[ad_1]

Key Takeaways

- “Administration That Is Aware of Value of Capital” (MTICCC) is a big driver of the current bullish development within the Japanese inventory market, with the Nikkei surpassing its 1989 excessive and the 40,000 stage.

- Japan is attempting to shift from a cash-hoarding tradition to an funding tradition, with reforms just like the Doubling Asset-Primarily based Earnings Plan and modifications to NISA accounts to encourage fairness investments.

- The Japan Alternate Group is encouraging corporations that adhere to MTICCC ideas, and there’s a broader push for asset administration business reform and accountability to shareholders.

Who would have thought that such a benign phrase as “Administration That Is Aware of Value of Capital” (MTICCC from right here on) might be a driver of bullish spirits in a inventory market?

Although the factitious intelligence (AI) frenzy deserves a hat tip for the Japanese inventory market’s current vertical run, MTICCC might be a much bigger driver. The Nikkei has taken out each the long-standing 1989 excessive and in addition the psychologically essential 40,000 stage.

Determine 1: Nikkei 225

For months, the catch-all MTICCC has been used again and again by the Tokyo Inventory Alternate (TSE) in its profitability push. Each time the TSE put out a memo, MTICCC has been there in spades. The message is basically, “Begin investing in initiatives that make financial sense, purchase again inventory, hearken to activists, perhaps exchange the board of administrators. For those who don’t, your organization’s identify is happening our ‘Identify and Disgrace’ Checklist.”

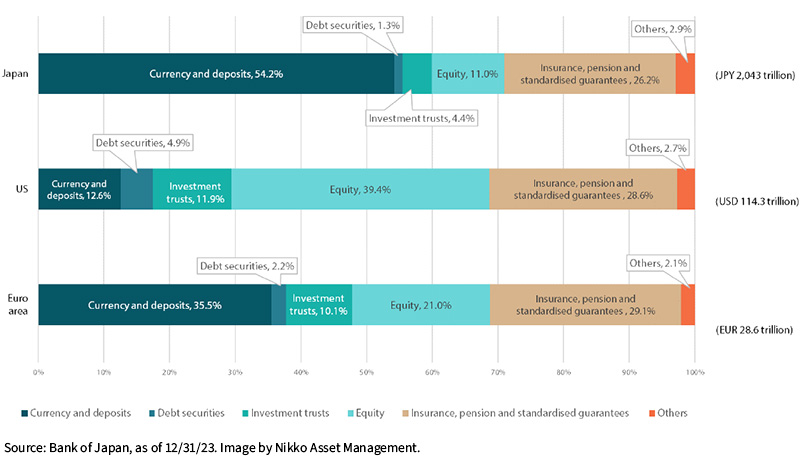

Past MTICCC, there may be additionally a push to alter Japan’s cash-hoarding tradition. Prime Minister Fumio Kishida has made it his mission. The everyday Japanese family retains 54% of its belongings in foreign money and deposits. For context, the determine within the U.S. is 12.6%.

Determine 2: Family Asset Proportions

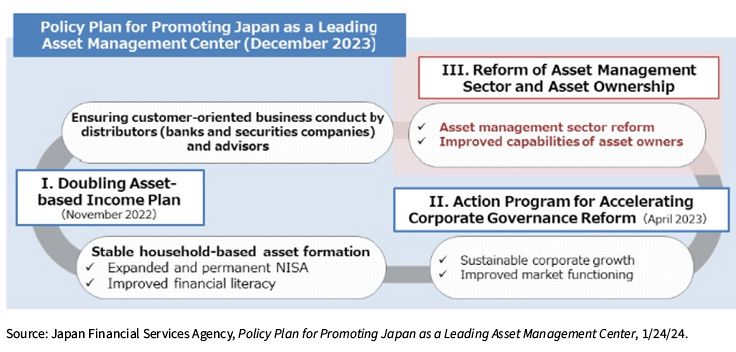

Enter Prime Minister Fumio Kishida’s “Doubling Asset-Primarily based Earnings Plan,” one in every of a handful of forces which are driving bullishness for the Japanese market. His objective is to extend the variety of Nippon Particular person Financial savings Accounts, or NISAs, which I consider as Japan’s “Conventional IRA.” As a result of the fairness society isn’t completed if folks open NISAs however put all the pieces in money, there’s a large push for allocations to enter Tokyo-listed firms.

Determine 3 exhibits the final define from Japan’s Monetary Companies Company (FSA). The one half that’s new to me is within the decrease left: “improved monetary literacy.” I’m not certain what the FSA is referring to, as a result of I hadn’t seen something alongside these traces till coming throughout this exhibit.

Determine 3: The Plan

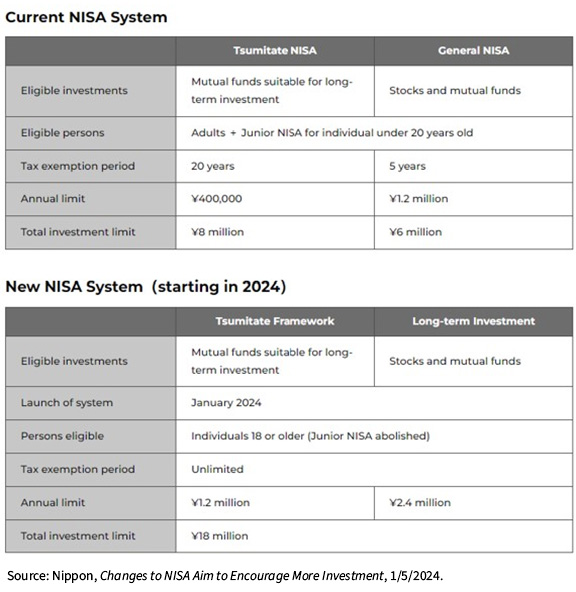

Till December 31, there have been three sorts of NISA accounts:

1. The Tsumitate NISA, for financial savings

2. The Normal NISA (like a Conventional IRA)

3. The Junior NISA, for minors

Efficient January 1, 2024, they simplified this system, made it extra tax-friendly and allowed greater contributions.

The one for financial savings, the Tsumitate NISA, now has an annual contribution restrict of ¥1.2 million ($8,000), a tripling from final yr’s ¥400,000 ($2,666).

The Normal NISA is now known as the Lengthy-Time period Funding NISA. The contribution restrict doubled from ¥1.2 million ($8,000) to ¥2.4 million ($16,000). Junior NISAs had been eradicated.

Determine 4: NISA System

Importantly, till a number of weeks in the past, the tax exemption timeframe was both 5 or 20 years, relying on the account kind. Now the tax exemption interval is indefinite, although account dimension caps apply.

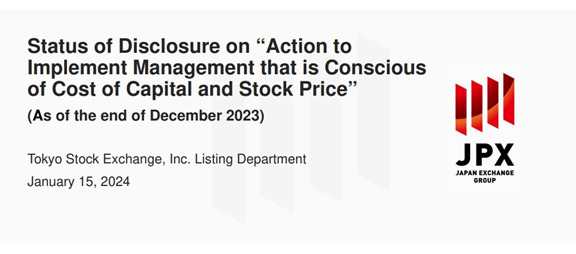

As that cash will get invested, the hope is that will probably be invested in corporations that took to coronary heart the push for MTICCC. Determine 5 is the opening slide of the Japan Alternate Group’s January memo.

Determine 5: There’s That Phrase

The Japan Alternate Group, which runs the TSE, additionally created an index that owns a bunch of corporations that exemplify the perfect MTICCC company. A futures market on the JPX Prime 150 Index commenced March 18; an ETF launched in Tokyo that very same day. That is from the JPX’s house web page (determine 6).

Determine 6: JPX Prime 150 Futures and Funds Are Coming

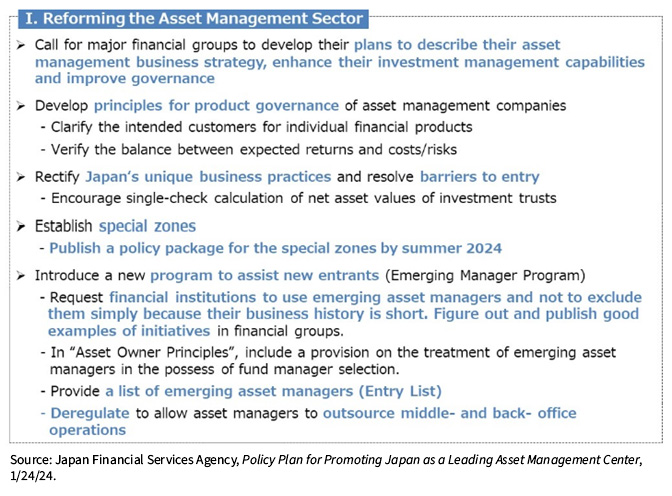

Lastly, Japan is pushing asset administration business reform. Cash managers had been informed to submit a plan that exhibits how they’re dedicated to bettering their Japanese operations. There are additionally different plans resembling “particular zones” for nurturing enterprise capital experience (determine 7).

Determine 7: A Portion of the FSA’s Coverage Plan

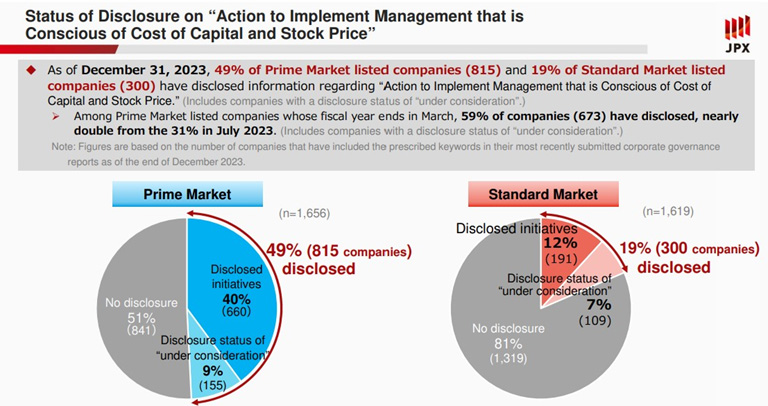

Lastly, traders are inspired that the Identify and Disgrace initiative is forcing corporations to do proper by shareholders. As of December 31, about half of Prime Market corporations (the large ones) and 19% of Customary Market (small) corporations have disclosed their “Motion to Implement MTICCC.” The speculation goes that the passage of time will witness extra corporations fall in line, ostensibly boosting valuations.

Determine 8: Rising Consciousness

We’ve got three Japan Funds:

• DXJ: WisdomTree Japan Hedged Equity Fund

• DXJS: WisdomTree Japan Hedged SmallCap Equity Fund

• DFJ: WisdomTree Japan SmallCap Dividend Fund

I additionally went by means of our broad Developed Market Funds. Those which are heaviest in Japan are DLS and DDLS, every with 28% within the nation:

• DLS: WisdomTree International SmallCap Dividend Fund

• DDLS: WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund

[ad_2]

Source link