[ad_1]

This week, researchers on the Federal Housing Finance Company (FHFA) printed a 52-page working paper titled, The Lock-In Effect of Rising Mortgage Rates.

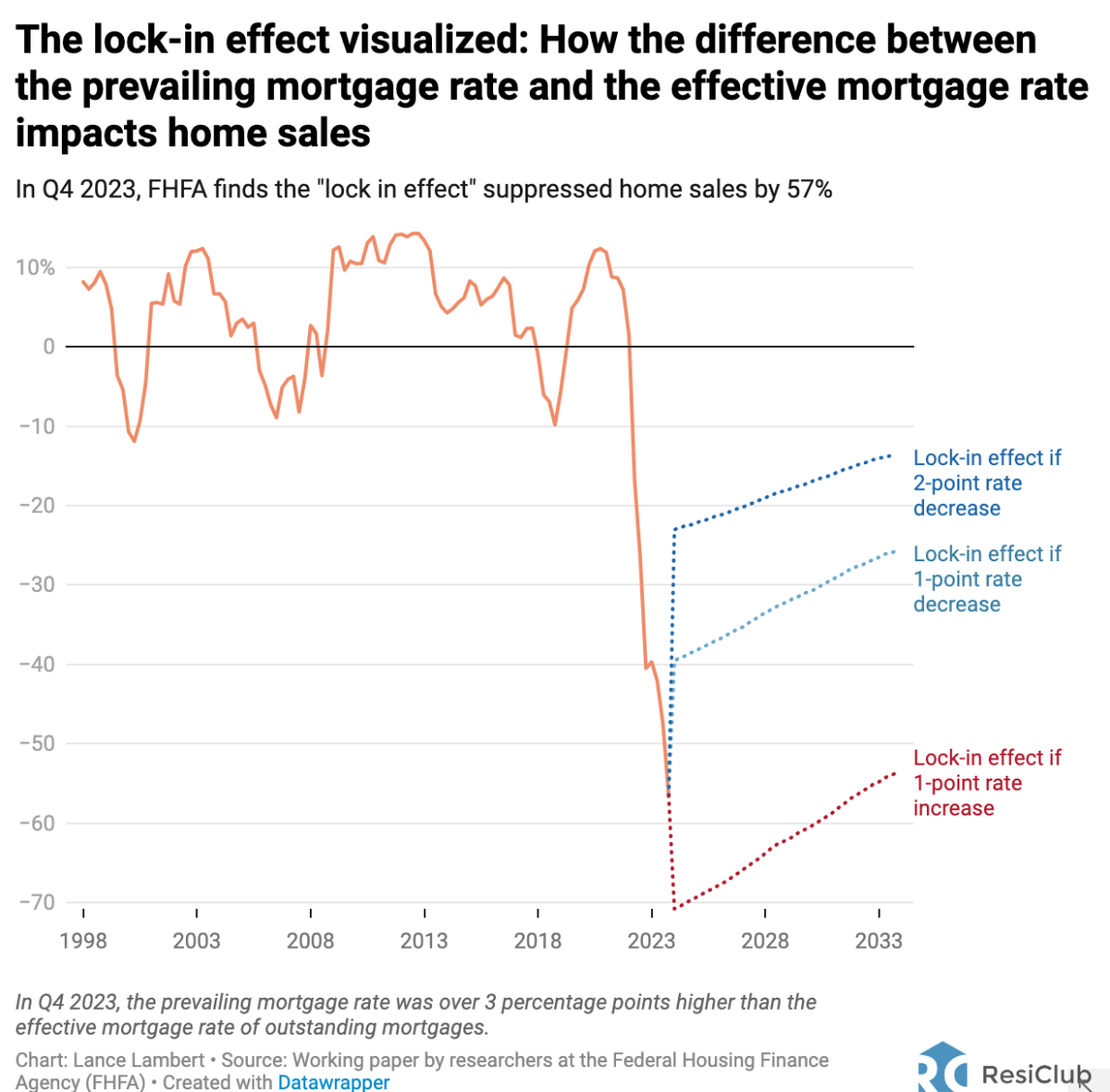

The FHFA researchers’ evaluation reveals that the lock-in effect—the place householders with decrease mortgage charges are unwilling to promote and buy one other dwelling at considerably larger mortgage charges—has resulted in 1.3 million “misplaced” dwelling gross sales between Q2 2022 and This fall 2023.

“Individuals could be ‘locked-in’ or constrained of their capability to make acceptable monetary modifications, resembling being unable to maneuver houses, change jobs, promote shares, rebalance portfolios, shift monetary accounts, modify insurance coverage insurance policies, switch funding income, or inherit wealth,” the paper’s summary notes. “In america, practically all 50 million lively mortgages have fastened charges, and most have rates of interest far beneath prevailing market charges, making a disincentive to promote. This paper finds that for each share level that market mortgage charges exceed the origination rate of interest, the likelihood of sale is decreased by 18.1%. This mortgage price lock-in led to a 57% discount in dwelling gross sales with fixed-rate mortgages in 2023Q4 and prevented 1.33 million gross sales between [Q2 2022 and Q4 2023].”

Not solely has the lock-in impact value the housing market 1.3 million dwelling gross sales, however FHFA researchers discover it has additionally put upward strain on nationwide dwelling costs.

“The availability discount [created by the lock-in effect] elevated [national] dwelling costs by 5.7%, outweighing the direct influence of elevated [mortgage] charges, which decreased costs by 3.3%. These findings underscore how mortgage price lock-in restricts mobility, leads to individuals not dwelling in houses they would like, inflates costs, and worsens affordability. Sure borrower teams with decrease wealth accumulation are much less in a position to strategically time their gross sales, worsening inequality,” wrote the FHFA researchers.

So, is the lock-in virtually over? The evaluation by FHFA researchers says no.

“Absent a dramatic lower in [mortgage] charges, it appears to be like like lock-in might be with us for a very long time,” wrote FHFA researchers.

[ad_2]

Source link