[ad_1]

Nvidia’s earnings report introduced a lot intrigue. Take into account this headline from the Monetary Occasions:

“Nvidia Is Nuts, When’s the Crash?”1

The outcomes over the previous yr have been superb, sure, however there are not any precedents for an organization rising from a market capitalization beneath a $1 trillion to $2 trillion in lower than a yr.1

Does the hype match actuality?

The CURRENT share worth just isn’t essentially a mirrored image the previous, however reasonably a view on the FUTURE. One analyst believes Nvidia’s present valuation could be effectively supported IF the corporate can develop their present revenues tenfold and accomplish that with an working margin round 55% over the approaching 10 years.

We can not know immediately if that may occur, however observe your complete semiconductor market—that means all gross sales of all semiconductors, not simply AI accelerators—has been $500–$600 billion in recent times.3

Continued execution on an exponential development thesis, whereas not not possible, is a really excessive hurdle to clear.

What Does a 10-Occasions Income Leap Look Like?

Nvidia has been a public firm for a very long time—it went public in 1999 at $12 per share.1 Earlier than the intense emotions of FOMO (worry of lacking out) kick in, keep in mind the position of graphics processing items (GPUs) in synthetic intelligence purposes didn’t hit the mainstream till the so-called “AlexNet” second in 2012.5

Because of this we will have a look at Nvidia’s revenues, yr by yr, for fairly a very long time in determine 1.

- Annually is specifying the income determine within the 10-Okay, so 2013 represents Nvidia’s revenues for the 12 months main as much as January 31, 2013, as reported within the 2013 10-Okay. The entire firm earned $4.28 billion in revenues throughout that interval, after which through the 12 months main as much as January 31, 2024, the entire firm earned $60.92 billion: greater than a easy 10 instances enhance. We additionally see exponential form to the expansion.

- Whereas the overall income on the earnings assertion is a standardized accounting discipline, corporations have the flexibleness to indicate totally different sources of that income based mostly on the tales that they need to painting associated to their enterprise. Over time, the best way these categorizations are made can change. We discovered that Nvidia denoted a “Compute and Networking” phase of revenues from 2021 onwards. This phase is comprised of Nvidia’s Information Middle accelerated computing platforms and end-to-end networking platforms. The concentrate on Nvidia in 2024 lies within the demand for its AI accelerator chips for knowledge facilities, so there’s worth in this explicit phase of revenues.

Determine 1: Nvidia’s Annual Revenues over Time

What about Earnings?

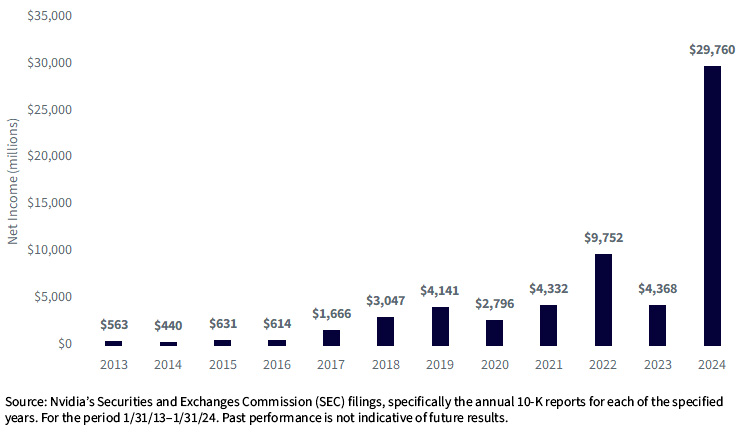

Now, revenues usually are not earnings. Nonetheless, the expansion story of Nvidia’s internet earnings is much more spectacular than the income development part, as we see in determine 2:

- For the 12 months to January 31, 2013, we see Nvidia’s internet earnings was $563 million. For the 12 months main as much as January 31, 2024, we see this determine jumped to nearly $30 billion.

- Most of this development, by far, was once more based mostly on being effectively positioned for the huge, unprecedented build-out of compute infrastructure kicked off by ChatGPT and generative AI. Within the 12 months to January 31, 2023, internet earnings was roughly $4.4 billion—important development from $563 million, however nothing near the close to $30 billion seen over the subsequent yr.

Determine 2: Nvidia’s Income over Time

Who Are Nvidia’s Prospects?

The Nvidia A100, H100 and shortly B100 AI accelerator chips are actually techniques and never chips that people would purchase. The worth lies extra in constructing a community of those techniques—often 1000’s or tens of 1000’s of them—versus simply shopping for a pair. Meta Platforms CEO Mark Zuckerberg indicated Meta would, by the top of 2024, have 350,000 Nvidia H100s—which may characterize $9 billion.5 That doesn’t really feel like sort of standard buy, however we will see.

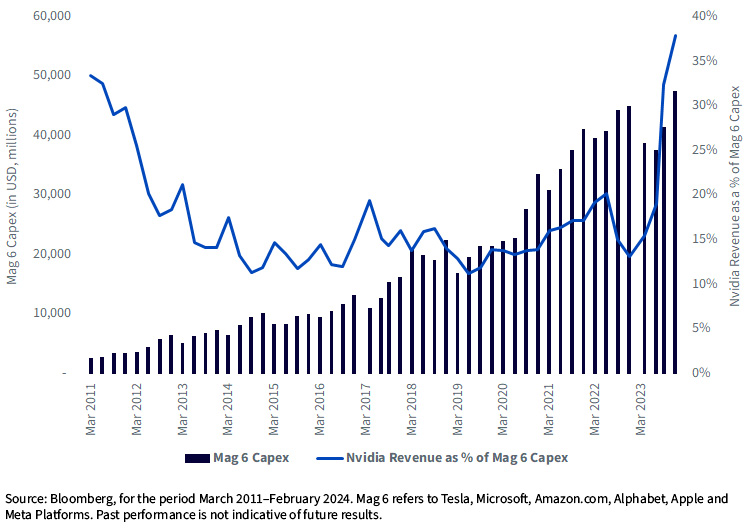

The Magnificent 7, excluding Nvidia (the so-called Magazine 6) characterize a big chunk of the purchasers which are at present spending the cash to assist Nvidia’s ongoing, blockbuster outcomes.

Microsoft, Amazon.com and Alphabet are working the world’s three largest public cloud infrastructure platforms. If the purchasers need to practice and run fashions on Nvidia chips, these corporations want to purchase Nvidia chips. If one supplier slows down, it creates a chance on the others.

The Magazine 6 have been rising their capital expenditures. If we evaluate the extent of reported capital expenditures at these corporations and the general degree of revenues that Nvidia has reported, blunt evaluation signifies nearly 40% of the overall capex could possibly be represented by Nvidia’s revenues. We have no idea what every of those corporations is spending at Nvidia, though anecdotal proof abounds that corporations must preserve ordering from Nvidia for danger of being shut out of future manufacturing runs in the event that they decelerate.

Determine 3: A Important Quantity of Nvidia’s Income May Be Magazine 6 Capex

Conclusion: Megatrends & the Energy Legislation

Nvidia’s outcomes are so exceptional that it’s tough for any firm to match. When contemplating thematic investments, much like enterprise capital, there is usually a energy regulation at work, through which, as an alternative of all corporations delivering a outcome near common, we must always seemingly see a small variety of corporations delivering astronomical outcomes and different corporations with horrible outcomes. Luckily, the astronomical outcomes can cancel out the horrible outcomes over time.

For methods centered on AI, Nvidia is clearly a necessary firm however the success won’t transfer ahead based mostly on a single firm. The semiconductor worth chain is advanced, and we advocate fascinated with the relationships exemplified inside it—for example, the truth that Taiwan Semiconductor Manufacturing Co. (TSMC) is fabricating Nvidia’s superior chips. Nvidia just isn’t, at present, making the bodily chips.

When contemplating totally different AI methods, we observe that it’s extra essential to look underneath the hood and easily perceive—what’s the Nvidia publicity? What’s the Magnificent 7 publicity? There usually are not appropriate and incorrect solutions, however it’s essential to verify the diploma of publicity to those totally different sorts of issues is monitored over time and matches the view the investor is trying to implement.

1 Dan McCrum, “Nvidia Is Nuts, When’s the Crash?” Monetary Occasions, 2/16/24.

2 Nvidia’s market cap on 2/18/23 was roughly $532 billion, whereas on 2/2/24 it was round $1.9 trillion. Supply: https://companiesmarketcap.com/nvidia/marketcap/

3 Supply: “Investor FAQs,” Nvidia.com. https://investor.nvidia.com/investor-resources/faqs/default.aspx#:~:text=back%20to%20top-,When%20was%20NVIDIA’s%20initial%20public%20offering%20and%20what%20was%20the,%2C%201999%20at%20%2412%2Fshare.

4 Supply: “AlexNet and ImageNet: The Delivery of Deep Studying,” Pinecone.io. https://www.pinecone.io/learn/series/image-search/imagenet/

5 Supply: Asa Fitch, “Nvidia Hits $2 Trillion on Insatiable AI Chip Demand,” Wall Road Journal, 2/23/23.

[ad_2]

Source link