacted the inventory market, as evidenced by the 25% enhance within the S&P 500 since then.

Q. What’s the anticipated future stance of the Federal Reserve?

The Federal Reserve is anticipated to proceed sustaining low-interest charges within the close to future to help the financial restoration.

Q. How do the Federal Reserve’s selections affect the inventory market?

The Federal Reserve’s financial coverage selections considerably affect the inventory market. For example, sustaining low-interest charges has created a positive financial progress and funding surroundings, resulting in a surge within the S&P 500.

The put up Understanding the S&P 500’s significant surge appeared first on Due.

[ad_2]

Source link