[ad_1]

The brand new yr began with a thud for inventory market…that’s in stark distinction to the raging bull market all of us loved to shut out the yr. But because the S&P 500 (SPY) closes in on the all time highs it does make one take pause and contemplate the easiest way ahead because the methods that labored finest in 2023 will probably not maintain the keys to success in 2024. Get Steve Reitmeister’s sport plan for 2024 together with a preview of his prime 13 trades beneath.

2024 is NOT 2023!

A brand new sport plan for shares is afoot which was very a lot on show in December and kicked off the brand new yr in the identical vogue.

What’s that new sport plan?

And the right way to outpace the market from right here?

The solutions to these questions and extra are on this first Reitmeister Complete Return commentary of 2024.

Market Commentary

Shares stored sprinting into the end line ending the yr 4,769 for the S&P 500 (SPY). That’s spitting distance from the all-time closing excessive of 4,796. Which means we are going to get there quickly sufficient within the new yr.

Apparently, buyers spent the primary day of the brand new yr hitting the brakes. That makes excellent sense whenever you respect the continuous tempo of features the previous a number of weeks. Plus nearing the all time highs is a pure level of resistance resulting in a palpable pause.

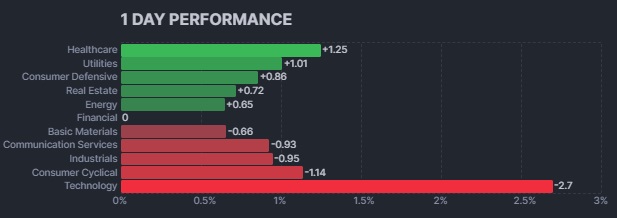

Nonetheless, not all shares have been within the purple. As a substitute, a rotation passed off. In easiest phrases it was OUT with the winners of 2023…and IN with the weakest teams from the previous yr. The following 2 charts inform this story in stark distinction:

Certainly, final yr’s large winners in Know-how and Communication Providers went from the highest of efficiency chart to the underside to kick off the yr. Conversely the 2023 weaklings like Healthcare, Utilities and Shopper Defensive took a wholesome step ahead within the new yr.

The reason for this rotation may be simply defined whenever you respect the tax video games buyers play. For instance, buyers wish to delay the tax ramifications for giant income on their winners by promoting on the onset of 2024 as a substitute of the tip of 2023. That’s the reason know-how took it so exhausting Tuesday.

One other well-liked tax season development is to promote the most important losers on the finish of the yr to take the tax loss to offset features to decrease their tax invoice. After which those self same shares benefit from the largest rebound early within the New 12 months as worth seekers purchase that dip.

At this stage most everyone seems to be feeling comfy in regards to the financial system, particularly with the Fed prone to begin decreasing charges within the coming yr. At this second the GDPNow mannequin from the Atlanta Fed stands at +2.0% for This autumn.

Not too scorching to maintain inflation aloft. Not too chilly to fret anybody about recession.

Now the guessing sport begins about WHEN the Fed will make their first fee reduce. Only a few folks anticipate that at their January 31st announcement. Nonetheless, odds go as much as almost 80% probability for March 24th.

I do not assume it issues a lot after they first drop charges…however how aggressively. A minor 25 level reduce in March barely strikes the needle. Given how aggressively they raised charges I’d wish to see a sooner tempo of withdrawal…like 50 factors to get the social gathering began. Proper now, the chances of that in March are solely 10% (maybe that needs to be a notch larger).

However because the Fed likes to say…they’re knowledge dependent. Thus, all of us have to maintain a watchful eye on these upcoming financial occasions:

1/3 ISM Manufacturing

1/5 Authorities Employment (not simply jobs added, but in addition wage inflation)

1/5 ISM Providers

1/11 CPI

1/12 PPI

1/25 This autumn GDP + the Feds favourite studying on inflation, PCE

All resulting in the 1/31 Fed assembly.

Buying and selling Plan

It is a pure spot for the bull run to take a relaxation and kind a buying and selling vary. The highest finish is round 4,800 given the way it correlates with the all time highs. The low finish is just not that low…perhaps 4,650’ish.

The extra essential aspect is the continuing rotation that ought to happen. Final yr’s large winners are performed out. Which means simply driving the identical ol’ Magnificent 7 bandwagon is just not the trail to outperformance in 2024.

As a substitute, it will likely be the continuing rotation to smaller shares (mid caps too). They’ve plenty of room to play catch up given a virtually 4 yr benefit for big caps.

I additionally like industrials and supplies that ought to profit from decrease charges as they typically borrow loads to run their companies. So, this decrease value of borrowing ought to assist enhance earnings development and share costs.

I consider the S&P 500 can have modest returns this yr. Like excessive single digits. Perhaps 10% tops. Thus, would anticipate to finish the yr round 5,200.

Index buyers won’t be so happy because it turns into extra of a yr for inventory pickers. And in that surroundings, I like our odds by leaning into probably the most engaging teams within the yr forward. Plus, taking full benefit of the advantages of our POWR Score system I like our odds to honest a lot, a lot better within the Reitmeister Complete Return portfolio.

Extra on that beneath…

What To Do Subsequent?

Uncover my present portfolio of 11 shares packed to the brim with the outperforming advantages present in our unique POWR Rankings mannequin. (4X higher than the S&P 500 going again to 1999)

This consists of 5 small caps just lately added with super upside potential.

Plus I’ve added 2 particular ETFs which can be all in sectors properly positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and all the pieces between.

If you’re curious to be taught extra, and wish to see these fortunate 13 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares . 12 months-to-date, SPY has declined -0.56%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Total Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The put up Happy New Year for Stock Investors??? appeared first on StockNews.com

[ad_2]

Source link