[ad_1]

In a 12 months of reasonable financial development, money dividend payouts have additionally grown at a gradual tempo. The U.S. Dividend Stream®, which sums the indicated dividend funds of all U.S. listed payers, has grown at a 5.4% fee over the earlier 12 months, near the 5.8% annual determine since 2007.1

Of the 20 largest dividend payers within the U.S. market, 18 have grown their funds this 12 months. The WisdomTree U.S. Quality Dividend Growth Index (WTDGI) held 12 out of those 18 securities in 2023, which contributed to its dividend development of 6.6% exceeding the broad U.S. market by north of 1%. It is very important spotlight how WTDGI didn’t maintain the one two non-growers, AbbVie and AT&T.

The WisdomTree U.S. Quality Dividend Growth Index (WTDGI), tracked by the WisdomTree U.S. Quality Dividend Growth Fund (DGRW), selects corporations that look engaging throughout measures of profitability, like ROE and ROA, and earnings development prospects and weights them by their Dividend Stream. As highlighted above, this basic mannequin has allowed WTDGI to realize publicity to dividend growers and keep away from corporations vulnerable to chopping or suspending dividend funds.

Bettering Danger-Adjusted Return of a Core Allocation

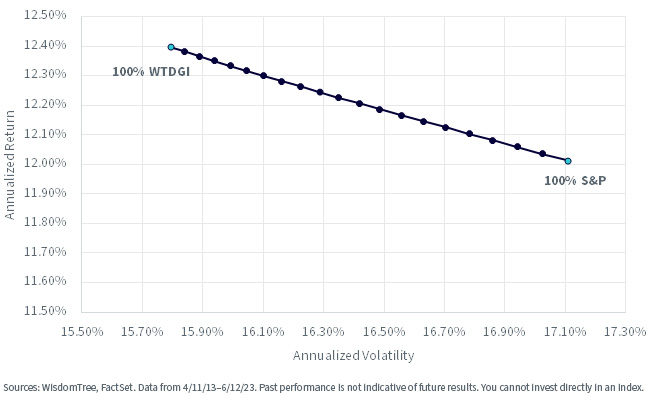

In a put up we wrote to have fun WTDGI’s 10-year anniversary final 12 months, we highlighted how since its inception in 2013, WTDGI has managed to outperform the S&P 500 by about 40 basis points yearly and achieve this with 1.3% decrease volatility.

The environment friendly frontier under exhibits the annualized return and volatility of portfolios constructed by combining WTDGI and S&P 500. The information used for this chart stems from April 11, 2013, to December 6, 2023, and assumes that the allocation is rebalanced semiannually on the finish of April and October. Every dot on the curve exhibits a 5% shift in allocation from one asset to the opposite.

Given their excessive correlation, which ranges from 0.91 to 0.99 in rolling one-year intervals, it’s not shocking to see the straight-line nature of the environment friendly frontier reasonably than the standard curve of decrease correlation property. This being stated, you will need to spotlight how combining these two would’ve helped buyers scale back volatility with out coming at the price of efficiency or, reasonably, even be a profit in efficiency.

Asset Allocation: WTDGI vs. S&P 500

Index Methodology

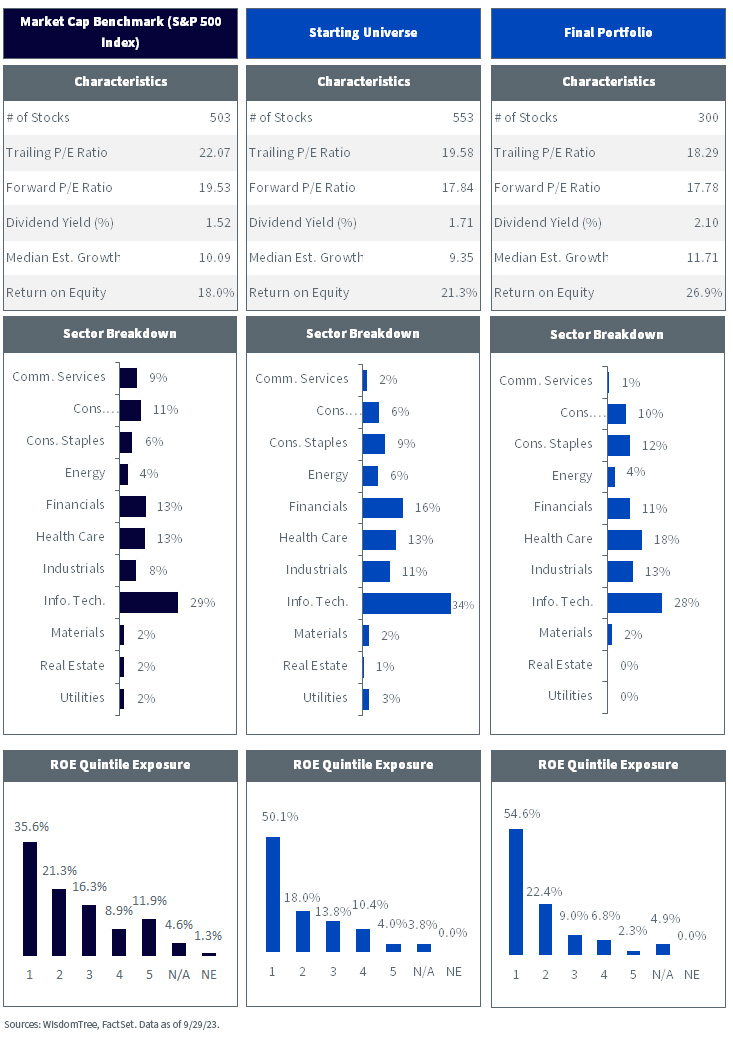

The methodology of WTDGI’s annual rebalance, which occurred on December 13, will be defined within the following levels:

- Beginning Universe: The Index’s beginning universe consists of dividend-paying U.S. equities that meet WisdomTree’s liquidity necessities and whose market caps exceed $2 billion. Corporations whose dividend protection ratios are lower than 1 (i.e., dividends exceed earnings) are eliminated, as are corporations flagged as dangerous by WisdomTree’s composite risk score (CRS).

- Composite Rating Choice: Corporations are then ranked primarily based on an equally weighted composite rating of development and high quality. Progress is outlined as consensus estimated earnings development over the following one to 3 years, whereas high quality is calculated as a 50/50 rating of the corporate’s common three-year ROE and ROA. The highest 300 corporations are chosen into the portfolio.

- Last Portfolio: The 300 corporations chosen are Dividend-Stream-weighted to mirror the proportionate share of mixture money dividends. A person holding cap of 8% is utilized previous to a 20% sector cap for all sectors besides Information. Tech. (30%) and Actual Property (10%).

The chart under highlights the completely different levels of WTDGI’s newest rebalance in December 2023 and compares portfolio traits versus these of the S&P 500 Index (teal).

For definitions of phrases within the determine above, please go to the glossary.

Rebalance Highlights

WTDGI’s beginning universe already exhibits a top quality tilt and bettering valuation coming from eradicating non-dividend payers and corporations whose dividends exceed earnings or are vulnerable to chopping their dividend funds.

Upon deciding on the 300 best-scoring corporations on the composite rating of development and high quality and Dividend-Stream-weighting the basket, the portfolio reveals stronger high quality and development traits. Combination ROE exceeds the S&P 500 by nearly 9%, and the median estimated development of the portfolio is 1.5% increased.

Greater than half of the load is allotted to the very best ROE corporations. Each the trailing and ahead valuations of the portfolio are decrease than the S&P 500, displaying how this course of can obtain its tilts by holding valuations in verify and having the next dividend yield than the market.

Sectors like Client Staples, Well being Care and Industrials are over-weight whereas Comm. Companies and Utilities are under-weight.

DGRW: The ETF That Tracks WTDGI

DGRW has been a well-liked ETF for core publicity to the market, and outperforming the S&P 500 with decrease volatility has been a main characteristic. Choosing solely corporations we see as finest positioned to ship dividend development has led this ETF to have a smoother trip than core indexes with the extra risky non-dividend-paying shares. Whether or not you need some worth publicity or development publicity, DGRW performs down the center, making an attempt to deliver parts of choosing high-quality development shares however with a dividend and valuation framework concerned in weighting.

1 Sources: WisdomTree, MSCI. Information from 11/30/07–11/30/23.

Essential Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. Funds focusing their investments on sure sectors improve their vulnerability to any single financial or regulatory growth. This may occasionally end in better share worth volatility. Dividends will not be assured, and an organization at the moment paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

[ad_2]

Source link