[ad_1]

On February 1, Meta introduced its first quarterly dividend. The dividend will probably be a $5 billion annual money outlay, representing roughly 12% of its earnings.

This preliminary fee is a vital step in showcasing administration confidence in its excessive cash flow producing enterprise. As is frequent, this preliminary payout is conservative relative to earnings.

For reference, Microsoft pays an annual dividend that’s 28% of earnings. In distinction, Nvidia pays out a extra modest 2%.

Annual Dividend as % of Earnings

Contemplating Meta’s inaugural dividend, we’ll look at the historic dividend development trajectory of a number of different notable know-how firms.

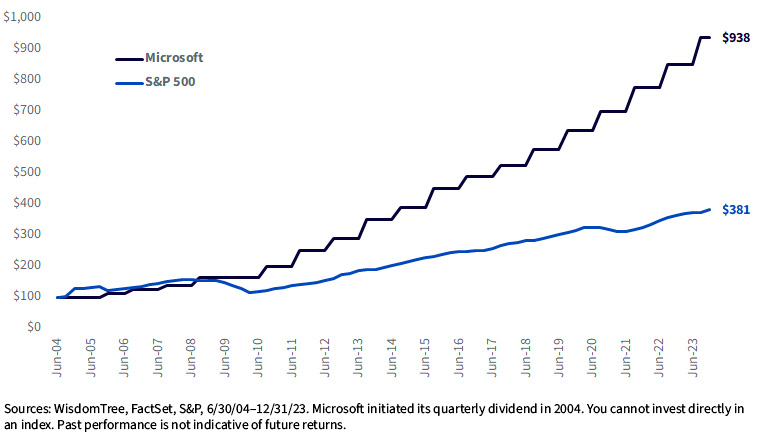

Microsoft

Microsoft started paying its first quarterly dividend in 2004. During the last 20 years, the corporate has had exceptional consistency in rising its dividend at a premium price yr over yr.

Development of $100: Cumulative Dividend Development

Over the complete interval, Microsoft has grown its dividend at a 12% annualized price—over 5% higher than the S&P 500 dividend development.

Annualized Dividend Development

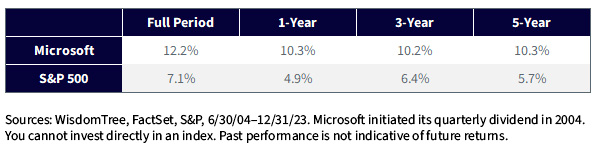

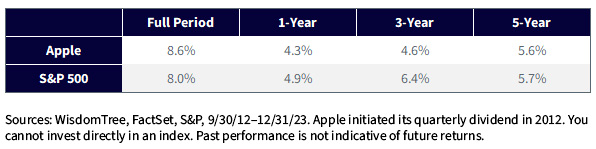

Apple

Apple started paying its quarterly dividend in 2012 and was instantly one of many largest money dividend payers on the planet.

Like Microsoft, Apple has persistently grown its dividend yr over yr. Its dividend development price has been increased than the S&P 500, regardless of persevering with to put money into a fast-growing enterprise.

Development of $100: Cumulative Dividend Development

Apple’s dividend grew at a conservative price for its first a number of years earlier than surging forward of the S&P 500. Between 2015 to 2018, Apple grew its dividend at 12% annualized, from $0.52 in 2015 to $0.73 by 2018. In the meantime, the S&P 500 dividend grew at a decrease than 7% price.

This Apple instance highlights an organization that began rising its dividend comparatively slowly from a conservative payout earlier than leaping increased after numerous years of a daily dividend.

Annualized Dividend Development

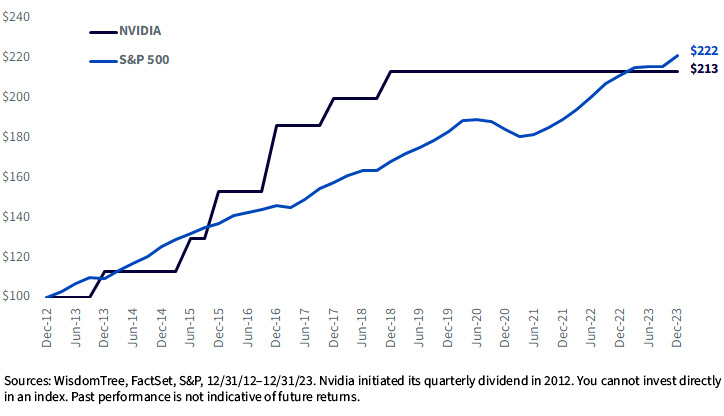

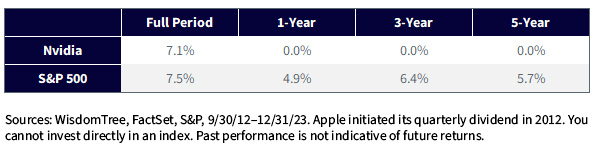

Nvidia

Like Apple, Nvidia additionally launched its quarterly dividend in 2012.

Throughout its first 5 years, Nvidia’s dividend development considerably outpaced the S&P 500. From 2012 to 2018, its annual dividend elevated by over 13% yearly, rising from $0.075 to $0.16.

Development of $100: Cumulative Dividend Development

Within the final 5 years, Nvidia has prioritized reinvesting in its market management throughout the superior semiconductor chips house. Regardless of sustaining an unchanged payout since 2018, Nvidia’s dividend development has remained near that of the S&P 500.

This makes Nvidia an much more drastic instance than Apple, illustrating how firms typically front-load important dividend development in the course of the preliminary years of dividend payouts.

Annualized Dividend Development

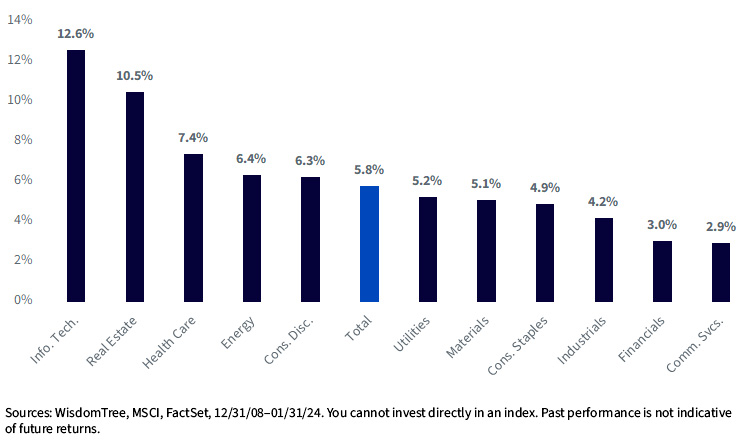

Data Know-how Dividend Development

During the last 15 years, Data Know-how has skilled the quickest dividend development of any sector, rising at a price over twice that of the full U.S. fairness market.

Sector Dividend Development since 2008

A lot of this development has come from firms that initiated dividends within the final 20 years (similar to Microsoft, Apple and Broadcom), that haven’t been eligible for inclusion in dividend development indexes that require a constant dividend development historical past of anyplace from 5 to 25 years.

WisdomTree designed its dividend Indexes to be broadly inclusive of dividend payers, recognizing that among the quickest dividend development for firms can happen within the years instantly after initiating a dividend.

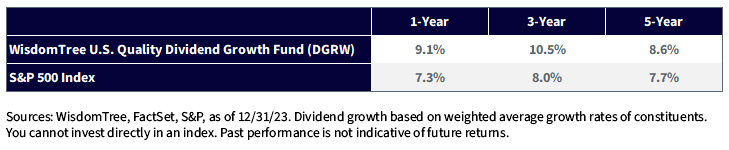

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) selects dividend-paying firms with excessive profitability and development traits, and not using a requirement for historic dividend development.

As a byproduct of our profitability and development screens, the Fund has increased publicity to the businesses which have been rising dividends at a sooner price than the general market.

Annualized Dividend Development

Essential Dangers Associated to this Article

For present Fund holdings, please click on here. Holdings are topic to threat and alter.

There are dangers related to investing, together with the doable lack of principal. Funds focusing their investments on sure sectors enhance their vulnerability to any single financial or regulatory improvement. This will likely end in better share value volatility. Dividends should not assured, and an organization at present paying dividends could stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link