[ad_1]

The potential for cussed inflation, a higher-for-longer coverage from the Federal Reserve and structural $1 trillion deficits have all contributed to an irregular form within the U.S. Treasury curve. On this piece we glance to different intervals of curve inversion and conclude that inverted yield curves are usually not an obstacle to fairness returns. For mounted revenue, the affect is extra nuanced and rely upon when the Fed stops hiking rates.

In a “regular” bond market, the yield curve slopes upward. The structural driver of this yield premium is that investing turns into riskier the additional you get into the long run. In in the present day’s markets, short-term charges want to stay excessive to tamp down inflation, however sooner or later, the Fed is prone to reduce charges as soon as the storm has handed.

At the moment, traders can lock in the next fee of return in change for the danger that charges might fall sooner or later. During the last 35 years, the U.S. skilled an inverted yield curve in 5 distinct intervals, which we’ve got reviewed from the preliminary inversion of the 2 yr versus the 10-Year Treasury till that a part of the curve finally shifted again into optimistic territory on a sustained foundation.

Whole Returns vs. Bond Yields

Huge Image

In each episode of yield curve inversion besides 2007 and the present episode (2023), bonds delivered optimistic complete returns because of falling charges. The problem in the present day is that not solely have bond yields risen dramatically throughout the curve, however they had been at a lot decrease ranges when the inversion occurred.

Aside from 2000, equities considerably outperformed mounted revenue on this atmosphere regardless of the implication that inverted yield curves sign a looming recession.

The clear implication for 2023 is that longer duration has underperformed quick length whereas the curve has been inverted due primarily to rising charges versus decrease ranges of carry. Nevertheless, except traders anticipate this atypical interval to persist, they should think about when to start out positioning for the last word pivot from the Fed.

In our view, the important thing issue that’s driving inversion is that short-term rates of interest are too excessive. Any alerts from the Fed that it might be inclined to start out slicing charges have resulted in huge rallies for the lengthy finish, which has boosted complete returns. Whereas this may occasionally not end in an upward-sloping curve instantly, traders may have locked in charges not seen because the early 2000s.

We additionally distinction this with above-average fairness efficiency throughout an inverted yield curve atmosphere as a chance to de-risk. Nevertheless, this view additionally is determined by timing, which we focus on throughout particular intervals of curve inversion beneath.

Cumulative Returns: 1/5/89–3/29/90

Throughout this era with a flat/inverted curve, mounted revenue skilled much less important drawdowns on account of upper beginning yields. Because the Fed began slicing charges in July 1989, length began to outperform in a giant method. The fairness market additionally rallied strongly because the Fed moved away from restrictive coverage. Nevertheless, the U.S. tipped into recession in July 1990, which additional favored allocations to mounted revenue versus equities.

Cumulative Returns: 5/26/98–7/26/98

It’s arduous to attract too many conclusions from this era of inversion on account of the quick interval (two months), however mounted revenue delivered optimistic complete returns over your complete interval, albeit at a lot smaller ranges since adjustments in yields had been the first driver versus revenue. Whereas equities delivered the very best complete returns, this got here at the price of a way more volatile journey.

Cumulative Returns: 2/2/2000–12/28/2000

This era coincided with the height of the dot com bubble in March 2000, and is probably essentially the most anomalous for the present atmosphere. Frothy fairness markets finally resulted in a pullback for shares whereas longer-term Treasuries rallied. After a closing fee hike in July 2000, Treasuries then proceeded to rally because the Fed switched to impartial coverage. It could be doable that we see the same response in December 2023.

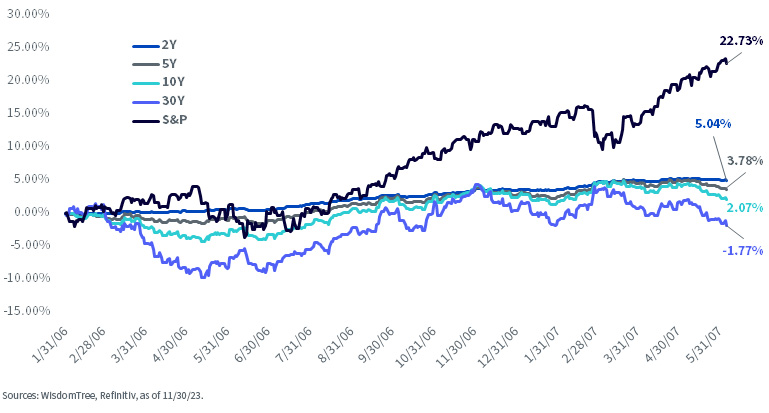

Cumulative Returns: 1/31/06–6/5/07

This era is marked by the biggest outperformance for equities mixed with basic underperformance within the bond market, notably within the lengthy finish. The Fed had been steadily tightening coverage since 2004 in a measured, predictable style. In response, bonds usually languished whereas equities continued to run.

2022–2023

As most traders have been painfully conscious, the lengthy finish of the Treasury curve has massively underperformed. The large distinction throughout this era is that regardless of a modest steepening within the yield curve, the spread between 2-Yr and 10-Yr charges has remained inverted at 35 basis points, which contrasts with the opposite historic analyses.

For relative worth traders, the important thing query comes right down to how far more divergence can happen between long-term bonds and equities. Whereas the timing of that imply reversion is open for debate, given the almost unprecedented dislocation, it might make sense to make this commerce earlier than the Fed totally alerts that charges might be falling.

Locking in a complete return of almost 4.5% for 10 years with the added upside potential of falling charges is turning into a extra enticing commerce, notably if inflation falls sooner somewhat than later.

Cumulative Returns: 7/5/22–11/30/23

Conclusion

When the yield curve inverts, assumptions concerning the bond market get turned on their heads. Whereas equities can usually tolerate inversion higher than bonds, we all know that markets are dynamic and nothing lasts ceaselessly. In gentle of current underperformance, it might make sense to start out shifting the length of investor portfolios to reap the benefits of an eventual shift from the Fed.

In our view, any investor with publicity to a 60/40 allocation ought to think about the WisdomTree U.S. Efficient Core Strategy (NTSX) in its place. With mounted revenue offering a lot greater yields, we’re extra postive concerning the capacity for the technique to generate returns that differ from a 100% fairness allocation given the unsure otulook for equities heading into 2024.

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. Whereas the Fund is actively managed, the Fund’s funding course of is predicted to be closely depending on quantitative fashions and the fashions might not carry out as supposed. Fairness securities, reminiscent of widespread shares, are topic to market, financial and enterprise dangers which will trigger their costs to fluctuate. The Fund invests in derivatives to achieve publicity to U.S. Treasuries. The return on a by-product instrument might not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage and derivatives might be unstable and could also be much less liquid than different securities. Because of this, the worth of an funding within the Fund might change shortly and with out warning and you might lose cash. Rate of interest threat is the danger that mounted revenue securities, and monetary devices associated to mounted revenue securities, will decline in worth due to a rise in rates of interest and adjustments to different components, reminiscent of notion of an issuer’s creditworthiness. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link