[ad_1]

Key Takeaways

- Inflation has proven notable enchancment from its 2022 peak readings, however the highway forward might not be straightforward.

- Each Core CPI and Core PCE inflation readings reversed course in 2023, however the tempo of enchancment has slowed down within the final two to a few months.

- There might be some daylight rising between Fed coverage makers relating to the timing and extent of charge cuts, with Fed Chairman Powell much less deterred by latest inflation readings and Governor Waller suggesting a discount within the total variety of charge cuts or pushing them additional into the longer term.

Regardless that I’ve by no means come wherever near operating a marathon of any kind, I’m advised the final mile might be probably the most troublesome a part of the endeavor. how inflation has carried out to start 2024, it seems the development buyers have witnessed over the primary 25 miles of this marathon may have been the simple half, and the highway to mile quantity 26 could also be more durable.

The cash and bond markets could have gotten a little bit complacent on inflation developments after the 2023 expertise. Certainly, the height readings of 2022 for each headline and core inflation have been put within the rearview mirror fairly rapidly, as value pressures cooled off on an virtually month-to-month foundation. Given the rally within the Treasury market that was witnessed in This autumn of final 12 months, there may be little doubt that this sort of enchancment was anticipated to proceed, maybe resulting in the Federal Reserve reaching their 2% threshold within the course of.

Core Inflation

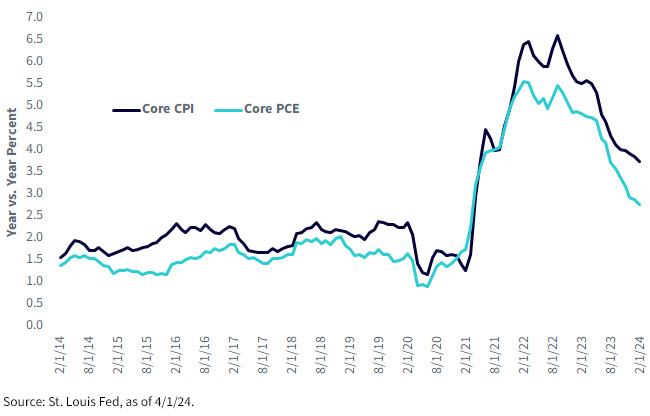

For this weblog publish, I’m going to focus solely on inflation minus meals and power, utilizing two completely different gauges: the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE). Curiously, one may argue the markets focus extra on the CPI gauge, whereas the Fed makes use of the PCE measure for its official inflation goal.

As you possibly can see, each core inflation readings reversed course in 2023, however the diploma of enchancment has leveled off considerably. Core CPI and PCE every hit their peak year-over-year beneficial properties of 6.6% and 5.5%, respectively, in September 2022 and dropped to roughly 4% and three% towards the top of final 12 months. Nonetheless, the tempo of enchancment has grow to be a bit extra grudging during the last two to a few months, with Core CPI coming in at 3.8% and Core PCE at 2.8% in February, the newest knowledge obtainable.

Given this backdrop, what’s a central banker to do? latest feedback from Fed Chairman Powell and Governor Waller, one will get the constant message that the voting members aren’t in a rush to chop charges, however that charge cuts will greater than seemingly happen this 12 months. Nonetheless, there appears to be some daylight between these two coverage makers’ views on when and by how a lot. Whereas Powell doesn’t appear to be overly deterred by the latest inflation readings, Waller did say the info is main him to consider that “it’s applicable to scale back the general variety of charge cuts or push them additional into the longer term.”

Powell has additionally not too long ago talked about that maybe inflation doesn’t have to get down exactly to the Fed’s 2% goal. Does that imply that Core PCE at 2.5% can be seen as an appropriate level to start reducing charges? In the event you have a look at the historical past of Core CPI and Core PCE, there may be normally an expansion between their year-over-year readings, with the post-COVID interval of December 2020–December 2021 being the one exception during the last 10 years. If this unfold holds, would the Fed really feel comfy decreasing charges if Core CPI was someplace between 3% and three.5%?

Conclusion

Whereas the Fed could look to start easing in such a state of affairs, the U.S. Treasury 10-year note might not be that thrilled, particularly if the labor market knowledge stays resilient and stable.

[ad_2]

Source link