[ad_1]

2023 was one more “show it” yr for the golf trade. Following a notable surge in golf participation through the pandemic, many within the trade anticipated a decline in 2022. However as we outlined in final yr’s Golf Business Tendencies Report, North American programs that use Lightspeed skilled development in each rounds and gross sales final yr.

On the heels of a 2022 that exceeded expectations, the query for 2023 remained the identical: might this momentum proceed? Or would the trade see regression? Encouragingly, an early have a look at the info signifies that 2023 was one more yr of development.

Not solely does the National Golf Foundation (NGF) report that year-to-date (YTD) October 2023 US rounds are trending 3% forward of YTD October 2022 totals (and effectively forward of pre-pandemic averages), however aggregated buyer knowledge from Lightspeed golf programs throughout North America reveals year-over-year (YOY) beneficial properties in gross sales quantity.

Maintain studying to study the place and when Lightspeed programs noticed development in addition to which golf trade traits homeowners and operators ought to keep watch over as we head right into a pivotal 2024.

The 2023 State of the Golf Business Report

Wish to study extra in regards to the state of the trade? Obtain our free 2023 report now!

Coming off a robust 2022, Lightspeed programs noticed continued development in transaction quantity in 2023

Averaging out transaction knowledge from the golf programs that use Lightspeed’s golf administration software program throughout North America, Gross Transaction Quantity (GTV)1, 2 elevated between YTD November 2022 and YTD November 2023.

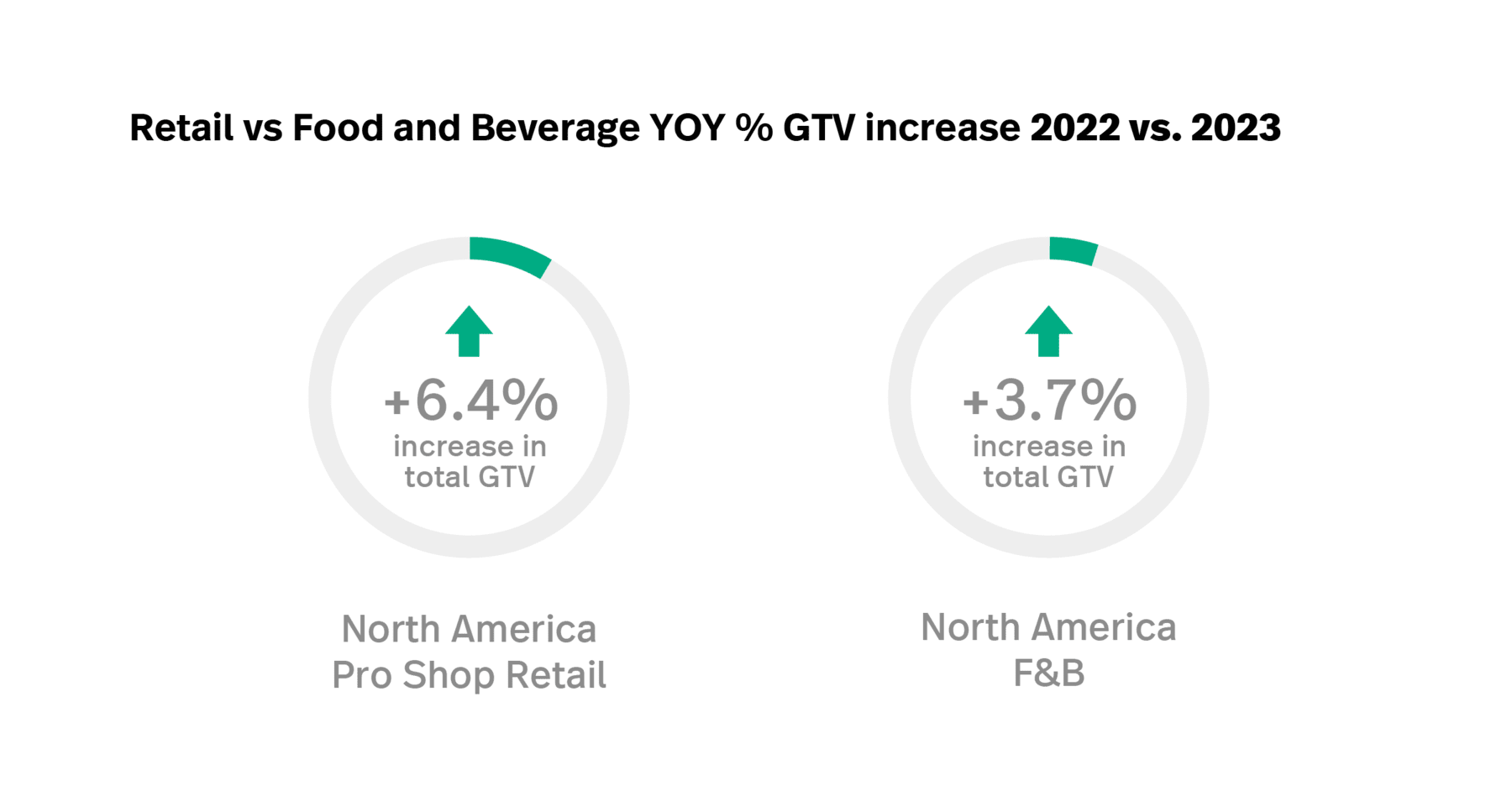

2023 golf retail transaction quantity vs. meals and beverage transaction quantity

In our breakdown of 2022 North American Lightspeed course knowledge, one determine that basically stood out was the YOY enhance in same-store meals and beverage (F&B) gross sales when in comparison with 2021. F&B gross sales had the largest impact on the expansion in whole GTV by 2022, practically tripling the YOY development seen in same-store retail/professional store GTV.

Quick-forward to 2023, and it’s clear to see a extra balanced distribution of development throughout retail/professional store transactions and people made on the beverage cart, within the restaurant or on the midway home.

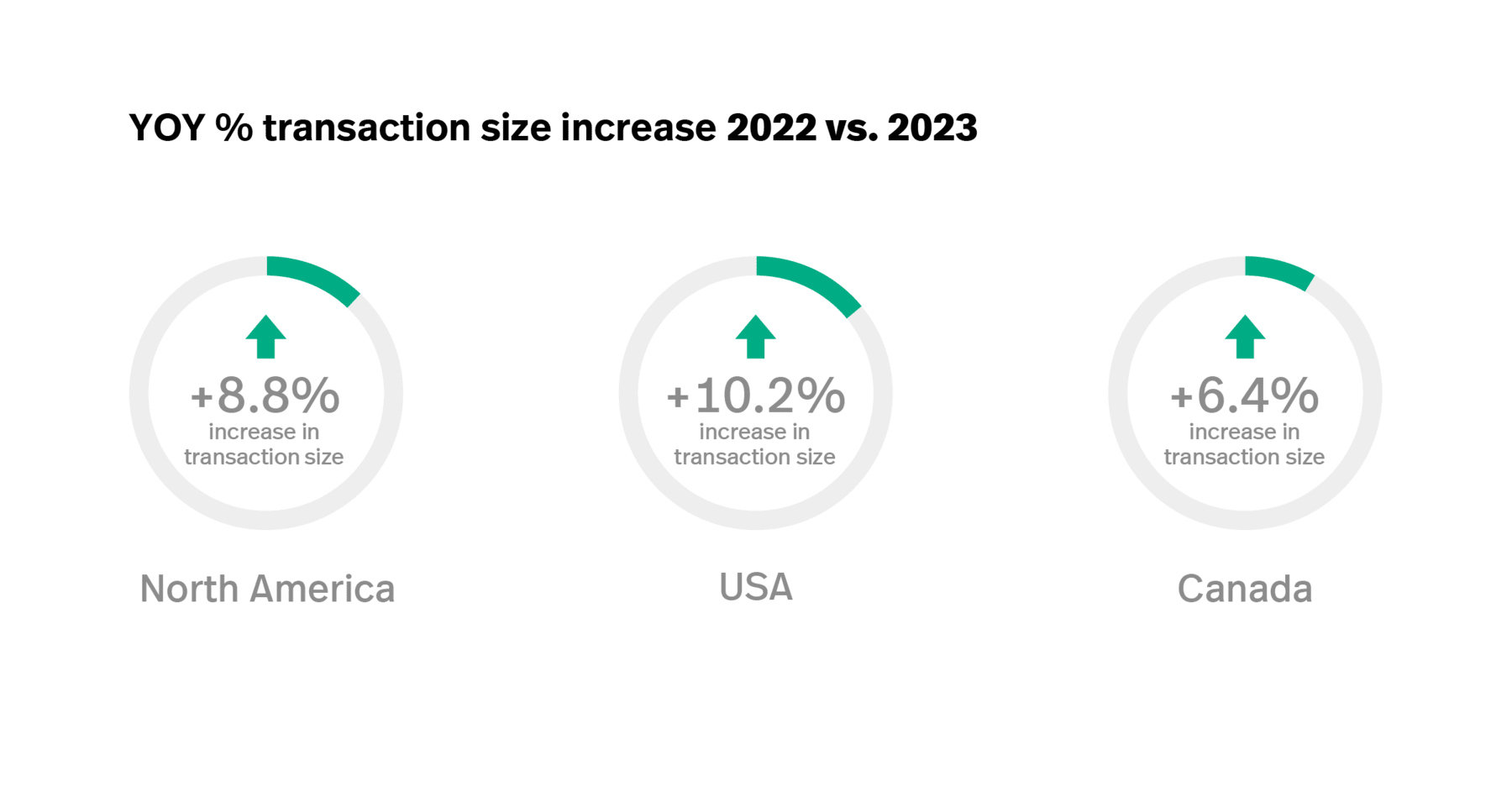

A have a look at YOY % adjustments in common transaction measurement

Evaluating the entire will increase in transaction measurement throughout North American Lightspeed programs yields some attention-grabbing findings.

Inflationary results

Inflation was a time period you couldn’t escape in 2023, and the golf trade was not resistant to its results. That stated, Lightspeed programs in america and Canada noticed a rise in common transaction measurement by a lot of 2023 that was in a position to outpace the typical client value index (CPI) enhance.

Huge months for big-ticket gross sales

The YOY development in transaction measurement in each Canada and america was punctuated by two significantly sturdy months: March and November.

Golf retail transactions drove these significantly sharp will increase throughout March and November. And when you think about the truth that these months align with key gross sales and advertising durations for golf programs, it’s not troublesome to see why:

Golf trade traits counsel that March is a time when 1000’s of programs throughout america and Canada launch start-of-season promotions, membership drives, subscription campaigns, and many others. With spring and the beginning of the season looming, March can also be when golfers will head to their professional store to search out offers on larger ticket objects similar to golf gear and attire.

Moreover, November is a key retail month throughout all industries. With Black Friday, Cyber Monday and the beginning of the vacation procuring season, this is a perfect time for golf programs throughout North America to run reductions on spherical packages and costlier merchandise.

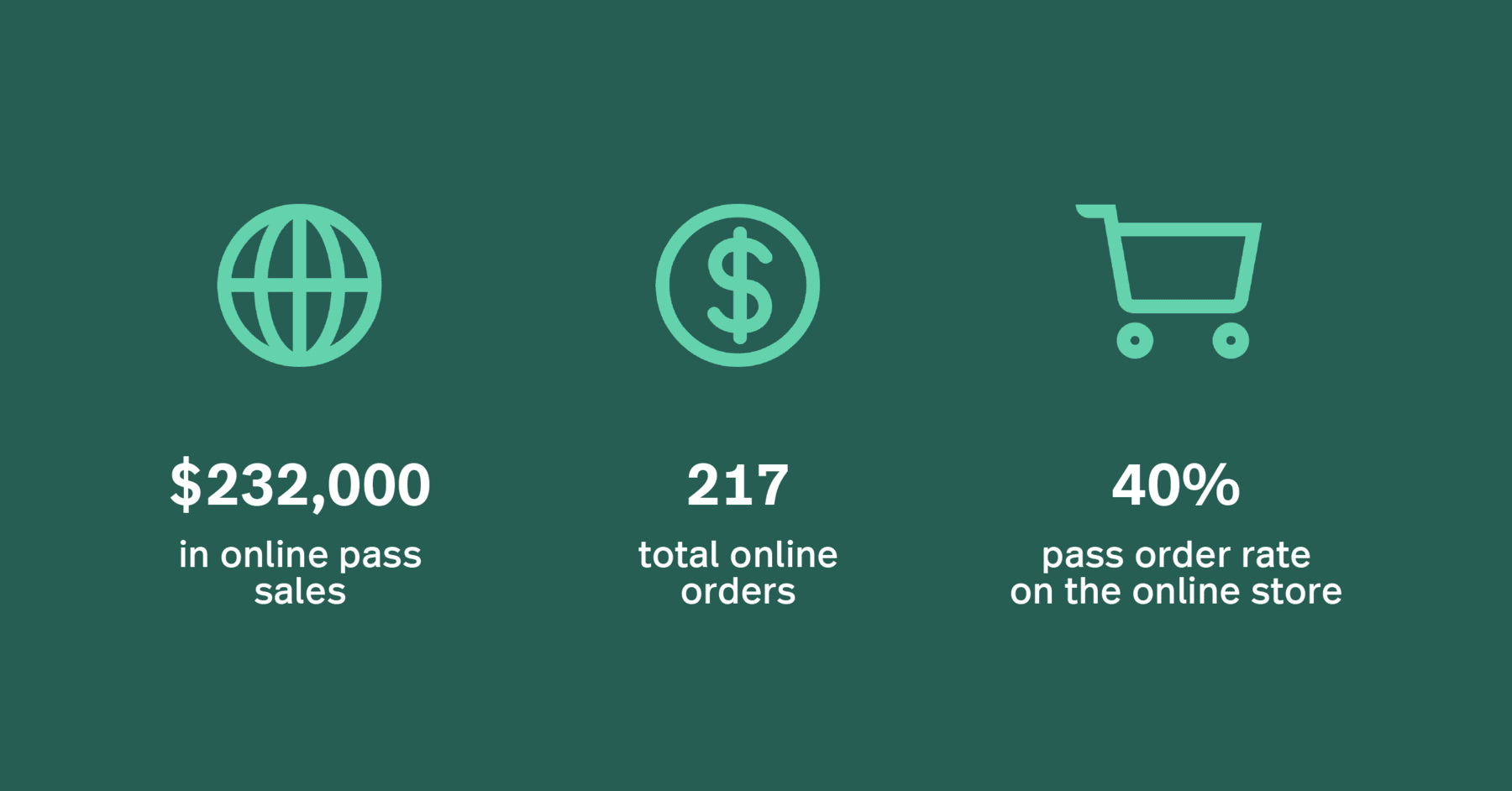

Black Friday Success: Sioux Falls Golf

For proof of how leveraging pivotal procuring durations can drive bigger transactions, look no additional than Sioux Falls Golf. So as to drive play, Sioux Falls Golf sells annual memberships that give golfers entry to all three of their municipal golf programs.

Over the 2023 Black Friday interval Sioux Falls Golf bought over $250,000 of those annual passes. Utilizing Lightspeed eCom, on-line gross sales account for 92% of this whole.

Key takeaways

These surges in transaction measurement throughout pivotal months of the yr reinforce how necessary it’s for golf programs to have entry to clean, accurate, actionable data that illustrates (amongst different issues):

- When golfers traditionally buy passes, memberships and merchandise

- Which golfers to focus on with remarketing efforts

- The success of particular campaigns, drives and promotions

- The breakdown of on-line versus in-store purchases

- Which passes, subscriptions, memberships and SKUs drive probably the most purchases amongst totally different buyer varieties and demographics

With the best insights at your disposal, you’ll be able to higher time (and goal) your gross sales and advertising efforts, push larger ticket objects and drive income at pivotal moments all year long.

Key golf trade traits to observe in 2024

With the explosive development and recognition of off-course golf, urgent questions of entry and inclusion, the rising affect of AI and automation on enterprise operations and extra, there are many golf trade traits to observe because the calendar turns to 2024.

1. The rising participation in off-course golf

It will be a mistake to characterize golf’s surge in recognition as a strictly on-course phenomenon. Due to venues like Topgolf and the newfound accessibility of golf simulator technology, off-course golf has altered the way in which hundreds of thousands of individuals benefit from the sport.

- According to the NGF, the quantity of People taking part in simulator golf has grown 73% since 2019.

- Of the roughly 6.2 million People utilizing golf simulators, greater than half (53%) don’t play conventional on-course golf.

- The Professional Golfers’ Association studies that, of the 16.3 million golfers throughout the UK and Eire, 11.4 million are completely off-course golfers.

- Almost half of those golfers are girls (47%) and are extra numerous by way of social background and ethnicity than it’s for on-course golf.

The popularity of off-course golf formats is a welcome trend, nevertheless it’s additionally an unsurprising one: ball and membership monitoring expertise has superior to the purpose the place it’s now not solely accessible to elite professionals and membership producers. That is expertise with an unimaginable quantity of economic potential and the trade is now beginning to see that potential realized.

Why golf programs ought to embrace off-course golf

Whereas it could be troublesome for traditionalists to listen to, off-course golf holds nice enchantment for mass audiences. Whereas hundreds of thousands of individuals have an curiosity in making an attempt golf, solely a sure subset of them will wish to decide to the time, price and relative problem of the on-course sport. It’s far simpler for these on golf’s periphery to decide to an evening of socializing, watching sports activities and hitting the occasional shot at Topgolf than it’s to taking part in 18 (and even 9) holes.

Fairly than see this as any type of risk, golf course operators ought to embrace this modification. From simulator bays and placing programs to an enhanced driving vary expertise, the rising curiosity in off-course golf presents amenities with the chance to scale their operations and add new companies that each one golfers will love.

2. Value of the on-course sport and its influence on play

The price of golf is a barrier to entry for a lot of who want to attempt the sport. Setting apart the excessive prices of apparatus and attire, the price of inexperienced charges have undeniably risen throughout golf’s growth years.

The NGF reports that peak season charges are cumulatively up 15% since 2021. And whereas 2023 is ready to be one other yr of participation development, the share of core golfers taking part in lower than regular is about twice as excessive as these taking part in greater than regular.

Whereas it’s fully justifiable for operators to boost costs to maintain up with demand and inflation, it’s additionally necessary to observe the continued influence of rising inexperienced charges to make sure that encouraging golf trade traits round participation aren’t derailed by financial components.

3. AI and automation

No trade is resistant to the rising influence of AI and automation on customer-facing and back-office operations. For golf course operators, AI instruments and the automation of processes can create key efficiencies and enhance the client expertise each on the course and on-line.

Buyer-facing instruments like AI chatbots and GPS-activated cell self check-in may help high-occupancy programs pace up service with out sacrificing buyer satisfaction. On the again finish, instruments like automated dynamic pricing, Business Intelligence, automated stock administration and AI-powered climate benchmarking instruments are shortly changing into trade requirements: they assist golf programs maximize income, simplify operations and make data-backed choices in actual time.

With on-course golf nonetheless surging, buyer expectations on the rise and extra demand for various forms of experiences, discovering methods to leverage AI and automation on the course might be key in 2024 and past.

4. Grassroots participation, variety, entry and inclusion

In accordance with the NGF, the three demographic groups which have seen the biggest leap in participation since 2019 are: juniors (36%), individuals of coloration (17%) and ladies (15%). These figures are extremely encouraging, and but they don’t distract from the truth that golf is still largely, middle aged, white and male.

Encouraging extra lively participation in golf, whether or not on-course or off, from numerous audiences is significant to the wholesome development and sustainability of the sport. That is solely attainable by a dedication to grassroots efforts and creating extra public, accessible avenues to golf no matter age, gender, race, ethnicity or financial standing.

Coming off of one other very sturdy yr of golf participation, amplifying the voice, attain and influence of teams like The First Tee, Make Golf Your Thing, The National Links Trust, Women’s Golf Day and different neighborhood initiatives might be essential in 2024.

For golf course operators, 2024 must be the yr to companion with teams like those above, break down obstacles to entry, have interaction in neighborhood outreach and set up opportunities for new golfers to meet, socialize and have fun at the course.

Right here’s to conserving the momentum moving into 2024

In mild of those golf trade traits, the longer term is vibrant for customer-centric programs who’re constantly leveling up their operations and discovering methods to simplify, scale and supply distinctive experiences for all golfers.

At Lightspeed, we’re dedicated to serving formidable golf programs who wish to succeed and thrive—now and sooner or later. Watch a demo of Lightspeed Golf and uncover why 1000’s of golf programs select our platform to run and develop their companies.

Disclaimers:

1. Key Efficiency Indicators: We monitor “Gross Transaction Quantity” or “GTV”as a key efficiency indicator to assist us consider our enterprise, measure our efficiency, establish traits affecting our enterprise, formulate enterprise plans and make strategic choices. Our key efficiency indicators could also be calculated in a fashion totally different from related key efficiency indicators utilized by different corporations.

2. Ahead-Trying Statements: This report could embody forward-looking info and forward-looking statements throughout the which means of relevant securities legal guidelines (“forward-looking statements”). Ahead-looking statements are statements which can be predictive in nature, rely upon or discuss with future occasions or situations and are recognized by phrases similar to “will”, “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” or related expressions regarding issues that aren’t historic details. Such statements are primarily based on present expectations of Lightspeed’s administration and inherently contain quite a few dangers and uncertainties, identified and unknown, together with financial components. Plenty of dangers, uncertainties and different components could trigger precise outcomes to vary materially from the forward-looking statements contained on this report, together with, amongst different components, these danger components recognized in our most up-to-date Administration’s Dialogue and Evaluation of Monetary Situation and Outcomes of Operations, beneath “Threat Elements” in our most up-to-date Annual Info Kind, and in our different filings with the Canadian securities regulatory authorities and the U.S. Securities and Trade Fee, all of which can be found beneath our profile on SEDAR at www.sedarplus.ca and on EDGAR at www.sec.gov. Readers are cautioned to think about these and different components fastidiously when making choices with respect to Lightspeed’s subordinate voting shares and to not place undue reliance on forward-looking statements. Ahead-looking statements contained on this information launch aren’t ensures of future efficiency and, whereas forward-looking statements are primarily based on sure assumptions that Lightspeed considers affordable, precise occasions and outcomes might differ materially from these expressed or implied by forward-looking statements made by Lightspeed. Besides as could also be expressly required by relevant regulation, Lightspeed doesn’t undertake any obligation to replace publicly or revise any such forward-looking statements, whether or not because of new info, future occasions or in any other case.

[ad_2]

Source link