[ad_1]

Key Takeaways

- Traders can make use of the time-tested barbell technique to navigate the present bond market panorama and put together for what lies forward. This method entails balancing short-term and long-term bonds, doubtlessly offering each stability and better returns.

- Latest shifts in U.S. Treasury yields spotlight the dramatic modifications within the rate of interest backdrop. Whereas an entire spherical journey hasn’t occurred but, understanding fee actions is essential. The barbell technique can assist mitigate uncertainties arising from rate of interest fluctuations.

- Regulate upcoming Fed coverage choices. The preliminary expectation of six fee cuts has shifted, and there’s speak that no fee cuts might happen in 2024 if labor market and inflation information stay sturdy. Staying knowledgeable and adaptable is important for bond traders.

The primary three months and alter of 2024 has introduced with it a relatively noteworthy shift in bond market sentiment. With Federal Reserve coverage decision-making remaining information dependent for the foreseeable future, traders have been left to surprise easy methods to place their mounted revenue portfolios for these altering rate of interest landscapes. In our opinion, traders can use the time-tested barbell strategy to navigate not solely the present setting, however extra importantly, what doubtlessly lies forward.

Let me present a fast perspective of how charges and fee expectations have modified just lately. One solely must see the motion in U.S. Treasury (UST) yields over the past six months to spotlight how the speed backdrop has shifted dramatically. After primarily hitting the 5% threshold, if not larger, the UST 2- and 10-12 months yields fell by greater than 100 foundation factors in the course of the This fall rally earlier than reversing course and retracing greater than 50% of that decline. Whereas it hasn’t been an entire spherical journey, the story isn’t over but.

U.S. Treasury Yields

Whereas a repeat efficiency of one of these fee motion is just not anticipated any time quickly, this episode underscores the significance of utilizing a technique that may assist navigate the uncertainties that also exist within the cash and bond markets. What do I imply by uncertainties? Let’s start and finish with upcoming Fed coverage choices to maintain it easy. Coming into the 12 months, the expectation was for six fee cuts, with the preliminary transfer pegged for March. As I write this put up, the implied chance for Fed Fund Futures has now slipped to about two fee cuts as in comparison with the Fed’s dot plot projection for 3 strikes. In reality, there was growing speak that if the labor market and inflation information continues to come back in as we’ve seen up up to now, maybe there shall be no fee cuts in 2024. For what it’s value, I’m now within the two camp.

For every Fund’s full standardized efficiency, month-end information, dangers and different essential info, click on the respective ticker: AGGY, USFR.

So, how can traders put together their bond portfolios for this looming uncertainty, which, by the best way, will seemingly carry into 2025? Again to the intro: the barbell technique.

We consider the barbell technique I’m going to debate right here permits traders the pliability to start including period in a deliberate vogue whereas nonetheless benefiting from the revenue obtainable within the ultra-short/brief portion of the inverted yield curve. The “including period” side is designed to not solely start locking in yield exterior of shorter-dated maturities, but in addition provides the power to attempt to participate in a bond market rally if charges had been to reverse course and fall once more.

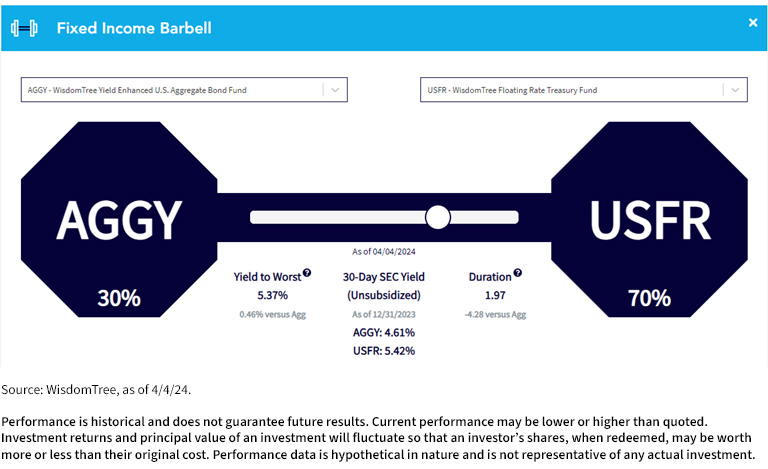

For illustrative functions, the WisdomTree in-house barbell uses our Floating Rate Treasury Fund (USFR) for the ultra-short/brief place and our Yield Enhanced U.S. Aggregate Bond Fund (AGGY) for the period counterweight. As you may see, a 70 (USFR)/30 (AGGY) allocation offers a yield to worst of 5.37%, whereas bringing period to only underneath two years (1.97). To sum up, this hypothetical barbell doubtlessly provides a yield benefit of just about 50 foundation factors versus the benchmark Agg, however with solely one-third of the period danger.

Conclusion

With uncertainty surrounding Fed coverage and bond yields, the barbell method offers traders with a time-tested, versatile technique to navigate the street forward with out making an outright fee name.

To see the barbell instrument for your self, please go to our Fixed Income Strategy page.

[ad_2]

Source link