[ad_1]

Key Takeaways

- The launch of 11 distinct spot bitcoin ETF methods within the first quarter of 2024 has resulted in roughly $60 billion in property below administration, a historic success for ETF launches.

- The upcoming bitcoin halving occasion in April 2024, the place the block reward paid to miners will lower, suggests a possible shift within the provide/demand stability towards demand outpacing provide, which might result in upward strain on the value of bitcoin.

- ETF shopping for has outpaced the creation of latest bitcoin for the reason that launch of the ETFs, indicating elevated investor curiosity in gaining publicity to bitcoin by way of acquainted brokerage platforms.

One of many largest tales of the primary quarter of 2024 in U.S. ETFs has been the launch of 11 distinct spot bitcoin methods. January 11, 2024, is really a date that may go down in ETF historical past, much like the launch of SPDR’s gold trust in 20041 and even SPDR’s S&P 500 Index trust in 1993.2

As we write these phrases, roughly $60 billion in property below administration are represented by these 11 spot bitcoin ETF methods.3 As is usually the case, this $60 billion represents a large dispersion, with just a few fairly massive methods, some mid-sized and a few smaller.

The Halving

In April 2024, an occasion known as “the halving” will happen throughout the bitcoin protocol. That is extensively anticipated, in that it’s written into the code that the block reward paid to bitcoin miners will shift from 6.25 bitcoin to roughly 3.13 bitcoin. Bitcoin’s protocol has a so-called “halving cycle” of about 4 years, so we’ve seen these occasions earlier than—rewards began at 50, dropping first to 25, then 12.5 after which 6.25. This can hold occurring between now and 2140, when all 21 million bitcoin slated to ever be created will exist.

Determine 1 is a chart that we’ve proven earlier than, noting that if we scale bitcoin’s value on the day of a previous halving to 1.0, we see that over the following roughly 2.5-year interval, there was additional appreciation in every of the three circumstances.

- On the one hand, we are able to take into consideration bitcoin on a provide/demand foundation. If demand is outpacing provide, there ought to be upward strain on the value. The halving signifies that there’s much less new bitcoin provide coming into the world, so if demand merely stays the identical, the availability/demand stability instantly shifts extra towards demand outpacing provide.

- To be balanced, we’ve to additionally acknowledge that many issues affect the habits of buyers throughout the general bitcoin market. Prior halving cycles being related to bitcoin’s value appreciation can not inform us with certainty what is going to happen sooner or later.

Determine 1: Bitcoin’s Value Habits after Three Halving Cycles So Far

Spot Bitcoin ETFs: A New Supply of Demand

Probably the most-loved attributes of bitcoin regards the understanding of provide primarily based on the protocol’s code over time. As an illustration, we all know that in 2140, there might be 21 million bitcoin, and we all know that nothing can happen to vary this. We all know, as said with the halving, the minting of latest provide coming on-line is being diminished, by half, roughly each 4 years.

That is in direct distinction to fiat forex programs the place governments can resolve to print extra items of forex on an infinite foundation. All through historical past, we’ve seen examples of fiat currencies dropping their worth and primacy as a result of additional and additional printing. We’ve got seen the U.S. greenback lose worth over time after breaking the hyperlink to gold in 1971,4 permitting the U.S. authorities to print an increasing number of forex with no need it to be backed by items of gold.

It was hypothesized that, if the Securities and Trade Fee accepted spot bitcoin ETFs, new sources of demand to carry bitcoin would open up. In 2004, a brand new possibility opened up for buyers who didn’t wish to undergo the trouble of buying and storing bodily gold bars. Similarly, in 2024, an possibility opened as much as enable buyers to realize publicity to identify bitcoin by way of acquainted brokerage platforms on which they commerce ETFs backed by different forms of property.

Now, slightly greater than two months into the journey, we are able to evaluation how the availability/demand story has been evolving in bitcoin and whether or not we are able to clearly see any affect from the ETFs.

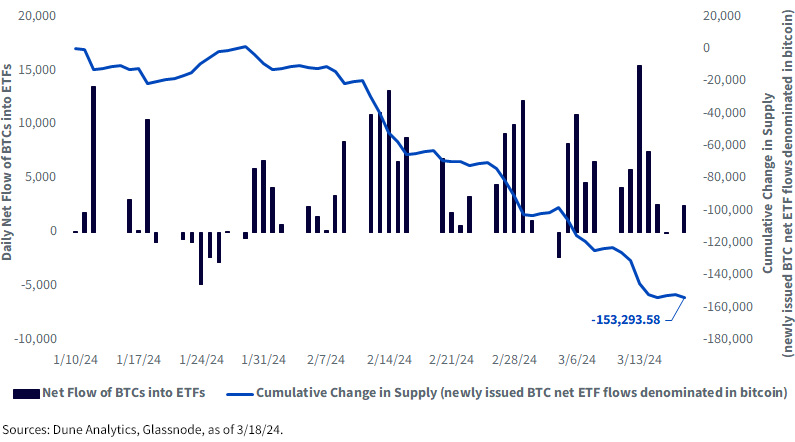

Determine 2 reveals us:

- It appears to be like like many are concerned with bitcoin: One speculation superior earlier than the ETFs launched regarded a rise in investor sorts—people who have been precluded from establishing their very own crypto wallets, for instance—having the ability to achieve publicity. The every day internet circulate of BTCs into ETFs is totally skewed to the constructive finish of the spectrum, and we observe that there have been nonetheless many buyers working at corporations the place central dwelling workplaces haven’t but issued blanket approvals to make use of these merchandise throughout the board.

- ETF shopping for has outpaced bitcoin issuance: Bitcoin purchases by ETFs has outpaced the creation of latest bitcoin, over this particular interval, by roughly 153,294 items. This may occasionally not at all times be the case, and we observe that the general worth of the bitcoin market is over $1 trillion, as we write, however there are massive volumes of bitcoin which might be confirmed to not commerce with a excessive frequency. The house is clear—we are able to see the ETF shopping for, we are able to see the wallets, we are able to see how lengthy it has been since particular person items have moved. The one factor we have no idea is strictly when or why house owners might commerce.

Determine 2: ETF Demand vs. Bitcoin Issuance

Conclusion: Bitcoin Is about Provide and Demand

There isn’t any scarcity of various fashions that may create a possible value or vary of value ranges that may be applicable for bitcoin. The house is so new, solely beginning in 2009, that there’s not but a universally accepted valuation methodology—versus, as an illustration, discounted money flows for shares or bonds.

Whereas buyers proceed to go looking and refine higher methods to develop value targets, we discover it extra informative to contemplate provide and demand. Proper now, it seems that ETF demand is excessive, and we additionally know that the halving is coming. Now, ETF demand can change shortly—that is the great thing about the construction—however this might be seen and clear, and we (in addition to others) will be capable of monitor these tendencies in almost actual time.

1 The SPDR Gold Shares Technique (GLD) launched on 11/18/04. As of three/19/24, it had greater than $58 billion in property below administration.

2 The SPDR S&P 500 ETF Belief (SPY) launched on 1/22/93. As of three/19/24, it had greater than $526 billion in property below administration.

3 Supply: Bloomberg, with information, as of three/19/24.

4 Supply: Sandra Kollen Ghizoni, “Nixon Ends Convertibility of U.S. {Dollars} to Gold and Declares Wage/Value Controls,” Federal Reserve Historical past, 11/22/13. https://www.federalreservehistory.org/essays/gold-convertibility-ends

[ad_2]

Source link