[ad_1]

Final week, Wyoming Gov. Mark Gordon signed 4 payments that may cut back property taxes for Wyoming owners.

“I’m completely happy to signal this bundle of laws, which gives focused reduction to taxpayers most impacted by rising valuations whereas making certain our counties and faculties are capable of proceed to offer the companies our residents depend on,” Gov. Gordon stated in a press release.

Wyoming has seen the biggest soar in median property taxes paid because the pre-pandemic interval. Based on CoreLogic knowledge, between 2019 and 2023, the median annual property taxes paid for single-family properties elevated by 41% for Wyoming owners. Throughout the identical interval, Wyoming dwelling costs, as tracked by Zillow, rose by 32.5%.

However right here’s the factor: Wyoming is an outlier.

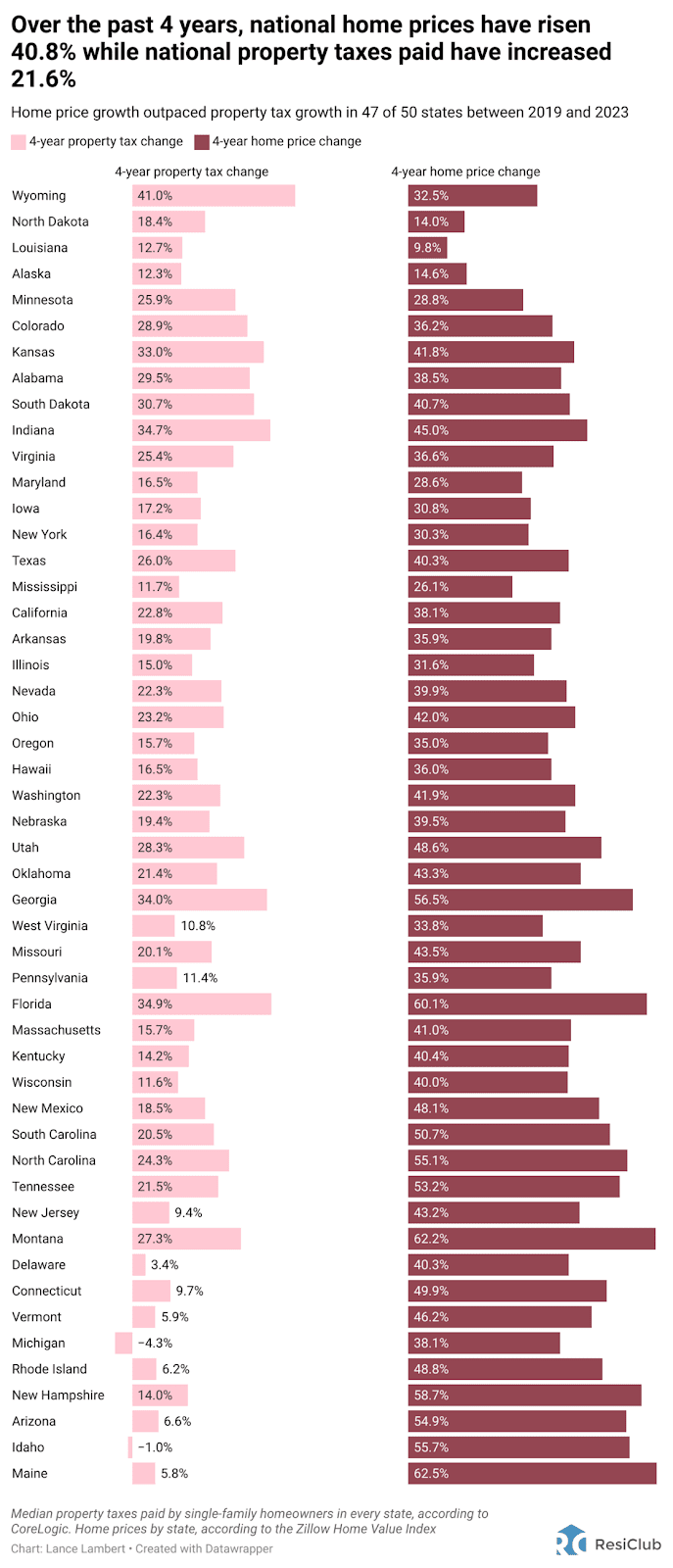

Over the previous 4 years, nationwide dwelling costs have risen 40.8% whereas nationwide property taxes paid have risen 21.6%. Dwelling worth progress outpaced property tax progress in 47 of fifty states between 2019 and 2023. Solely three states, together with Wyoming, have seen the other.

The truth that property taxes haven’t caught as much as dwelling worth progress that occurred through the pandemic housing increase means that larger property tax payments await owners in most states. The identical can be true for dwelling insurance coverage charges. These lingering property tax hikes and residential insurance coverage hikes are what ResiClub has coined the “Echo Housing Increase.”

To see what’s taking place to property taxes throughout the nation, ResiClub reached out to CoreLogic, which offered knowledge on the median quantity owners paid in property taxes for single-family properties by state from 2019 to 2023.

Earlier than we dive into the state-level knowledge, it’s essential to notice that property tax coverage varies considerably by state, and even all the way down to the native municipality degree. Some states go it on to owners quicker. Different states have guidelines that make will increase a sluggish drip.

Click here to view an interactive model of the map under.

Householders in these 5 states noticed the most important surges in property taxes paid from 2019 to 2023:

- Wyoming: +41.0%

- Florida: +34.9%

- Indiana: +34.7%

- Georgia: +34.0%

- Kansas: +33.0%

These 5 states’ property taxes paid elevated the least from 2019 to 2023:

- Michigan: -4.3% (CoreLogic isn’t positive why Michigan is down)

- Idaho -1.0%

- Delaware: +3.4%

- Maine: +5.8%

- Vermont: +5.9%

Click here to view an interactive model of the chart under.

Typically talking, owners with fastened mortgages are buffered from the detrimental monetary impacts of spiked home costs and mortgage charges. After all, it’s a unique story for property tax and residential insurance coverage funds.

“Whereas owners profit from larger dwelling costs and features in owners’ fairness, they’re additionally experiencing a rising burden from larger property tax fee,” CoreLogic economist Yanling Mayer tells ResiClub.

Mayer added: “Usually, one would usually anticipate states with persistent and quick appreciating dwelling costs to expertise the quickest will increase in property taxes, assuming property tax charges have stayed comparatively unchanged… However this isn’t at all times true, particularly when there are state legal guidelines which restrict how a lot property evaluation can go up in a given evaluation cycle.”

Click here to view an interactive model of the chart under.

California properties are famend for his or her exorbitant costs, with quite a few cities within the state rating among the many most costly locations to stay within the U.S. Moreover, metropolitan areas in California corresponding to San Diego, Riverside, and Santa Maria skilled dwelling worth will increase of 45% or extra over the previous 4 years.

Regardless of seeing a number of the steepest dwelling worth surges, California evaded the very prime of the listing for states with the biggest shifts in median property tax funds. This, in fact, is because of Proposition 13.

Adopted in 1978, Proposition 13 does three principal issues for California owners:

- Limits the annual actual property tax to 1% of the property’s assessed worth

- Requires properties to be assessed at market worth on the time of sale

- Prohibits assessments from rising by greater than 2% per yr

“Proposition 13 has shielded owners from upside shocks to dwelling costs,” CoreLogic’s Mayer informed ResiClub. “As well as, Proposition 13’s acquisition-based evaluation technique signifies that many owners in California are paying moderately modest quantities of property taxes.”

Officers in different states are additionally dealing with political stress to decelerate the will increase. Wyoming’s 4 new property tax legal guidelines will mood the rising tax burden for owners, largely by exemptions. Idaho, which noticed a surge in interstate migration through the pandemic, handed a tax reduction invoice in 2023 to chop property taxes by a median of 18% throughout the state. Since 2019, the median quantity of property taxes a house owner is paying in Idaho has decreased by 1%.

[ad_2]

Source link