[ad_1]

Tuesday shares fell after a really horrific financial report pushing them again from close to the all time highs for the S&P 500 (SPY). Was this report the trigger for the market decline? And what does it imply for the market going ahead? 43 yr funding veteran Steve Reitmeister shares his views and high 13 trades within the commentary that follows under.

The Empire State Manufacturing Index plummeted earlier than the market open on Tuesday. Subsequently, the inventory market plummeted too.

Is that coincidence or causation?

That vital exploration, and what it means for the inventory market going ahead, would be the focus of at the moment’s Reitmeister Whole Return commentary.

Market Commentary

The Empire State Manufacturing Index is without doubt one of the most generally adopted regional financial reviews. That is as a result of it covers the big manufacturing base in New York, which is commonly a bellwether for industrial exercise throughout the nation.

Effectively, that very important index plummeted to a studying of -43.7 on Tuesday morning. That’s shockingly dangerous when the consensus estimate referred to as for a studying of solely -5.

The worst of the part rankings was the -49.4 exhibiting for New Orders. That ahead wanting aspect doesn’t bode nicely for what lies forward.

This information on Tuesday morning is actually a part of the combo resulting in a pullback in shares. However earlier than you hit the panic button let’s think about just a few issues beginning with this chart:

Notice how dangerous this report has been for the previous yr…though your complete time the nationwide financial system has been in optimistic territory and a bull market has emerged. Plenty of that has to do with manufacturing being a contact weak whereas the a lot bigger providers sector was doing fairly nicely.

One other oddity is that additionally on Tuesday the ten yr Treasury charges spiked as soon as once more again above 4%. That’s in nice contradiction to what the weak spot of the Empire State Index would suggest.

Which means that manufacturing report, if thought-about a harbinger of what’s to indicate up in different financial reviews, would have many extra folks fearful in regards to the chance of future recession. And as you already know, recessions are deflationary which might completely have charges heading decrease on Tuesday…not larger as what occurred.

The purpose being, buyers usually are not reacting to the weak spot within the Empire State Manufacturing Index. Very true when broader, and extra full, readings of the financial system are nonetheless fairly wholesome. For instance, the +2.2% development estimate for This autumn as measured by the famed GDPNow mannequin.

Are you saying that buyers are as soon as once more fearful about rising charges and what the Fed will do at upcoming conferences?

Probably not fearful about that both, due to a formidable exhibiting for the Producer Worth Index (PPI) on Friday. 12 months over yr that’s right down to just one% inflation. Even higher was discovering the month to month PPI studying truly in minus territory.

Which means that prime inflation continues to go decrease growing the chances on the Fed will begin reducing charges sooner or later this yr. The better thriller is whether or not that begins on the March, Might or June Fed conferences.

I consider that the rationale for Tuesday’s inventory unload is rather more benign whenever you admire that 4,800 poses severe resistance for the S&P 500 (SPY). That is as a result of it equates to creating new all time highs for the inventory market.

Will probably be laborious to interrupt to these new highs with out supreme confidence that the Fed will begin reducing charges to spark better financial exercise which begets larger earnings development which, as everyone knows, begets larger share costs.

This very idea was on the coronary heart of my current commentary: When Will the Bull Market Run Again?

On the earliest, that fee lower and inventory catalyst could also be in hand as early as March 20th the place buyers at present place 67% odds on a fee lower going down. To be sincere, I feel it is nearer to 50/50 probability making the Might 1st and June 12th conferences as actual prospects.

Lengthy story quick, I don’t anticipate a significant inventory advance till after the Fed makes the primary fee cuts. That most definitely factors to a buying and selling vary forming with 4,800 being the upside and the earlier help space of 4,600 being the draw back.

That will not be thrilling…however it’s not scary both. Very true after the super bull run we loved to shut out the yr. So, to offer again 3-5% should not shock anybody.

As an alternative, this can be a good time to overview all of your inventory holdings. That are getting wealthy in valuation prompting you to take earnings. And which new picks, with extra interesting upside, needs to be added again.

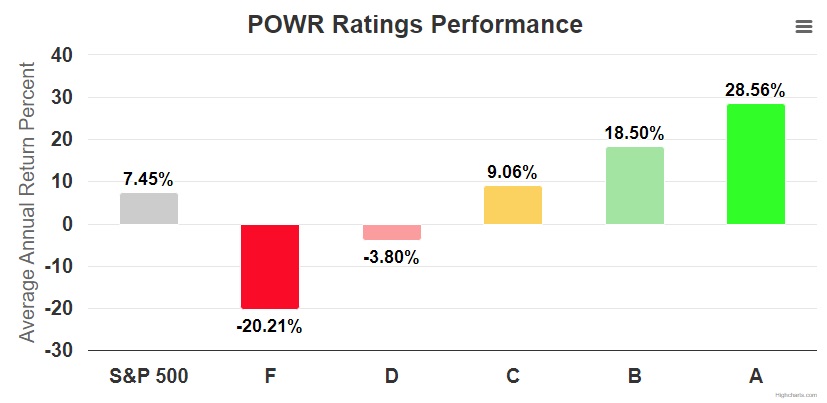

Our POWR Rankings is actually useful in that regard. We simply up to date the long run efficiency by the top of 2023:

The excellent news of these outcomes is the practically 4X benefit of our A rated shares over the S&P 500 for the reason that begin of 1999.

The dangerous information is that there are at present practically 300 A rated shares. Too many to purchase…and too many to simply analysis to slender right down to those you want finest.

The answer for locating a smaller, extra engaging group of those POWR Rated shares is shared within the part that follows…

What To Do Subsequent?

Uncover my present portfolio of 11 shares packed to the brim with the outperforming advantages present in our unique POWR Rankings mannequin. (Practically 4X higher than the S&P 500 going again to 1999)

This consists of 5 below the radar small caps just lately added with super upside potential.

Plus I’ve chosen 2 particular ETFs which are all in sectors nicely positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and the whole lot between.

In case you are curious to study extra, and wish to see these fortunate 13 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares had been buying and selling at $474.93 per share on Tuesday afternoon, down $1.75 (-0.37%). 12 months-to-date, SPY has declined -0.08%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Total Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Recession & Bear Market Warning from Tuesday? appeared first on StockNews.com

[ad_2]

Source link