[ad_1]

Proudly owning a restaurant is a dream for a lot of businesspeople.

But, the day-to-day prices of opening and working a restaurant could make house owners suppose twice about doing so.

Whether or not you’re a gifted chef, native entrepreneur or a seasoned restaurateur opening new areas, restaurant financing will be a method to assist convey the dream to life.

That’s why on this article, you’re going to be taught:

Let’s dive proper in.

Your POS system is your restaurant’s heartbeat

Run your restaurant with Lightspeed POS and Funds. Create customized flooring plans and menus, take tableside orders, settle for funds and handle your entire enterprise from one intuitive platform.

What’s restaurant financing?

Restaurant financing refers to any type of exterior funding that enterprise house owners safe to assist a variety of enterprise wants. This could possibly be a financial institution mortgage, funds from household and associates, traders or different lending sources.

What to do earlier than you apply for restaurant financing

Write a marketing strategy

Whenever you’re beginning or shopping for a restaurant, you want a marketing strategy that outlines your aims and the way you propose to get there.

Not solely will this doc enable you to strategize your manner in direction of paying down your mortgage and creating an economically viable restaurant however, in lots of instances, a written marketing strategy is required when making use of for funds. Get forward of the curve and make this your first step earlier than you even search financing.

The identical goes for for those who’re increasing what you are promoting to new areas.

Decide how a lot financing your restaurant will want

The price of shopping for or opening a restaurant can vary from 1000’s to hundreds of thousands of {dollars} relying on the placement, dimension, restaurant kind and different components. Even when we assume that the value is cheap to you and also you’re keen to take out financing to assist pay for it, the precise quantity will assist dictate what sort of mortgage that you must apply for and what the phrases might be.

Why do restaurant house owners apply for financing?

There’s a number of the reason why restaurant house owners and finance groups search for funding within the first place.

- Beginning a brand new enterprise

- Renovating an present location

- Buying an already-established restaurant

- Investing in new gear

- Opening one other location

- Including extra tables to extend covers

- Operations, advertising and marketing or hiring recommendation

- Rebranding

- Diversifying via catering and packaged items

- Funding operational bills

Beginning a brand new enterprise

There are many startup costs to plan for earlier than a restaurant can open its doorways to the general public. Homeowners may must refurbish premises, replace previous kitchen gear, purchase furnishings and fittings and put money into menus and employees uniforms. And let’s not overlook the necessity to fastidiously supply that all-important meals, alcohol and beverage inventory.

Renovating an present location

As profitable eating places evolve, many cooks and house owners search to rent extra skilled kitchen employees or redesign their interiors. Inside design developments change quickly, particularly in metropolitan areas. What’s extra, busy eating places can shortly expertise put on and tear due to the sheer variety of prospects coming via the doorways every day. Whereas it’s drawback to have, it does imply common renovations develop into a actuality.

Buying an already-established restaurant

Buying an already-established restaurant generally is a good thing—your buyer base is probably going already inbuilt. Nonetheless, there are some things it’s best to ask earlier than deciding to buy a enterprise.

- Why is that this restaurant on the market? Except you’re making the house owners a ridiculous provide, they’ll have their very own causes for desirous to get out of the enterprise. These causes is perhaps private—household obligations, burnout—or they is perhaps associated to the well being of the enterprise. If it’s the latter, determine whether or not you’ve gotten the talents to remodel the restaurant before you purchase.

- Is the restaurant in location? A restaurant’s location will be the only largest purpose why it succeeds or fails. If the restaurant is doing effectively, perform a little research to see simply how a lot of its success is due to components aside from location. If the restaurant is coasting off of reductions, offers or current media publicity relatively than constructing a sustainable loyal buyer base, your reign is perhaps a brief one.

- What’s the money move state of affairs? You want a real understanding of the restaurant’s funds before you purchase, which suggests inspecting its money move. Eating places are identified for having low margins, however are these margins, on the very least, constant? Will you ultimately end up taking out extra financing to cowl payroll you probably have a gradual month? The money move image for a restaurant ought to embody overhead prices, reminiscent of hire, utilities, insurance coverage, and taxes, in addition to labor prices, meals prices, examine averages and meals and beverage gross sales. If the present proprietor is reluctant to point out you the books, that’s a purple flag.

- Does the restaurant have any lingering liabilities? Be sure you examine any liabilities hooked up to the enterprise, reminiscent of well being code violations, lawsuits or unpaid gross sales tax. You don’t must inherit any excellent money owed on prime of what you’ll owe your self.

- Is the gear in good situation? A restaurant’s gear is the center of the enterprise. Not solely are belongings like fridges, industrial ovens and meals preparation gear very important to the success of a restaurant, they’re additionally sometimes fairly costly and tough to exchange or repair on the fly. Earlier than agreeing to purchase a restaurant, have an skilled examine the gear.

Investing in new gear

Whether or not it’s cooks, waitstaff, or baristas—everybody wants the appropriate instruments to do their jobs. For that reason, many homeowners look to gear financing to assist fund the restaurant gear they’ll want, from coffeemakers, a POS system and premium ovens, to grills and stoves.

Opening one other location

Enlargement is one other widespread purpose why house owners discover their restaurant financing choices. Many entrepreneurs have daring plans to develop from a single location into both a sequence of city-wide or regional eating places. Doing so comes with prices associated to sourcing new commercial spaces, dealing with renovations, paying working bills and even developing a brand new constructing.

Including extra tables to extend covers

However not all enlargement plans must be so grand. Very similar to their cooks who fastidiously add an ingredient right here and there to make sure an ideal style, restaurant house owners might look to vary their enterprise extra slowly. Increasing can contain one thing so simple as including house to serve extra ‘covers’ on new tables.

Operations, advertising and marketing or hiring recommendation

Restaurant house owners should make many selections every single day, typically in opposition to the backdrop of the hustle and bustle of a busy restaurant. It’s comprehensible that many homeowners select to get some exterior recommendation. There may be an rising variety of consultants—some who personal or chef in different eating places—who’ve begun to offer recommendation to different restaurant house owners. Such consultants may also help with sourcing managers or sous cooks, give recommendation about how you can place a restaurant in a crowded market or assist to enhance the general working of the enterprise.

Rebranding

Restaurant house owners know the trade is very aggressive. In actual fact, many thrive on it.

Nonetheless, it may be a problem for eating places serving extremely in style cuisines—in French bistros, Italian pizzerias and Japanese ramen spots—to face out from rivals providing related dishes and experiences. It’s right here the place the worth of a restaurant’s model can develop into a key level of distinction. Some restaurant loans are getting used to create standout manufacturers or to rebrand conventional venues for rising culinary and dietary tastes.

Diversifying via catering or packaged items

A method eating places can construct a robust model is by persevering with prospects’ experiences with them past the constructing. Right here’s the place offering catering services and take-home merchandise can play a component.

Many grills are well-known for his or her steak and rib sauces. Italian eating places have home-made pasta that’s not possible to recreate your self. And a few Asian eating places have frozen dumplings that may—for just a few fleeting moments—whisk your tastebuds again to that favourite restaurant.

Whereas offering these items can present a further income stream for eating places, they do include the prices of product growth, packaging and logistics.

Funding operational bills

In search of funding will not be all the time about progress. On different events, house owners pursue restaurant funding choices to assist the day-to-day working of the enterprise. In eating places the place income is seasonal—and even unpredictable—some house owners might determine to safe funds to assist constructive cashflow.

10 restaurant financing choices

Now that you just’ve realized about a number of the causes for restaurant lending, listed here are 10 totally different financing choices you possibly can take into account:

- Brick-and-mortar financial institution loans

- Various loans

- Small Enterprise Administration loans (SBA)

- Service provider Money Advances (MCA)

- Enterprise line of credit score (LOC)

- Enterprise crowdfunding

- Loans from family and friends

- Business actual property mortgage (CRE)

- Gear financing

- Buy order financing

For a quick overview of how these restaurant financing choices stack up in opposition to each other, seek the advice of the desk beneath.

| Brick-and-mortar financial institution loans | Various loans | Small Enterprise Administration loans (SBA) | Service provider money advances (MCA) | Enterprise line of credit score (LOC) | Enterprise crowdfunding | Loans from family and friends | Business actual property mortgage (CRE) | Gear financing | Buy order financing | |

| Curiosity Charges | Varies | Varies | Varies | Varies | Varies | Varies | Varies | Varies | Varies | Varies |

| Collateral Necessities | Sure | Varies | Sure | No | No | No | No | Sure | Sure | No |

| Approval Course of | May be prolonged | May be faster | May be prolonged | Fast | Fast | May be prolonged | Fast | May be prolonged | May be prolonged | Fast |

| Compensation/Remittance Phrases | Varies | Varies | Varies | Fastened | Fastened | Varies | Varies | Varies | Varies | Varies |

| Eligibility Necessities | Good credit score, robust financials | Varies | Good credit score, robust financials | Enterprise should generate income | Good credit score, robust financials | Varies | None | Good credit score, robust financials | Good credit score, robust financials | None |

| Finest For | Established companies | Companies with less-than-perfect credit score | Established companies with robust financials | Companies with short-term money move wants | Companies with ongoing money move wants | Companies looking for funding for particular tasks | Companies with restricted entry to conventional financing | Companies buying industrial actual property | Companies buying gear | Companies fulfilling giant buy orders |

Now, let’s dive into extra element in regards to the professionals and cons of all 10 choices for sourcing funds.

1. Brick-and-mortar financial institution loans

Let’s begin with most likely essentially the most well-known possibility: your financial institution. Conventional banks have been lending to small to mid-sized companies for a really very long time. Their techniques are established, rigorous and confirmed. Let’s take a fast have a look at the professionals and cons of looking for finance via a financial institution.

Are financial institution loans proper to your restaurant?

2. Various loans

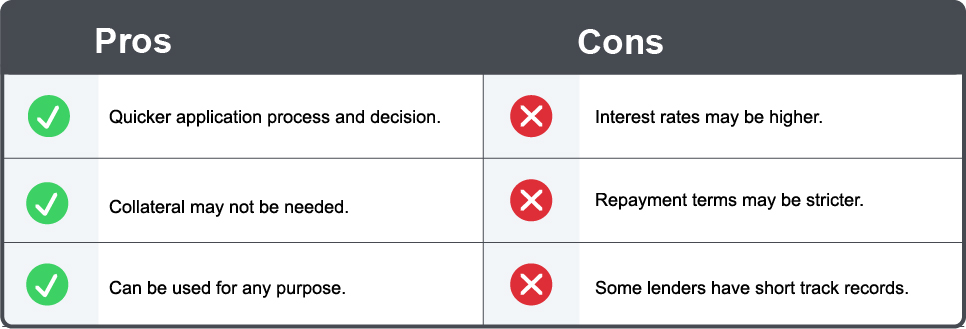

Understandably, not each restaurant proprietor has the time or often the credit score historical past to safe funding from a brick-and-mortar lender. In these conditions, loans for eating places will be pursued with a variety of various lenders. Listed here are some factors you may need to take into account when trying into another mortgage possibility.

Are various loans proper to your restaurant?

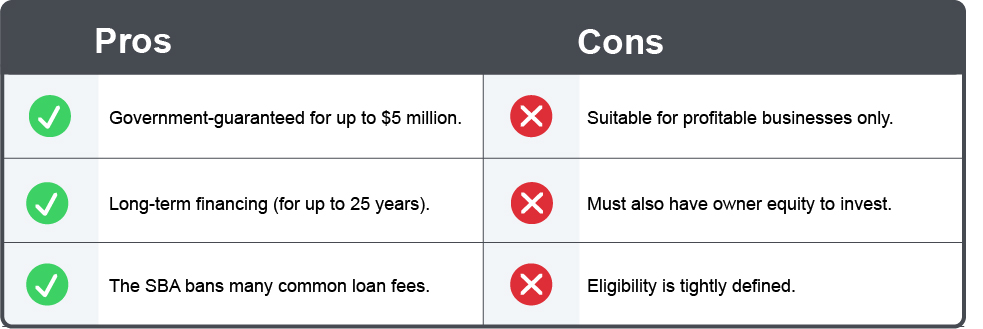

3. Small Enterprise Administration (SBA) loans

SBA loans assist present small companies after they can’t get financing from different sources or with out an SBA assure for the lender. The SBA doesn’t fund these restaurant loans instantly. It ensures banks it can repay a portion of the mortgage if a enterprise defaults.

SBA loans could also be used to purchase land or gear, purchase an present enterprise, refinance present debt, or buy equipment, furnishings, fixtures, provides or supplies.

Is an SBA mortgage proper to your restaurant?

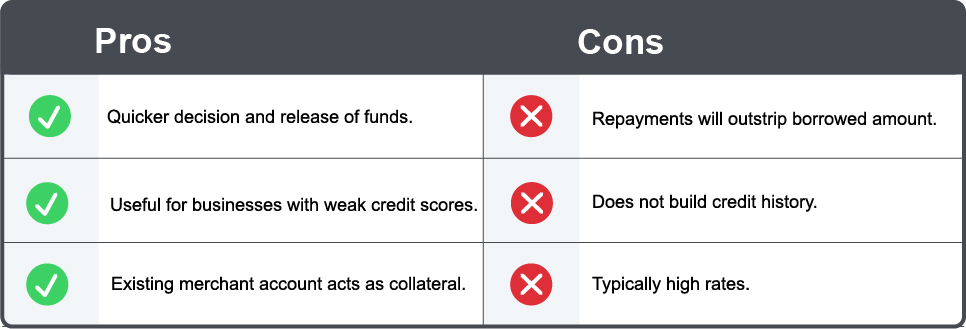

4. Service provider money advance (MCA)

Technically not a mortgage, a service provider money advance (MCA) is a manner for eating places to obtain funds in opposition to future funds that might be made via their service provider cost system.

This may be helpful for eating places which might be processing a excessive quantity of bank card transactions whereas needing entry to funds—quick. Nonetheless, the charges of some MCA suppliers can result in reimbursement quantities outstripping the unique advance by as a lot as 40%.

Level of sale companions like Lightspeed additionally provide service provider money advance choices for his or her prospects. Lightspeed Capital takes away the roadblocks many restaurant house owners face on their seek for funding. With a money advance provide that’s tailor-made to what you are promoting, you’ll be capable of develop your restaurant, keep money move and finance new tasks. It’s quick, handy and safe funding you could obtain in as quickly as two enterprise days.

For Lightspeed buyer and restaurant collective Dabangg Group, Lightspeed Capital is essential to their progress. They used their money advance to put money into fashionable {hardware}.

“In relation to opening a restaurant, there are loads of overhead prices and capital belongings we have to inject into the brand new websites. So, when Lightspeed Capital got here in, that helped us keep the infrastructure and put money into new techniques.” mentioned buying supervisor Joju Shibu.

Tip: Lightspeed eating places which might be eligible for a money advance via Lightspeed Capital can speak to their account managers for extra particulars on the flat payment. Attain out for extra info.

Is an MCA proper to your restaurant?

Get an in-depth understanding about merchant cash advances in this article.

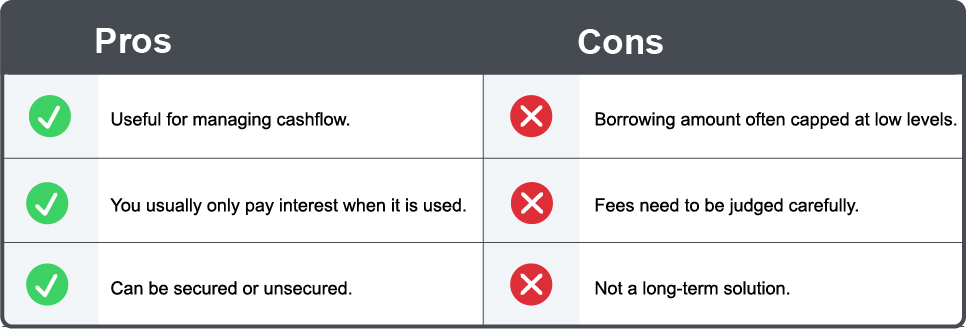

5. A enterprise line of credit score (LOC)

Companies normally hunt down strains of credit score via their financial institution. Many various lenders are actually providing this selection too. In brief, a enterprise line of credit score permits eating places to entry a set extra quantity of funds every, as and when wanted. Bigger companies particularly typically pull funding from a LOC.

Is a enterprise line of credit score (LOC) proper to your restaurant?

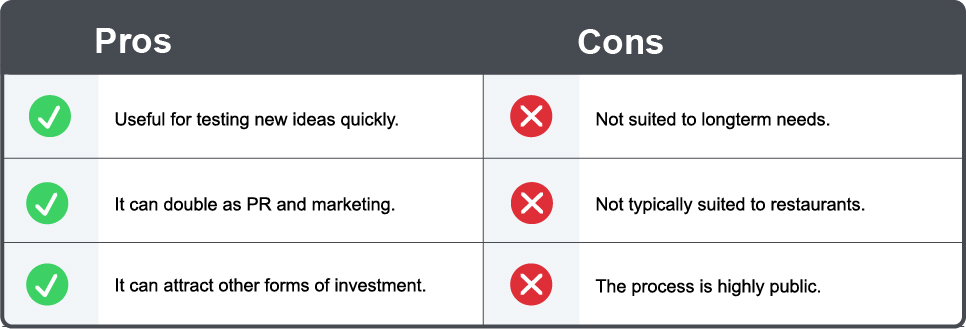

6. Crowdfunding

Crowdfunding is the usage of small quantities of capital from a lot of people to finance a brand new enterprise enterprise, in keeping with Investopedia. Crowdfunding is usually used to validate new product concepts or search funding from early adopters for a brand new startup concept. It’s much less related to service companies, notably eating places. Nonetheless ? Listed here are a number of the professionals and cons. It’s not the commonest methodology of funding, and is normally a final resort for entrepreneurs who’re searching for funding.

Is crowdfunding proper to your restaurant?

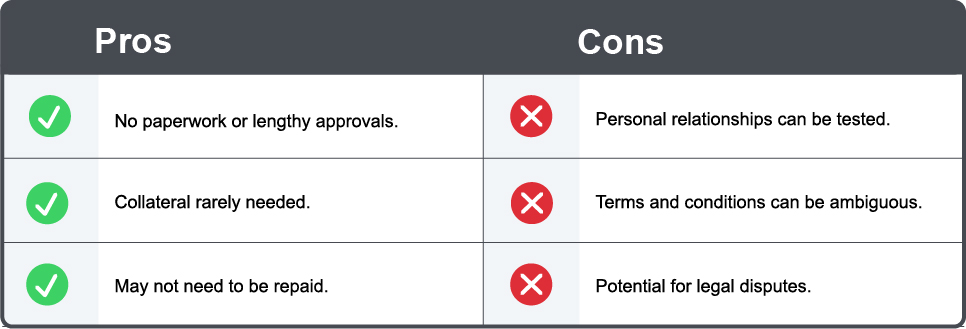

7. Family and friends

For those who’ve been working a restaurant for a variety of years, your family and friends are possible a few of your largest supporters. They could have backed you as a enterprise proprietor and dug into their very own pockets, as your earliest and subsequently most loyal patrons.

It is smart then. That is why many enterprise house owners select to ask mother and father, siblings, companions and associates for financing. They may also help cooks and restaurant-owners get working capital via a mortgage and not using a credit score examine. Simply bear in mind: mixing skilled and private relationships can develop into difficult.

Is a mortgage from household and associates proper to your restaurant?

8. Business actual property mortgage (CRE)

Business actual property isn’t getting cheaper any time quickly. Restaurateurs can faucet into industrial actual property (CRE) loans to enhance buildings, parking heaps, gardens and extra. Some lenders, notably these collaborating in SBA schemes, might enable debtors to incorporate architectural and authorized charges, value determinations and different building prices inside a mortgage.

Editor’s be aware: We’ve got skipped the professionals and cons right here. That’s as a result of, for those who’re critically contemplating a industrial actual property (CRE) mortgage, it might be finest to talk to your accountant or a trusted monetary adviser. CRE loans are very totally different from residential actual property mortgages, for instance. Talking to an advisor might enable you to higher perceive how CRE loans are assessed and structured in another way for eating places of assorted sizes.

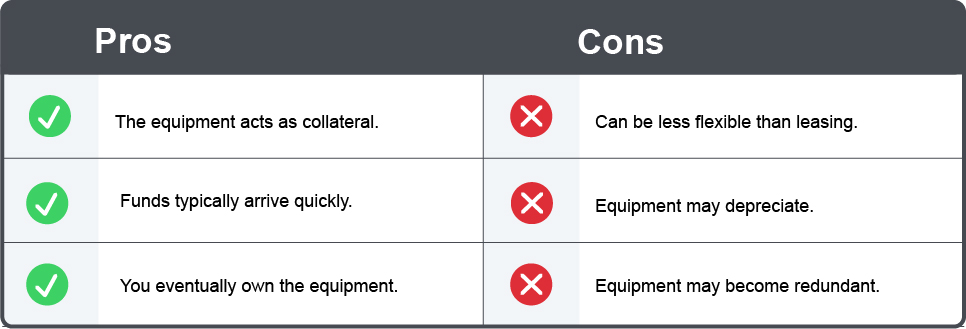

9. Gear financing

Eating places typically must fund issues like coffee-makers, POS know-how, premium ovens, grills and stoves. That is the place gear financing may also help. Listed here are its professionals and cons.

Is gear financing proper to your restaurant?

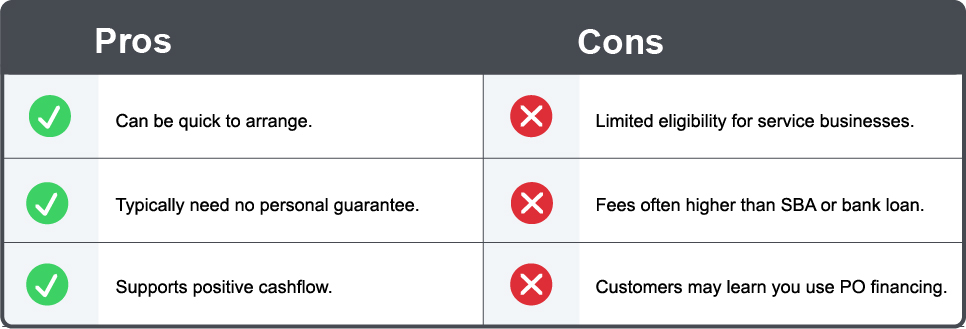

10. Buy order (PO) financing

As each enterprise proprietor is aware of, orders are sometimes obtained and accomplished lengthy earlier than they’re paid for. You most likely know this solely too effectively, in case your restaurant gives a catering service, for instance. Purchase order (PO) financing generally is a helpful possibility for eating places that don’t have sufficient money move to finish excellent orders.

Is PO financing proper to your restaurant?

6 methods to judge restaurant financing and loans

As you possibly can see, the funding choices we’ve checked out range extensively. Right here’s what to do subsequent, for those who’ve began to hone in on some attainable choices from the record above. Take the next steps when assessing every possibility:

1. Examine how shortly you get your capital

When selecting a financing possibility, an necessary level to think about is the time earlier than you possibly can really use the capital. Do you want the cash in just a few months for an enlargement? Or did your fridge break and that you must purchase new gear at present? These components will decide which possibility works finest for what you are promoting.

2. Consider complete repayments

Eating places can calculate the full repayments of their financing by contemplating a number of key components. First, they should decide the mortgage quantity, which is the principal borrowed from the lender. Subsequent, they need to determine the rate of interest utilized to the mortgage, whether or not it’s fastened or variable. With these two items of data, they will calculate the curiosity expense by multiplying the mortgage quantity by the rate of interest. Moreover, they need to take into account any charges related to the mortgage, reminiscent of origination charges or prepayment penalties and issue these into the full reimbursement quantity.

As soon as the curiosity expense and costs are decided, eating places can add them to the mortgage quantity to acquire the full reimbursement quantity. To grasp the reimbursement construction, they need to additionally decide the reimbursement time period, the variety of month-to-month or yearly funds required. By multiplying the month-to-month or annual cost quantity by the full variety of funds, eating places can calculate the full repayments over the mortgage time period. It’s important to think about these calculations fastidiously to evaluate the affordability of the financing and make knowledgeable choices concerning their monetary obligations.

3. Examine the time period of the mortgage

In restaurant financing, the reimbursement time period refers back to the agreed-upon interval over which the borrower should repay the borrowed funds, together with any accrued curiosity and costs. It’s the length inside which the mortgage should be absolutely repaid to the lender. The reimbursement time period is often laid out in months or years and is a crucial side of the mortgage settlement. The size of the reimbursement time period can range relying on the precise phrases of the mortgage, the quantity borrowed, the borrower’s monetary profile and the lender’s necessities.

Shorter reimbursement phrases normally imply larger month-to-month funds however end in sooner mortgage payoff and probably decrease total curiosity prices. Alternatively, longer reimbursement phrases typically end in decrease month-to-month funds however might entail larger curiosity bills over the lifetime of the mortgage. You will need to fastidiously take into account the reimbursement time period and select a length that aligns with their monetary capabilities and long-term enterprise plans.

4. Examine the advantages of fastened vs. variable charges

When evaluating the advantages of fastened versus variable charges when financing, eating places ought to take into account a number of components. Fastened charges present stability and predictability, because the rate of interest stays fixed all through the mortgage time period, permitting eating places to funds and plan accordingly. This may be advantageous in periods of financial uncertainty or when rates of interest are anticipated to rise. Alternatively, variable charges might provide decrease preliminary rates of interest, offering potential price financial savings within the early levels of the mortgage.

Nonetheless, in addition they introduce the chance of charge fluctuations, which means that the rate of interest can improve over time, probably rising the restaurant’s borrowing prices. Eating places ought to fastidiously assess their monetary state of affairs, danger tolerance and market circumstances to find out which possibility aligns finest with their long-term monetary objectives and stability requirement.

5. Discover out of collateral is required

Discovering out if collateral is required is essential when searching for restaurant financing attributable to its important implications on the borrowing course of and danger administration. Collateral serves as safety for the lender, lowering their danger by offering an asset that may be seized and offered within the occasion of mortgage default.

Understanding whether or not collateral is required helps eating places assess their skill to satisfy the lender’s standards and decide if they’ve enough belongings to safe the mortgage. It additionally impacts the mortgage phrases, rates of interest and borrowing capability. By clarifying collateral necessities early on, eating places could make knowledgeable choices, discover various financing choices if essential and guarantee they’re adequately ready to satisfy the lender’s circumstances and defend their enterprise belongings.

6. Assessment the lender’s fame

In relation to cash and financing, Reviewing the lender’s fame is an important step. A lender’s fame displays their observe document, credibility and reliability within the trade. Eating places ought to conduct thorough analysis, search suggestions from different debtors and evaluate on-line sources to evaluate the lender’s fame. This contains evaluating their customer support, responsiveness and transparency of their lending practices. Have you ever labored with this lender earlier than? Have you learnt of different eating places or companies which have labored with them earlier than?

A good lender could have a constructive fame, demonstrating a historical past of truthful and moral dealings, aggressive rates of interest and clear mortgage phrases. They need to have a strong monetary standing, making certain they will present the mandatory funds and assist all through the mortgage time period. By reviewing the lender’s fame, eating places can mitigate the chance of potential points or unfavorable experiences, making certain a constructive and useful financing partnership.

You won’t even must look far for lending choices. A few of your present suppliers may already provide funding choices. Partnering with a POS provider that gives safe entry to funding is a good way to take away a number of the danger from financing.

Your financing and loans match

Taking a step to develop or assist your restaurant enterprise will be equal elements thrilling and nerve-wracking. In the end, you’ll know finest which is the appropriate possibility for what you are promoting as you proceed to look into funding sources.

For those who’re at the moment a Lightspeed buyer, attain out to your Account Supervisor to seek out out for those who’re eligible for Lightspeed Capital.

Lightspeed enterprise Wander the Resort selected Lightspeed Restaurant to combine with its lodge administration system Cloudbeds. They’ve saved tons of a month on charges and have elevated their choices and income streams consequently.

Able to take the subsequent step to your restaurant? Talk to one of our experts to learn the way Lightspeed may also help.

FAQ

How do you get financing for a restaurant?

There are a lot of methods you may get financing to your restaurant, together with: service provider money advances, financial institution loans, small enterprise loans and a enterprise line of credit score. Speak to a monetary advisor to see what the most suitable choice is for you.

How a lot do you funds to pay again restaurant financing?

Relying on the financing you employ, your financial institution, credit score union or accountant will give you an amortization schedule.

How arduous is it for a restaurant to get financing after declaring chapter?

It relies upon. Normally, it’s necessary to take the time to construct your credit score, construct regular revenue, pay present money owed and flesh out a long-term marketing strategy.

How arduous is it to finance a restaurant?

There are many funding choices on the market to get the financing you want to your restaurant. Whether or not you’re opening new areas, shopping for new gear or paying for working bills, there’s a plan on the market for you.

[ad_2]

Source link