[ad_1]

This text initially appeared on Business Insider.

A administration advisor turned jazz critic made a $6 million mistake when he bought Apple inventory about 25 years in the past.

Ted Gioia first invested within the know-how titan as a result of he was an avid consumer of its merchandise, he advised Markets Insider this week. Whereas finding out for a MBA at Stanford within the Nineteen Eighties, he accepted a job supply from Boston Consulting Group, and acquired an Apple II desktop laptop as a part of his signing bonus.

“Individuals would snicker at that laptop these days, but it surely was an enormous productiveness enhance again then,” he stated. “I wrote my second ebook on an Apple laptop — beforehand I had used a typewriter — and by no means regarded again.”

Gioia bought 300 Apple shares, paying solely a little bit above the corporate’s IPO worth. Apple went public at $22 in 1980, or 10 cents adjusted for the 5 inventory splits since then, and now trades at $191 a share.

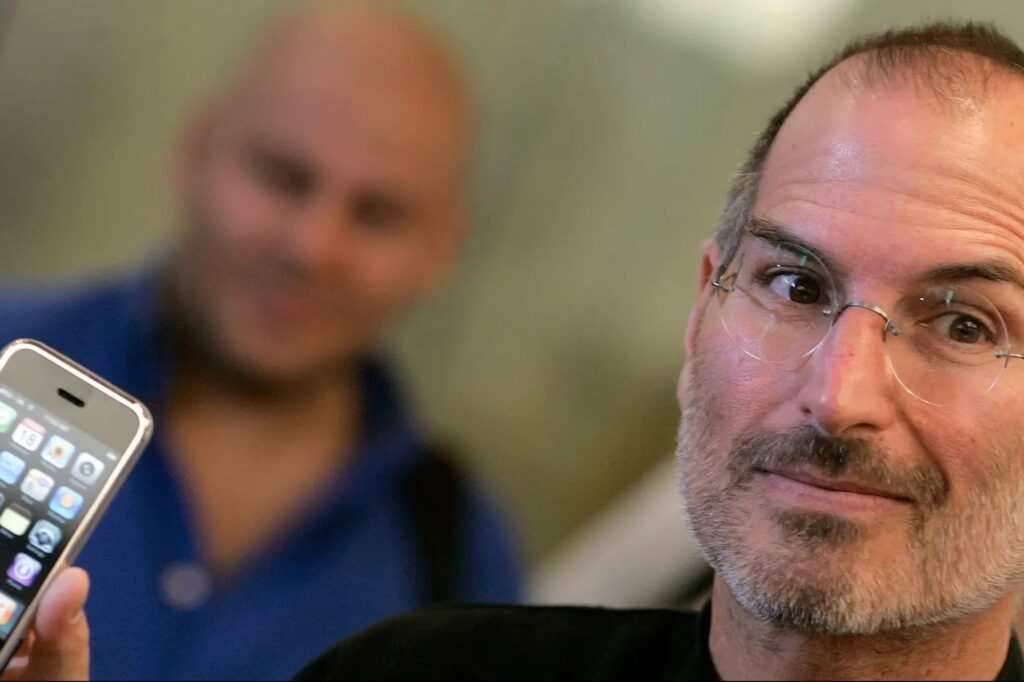

Nonetheless, Gioia cashed in his shares in about 1997, across the time when cofounder Steve Jobs, who had simply returned to Apple after being fired in 1985, bought nearly his complete stake.

“If I hadn’t bought, these 300 shares (with all of the inventory splits) would have become 33,600 shares as we speak,” Gioia stated in a X post on Sunday. “At as we speak’s share worth, my funding could be price $6.4 million — which is about 700 instances what I bought them for. Sigh!”

Gioia’s publish suggests he disposed of the shares for about $9,100 in whole, lacking out on a roughly 70,000% revenue. It is onerous now to think about promoting Apple inventory for such a pittance, he advised Markets Insider, “however after the board fired Steve Jobs, the corporate misplaced its means for an extended, very long time.”

“With out Jobs, Apple failed each time it tried one thing new, for instance the Newton handheld machine, which was an enormous catastrophe—and nearly a joke,” Gioia continued.

“I most likely ought to have purchased these shares again when Jobs returned to Apple,” he added. “And finally I did purchase a number of shares, and made some income — however they have been tiny in comparison with the good points I may have loved simply by holding on to my unique funding.”

Gioia, the writer of 11 books together with “The Historical past of Jazz” and “Love Songs: The Hidden Historical past,” struck a bearish tone on Apple in his X publish. He famous the corporate’s revenues declined final monetary 12 months — a pointy distinction from their 40% compound annual progress charge over the last 5 years of Jobs’ life.

The music historian and former McKinsey advisor additionally identified that after Jobs was fired, Apple’s solely huge vendor a decade later was the Mac, the final main product he’d launched. It is a comparable story as we speak, he stated, because the iPhone nonetheless generates the lion’s share of Apple’s revenues and income.

“So (as soon as once more) greater than ten years after Jobs’ departure, the corporate continues to be depending on his imaginative and prescient,” Gioia wrote. He asserted in one other post that Apple’s Tim Prepare dinner could excel at controlling prices and boosting effectivity, however he is a significantly better match as the corporate’s working chief, not its CEO.

“Should you’re searching for imaginative and prescient, innovation and progress, you do not rent Tim Prepare dinner,” he stated, arguing that Apple’s shrinking gross sales are proof that Prepare dinner wasn’t the proper successor to Jobs.

Gioia could be bitter about leaving over $6 million on the desk, however as a longtime Apple consumer, investor, and follower, he could have a degree in regards to the firm’s challenges within the post-Jobs period.

[ad_2]

Source link