[ad_1]

Worldwide leisure journey from the UK has nearly returned to pre-pandemic ranges, in response to new analysis. However whereas the will to see the world, or go to family and friends abroad has seen shoppers more and more return to the skies, enterprise journey is unlikely to hit its outdated charges for an additional 12 months – as prices proceed to chew.

In the course of the early levels of the pandemic, worldwide lockdowns noticed many airways slip into disaster mode. With demand abruptly drying up totally, many firms had been compelled to beg for state bailouts, or face collapse. Within the years since, large inflationary pressures have slowed the restoration from this – however demand for leisure journey has nonetheless been rising, because of the pent up demand of the lockdown months.

Now, a brand new research from OC&C Strategy Consultants has discovered that worldwide leisure journey from the UK is lastly set to hit pre-pandemic ranges over 2024. And additional to that, shoppers count on to spend extra on massive ticket leisure moments and holidays within the subsequent 12 months in comparison with 2023 – one thing which can relieve airways whose bottom-lines have continued to be a fear over the past 4 years.

A survey of two,025 individuals by OC&C and Harris Williams discovered that UK shoppers intend to spend 6% extra on massive holidays over the following 12 months in comparison with final 12 months – whilst they proceed to take care of the impacts of the cost-of-living disaster. It appears they intend to pay for this spending by reducing again on different areas: particularly, homeware, and hobbies and sport, each of which can see 10% discount in spending – and attire and wonder, the place the discount can be 17%.

Mohsin Saleh, an affiliate companion at OC&C, stated, “This demand is a implausible alternative for the journey trade. With provide and operational challenges receding and price inflation changing into extra secure, the trade ought to be seeking to seize demand by making certain they’re providing value-additive journey, adapting their affords for youthful travellers, and making certain they proceed to concentrate on sustainability. AI additionally has a task in enhancing the client expertise and decreasing working price. After a turbulent few years for the journey and leisure trade, there ought to be calmer waters forward for the sector.”

Nonetheless, this doesn’t imply that it’s all plain crusing for airways in the mean time. Enterprise journey – which is mostly a extra important line of revenue for the trade – continues to be a 12 months away from recovering its 2019 revenues. Which means within the meantime, there’s additionally extra stress to maintain shoppers completely satisfied in relation to leisure journey; and which will grow to be more and more tough in a single explicit space.

As is the case in each different trade, the journey commerce has spent the final decade treating sustainability measures as a ‘premium product’. Reasonably than progressively adapting their enterprise fashions to be much less environmentally harmful, they’ve rolled out offsetting schemes and different merchandise of debatable use – and sought to cost conscientious shoppers for the privilege. The issue is that whereas that may have been considerably efficient in additional secure financial instances, shoppers have had their spending energy slashed dramatically within the final two years.

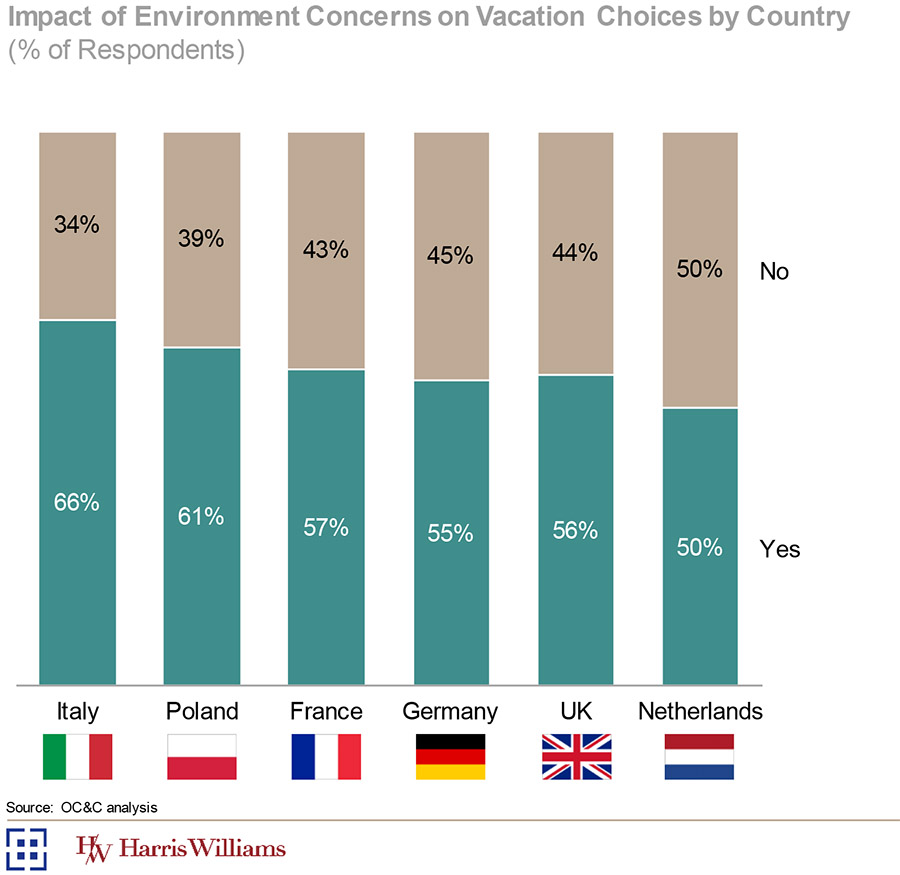

At current which means that 56% of UK travellers be aware that sustainability points affect their journey and trip selections. Globally, this rises to 58%. Nonetheless, solely 9% of shoppers now say they’re “keen to pay extra for journey experiences according to my ESG values”. That implies that airways are anticipated to do something about the environmental disaster the world faces – partly due to the trade’s personal large emissions legacy – however consider it’s an expense airways shouldn’t be passing on to them.

Failing to do that may imply that airways start to overlook out on a rising variety of shoppers. Certainly, 26% of world respondents already use the practice or the bus wherever potential. And this isn’t an space the place the airways can afford to suppose returning enterprise clients will quickly offset this loss both – as a result of these emissions are more and more coming into the equation when corporations measure up their Scope 3 tasks, on their net-zero journey. Wanting forward, then, there might be additional turbulence on the horizon for airways – whilst they count on revenues to return to former ranges.

[ad_2]

Source link