[ad_1]

Whenever you run a retailer, it’s crucial to maintain a finger on the heartbeat of your enterprise. Taking note of metrics like stock worth can reveal loads concerning the state of your organization’s funds and its operational effectivity.

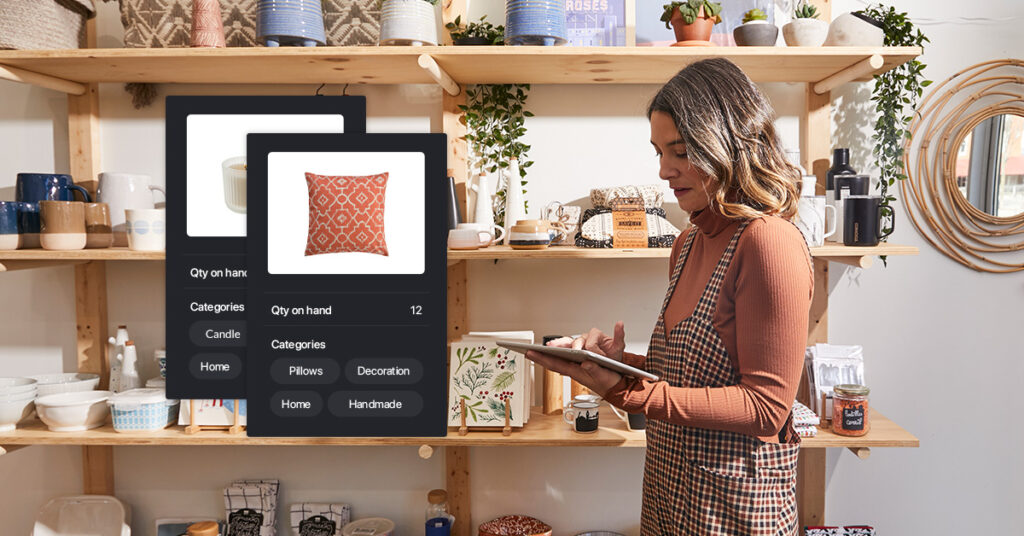

Though information is energy, counting and managing stock generally is a restrictively time-consuming job. With the intention to rapidly confirm how a lot your stock is price, you both want a retail inventory management system that retains monitor of your inventory in actual time, or a shortcut for manually gauging your stock’s worth. The retail stock methodology was created that can assist you obtain the latter.

On this information to the retail stock methodology, you’ll be taught:

Stock administration made straightforward

Use our straight-forward stock administration template to streamline stock monitoring, saving you hours of time.

What’s the retail stock methodology?

The retail stock methodology is an accounting technique for approximating the ending worth of your retailer’s stock, i.e., the worth of the stock remaining on the finish of your accounting interval. This methodology estimates worth by evaluating how a lot you, the retailer, paid for the merchandise to how a lot you promote the merchandise for.

The retail methodology serves as a shortcut to conducting a guide stock rely, however shouldn’t exchange it. In any case, this methodology isn’t all the time correct as a result of shedding or damaging a fraction of your inventory is unavoidable.

For greatest outcomes, use the retail stock methodology solely when the merchandise you’re appraising have the identical markup. For instance, this methodology gained’t work if you happen to’re calculating the worth of denims which have a 50% markup and pencils which have a 150% markup. As a substitute, examine apples to apples.

Why it is best to use the retail stock methodology

The retail stock methodology is a useful technique for valuing stock for a lot of causes.

First, it’s a quicker various to conducting bodily stock counts. Counting stock manually is simple whenever you promote giant, massive ticket objects, like mattresses or boats. Nevertheless, it’s extra sophisticated whenever you run a retailer with many SKUs, like a boutique or grocery retailer, for instance. This stock accounting methodology is a shortcut to estimating your inventory’s worth.

The retail methodology may also assist you perceive when to replenish your inventory. As the worth of your stock decreases, you’ll know that you just’re getting nearer to your reorder point.

Through the use of the retail stock methodology, you may as well achieve a greater understanding of methods to manage inventory costs. When you understand how a lot your stock is price, you achieve insights into inventory-related bills, corresponding to holding, ordering, and delivery prices. The extra you already know about your enterprise, the higher you’re outfitted to make choices.

Lastly, this accounting methodology reveals insights into gross sales efficiency. By calculating stock worth regularly, you may perceive how rapidly you’re promoting merchandise and see how your gross sales examine to these of earlier months. If gross sales of sure objects are stagnant, that might be an indication that it is advisable higher manage overstock inventory or conduct an inventory cleanup.

The way to calculate worth utilizing the retail stock methodology

The retail stock methodology estimates ending stock worth. The system for ending stock worth utilizing the retail stock methodology is:

Worth of Ending Stock = Value of Items Out there for Sale – (Gross sales*Value-to-Retail Share)

Let’s break down that system additional.

Value of products out there on the market is the cost of goods sold (COGS) for the stock you already had in inventory firstly of the accounting interval plus the price of any new stock bought through the accounting interval. Bear in mind to make use of the wholesale value you paid for the stock, and never the worth you’re charging your prospects.

Value of Items Out there for Sale = Worth of Present Stock + Worth of Newly Bought Stock

By gross sales we imply the retail worth (i.e., value to prospects with a markup) of the merchandise you offered throughout this time.

To search out your cost-to-retail share, a.okay.a. the fee complement share, divide the price of items offered (how a lot you paid for the stock) by the retail costs of these items (how a lot you cost prospects for these items). Then, a number of that quantity by 100 to finish up with a share.

Value-to-Retail Share = (Value of Items Bought/Retail Value)*100

Instance of calculating stock worth by the retail methodology

Now let’s apply placing the retail stock methodology into apply. Let’s say that you just run a clothes boutique and need to know the ending worth of your denims stock on the finish of the primary quarter of the 12 months.

1. Calculate price of products out there on the market

First it is advisable discover the price of items for the denims out there on the market that you just had in inventory firstly of the quarter. By information out of your point-of-sale (POS) system, you see that on January 1, you already had $1,000 price of denims in inventory. That makes the worth of your present stock $1,000.

Now it is advisable calculate how a lot you spent shopping for further stock throughout Q1. In accordance with stock experiences, in January, you bought an extra $500 in denims, then spent $250 on denims in February, and one other $500 on denims in March. By including these purchases collectively, you be taught that the worth of your newly bought stock is $1,250.

Now we plug these figures into the system for the price of items out there on the market.

Value of Items Out there for Sale = Worth of Present Stock + Worth of Newly Bought Stock

Value of Items Out there for Sale = $1,000 + [$500 + $250 + $500] = $1,000 + $1,250 = $2,250

Your price of products out there on the market is $2,250.

2. Calculate gross sales

Subsequent, it is advisable learn how a lot income your retailer generated from promoting denims throughout Q1. In accordance with your retail POS experiences, your boutique offered $2,500 price of denims from January by March.

3. Calculate cost-to-retail share

Now it’s time to calculate your cost-to-retail share, which might be discovered by dividing the price of items offered by retail value. Based mostly in your POS experiences, the typical price of products offered for a pair of denims in your retailer is $20. These retail analytics reports additionally inform you that the typical retail value at which you promote denims at your store is $80.

Due to this fact, your price complement share is:

Value-to-Retail Share = (Value of Items Bought/Retail Value)*100 = $20/$80 = 0.25*100 = 25%

4. Enter figures into stock worth system

Now you have got all of the figures it is advisable calculate the worth of your stock on the finish of Q1.

Value of Items Out there for Sale = $2,250

Gross sales = $2,500

Value Complement Share = 0.25

Let’s plug the entire figures into the system:

Worth of Ending Stock = Value of Items Out there for Sale – (Gross sales*Value-to-Retail Share)

Worth of Ending Stock = $2,250 – ($2,500*25%) = $2,250 – $625 = $1,625

The approximate worth of the stock you have got left on the finish of Q1 is $1,625.

Alternate options to the retail stock methodology

The retail methodology to stock represents only one technique for calculating your stock’s worth. Alternate approaches embody counting stock, the FIFO (first in, first out) methodology, the LIFO (final in, first out) methodology, and the weighted common price methodology. Let’s take a more in-depth take a look at these options to the retail stock methodology.

Counting stock

As famous, the retail stock methodology solely gives an approximate worth to your stock. It doesn’t account for objects that may’t be offered as a result of they’ve been misplaced, stolen, or broken, so your precise stock worth will most likely be lower than this estimated worth.

Essentially the most correct technique to learn how a lot your stock is price is to do a guide rely. Whereas the retail methodology to stock valuation is an efficient shortcut whenever you’re in a pinch, it may’t exchange bodily stock counting.

FIFO

The First In, First Out (FIFO) methodology calculates the worth of your stock based mostly on the COGS of the oldest objects in your stock. As a result of costs fluctuate in occasions of financial volatility, it may be advantageous to make use of an accounting methodology that acknowledges these adjustments.

The FIFO methodology for calculating stock worth entails dividing the COGS for the objects that had been bought first by the variety of models bought. Be aware that this methodology provides you the typical value for one unit of stock, whereas the retail stock methodology provides you the worth of your complete stock, or the phase of your stock that you just’re trying into.

LIFO

Within the Final In, First Out (LIFO) methodology, stock is calculated based mostly on COGS for the latest objects in your stock. The system for stock worth utilizing the LIFO methodology entails dividing the COGS for objects bought final by the variety of models bought. As with the FIFO methodology, the LIFO methodology calculates a mean price per unit.

Weighted common price methodology

The weighted common price (WAC) methodology makes use of the weighted common price of things in stock to calculate their worth. That signifies that not like LIFO and FIFO, this methodology isn’t involved with when the objects had been bought. To search out stock worth per the WAC methodology, merely divide your common COGS by the variety of models in your stock.

Retail stock administration system

Whenever you equip your retailer with a retail inventory management system, you may skip counting and calculating altogether. When your POS has complete stock options inbuilt, you’ll all the time know precisely how a lot your stock is price, in actual time.

Calculating stock worth by the retail stock methodology

Figuring out how a lot your stock is price provides you beneficial details about your enterprise. With this perception, you may perceive gross sales efficiency, higher handle prices, know when to reorder stock, and extra. Though the retail stock methodology doesn’t exchange bodily stock counts, it gives a fast estimate that may assist energy enterprise choices.

Skip the calculations and equip your retailer with Lightspeed POS. Watch a demo immediately.

[ad_2]

Source link