[ad_1]

A brand new research means that the UK’s largest listed firms contributed practically £90 billion in taxes within the final monetary 12 months. Nevertheless, solely round one-third of that quantity got here as a direct price to the businesses – with the bulk really coming from earnings tax and worker contributions to nationwide insurance coverage.

The 100 Group represents the views of the finance administrators of FTSE 100, and several other massive UK non-public firms. In keeping with a brand new research from PwC, the companies making up the 100 Group instantly and not directly generate tax revenues with are equal of 10% of all UK authorities receipts.

Andy Agg, chair of the 100 Group tax committee, commented on the findings, “With complete tax contribution reaching its highest stage because the survey started, the report demonstrates the vital contribution to public funds the 100 Group gives. Past that, the findings illustrate that giant companies are constantly offering excessive ranges of funding and innovation, throughout a time of difficult financial situations and heightened geopolitical uncertainty, which have helped foster financial development all through the UK economic system. At 10% of complete authorities receipts, the 100 Group complete tax contribution underlines the soundness the biggest UK firms supply to the economic system and wider society.”

The Whole Tax Contribution (TTC) elevated by £8.3bn in 2022/23

Supply: PwC, The 100 Group

Some will argue that that contribution remains to be lower than it is likely to be, although. PwC’s numbers recommend that whereas the full quantity paid by the nation’s largest companies seems to have risen, the image could also be extra sophisticated than that. For instance, in 2018, that determine was £84.1 billion, whereas in 2023, that has risen to £89.8 billion in tax in the course of the 2022/23 monetary 12 months. However whereas that may be a bigger quantity, the portion of complete receipts which that constitutes has decreased – having stood at 12.3% 5 years in the past, in keeping with PwC’s analysis.

Additional to that, adjusted for inflation – and the final 5 years have seen a variety of it – £84.1 billion in 2018 can be price greater than £106.2 billion, in keeping with the CPI Inflation Calculator. In reverse in the meantime, £89.8 billion in 2023 would have been price simply over £71 billion in 2018. In order a lot as a lot because the group’s members would possibly declare their tax burden is exemplifies a rising centrality to the UK’s public funds, proportionally it the reverse could possibly be argued to be true.

On the identical time, nearly all of the contribution that the 100 Group takes credit score for doesn’t come instantly from the earnings of its companies. Whereas the businesses contributed £29.1 billion in taxes borne – these which are a direct price to the corporate equivalent to company tax – as a part of their headline ‘virtually £90 billion’ determine, the bigger £60.6 billion portion of that got here from taxes collected. This contains levies equivalent to gas responsibility and VAT – normally a price handed on to the buyer – particular person earnings tax and worker nationwide insurance coverage contributions (NICs) deducted below PAYE.

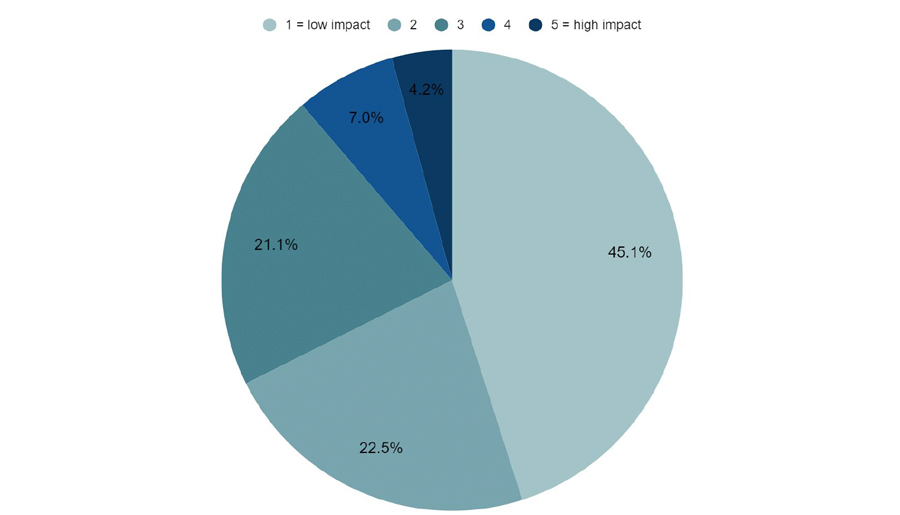

Is tax coverage more likely to be a major lever for attaining your internet zero goal?

Supply: PwC, The 100 Group

That may see just a few eyebrows raised on the suggestion that, within the wake of those figures, the UK’s largest company gamers should be reduce some slack, to encourage them to spend huge on the nation’s transition to internet zero. PwC polled members of the 100 Group, asking about their views on the influence of their internet zero targets. An amazing majority of 96% heads of tax stated they’ve a internet zero goal, however 11% anticipated tax coverage to have a excessive influence on assembly these targets. Following on from this, 68% argued that extra beneficiant inexperienced incentives must be provided to companies to hasten the UK in transitioning to internet zero.

Summarising these responses, Andy Wiggins, tax associate at PwC, commented, “Companies will play an necessary function within the UK’s potential to satisfy its 2050 internet zero goal, and transition plans shall be a key a part of firms’ forward-looking methods. Many anticipate their enterprise mannequin to be considerably influenced by the web zero adoption, together with a big impact on enterprise funding and analysis and improvement. Given the dimensions of effort required to satisfy the targets, firms had been eager to emphasize the significance of long-term consistency and readability over internet zero insurance policies, alongside incentives within the type of carrots over sticks to ease the transition.”

Provided that research by CDP and the Local weather Accountability Institute means that simply 100 companies account for nearly three-quarters of worldwide emissions, and a variety of them are among the many largest company entities within the UK, critics would possibly scoff on the thought they need to be incentivised to clear up what’s arguably their mess. On the identical time, different studies from TaxWatch means that the UK misses out on billions in income yearly because of the means seven of the world’s largest tech companies efficiently minimise their tax payments – one thing which could considerably undermine the thought such big operators are hard-done-by sufficient by the current tax system to wish an additional handout.

[ad_2]

Source link