[ad_1]

Spot Bitcoin ETFs Prone to Broaden the Investor Base

Ten years after the primary spot Bitcoin exchange-traded fund utility was filed within the U.S., the Securities and Change Fee (SEC) finally approved spot Bitcoin ETFs on January 10, 2024.

Whereas the European markets have been providing crypto exchange-traded merchandise (ETPs) since 2019, that is the primary time U.S. traders can entry the spot value of Bitcoin in a brokerage account through a well-known ETF construction. We imagine this approval will assist to broaden the investor base for bitcoin within the U.S. and encourage regulators in different international locations to rethink their place in digital belongings.

The obvious goal marketplace for spot bitcoin ETFs is the U.S. wealth administration shopper belongings, which might be roughly $44 trillion in dimension.1 Many of those traders weren’t ready or prepared to arrange procedures to carry bitcoin instantly.

Growing Demand for Bitcoin Dealing with a Lower in New Provide

When Bitcoin was created in 2009 partly as a response to the global financial crisis, steady cash printing and devaluation of fiat currencies, the creators of the bitcoin blockchain wished to restrict the provision of bitcoin to 21 million. This provide restrict is hard-coded into the bitcoin cryptocurrency. Greater than 94% of those bitcoins have already been mined.2 Some bitcoin has been misplaced eternally, however it’s tough to estimate the precise quantity, as there should be some early traders who haven’t transacted on their bitcoin for a number of years.

In roughly the April/Might 2024 timeframe, the issuance of recent bitcoin, within the type of Bitcoin block rewards awarded to miners, will probably be lower in half, and miners will obtain 3.1 Bitcoin each 10 minutes or so.3 Usually, bitcoin miners must promote a part of their Bitcoin available in the market to cowl a few of their operational bills, reminiscent of vitality prices and computing gear upgrades. As miners may have much less Bitcoin to promote available in the market, this might imply a decrease provide of Bitcoin available in the market total.

Chart 1: Bitcoin “Halving,” Estimated April/Might 2024

Traditionally, this “halving” occasion has led to an preliminary improve within the value, and though the value improve a number of has declined over time, this time round, there may be a further issue—a U.S. spot bitcoin ETF obtainable within the U.S. In regular circumstances, when the demand will increase whereas the provision declines or stays the identical, the value ought to transfer upward.

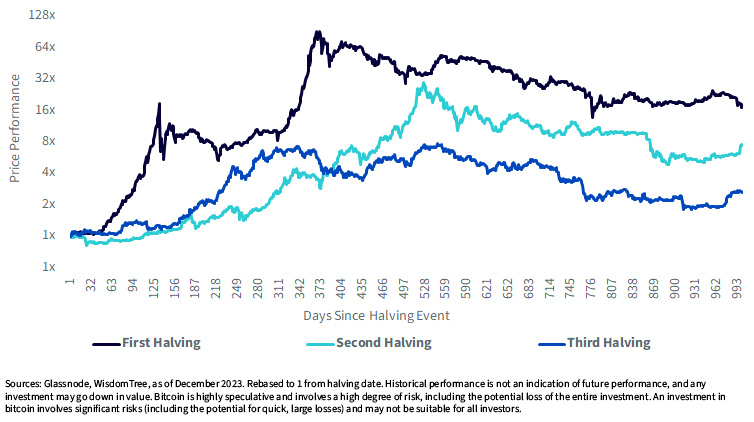

We see inside chart 2:

- The unique bitcoin value on the day of every halving is represented by “1.0x.” If the value was initially $1,000 and then you definately see within the vertical axis it goes to “2.0x,” this may imply it went from $1,000 to $2,000. Your complete chart may be learn analogously.

- The primary halving occurred the earliest in bitcoin’s historic trajectory. In a relative sense, at earlier factors in bitcoin’s historical past, there was higher risk and higher value volatility. The third halving is the newest. Over time, bitcoin has change into recognized by an increasing number of individuals, the market capitalization has largely been growing, and the value volatility has been trending decrease slightly than increased, even whether it is nonetheless excessive relative to different asset courses. This doesn’t imply that this pattern will persist—it simply pertains to chart 2 within the sense that roughly 990 days after the third halving, the value had gone from 1.0x to someplace between 2.0x and 4.0x. Compared, 990 days after the primary halving, the value had gone from 1.0x to about 16.0x.

Chart 2: Bitcoin’s Worth Efficiency Submit Historic Halving Occasions

Lengthy-Time period Retailer of Worth Rising because the Most Distinguished Use Case for Bitcoin

Whereas the use case of Bitcoin as digital cash, a possible digital fee layer for the web, may materialize sooner or later, for the second, our view is that essentially the most accepted use case for Bitcoin is a type of digital gold, a long-term retailer of worth that acts as a hedge towards the debasement of currencies and geopolitical uncertainty. We particularly say “long-term” in recognition of the traditionally excessive value volatility that bitcoin has exhibited. An extended interval may permit for:

- Extra use instances to emerge, notably within the funds area.

- Extra time to research world central banks and be aware in the event that they proceed to print cash, growing future inflationary dangers.

- No expertise is “instantly adopted”—many customers is not going to develop a lot curiosity the primary or second time they hear about it. Persevering with to listen to about bitcoin in a an increasing number of diversified array of contexts will naturally inject it into the general public’s consciousness and provides individuals extra consolation that each one kinds of issues have occurred, however it’s nonetheless there.

1 Supply: Euart et al., “US Wealth Administration: Amid market turbulence, an trade converges,” McKinsey, 1/24. Yr-end U.S. wealth supervisor shopper belongings for 2022, consists of retail belongings with wealth intermediaries. Excludes instantly held securities and institutional belongings.

2 Bitcoin mining = a approach new bitcoins are getting into circulation; a course of through which bitcoin transactions are verified on the bitcoin blockchain. New bitcoin is issued to bitcoin miners as a reward for validating transactions. Precise “mining” makes use of software program and {hardware} to unravel complicated mathematical puzzles and guess a cryptographic quantity that matches a set criterion.

3 Supply: John Stec, “Why 2024 Can be Bitcoin’s Yr,” Coindesk, 1/17/24.

Necessary Dangers Associated to this Article

Crypto belongings, reminiscent of bitcoin and ether, are complicated, typically exhibit excessive value volatility and unpredictability, and ought to be seen as extremely speculative belongings. Crypto belongings are incessantly known as crypto “currencies,” however they usually function with out central authority or banks, should not backed by any authorities or issuing entity (i.e., no proper of recourse), don’t have any authorities or insurance coverage protections, should not authorized tender and have restricted or no usability as in comparison with fiat currencies. Federal, state or international governments might limit the use, switch, trade and worth of crypto belongings, and regulation within the U.S. and worldwide continues to be growing.

Crypto asset exchanges and/or settlement services might cease working, completely shut down or expertise points resulting from safety breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your buyer / Anti-Cash Laundering) procedures, non-compliance with relevant guidelines and rules, technical glitches, hackers, malware or different causes, which may negatively influence the value of any cryptocurrency traded on such exchanges or reliant on a settlement facility or in any other case might stop entry or use of the crypto asset. Crypto belongings can expertise distinctive occasions, reminiscent of forks or airdrops, which may influence the worth and performance of the crypto asset. Crypto asset transactions are typically irreversible, which signifies that a crypto asset could also be unrecoverable in cases the place: (i) it’s despatched to an incorrect tackle, (ii) the inaccurate quantity is distributed, or (iii) transactions are made fraudulently from an account. A crypto asset might decline in reputation, acceptance or use, thereby impairing its value, and the value of a crypto asset might also be impacted by the transactions of a small variety of holders of such crypto asset. Crypto belongings could also be tough to worth and valuations, even for a similar crypto asset, might differ considerably by pricing supply or in any other case be suspect resulting from market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto belongings typically depend on blockchain expertise and blockchain expertise is a comparatively new and untested expertise which operates as a distributed ledger. Blockchain techniques could possibly be topic to web connectivity disruptions, consensus failures or cybersecurity assaults, and the date or time that you simply provoke a transaction could also be totally different then when it’s recorded on the blockchain. Entry to a given blockchain requires an individualized key, which, if compromised, may lead to loss resulting from theft, destruction or inaccessibility. As well as, totally different crypto belongings exhibit totally different traits, use instances and threat profiles. Data offered by WisdomTree concerning digital belongings, crypto belongings or blockchain networks shouldn’t be thought of or relied upon as funding or different recommendation, as a advice from WisdomTree, together with concerning the use or suitability of any explicit digital asset, crypto asset, blockchain community or any explicit technique.

To view the prospectus, please click on here.

Bitcoin and, accordingly, the WisdomTree Bitcoin Fund, which holds bitcoin, are extremely speculative and contain a excessive diploma of threat, together with the potential for lack of all the funding. An funding within the WisdomTree Bitcoin Fund entails vital dangers (together with the potential for fast, giant losses) and will not be appropriate for all shareholders. You must rigorously think about whether or not your monetary situation lets you put money into the WisdomTree Bitcoin Fund, and you ought to be prepared to simply accept extra threat than could also be concerned with different exchange-traded merchandise or ETFs that don’t maintain bitcoin.

Excessive volatility of buying and selling costs that many digital belongings, together with bitcoin, have skilled in latest intervals and will proceed to expertise, may have a cloth antagonistic impact on the worth of the Shares and the Shares may lose all or considerably all of their worth. The worth of the Shares relies on the acceptance of digital belongings, reminiscent of bitcoin, which signify a brand new and quickly evolving trade. Digital belongings reminiscent of bitcoin had been solely launched throughout the previous twenty years, and the medium-to-long time period worth of the Shares is topic to quite a few elements referring to the capabilities and improvement of blockchain applied sciences and to the basic funding traits of digital belongings. Regulatory modifications or actions might have an effect on the worth of the Shares or limit the usage of Bitcoin, mining exercise or the operation of the Bitcoin Community or the Digital Asset Markets in a fashion that adversely impacts the worth of the Shares. Digital Asset Markets might expertise fraud, enterprise failures, safety failures or operational issues, which can adversely have an effect on the worth of Bitcoin and, consequently, the worth of the Shares.

The WisdomTree Bitcoin Fund shouldn’t be a fund registered beneath the Funding Firm Act of 1940, as amended (“1940 Act”), and isn’t topic to regulation beneath the 1940, in contrast to most exchange- traded merchandise or ETFs. The WisdomTree Bitcoin Fund can also be not a commodity pool for functions of the Commodity Change Act of 1936, as amended, and the sponsor shouldn’t be topic to rules by the Commodity Futures Buying and selling Fee as a commodity pool operator or commodity buying and selling advisor. The WisdomTree Bitcoin Fund’s shares are neither pursuits in nor obligations of the sponsor or the trustee or any of their associates.

The WisdomTree Bitcoin Fund has filed a registration assertion (together with a prospectus) with the SEC for the providing to which this communication relates. Earlier than you make investments, you must learn the prospectus in that registration assertion and different paperwork the WisdomTree Bitcoin Fund has filed with the SEC for extra full details about the WisdomTree Bitcoin Fund and this providing. It’s possible you’ll get these paperwork totally free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the WisdomTree Bitcoin Fund will prepare to ship you the prospectus in case you request it by calling toll-free at 866.909.9473.

Neither WisdomTree, Inc., nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax recommendation. All references to tax issues or data offered on this web site are for illustrative functions solely and shouldn’t be thought of tax recommendation and can’t be used for the aim of avoiding tax penalties. Buyers searching for tax recommendation ought to seek the advice of an unbiased tax advisor.

Foreside Funds Companies, LLC, is the Advertising and marketing Agent for the WisdomTree Bitcoin Fund (BTCW). Foreside Fund Companies, LLC, shouldn’t be affiliated with WisdomTree, Inc. nor another entities talked about.

[ad_2]

Source link