[ad_1]

Key Takeaways

- The Nikkei 225 index reaching new all-time highs, surpassing the earlier file set in 1989, is a big psychological achievement for Japan.

- Regardless of Japan’s present recession, the long-term results of Abenomics, significantly company governance reform, are influencing market sentiment and funding in Japanese shares.

- The current surge in Japanese equities could also be partially attributed to a shift away from Chinese language investments, although this development shouldn’t be solely answerable for the market’s efficiency.

It’s somewhat surreal, having checked out long-term charts of the Japanese inventory marketplace for my complete profession, however right here we’re, seeing new all-time highs on the Nikkei 225. The earlier file had held since 1989, when many people mid-career sorts had been youngsters. Granted, the Nikkei is price-weighted just like the Dow Industrials, so it’s somewhat blasphemous to quote such a poorly constructed index. Reduce us some slack. Everyone seems to be speaking in regards to the Nikkei and it’s the index they cite on CNBC. It’s a giant psychological win for Japan’s benchmark to surpass 40,000 for the primary time.

Determine 1: Nikkei 225

Abenomics, the reform program applied by former Prime Minister Shinzo Abe, is now over a decade previous. The primary two planks of Abenomics’ “Three Arrows” had been financial easing and monetary stimulus. Contemplating the nation is barely out of recession proper now, it’s laborious to argue Abenomics spurred some financial miracle.

Then once more, even with the Financial institution of Japan’s barely constructive coverage fee, the attendant collapse within the yen to ¥151 from ¥103 as not too long ago as three years in the past may very well be a set-up for a competitiveness thesis. Nonetheless, it’s not financial vibrancy that has the market serious about allocating to Japanese shares.

Abenomics’ third arrow, company governance reform, is driving sentiment. Progress had been coming in suits and begins. However now Japan has the notorious “Identify and Disgrace” record, which nonetheless has the ink drying on it. Named are all the companies who ignored the Tokyo Inventory Trade’s (TSE) demand, particularly that listed corporations plot out express enterprise plans for reinforcing their profitability and inventory costs.

We had been pumped about Identify and Disgrace as a result of the TSE has been particularly hammering corporations that commerce for lower than e book worth, that are the forms of shares that have a tendency to search out their manner into dividend funds.

We spent all these years making an attempt, typically with success, typically in futility, to poach enterprise from unhedged Japan ETFs. Fortuitously, the MSCI Japan Index has an combination price-to-book ratio of 1.55, whereas the WisdomTree Japan Hedged Equity Fund (DXJ) trades for 1.29 occasions e book.1 We expect we’ve got an alpha technology case as a result of we personal extra sub-1.0 price-to-book corporations.

Final 12 months, we felt like few buyers had been taking note of the TSE’s obscure memos, which had been aggressive of their calls for for company reform. I’d typically focus on with our World CIO, Jeremy Schwartz, why it typically appeared like buyers weren’t taking note of the regular stream of reforms.

However now we’ve got the Nikkei drawing consideration to a market that has been ignored by many…except the M&A crowd (determine 2).

Determine 2: Japan Represents About One-Third of All Asian M&A Exercise

A part of It (However Not All of It) Is “No China, Please”

Make no mistake: final 12 months we noticed a ton of ETF creations on DXJ and the WisdomTree India Earnings Fund (EPI) as a result of buyers had been promoting China first and asking questions later.

That was nice information for our Japan and India methods, however the danger was that the bull run in these nations was primarily based on portfolio clean-outs, not as a result of our investor base was actually enamored with them.

That brings me to determine 3, which is heartening as a result of China rallied laborious in current weeks. By the logic of “they’re promoting China and switching to Japan and India,” we should always have seen materials weak spot, perhaps losses in DXJ and EPI. That has not been the case. Perhaps we overestimated how a lot of it was “no China, please.”

Determine 3: Efficiency since 1/31/24

For the newest month-end and standardized performances and to obtain the Fund prospectus, please click on the respective ticker: CXSE, EPI, DXJ.

The Nikkei’s transfer to new all-time highs comes at an uncommon time; Japan simply launched a GDP report that skirted recession. It’s a weird state of affairs within the nation too, as a result of exports had been up 7.8% within the 12 months to February, whereas imports had been largely flat, rising simply 0.5%. That comes again to the ¥151 change fee, which has helped DXJ due to its low cost yen-reliant exporter display screen.

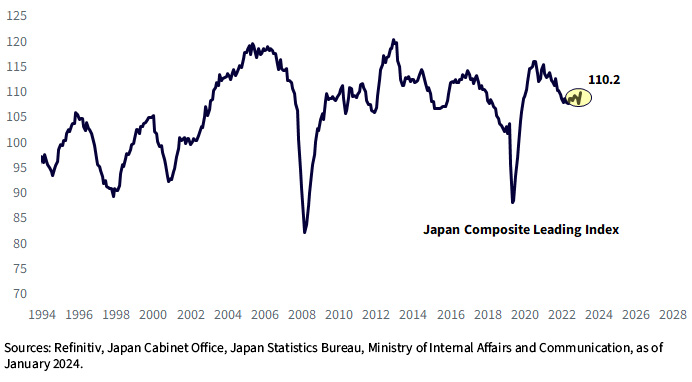

Promisingly, Japan’s recession-mired financial system may additionally have inexperienced shoots, if main indicators are to be believed. The Composite Leading Index is making an attempt to get some footing (determine 4).

Determine 4: Composite Main Indicators Are Making an attempt to Head Larger

We have now three Japan-oriented methods:

I didn’t get into it right here, however Japan can also be reforming retirement financial savings accounts. I feel that is an underappreciated bull catalyst. I’m engaged on a weblog put up for that particular topic. Keep tuned.

1 Worth-to-book ratios are as of January 2024.

[ad_2]

Source link