[ad_1]

Once you do that for some time, there are years that actually stick in your head relating to the notable and quotable dates of inventory market lore. The years 1999 and 2000 are amongst them, for causes of the tip of the dot-com bubble. Preserve these two particular years in thoughts as we have a look at 4 charts.

Proper now, the inventory market is blowing out the 20 years from 1980 to 2000 on a particular efficiency metric. The final twenty years have witnessed companies with a 0% dividend yield outperforming the very best yielders by a bigger quantity than at any time in pre-Covid historical past, together with that one. In determine 1, see the boldness with which the snapbacks hit.

Determine 1: 20-12 months Rolling Annualized Outperformance, High Quintile of Shares by Dividend Yield minus Shares Paying No Dividends

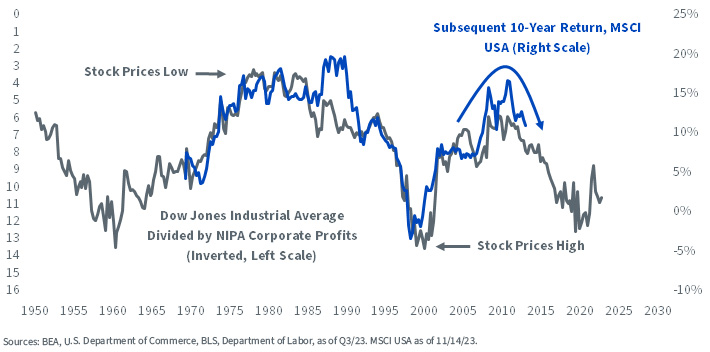

In determine 2, I divided the Dow Industrials by NIPA company earnings. As a result of the market bolted so boldly from the 2009 lows till the peak of the mania in 2021, the connection is close to historic extremes. If the chart’s match is any information, possibly the approaching years witness a market that frustrates the bulls.

Determine 2: Dow Industrials Relative to NIPA Company Income

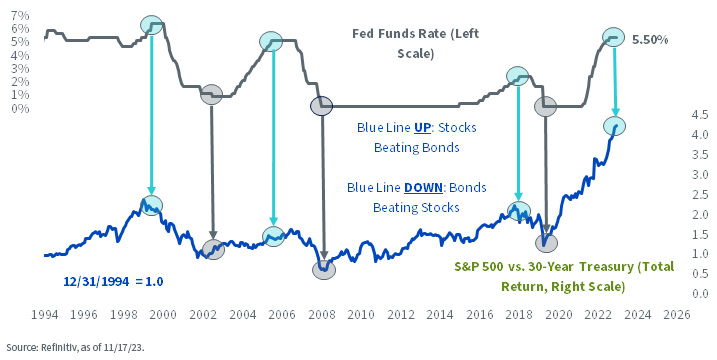

One other state of affairs which will simply mean revert is the connection between inventory and bond returns. If the consensus has it proper, that the Fed is completed tightening for this cycle, take heed of the message from determine 3. Perhaps the hated bond market is able to begin outperforming.

Determine 3: The Finish of Tightening Cycles Tends to Favor Lengthy-Time period Bonds over Shares

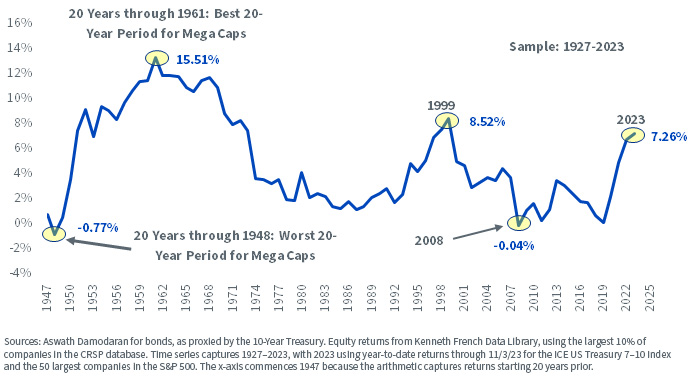

Determine 4 helps that argument. We’re at a 20-year excessive in fairness outperformance over bonds. Just like the chart of dividend payers versus non-payers, the pre-Covid precedent for such issues takes place in in regards to the eighth inning of the dot-com bubble: 1999.

Determine 4: 20-12 months Annualized Efficiency Differential, Mega-Caps vs. Bonds

Let’s summarize our 4 charts:

1. Corporations that paid no dividend simply had the best 20-year bout of outperformance over the most important dividend payers on report.

2. The Dow relative to NIPA company earnings factors to 2023–2033 being a tricky marketplace for shares.

3. The tip of the Fed’s tightening cycles factors to bonds beating shares.

4. 2003–2023 witnessed shares beating bonds by an order of magnitude that’s solely matched by the 20 years after the Second World Battle and by 1979–1999.

We see loads of portfolios land on our desk. High-heavy in tech, Magnificent Seven in all places, large overweights in U.S. equities, basic disdain for fastened revenue, little or nothing in the way in which of deep worth and on it goes. If all or any of those charts revert to the imply, heads will spin.

[ad_2]

Source link