[ad_1]

Key Takeaways

- In March 2024, there was a definite shift in efficiency from growth-oriented methods to value-oriented methods within the U.S. fairness market.

- After 2023 being all in regards to the so-called Magnificent 7, it’s doable that March 2024 is signaling a broadening out of U.S. fairness efficiency to an setting pushed by greater than merely the biggest corporations.

- WTV outperformed QQQ, IVW and IWF in March 2024, indicating a shift in market management from progress to worth.

It’s my fourteenth 12 months at WisdomTree, and I really feel like for the big majority of that point, growth investing has been in style and outperforming amongst U.S. equities. The Magnificent 71 of 2023 was simply the latest occasion of this pattern.

Nevertheless, one thing we noticed in March 2024 represented a definite shift on this pattern. The efficiency of value-oriented methods accelerated.

Worth Is within the Eye of the Beholder (or the Technique Creator)

If I paused and posed the query, what’s worth, would you might have a solution? Traditionally, the worth issue has been outlined many various methods, however probably the most long-standing definitions focuses on shares with excessive book-to-market worth, noting that the e-book worth fairness is the important thing fundamental to check again to a measure of the market’s value.2 As is the case with nearly any monetary metric, this isn’t good—every has its personal set of professionals and cons.

On this piece, we deal with three distinct worth methods for U.S. equities:

- WisdomTree U.S. Value Fund (WTV): The WisdomTree U.S. Worth Fund seeks earnings and capital appreciation by investing primarily in U.S. fairness securities that present a excessive whole shareholder yield with favorable relative high quality traits.3

- iShares Russell 1000 Value ETF (IWD): The iShares Russell 1000 Worth ETF seeks to trace the overall return efficiency, earlier than charges and bills, of the Russell 1000 Worth Index. This index measures the efficiency of the large-cap worth section of the U.S. fairness universe. It consists of these Russell 1000 Index universe corporations with comparatively decrease price-to-book (P/B) ratios, decrease I/B/E/S forecast medium-term (2 12 months) progress and decrease gross sales per share historic progress (5 years).5

In an effort to present the shift from progress to worth that we noticed happen in March 2024, we add three progress methods for comparability functions:

- Invesco QQQ Trust Series 1 (QQQ): The Invesco QQQ Belief, Collection 1, is designed to trace the overall return efficiency, earlier than charges, of the Nasdaq 100 Index. The Index consists of 100 of the biggest home and worldwide nonfinancial corporations listed on the Nasdaq Inventory Market based mostly on market capitalization.

- iShares S&P 500 Growth ETF (IVW): The iShares S&P 500 Development ETF seeks to trace the overall return efficiency, earlier than charges and bills, of the S&P 500 Growth Index. This index measures progress shares utilizing three elements: 1) gross sales progress, 2) the ratio of earnings change to cost, and three) momentum.

- iShares Russell 1000 Growth ETF (IWF): The iShares Russell 1000 Development ETF seeks to trace the overall return efficiency, earlier than charges and bills, of the Russell 1000 Growth Index. This index measures the efficiency of the large-cap progress section of the U.S. fairness universe. It consists of these Russell 1000 Index universe corporations with comparatively increased P/B ratios, increased I/B/E/S forecast medium-term (2 12 months) progress and better gross sales per share historic progress (5 years).

Within the figures that comply with, we see a couple of distinct efficiency tales. Persevering with to have a look at and examine these methods may inform us lots about how U.S. fairness market management is evolving.

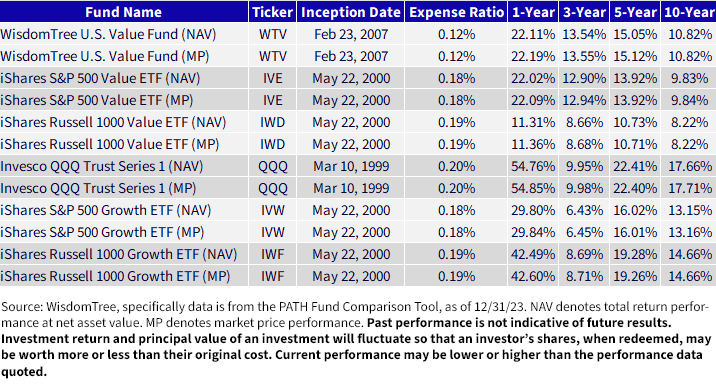

First, there may be determine 1—helpful in that the standardized return as of December 31, 2023, is ideal for trying on the 2023 returns. Traders take a look at 2023 as largely the 12 months of the Magnificent 7.

- QQQ was the chief: We see that QQQ delivered a return of practically 55% over the interval. IWF was in second place at 42%–43%. All the opposite methods have been under 30%.

- WTV & IVE led the cost for worth: In 2023, few have been discussing worth, no less than performance-wise. Each methods have been within the vary of twenty-two%. IWD lagged with a return within the vary of 11%.

So, in brief, these of us remembering 2023, keep in mind progress’s returns crushing worth’s returns.

Determine 1: Standardized Efficiency

For the latest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on the related ticker: WTV, IVE, IWD, QQQ, IVW and IWF.

The Yr-to-Date 2024 Efficiency Dialogue

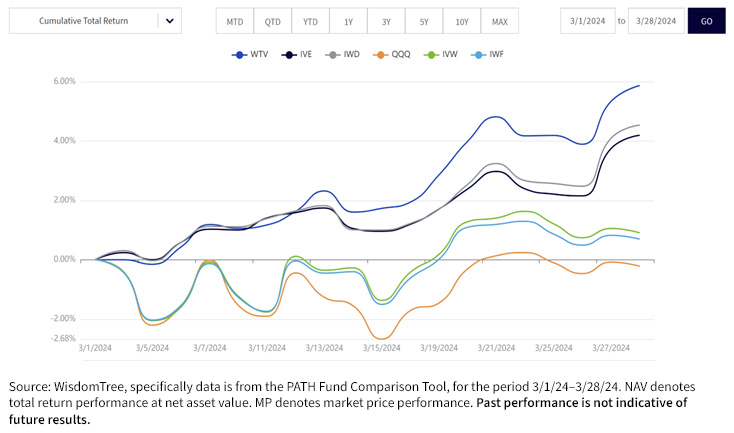

In determine 2, we see that typically the U.S. fairness market has been sturdy within the first quarter of 2024—we’re taking a look at three distinct worth methods and three distinct progress methods and all six have been in constructive territory for this three-month interval.

What’s clear is that IVW and IWF are nonetheless main—so, over the total quarter we can’t say that the returns of worth are beating the returns of progress. Nevertheless, we do see that late within the first quarter, QQQ began lagging WTV and in addition IWD.

That is the explanation why we wished to look extra intently on the month of March 2024.

Determine 2: A Robust First Quarter for U.S. Equities—Worth & Development in Optimistic Territory

The March 2024 Efficiency Dialogue

As we shift to determine 3, which reveals the efficiency of those methods from March 1 to March 28, 2024, the acceleration of worth over progress turns into clearer.

- WTV was the standout performer for this quick interval. IVE and IWD are a lot nearer collectively.

- QQQ was the relative laggard. After 2023, this represents an enormous change. IVW and IWF have been very shut collectively, however forward of QQQ.

Determine 3: March 2024 Noticed the Shift from Development to Worth Management in U.S. Equities

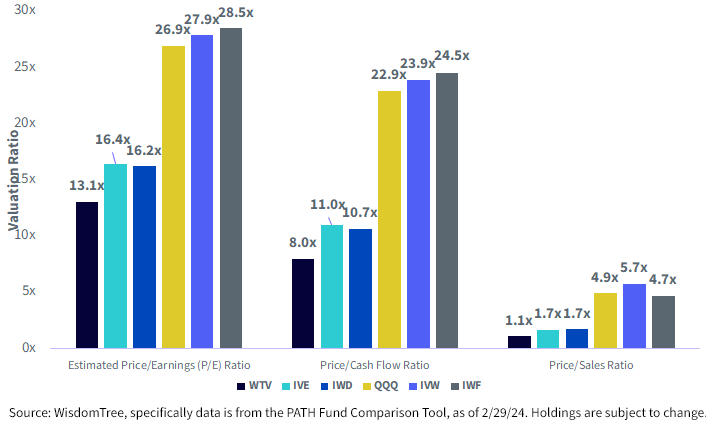

Valuation—The Query All Traders Are Asking About

We’ve got lots of conversations in regards to the rally and affect of synthetic intelligence (AI). Many—we imagine, incorrectly—are already evaluating the AI rally of 2023 and now 2024 to the Tech Bubble that fashioned within the late Nineteen Nineties into 2000.

Given that almost everyone seems to be speaking about this, we’d think about that investor flows into worth methods could be stronger since these methods are designed to keep away from the extra extremely valued areas of the market.

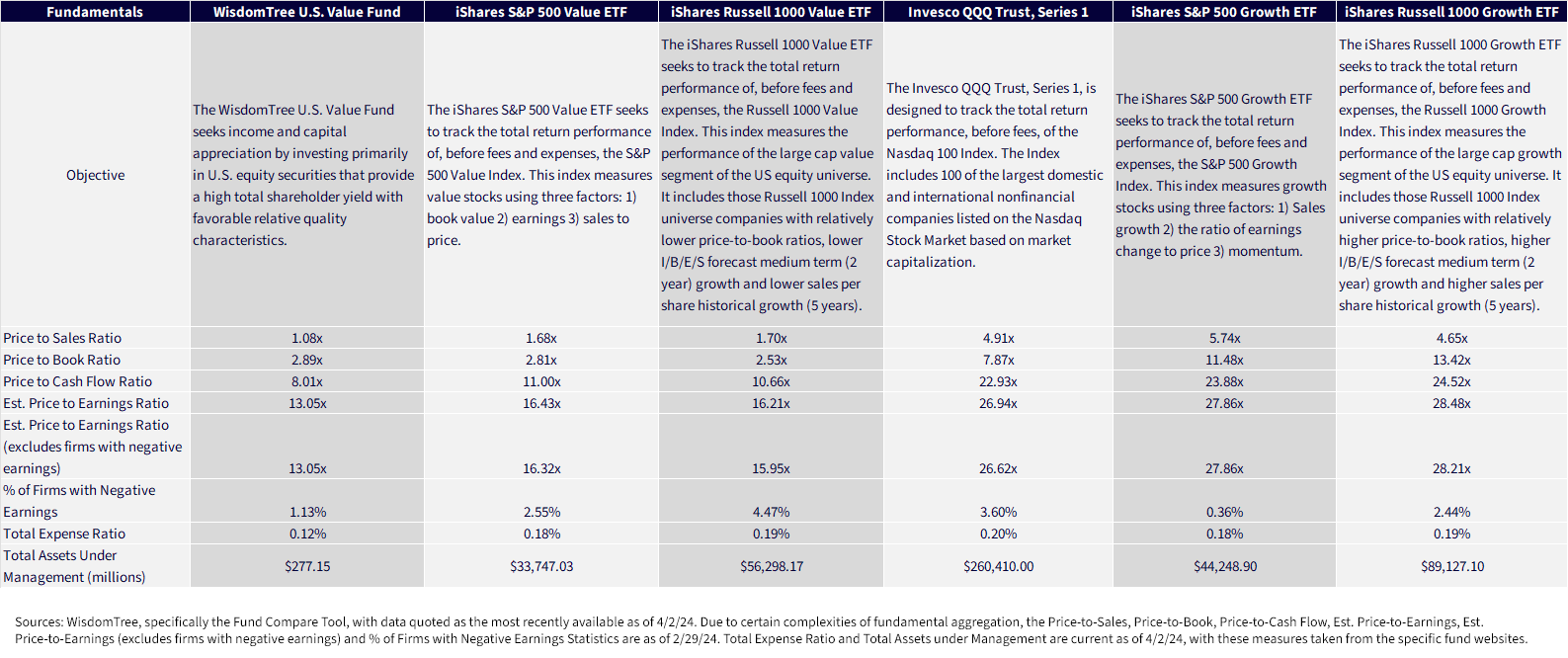

In determine 4, we discovered it notable that WTV had such a decrease estimated price-to-earnings (P/E) and price-to-cash stream ratio than each IVE and IWD. On a price-to-sales ratio foundation, absolutely the figures seem lots nearer, however on a proportion foundation the distinction continues to be stark. When persons are fascinated about increased valuations we imagine that they’re tending towards fascinated about the expansion facet of the ledger—QQQ, IVW and IWF had a lot increased valuation measures throughout the board in determine 4.

Determine 4: The Valuation Distinction between Worth & Development in U.S. Equities

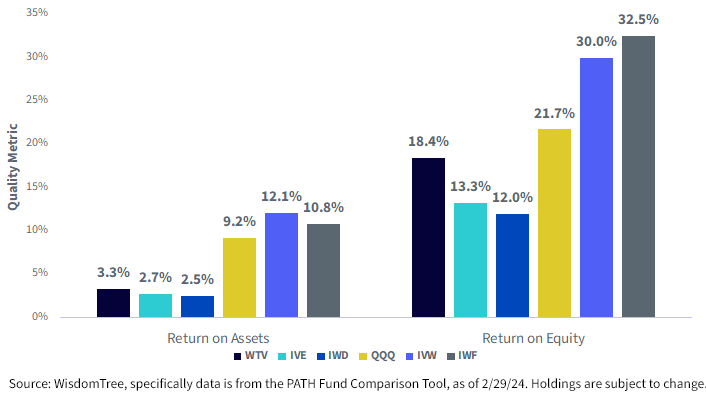

Continuously, worth methods don’t pay any consideration to high quality, that means issues like return on fairness (ROE), return on property (ROA) and decrease leverage. WTV does listen right here, so often this results in the next valuation, nevertheless it doesn’t seem that this was the case right here. WTV will not be in a position to fully shut the hole relative to QQQ, IVW and IWF, however we all know there’ll at all times be a niche between progress and worth. What’s attention-grabbing to us is that defining worth in a method that’s extra targeted on shareholder yield is ready to affect the scale of this hole. In determine 5:

- After we take a look at WTV and QQQ particularly on a ROE foundation, WTV has nearly closed the hole to three% between the 2—that means it’s lagging QQQ by a bit greater than 3%. We predict that individuals might be intrigued to see that QQQ is way behind IVW and IWF on an ROE foundation.

- With ROA there was much less variation—the three worth methods have been shut collectively, as have been the three progress methods.

Determine 5: Return on Fairness & Return on Property, Two Vital Measures of High quality

Conclusion: Worth Might Be Coming Again

We’ll need to see if the second quarter of 2024 provides additional affirmation of the pattern of worth beginning to put its foot ahead in U.S. fairness market efficiency. If this finally ends up the case, we think about it’s a wholesome signal that the identical seven shares are not carrying the total efficiency load of U.S. equities. Many individuals we spoke to wished to see broader fairness market management—possibly that’s what we’re seeing right here.

After we consider WTV, we particularly just like the sign that it sends by the shares chosen—that’s, corporations which are targeted on returning money to shareholders. A excessive whole shareholder yield (dividend yield and web buyback yield) is an attention-grabbing method, in our opinion, to outline a worth firm. We imagine that even when the worth type doesn’t mount a whole resurgence, one of these investing may nonetheless deliver efficiency to the desk.

Determine 6: Vital Additional Info Relating to the Totally different Methods

In case you are all for diving extra into the comparability of those Funds, please take a look at our Fund Comparison Tool.

In case you are all for diving extra into the comparability of those Funds, please take a look at our Fund Comparison Tool.

1When the time period “Magnificent 7” is used, it refers to 1) Apple, 2) Microsoft, 3) Amazon.com, 4) Meta Platforms, 5) Nvidia, 6) Alphabet and seven) Tesla.

2Supply: https://mba.tuck.dartmouth.edu/pages/college/ken.french/data_library.html

3The Fund’s goal modified efficient 12/18/17. Previous to 12/18/17, Fund efficiency displays the funding goal of the Fund when it tracked the efficiency, earlier than charges and bills, of the WisdomTree U.S. LargeCap Worth Index.

4Supply: S&P Dow Jones Indices S&P 500 Worth Index Factsheet, knowledge present as of three/28/24.

5Supply: FTSE Russell Russell 1000 Worth Index Factsheet, knowledge present as of two/29/24.

[ad_2]

Source link