[ad_1]

Key Takeaways

- Income development and profitability are vital components to think about when evaluating software program firms, as they’ll influence the potential for future funding returns.

- The BVP Nasdaq Rising Cloud Index and the WisdomTree Team8 Cybersecurity Index have exhibited bettering revenue margins, which is a optimistic sign for traders in 2024.

- Buyers tended to understand firms with larger income development and better profitability, resulting in larger valuations. Earlier than pondering a software program firm is dear or cheap, we be aware the significance of placing the expansion and profitability into context.

After we communicate with traders, the query of valuation might be the preferred level that tends to return up. That is notably true once we are discussing technology-oriented matters.

Folks recognize paradigms—in a world the place it’s uncomfortable that we really have no idea what’s going to occur, if we are able to relate what may occur to a previous paradigm, this provides us larger consolation. The interval of roughly 1995 to 2000 is getting some consideration immediately, in that folks see technology-oriented shares rallying (similar to throughout this era within the Nineteen Nineties) and it’s pure that, after a rally, there’s a correction or crash (similar to the one which started in 2000).

Nonetheless, it’s vital to acknowledge the restrictions of any paradigm. On this case, we don’t know the size of the runway, and we have now to acknowledge that the businesses driving the majority of U.S. market returns are actually producing revenues and earnings and rising each of those vital fundamentals. We’re not speaking as a lot about speculative development tales that may generate earnings in some unspecified time in the future sooner or later when contemplating such names as Microsoft, Alphabet, Amazon.com, Meta Platforms, Nvidia, and so on.

Thus far, we noticed speculative development firms main in 2020 and 2021, with the financial and monetary stimulus of the COVID interval, after which getting crushed in 2022, together with a lot of the tech sector. In 2023, the most important, most worthwhile firms exhibited the perfect restoration, and this development has continued by means of a lot of the first quarter of 2024.

We imagine that it is going to be tough for valuations in 2024 to beat the degrees seen in 2021—when rates of interest are at or close to zero throughout the developed world AND cash is being deposited from governments straight into individuals’s accounts, it turns into clear {that a} risk-taking mentality is being inspired. This 12 months is a a lot completely different atmosphere.

How We Take into consideration Software program Firm Valuation

We’d go as far as to say that, with software program firms, valuation by itself tells the investor virtually nothing. First, these ready for multiples to look extra wish to these in different sectors might be ready a really very long time, recognizing that the software program enterprise mannequin merely instructions larger valuation multiples than many different areas of the market. Second, whereas excessive valuations may perform as considerably of a threat gauge, indicating the potential for sharp corrections, these corrections are normally attributable to different catalysts. It’s uncommon to say that software program firm share costs are dropping solely attributable to excessive valuations.

Now we have drawn inspiration for the next evaluation from Janelle Teng, Vice President within the San Francisco workplace of Bessemer Enterprise Companions (BVP). WisdomTree has a enterprise relationship with BVP for our cloud computing technique, and Janelle places out a incredible sub stack known as “Subsequent Large Teng.”

In our opinion, if an investor can get a way of valuation, profitability and development, the mixture of those three parts helps to zero in on a greater sense of true alternatives. On this piece, we’ll have a look at two distinct teams of software program shares:

- BVP Nasdaq Emerging Cloud Index: This index is tracked by the WisdomTree Cloud Computing Fund (WCLD), earlier than charges and bills. It’s an equal-weighted basket of firms that derive greater than 50% of their revenues from business-oriented software program delivered by means of the cloud mannequin. BVP analyzes the underlying cloud firms two occasions a 12 months to drive the additions and deletions to the index.

- WisdomTree Team8 Cybersecurity Index: This Index is tracked by the WisdomTree Cybersecurity Fund (WCBR), earlier than charges and bills. Team8 analyses the cybersecurity choices of firms to seek out those who have a selected concentrate on the place the way forward for the house is heading. Corporations with a extra various array of cybersecurity choices and sooner income development will are likely to see the largest weights.

The Development of Valuation vs. Profitability

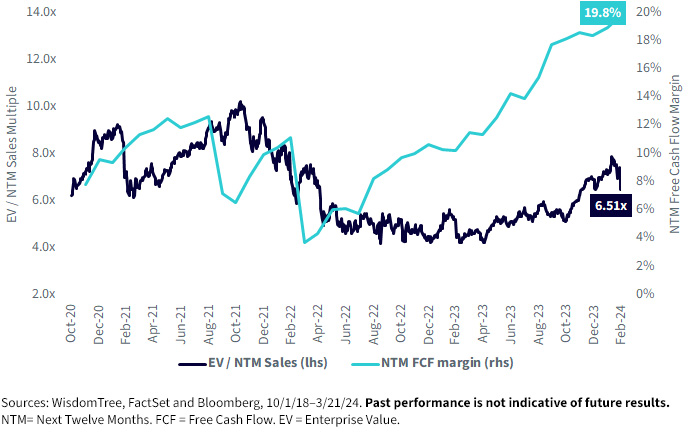

Inside software program, it’s typical to have a look at statistics with a concentrate on the following 12 months, normally seen with letters “NTM.”

- A preferred measure of valuation is the enterprise value/NTM sales multiple. The enterprise worth (EV) combines the worth of debt and fairness, minus money. NTM gross sales represents the forward-looking expectation of gross sales within the coming 12 months, recognizing that fairness markets don’t have a tendency to maneuver primarily based on the previous however quite on the expectations of the longer term.

- A preferred measure of profitability is the NTM free cash flow (FCF) margin. FCF represents an organization’s money from operations minus any capital expenditures, and the margin is searching for to check this determine to the software program firm’s revenues. After the expansion in any respect prices behaviors that had been seen to peak in 2021, there was extra of a concentrate on profitability, and this ratio helps to visualise this development.

Figures 1a and 1b inform us the next:

- Determine 1a showcases the valuation of the BVP Nasdaq Rising Cloud Index relative to its profitability. The near-term peak valuation of this index on an EV/NTM gross sales a number of foundation was noticed in early 2021 and practically touched a degree of 14.0 occasions. At present, we’re between 4.50 and 4.60 occasions—an enormous distinction. There can definitely be corrections, however we aren’t near 2021 valuations measured on this foundation. Throughout these peak valuations, NTM FCF margins had been at roughly 7.5%, however at present, this profitability gauge is shut to fifteen%, a degree about twice as excessive.

- Determine 1b showcases the valuation of the WisdomTree Team8 Cybersecurity Index relative to its profitability. The near-term peak valuation of this Index on an EV/NTM gross sales a number of foundation was noticed in late 2021 and barely eclipsed a degree of 10.0 occasions. The present valuation appears to have lately run as much as about 8.0 occasions earlier than falling again to six.50. Throughout these peak valuations, NTM FCF margins had been at roughly 6.0%, however this profitability gauge is now above 19%, a degree about thrice as excessive.

Determine 1a: Valuation vs. Profitability for the BVP Nasdaq Rising Cloud Index

Determine 1b: Valuation vs. Profitability for WisdomTree Team8 Cybersecurity Index

Are Buyers Paying Up for Sooner Progress and/or Greater Profitability?

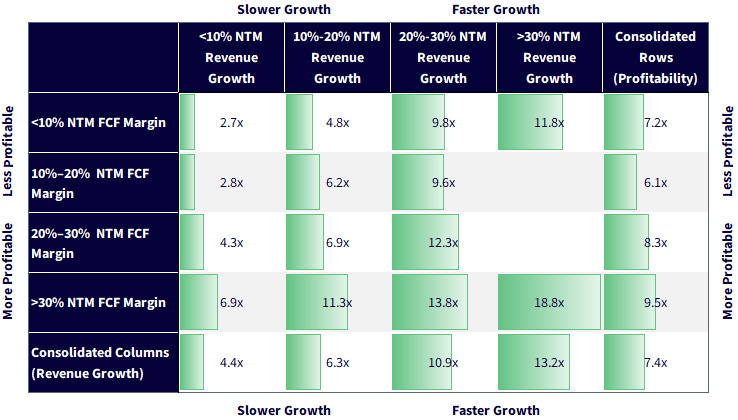

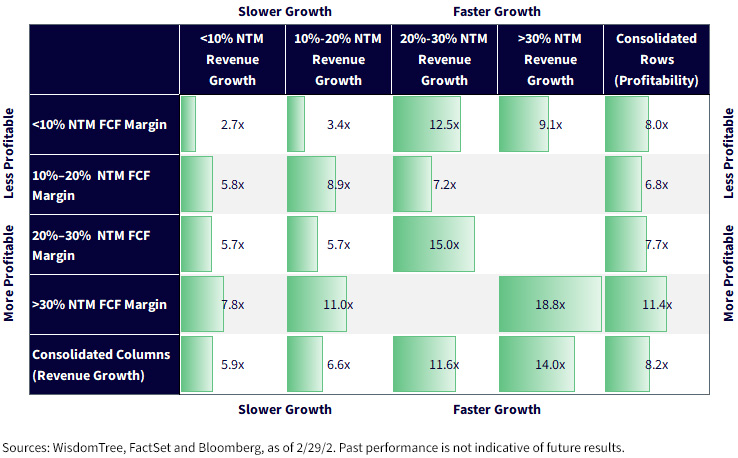

Software program firms can exhibit very giant variations in development, profitability and valuation. If traders had been strongly rational, excessive development and excessive profitability would command a premium valuation—this ought to be extra extremely valued than slower development and decrease profitability.

Nonetheless, it’s vital to check and monitor this thesis. We now flip our consideration to figures 2a and 2b:

- How rationally are traders treating the shares within the BVP Nasdaq Rising Cloud Index? (determine 2a): We do see that firms with larger than 30% anticipated income development and larger than 30% revenue margins did actually exhibit the very best valuation multiples. Equally, these firms with decrease than 10% revenue margins and decrease than 10% anticipated income development did have the bottom valuations. The distinction is fairly stark—probably the most fascinating shares had a a number of getting shut to twenty.0 occasions whereas the least fascinating had a a number of beneath 3.0. Any time one is trying on the valuations of cloud computing firms, don’t neglect to attempt to normalize it primarily based on how briskly these firms are rising their revenues!

- How rationally are traders treating the shares within the WisdomTree Team8 Cybersecurity Index? (determine 2b): We noticed roughly the identical relationship right here as we did with the cloud computing software program firms. Buyers seem keen to push valuations a lot larger for these firms with the very best revenue margins and the strongest income development. Vital to any group-based evaluation like this, we should be aware that the WisdomTree Team8 Cybersecurity Index has fewer than 30 shares, so a few of the groupings may solely signify a inventory or two.

Determine 2a: Normalizing Valuation on Income Progress and Profitability for the BVP Nasdaq Rising Cloud Index

Determine 2b: Normalizing Valuation on Income Progress and Profitability for the WisdomTree Team8 Cybersecurity Index

Conclusion: Danger, Sure, however Not Bubble Territory

Software program equities could be unstable, notably when one is targeted on thematic areas and firms that may have solely entered the general public markets extra lately. Nonetheless, we imagine that the bigger correction was what all of us skilled throughout a lot of 2022, after the 2021 highs. These taking a look at rates of interest and pondering they could be extra more likely to fall than to rise from right here may see one other catalyst for software program firm valuations.

We do be aware, nonetheless, that if one is considering valuations versus anticipated development and profitability, each the BVP Nasdaq Rising Cloud Index and the WisdomTree Team8 Cybersecurity Index have exhibited bettering revenue margins—an vital sign to see in 2024.

[ad_2]

Source link