[ad_1]

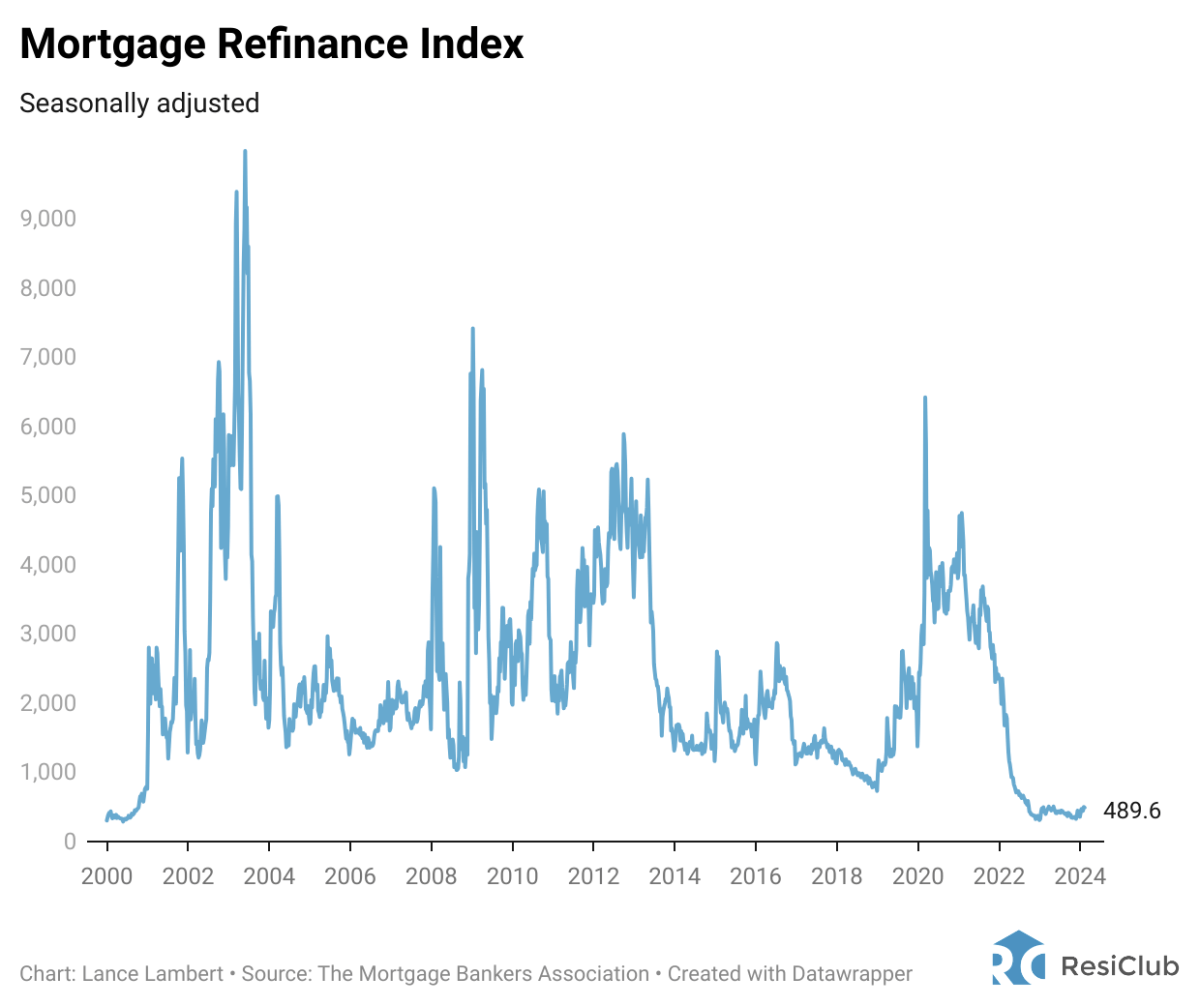

The dangerous information for the mortgage trade: The mortgage market continues to be passing by one among its largest slumps in current reminiscence. The excellent news? There are indicators this mortgage recession could have lastly hit the underside when it comes to quantity.

The story is fairly easy. After spiking in 2022, mortgage charges nonetheless haven’t come down in a significant approach.

That has constrained turnover available in the market for present properties, as the “switching costs” of going from a 3% mortgage charge to a 6% or 7% charge don’t make lots of monetary sense for would-be sellers. Moreover, conventional refinancing has primarily dried up.

In line with the most recent studying this week from the Mortgage Bankers Affiliation, each mortgage buy functions (see above) and refinance functions (see under) have bounced up—simply barely—from the lows they reached in 2023.

Mortgage functions are nonetheless hovering round multi-decade lows.

After we speak in regards to the “mortgage market,” we aren’t referring to your entire housing sector. As an example, on a nationwide degree, single-family dwelling costs rose in 2023.

And, all issues thought of, the homebuilding sector has been pretty resilient regardless of the mortgage-rate shock. Builders diminished their margins to supply incentives like mortgage buydowns, whereas the stock of present properties (builders’ competitors) remained tight. And so builders had been in a position to hold promoting.

Massive image: The first approach the mortgage trade may rebound within the brief time period is that if mortgage rates were to see a steep decline. An improved degree of housing affordability wouldn’t solely spur extra exercise within the present dwelling market but in addition unleash some pent-up demand within the refinance section.

[ad_2]

Source link