[ad_1]

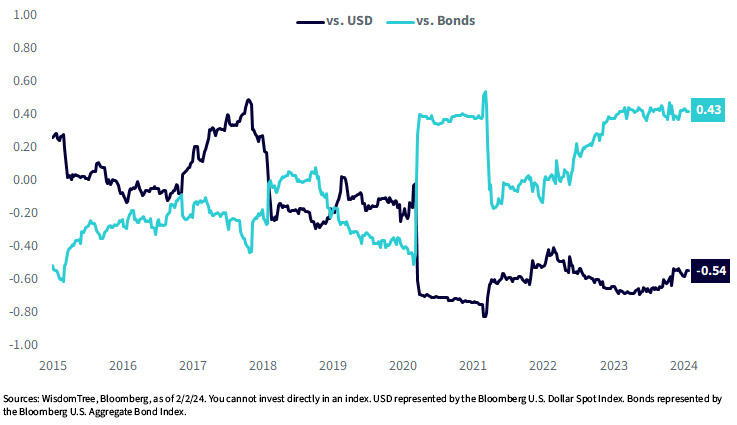

The inflationary period of the post-pandemic atmosphere will probably be remembered for the way it upended a number of longstanding market relationships.

Bonds are not diversifying fairness threat as they reliably did for a number of many years.

The U.S. greenback has been freshly minted as a greater diversifying hedge asset for fairness allocations. Will this final? We expect there are sound causes for it to take action.

These relationships diverged on the onset of the pandemic in March 2020 and created an inflection level with crucial implications for fairness portfolio building.

Rolling 52-Week Correlation: S&P 500 vs. USD & Bonds

However regardless of the altering relationships amongst U.S. asset lessons, one notable abroad relationship stays inside its historic norms.

Opposites (Do Not) Appeal to in Japan

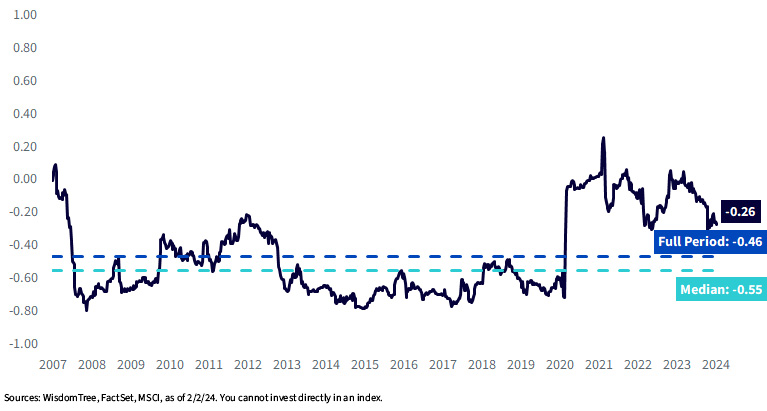

Although U.S. markets have gotten extra negatively correlated to the U.S. greenback, Japanese indexes are effectively accustomed to shifting reverse to the yen.

The Japanese economic system and revenue stream could be very export-oriented, which suggests essentially the most profitable durations for fairness markets usually coincide with a weaker yen and a stronger greenback. Throughout yen weak point, Japanese merchandise are inherently cheaper within the international market, which helps enterprise prospects and earnings for native exporters.

Japanese equities, subsequently, have a longstanding inverse correlation with the yen. Because the starting of our accessible knowledge historical past in 2006, Japanese fairness market returns (unique of foreign money results) maintained a persistently adverse 52-week return correlation to the yen.

Rolling 52-Week Correlation: MSCI Japan (Native) vs. Japanese Yen

However because the previous market adage goes, correlations spike towards 1 throughout a disaster, and the pandemic was no exception for this pair. The correlation briefly broke optimistic amid sharp fluctuations from 2020 to 2022 however has steadily declined since then and resumed its adverse relationship.

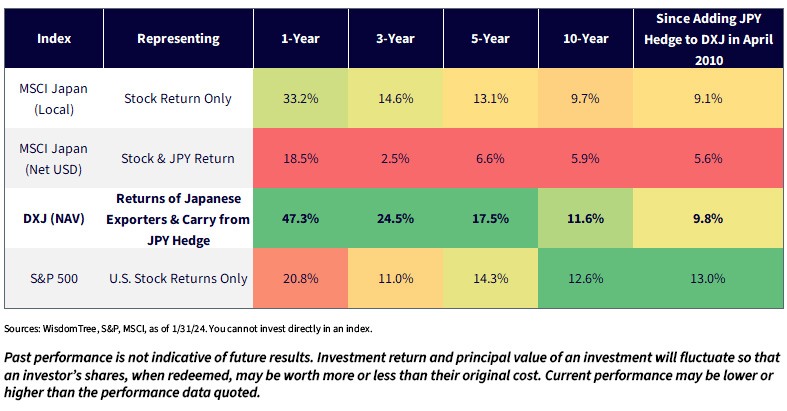

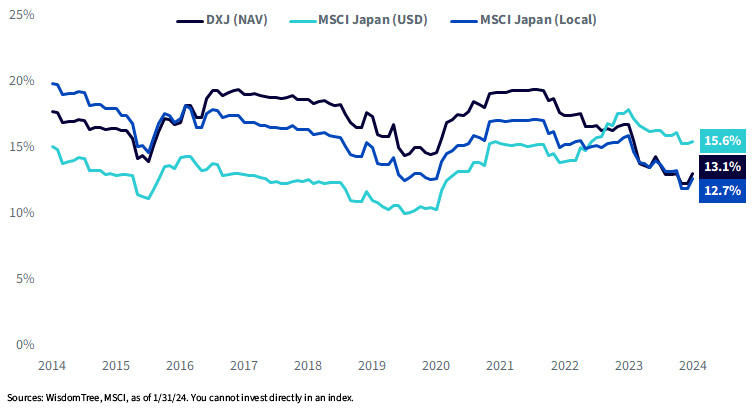

The inverse relationship between Japanese equities and the yen was a genesis for including the yen hedge to the WisdomTree Japan Hedged Equity Fund (DXJ) in April 2010. Since then, a number of key options have prevailed:

1.Hedging Yen Publicity Was Additive—It was detrimental for a U.S. investor to purchase Japanese shares with out hedging yen exposures over the short-, medium- and long-term durations of the final 15 years. Traders misplaced between 3.5% and 6.5% per yr from unhedged yen investments throughout this timeframe.

2. Pairing Japanese Exporters with a Yen Hedged Magnified Whole Returns—Hedging foreign money exposures inside an export- and dividend-focused fairness allocation often outpaced the native Japanese market. The pairing outperformed U.S. equities as effectively over the previous few years, disproving the notion that abroad investing is a nugatory endeavor for U.S. buyers.

Annualized Whole Returns

For the newest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on here.

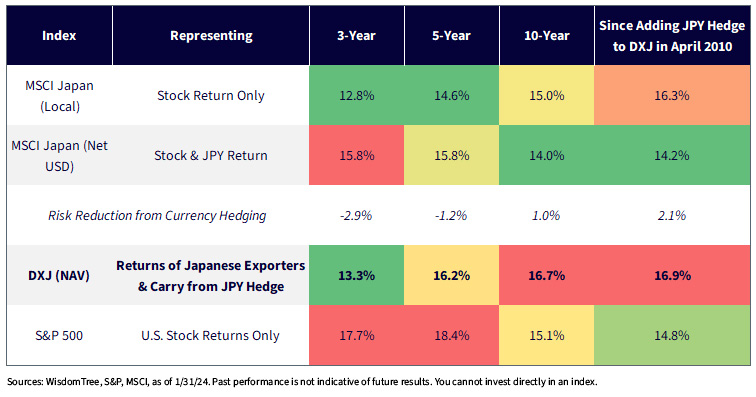

3.Hedging Yen Publicity Beginning to Decrease the Threat Profile of Japanese Equities—Within the post-pandemic atmosphere, DXJ outperformed unhedged Japanese shares by over 10% per yr with diminished (or comparable) volatility over the three- and five-year durations.

Annualized Volatility

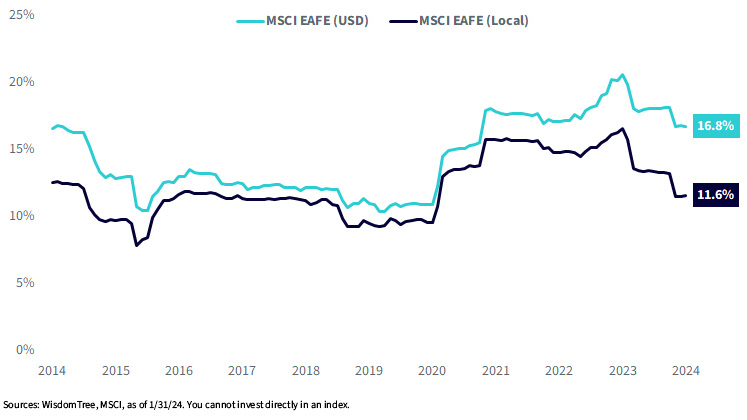

Over the long term, DXJ was extra risky than unhedged indexes due to the sturdy inverse correlation between the yen and the native inventory market. However over the previous few years, Japan has seen falling volatility amongst currency-hedged methods, which is extra in keeping with broader worldwide markets the place unhedged foreign money publicity normally provides to the volatility profile.

Rolling 36M Volatility: JPY-Hedged Methods Turning into Much less Dangerous

Forex hedging is changing into extra rewarding as a consequence of higher volatility discount throughout worldwide markets. Throughout the Europe, Australasia, Far East (EAFE) area, unhedged foreign money publicity added a mean of 230 basis points (bps) of incremental volatility on a rolling 36-month foundation during the last 10 years. Extra not too long ago, they’re including about 500 bps of elevated volatility in comparison with a static foreign money hedge.

Rolling 36M Volatility: Forex Hedging Reduces Threat in EAFE Area

As a ultimate level on DXJ’s volatility, its longer-term threat profile resembles that of the S&P 500, which dispels the misperception that worldwide investing is inherently riskier. At occasions it can be, however using a foreign money hedge to Japanese equities could ship a extra palatable volatility profile already acquainted to U.S. buyers.

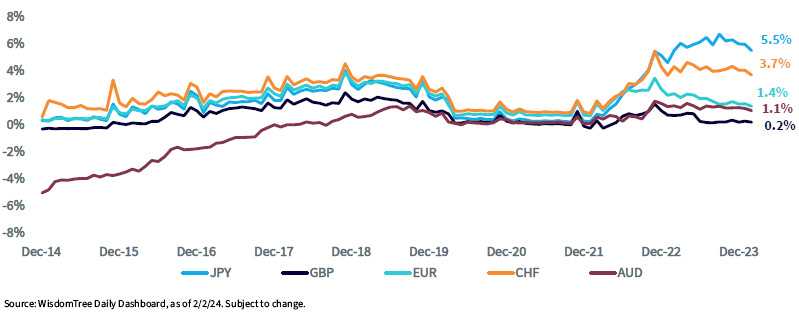

4. Coverage Price Differentials Imply U.S. Traders are Paid to Hedge Forex Dangers—Over the previous decade, coverage charges set by the Financial institution of Japan (BoJ) have been enormously exceeded by these within the U.S., making a compelling alternative to earn an incremental return on high of the native market return by hedging yen exposures.

At present, buyers can earn 5.5% of extra return by advantage of rate of interest carry, which successfully neutralizes lengthy yen (i.e., quick greenback) exposures with an offsetting quick yen (i.e., lengthy greenback) place. U.S. buyers theoretically earn the 5.5% price differential through the use of yen publicity to fund a greenback funding.

Annualized Carry by Forex

Japan Stays an Alternative amid Uncertainty

Being uncovered to international foreign money threat for the final decade has been one of many greatest errors buyers have made of their international portfolios.

Forex returns are fairly unpredictable. There isn’t a elementary rule or idea that means the yen ought to all the time respect, and unhedged methods are positioned for such an final result. Since our first currency-hedged ETF launched 15 years in the past, our personal analysis suggests taking a extra strategic method to hedging and focusing a portfolio on dangers you’re compensated to take—fairness threat. Unhedged foreign money threat serves as an added directional wager, in our view, that usually doesn’t repay and extra reliably provides to issues that may go mistaken—creating pointless volatility.

Essential Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. International investing includes particular dangers, resembling threat of loss from foreign money fluctuation or political or financial uncertainty. The Fund focuses its investments in Japan, thereby growing the affect of occasions and developments in Japan that may adversely have an effect on efficiency. Investments in foreign money contain extra particular dangers, resembling credit score threat, rate of interest fluctuations and spinoff investments, which could be risky and could also be much less liquid than different securities, and extra delicate to the impact of assorted financial circumstances. As this Fund can have a excessive focus in some issuers, the Fund could be adversely impacted by modifications affecting these issuers. As a result of funding technique of this Fund it might make greater capital achieve distributions than different ETFs. Dividends are usually not assured, and an organization at present paying dividends could stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link