[ad_1]

One of many largest themes throughout megatrend investing—a minimum of, in our opinion—is cybersecurity. Each time a brand new expertise is launched, it concurrently must be secured. That is true of autonomous autos, the metaverse, area, artificial intelligence…the record goes on.

It’s arduous to think about a theme that’s equally “required” throughout the board, even when we should admit that we can’t essentially take this logic throughout to discovering the strongest-performing firms. We all know the idea is required—we don’t know precisely which firms will execute the most effective for years to return.

WisdomTree’s Thematic Universe

WisdomTree is commonly monitoring the entire totally different exchange-traded funds (ETFs) that it deems to be a part of the “Thematic Universe.” The common report is out there here. It affords us to select matters—on this case, cybersecurity—and do comparisons to among the largest and most longstanding funds. Whereas we acknowledge efficiency at all times ebbs and flows, and no single fund outperforms all others the entire time, it’s our view that thematic matters run cold and warm.

If we’ve got motive to consider a subject is sizzling, then that’s the time to indicate whether or not totally different funds aiming at publicity to the subject are capturing the efficiency.

Cybersecurity Acquired HOT in Late 2023

As with many investments, there’s a fixed push and pull between the corporate fundamentals and the general macroeconomic backdrop. In late 2023, we had many corporations reporting earnings for the third quarter of 2023, after which we had an general view that possibly the U.S. Federal Reserve must think about decrease coverage charges sooner or later in 2024.

Downward-trending rates of interest and robust income development are an excellent recipe for cybersecurity firms—notably newer firms which have entered the general public markets extra just lately.

Determine 1a: Standardized Efficiency as of September 30, 2023

For the newest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on the related ticker: WCBR, HACK, CIBR

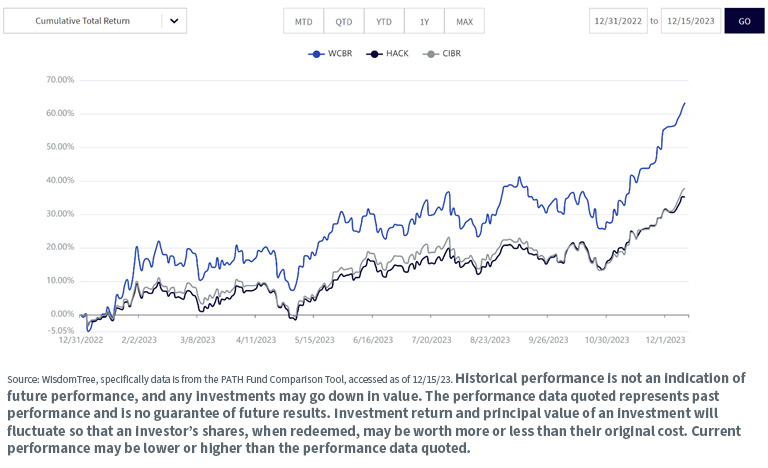

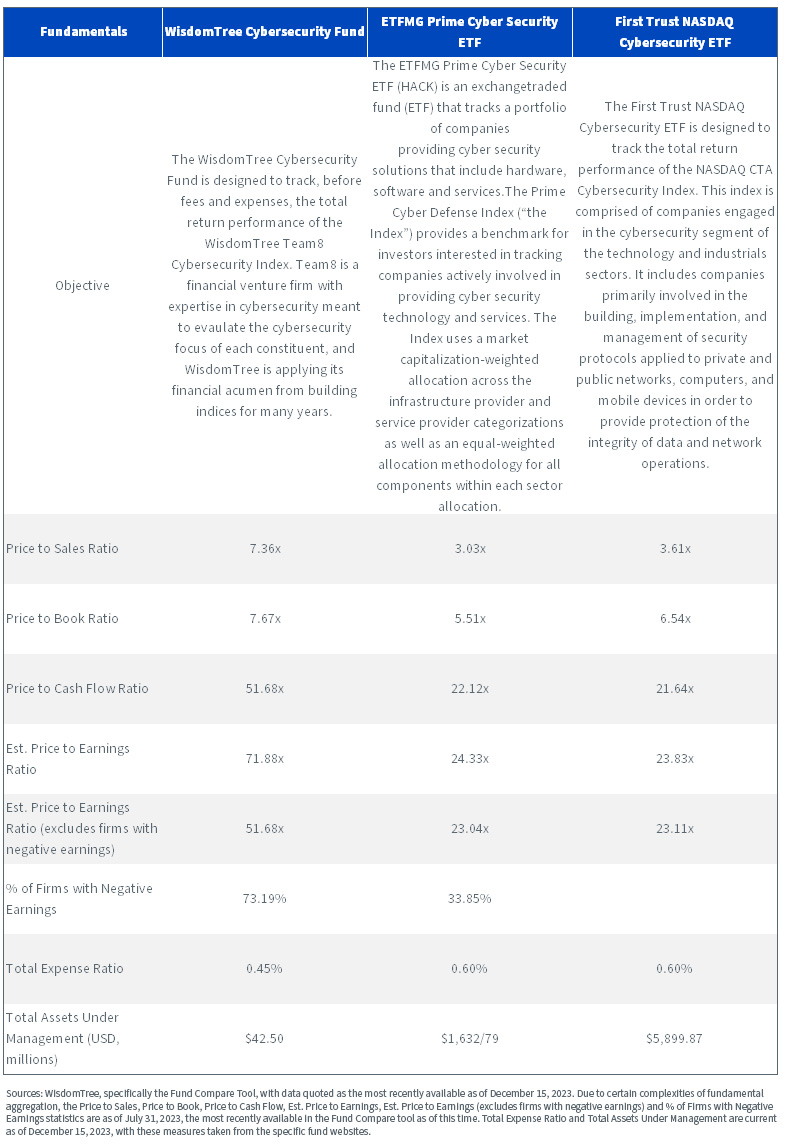

After we analyze ETFs centered on cybersecurity shares, HACK and CIBR are the 2 largest on the idea of belongings below administration as of December 15, 2023. CIBR just isn’t removed from $6 billion in belongings.

WCBR is a more recent entrant, launched in early 2021 versus late 2014 (HACK) or mid-2015 (CIBR). 2023 affords a chance to evaluate a interval after we know the subject of cybersecurity acquired sizzling, when current geopolitical threats are actual (Russia, Iran) and, probably, geopolitical threats are on the horizon (Taiwan).

How did these totally different funds reply?

- WCBR has tended towards the next volatility than both HACK or CIBR, however when the subject acquired sizzling in November and half of December 2023, there was a transparent acceleration in returns.

- HACK and CIBR additionally accelerated by way of their performances, however they had been similar to one another and didn’t have the identical upward-sloping trajectory as WCBR.

We might be aware that that is merely one occasion—it might not be the identical sooner or later—and traders ought to at all times evaluate many various efficiency intervals when analyzing totally different ETFs.

Determine 1b: WCBR vs. HACK & CIBR in 2023 (December 31, 2022, to December 15, 2023)

For the newest month-end and standardized efficiency and to obtain the respective fund prospectuses, click on the respect ticker: WCBR, HACK, CIBR

How Near Chopping-Edge Can You Get?

I’ve heard it stated by way of cybersecurity: the attackers solely must be proper as soon as, whereas the defenders have to defend towards 100% of assaults. Consider generative AI—on the one hand, an unimaginable software, however on the opposite, a brand new manner for attackers to repurpose it into doing multitudes of extra refined assaults.

There’s a premium on accessing the latest firms pursuing probably the most present defenses.

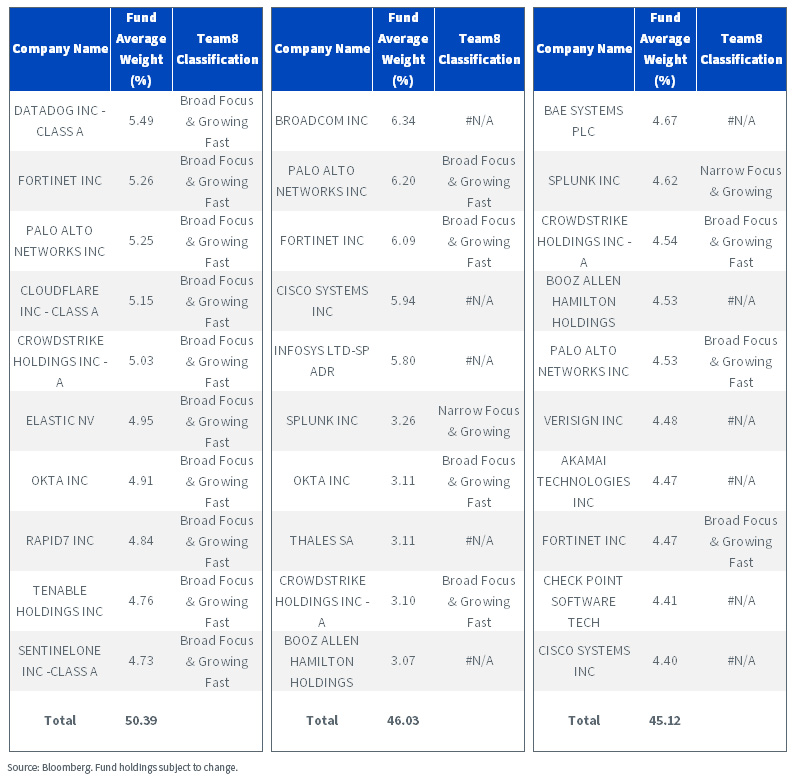

WCBR, HACK and CIBR are all monitoring the returns of indexes, so the first query regards how shut these indexes can get to the latest applied sciences. We are able to study rather a lot by trying on the high 10 positions.

In determine 2, we see:

- WCBR, CIBR and HACK all have the same weight within the high 10 holdings—45% to 50%, roughly talking.

- As a part of the method behind the WisdomTree Team8 Cybersecurity Index (tracked by WCBR), Team8, with its cybersecurity experience, charges what every firm is doing in cybersecurity towards what they consider are the eight most vital vital purposeful areas of the self-discipline. The main target is on the way forward for what shall be wanted in cybersecurity, and a broad focus is telling us that the corporate is doing a minimum of three issues that Team8 views as vital to the way forward for cybersecurity.

- The Nasdaq CTA Cybersecurity Index (tracked by CIBR) is concentrated on cybersecurity throughout the Expertise and Industrials sectors. It seems to see that the businesses are engaged within the constructing, implementation and administration of safety protocols utilized to personal and public networks. After we take a look at determine 2 and see #N/A, that is telling us that Team8 didn’t give the corporate a score that match inside one in every of its eight distinct focal factors on the way forward for cybersecurity.

- The Prime Cyber Defense Index (tracked by HACK) is concentrated on cybersecurity inside {hardware}, software program and providers. Once more, the #N/A is telling us that these firms didn’t meet Team8’s normal of being concerned in one in every of their eight vital cybersecurity areas.

We acknowledge that there isn’t any true benchmark of the efficiency of any thematic fairness technique, and in lots of instances, the biggest methods had been round for the longest intervals. Methods can evolve with the occasions—we attempt to design ours with this in thoughts—however we additionally acknowledge how troublesome that’s. Working with Team8, which has amongst its professionals individuals who have been coping with cyber actions in Israel’s army and the U.S.’s Nationwide Safety Company, is the best way through which we be sure that the main focus of the businesses on cybersecurity is the truth is evolving with as a lot pace as attainable throughout the Index.

Determine 2: High 10 Firm Exposures inside WCBR, CIBR and HACK (Common Weights from December 31, 2022, to November 30, 2023)

Conclusion: Will a Needed Thematic Get an Curiosity Fee Tailwind in 2024?

Pure-play cybersecurity firms have been unstable—in 2021, this volatility was within the upward route, whereas in 2022, it was within the downward route. A part of the explanation for that is that we noticed rates of interest going from principally the report lows of easy-money policy to among the highest ranges we’ve got seen in practically 20 years. If 2024 has extra of a downward than an upward development in charges, this might create a tailwind behind these shares at a time when the world is continually eager about safety amidst growing geopolitical dangers.

We expect that WCBR represents a excessive sensitivity to each this megatrend and rates of interest, however we’ve got little question that traders could need to do their very own evaluation below the hood of those three Funds.

Determine 3: Additional Info Supporting the Comparability of Completely different Funds

In the event you’re desirous about diving extra into the comparability of those Funds, please take a look at our Fund Comparison Tool.

Essential Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. The Fund invests in cybersecurity firms, which generate a significant a part of their income from safety protocols that stop intrusion and assaults on methods, networks, functions, computer systems and cell gadgets. Cybersecurity firms are notably susceptible to fast modifications in expertise, fast obsolescence of services and products, the lack of patent, copyright and trademark protections, authorities regulation and competitors, each domestically and internationally. Cybersecurity firm shares, particularly these that are web associated, have skilled excessive worth and quantity fluctuations up to now which have usually been unrelated to their working efficiency. These firms might also be smaller and fewer skilled firms, with restricted services or products strains, markets or monetary sources and fewer skilled administration or advertising and marketing personnel. The Fund invests within the securities included in, or consultant of, its Index no matter their funding advantage, and the Fund doesn’t try to outperform its Index or take defensive positions in declining markets. The composition of the Index is closely depending on quantitative and qualitative info and information from a number of third events, and the Index could not carry out as supposed. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link