[ad_1]

U.S. small caps struggled for the previous two years as rising borrowing costs and pressure from higher interest rates challenged the asset class and stifled danger urge for food.

Since 2021, buyers in beta merchandise monitoring market cap-weighted small-cap indexes have had a disappointing expertise, with just about no silver linings like this 12 months’s success of the Magnificent 7 within the large-cap universe.

So, the place ought to buyers alongside the decrease finish of the fairness measurement spectrum flip after two years of losses? We predict there’s worth to uncover in small-cap methods primarily based on fundamentals reasonably than unique broad market possession.

For these interested in fundamentals, we not too long ago carried out an annual rebalance for the WisdomTree U.S. SmallCap Dividend Index (WTSDI), which is tracked by the WisdomTree U.S. SmallCap Dividend Fund (DES). Let’s assess how its composition and fundamentals modified throughout our screening and reconstitution processes.

WisdomTree U.S. SmallCap Dividend Index (WTSDI)

The WisdomTree U.S. SmallCap Dividend Index applies a dividend-weighted methodology to the U.S. small-cap market. Starting with the dividend-paying U.S. fairness universe (ensuing within the WisdomTree U.S. Dividend Index (WTDI)), we take away the 300 largest firms by market cap to create the WisdomTree U.S. LargeCap Dividend Index (WTLDI). We then create the WisdomTree U.S. MidCap Dividend Index (WTMDI) from the highest 75% of market capitalization remaining. The residual 25% of market cap is reserved for a dividend-weighted small-cap basket.

Due to the volatile nature of small-cap equities, we regularly see extra pronounced adjustments to WTSDI throughout the annual rebalance, and this 12 months’s was no exception. Nevertheless, most adjustments stay per the inherent worth bias within the technique ensuing from its dividend emphasis.

Sector Composition – Publish-Rebalance Comparability

The small-cap Index elevated its publicity to Financials, a standard heavyweight in value-oriented indexes, because of decrease valuation ratios and the banking sector’s choice for paying money dividends. Vitality and Utilities, two extra value-oriented sectors, additionally acquired notable pickups. These additions primarily got here on the expense of Industrials and Supplies.

However WTSDI’s sector composition diverges from the Russell 2000 Value Index, which is broader and comprises a swath of unprofitable firms.

It stays over-weight within the two Shopper sectors relative to the market, however these over-weights have been barely pared by the rebalance. Supplies exhibited the identical conduct however to a larger extent. The other occurred inside Vitality and Financials, the place the post-rebalance pickups helped cut back present under-weights to the Russell 2000 Worth. A brand new over-weight was established in Utilities, the place rebalance additions put WTSDI 2.8% forward of the market, whereas Industrials have been decreased to roughly market weight.

The sector adjustments spotlight the fluid nature of the U.S. small-cap universe and the worth of a basic emphasis in a predominantly low-quality market with a prevalence of unprofitable firms.

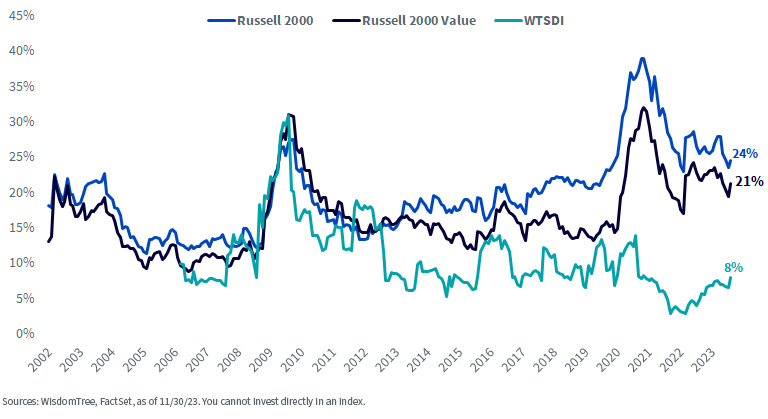

Weight in Unprofitable Firms over Time

Over the previous decade, each the small-cap and small-cap worth markets held roughly 20% of index weight in unprofitable firms, on common. Immediately, they account for one-fifth to one-quarter of every market after peaking at about 40% and 35%, respectively, throughout the top of the pandemic. WTSDI’s portion, in the meantime, stays under 10%.

Evidently, fundamentals matter for U.S. small caps, and WisdomTree’s annual rebalance for WTSDI illustrates how they’re enhanced in comparison with market cap-weighted composite possession.

Basic Comparability after Rebalance

The screening and reconstitution course of resulted in a 40-basis-point improve to trailing dividend yield and a decreased leverage multiplier in comparison with pre-rebalance metrics. Regardless of the 1.4% decline in ROE, all these measures are significantly higher than these of the Russell 2000 Worth Index. WTSDI delivers a 1.5% enchancment to dividend yield and a 7% mixed improve to ROE and ROA that leads to a 0.3-point discount to leverage.

As soon as once more, these enhancements don’t price extra when it comes to valuation, both. WTSDI’s trailing P/E stays seven factors under that of the U.S. small-cap worth market.

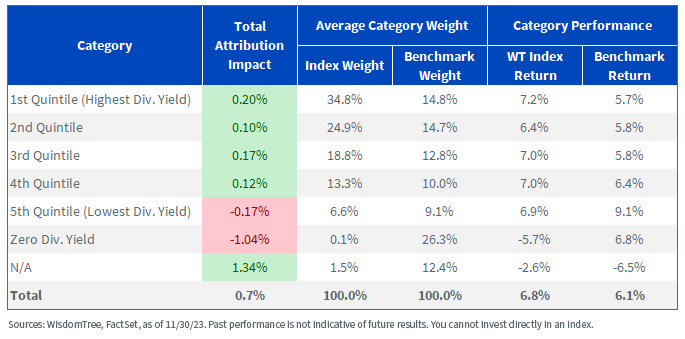

Our methodology has rewarded over the long term as properly, the place we see the worth of dividend-weighting the small-cap market. Since inception in June 2006, WTSDI outperformed the Russell 2000 Worth Index by greater than 70 foundation factors per 12 months. Screening for dividends enabled us to pick outperforming shares and cut back the affect of underperformers throughout the highest 4 quintiles of dividends over the 17-year interval. This considerably defined all outperformance.

Dividend Yield Attribution – WTSDI vs. Russell 2000 Worth Index – June 2006–November 2023

On to 2024…

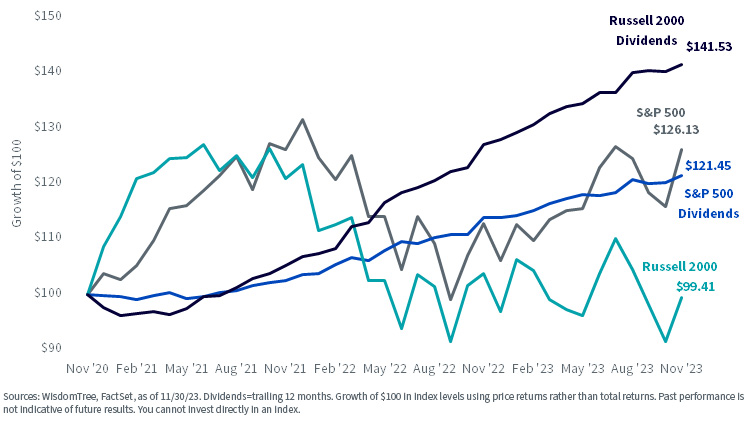

Heading into subsequent 12 months, we consider WTSDI can present compelling alternatives for no matter fairness market surroundings lays forward, particularly as soon as market sentiment reverses in small caps’ favor. Dividend-paying small caps might obtain an overdue tailwind as properly if prevailing tendencies in massive caps are any indication.

Over the previous three years, S&P 500 worth returns have largely stored tempo with the expansion of dividends regardless of briefly overshooting the basics throughout 2021. Small caps can not say the identical, nevertheless, because the Russell 2000 has solely fallen on a worth return foundation for the final three years, though its trailing dividend development significantly surpasses that of the S&P.

Basic Disconnect: Small Cap Costs down Whereas Dividends up >40% Over the Final 3 Years

We don’t suppose this development can, or ought to, proceed. As soon as the tide turns in small caps’ favor, we predict they are going to be poised for outperformance.

Between sectoral shifts and basic enhancements, and constructive tendencies amongst dividend-paying firms, we’re inspired that dividend-weighting the U.S. small-cap fairness market might proceed to be additive for a portfolio.

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. Funds focusing their investments on sure sectors and/or smaller firms improve their vulnerability to any single financial or regulatory growth. This will lead to larger share worth volatility. Dividends should not assured, and an organization at present paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link