[ad_1]

Equities completed the yr with a really sturdy fourth quarter. World equities gained 11.4% over the past three months to shut the yr with a 23.8% constructive efficiency. The decreasing of the “increased for longer” charges’ fears and the awakening of small-cap shares after three quarters of lackluster efficiency helped shares edge increased. General, markets completed the yr specializing in upcoming price cuts; mixed with lowering inflation, this led to a reversal of the adverse temper noticed in Q3.

This installment of the WisdomTree Quarterly Equity Factor Review goals to shed some gentle on how fairness elements behaved throughout this reversal and the way this may increasingly have impacted buyers’ portfolios.

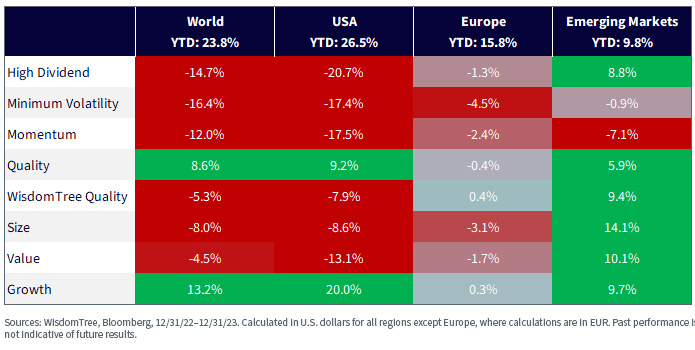

- General quality and growth continued to dominate, however small cap joined the celebration this quarter. Within the U.S. and Europe, small caps even posted the strongest outperformance.

- Excessive dividend, value and min volatility posted the biggest underperformance, affected by the markets’ pivot to optimism.

- In emerging markets, the image remained a bit totally different from the remainder of the world, with most elements outperforming. Solely momentum and min vol posted underperformance. High quality posted the strongest returns.

Seeking to 2024, the fairness outlook stays constructive however fairly unsure. It seems price cuts are coming, however a notable deterioration in financial information and continued disinflation could also be required to validate expectations for important coverage easing in 2024 and to assist fairness markets. With non-dividend payers having benefited from an distinctive run over the past decade in comparison with high-dividend payers, 2024 may even see a internet enlargement of the breadth of the market, resulting in some imply reversion in favor of dividend payers. This might play a vital position within the efficiency of high quality within the yr forward, pushing high-quality dividend-growing shares to outperform high-quality tech shares.

Efficiency in Focus: A Shocking Bull Run for This autumn

In This autumn, MSCI World (+11.4%) and MSCI USA (+11.8%) carried out very strongly. European and rising markets equities have been weaker however nonetheless returned excessive single-digit efficiency. General, Tech megacaps continued to guide, however the market’s breadth elevated, with small caps within the U.S. and Europe performing fairly strongly.

General, This autumn ended up fairly constructive to issue investing:

- In world developed markets, progress and high quality posted the strongest returns, according to the remainder of the yr. Small cap completed third in a late revival after three quarters of lackluster efficiency.

- Within the U.S. and Europe, small caps posted the strongest outperformance, adopted by progress. High quality carried out properly in Europe, ending third, however within the U.S., momentum grabbed the third place.

- General, in developed markets, excessive dividend, min volatility and, to a smaller extent, worth suffered the majority of the underperformance.

- In rising markets, high quality and momentum dominated, however like in earlier quarters, most elements have been capable of produce outperformance over the quarter. Momentum was the standout loser within the area.

Determine 1: Fairness Issue Outperformance in Q3 2023 throughout Areas

2023 in Overview

Wanting again on the full yr, progress remained the clear winner in developed and U.S. equities with double-digit outperformance versus the market. In each areas, solely high quality managed to comply with its lead, outperforming by virtually 10% in each markets. All the opposite elements underperformed, with excessive dividend, min vol and momentum posting giant underperformance.

In Europe, high quality and progress additionally dominated the opposite elements however posted solely minor outperformance. Minimal volatility and small caps have been the standout losers in that area.

In rising markets, all elements however momentum and min volatility did fairly properly in 2023. Small cap posted the strongest returns, adopted by worth and high quality.

Determine 2: Fairness Issue Outperformance in 2023 throughout Area

Is It Time for the Revenge of the Dividend Payers?

Analysis has proven that throughout markets, over the long run, big-dividend payers are inclined to outperform low-dividend payers or corporations that don’t pay dividends in any respect. Nonetheless, after the sturdy outperformance of Tech megacaps, together with many non-dividend payers in 2023 and over the past decade typically, information from Dartmouth’s Ken French reveals that over the past 20 years, the businesses that paid no dividend outperformed the quintile that paid the best dividends by the biggest quantity on file. Assuming some imply reversion, this might level to some resurgence of dividend payers.

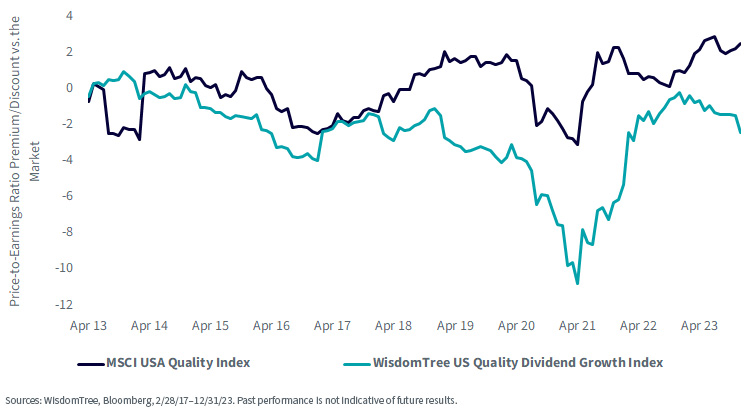

That is of explicit curiosity when wanting on the high quality issue. High quality continued to do properly over the yr, however over the past two years, we now have noticed a powerful divergence in conduct between high-quality corporations that pay dividends and people who don’t. In 2022, the standard dividend payers dominated, whereas the standard non-dividend payers did higher in 2023.

To take a look at the impression of that divergence on “investable” portfolios, we think about:

- the MSCI USA Quality Index, which at the moment allocates a big proportion of the portfolio to Tech and high-quality, non-dividend-paying corporations

- the WisdomTree U.S. Quality Dividend Growth Index, which focuses on high-quality, dividend-growing corporations and, due to this fact, invests solely in dividend-paying corporations, resulting in smaller allocations to Tech and the Magnificent Seven.

In determine 3, we observe that MSCI USA High quality, following the sturdy rally of Tech and the Magnificent Seven in 2023, is traditionally costly in comparison with the market. Quite the opposite, with a reduction of -2, the WisdomTree U.S. Quality Dividend Growth is at the moment fairly low cost and getting cheaper.

Determine 3: Historic Value-to-Incomes Ratio Premium/Low cost vs. the MSCI USA Index

For definitions of phrases within the chart above, please go to the glossary.

Taken collectively, this might point out that prime high quality with a dividend tilt could possibly be poised to take the lead in 2024.

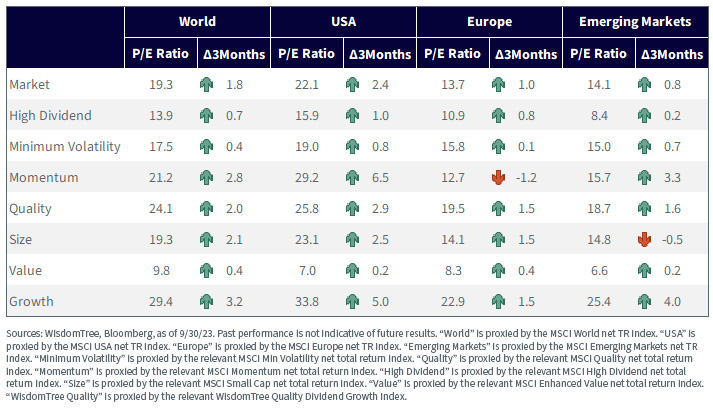

Valuations Elevated in This autumn

In This autumn 2023, developed markets obtained dearer following the sharp rally. All elements noticed the price-to-earnings ratio improve over the quarter aside from momentum in Europe. Development noticed the most important improve throughout areas on common. Small caps and momentum comply with simply behind. In rising markets, valuations elevated throughout most elements bar small caps.

Determine 4: Historic Evolution of Value-to-Earnings Ratios of Fairness Elements

Wanting Ahead to 2024

The fairness outlook stays constructive however fairly unsure. It seems price cuts are coming, however a notable deterioration in financial information and continued disinflation could also be required to validate expectations for important coverage easing in 2024 and to assist fairness markets. With non-dividend payers having benefited from an distinctive run over the past decade in comparison with high-dividend payers, 2024 may even see a internet enlargement of the breadth of the market, resulting in some imply reversion in favor of dividend payers. This might play a vital position within the efficiency of high quality within the yr forward, pushing high-quality dividend-growing shares to outperform high-quality tech shares.

Pierre Debru is an worker of WisdomTree UK Restricted, a European subsidiary of WisdomTree Asset Administration Inc.’s dad or mum firm, WisdomTree, Inc.

[ad_2]

Source link