[ad_1]

The European economic system will not be in free fall, however it’s stumbling.

Surprisingly resilient progress in 2022 within the face of the Russian invasion of Ukraine has given approach to an economic system that’s beginning to really feel the affect of the European Central Financial institution’s 10 consecutive rate hikes.

On October 26, the ECB introduced a pause on its rate-hiking marketing campaign to evaluate the impact of its financial tightening.

In the meantime, U.S. financial progress continues to shock to the upside.

Quarter-over-Quarter GDP Progress

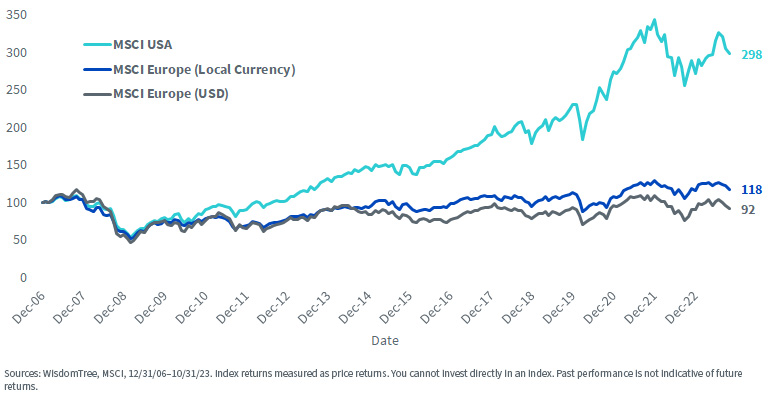

Wanting again to only earlier than the global financial crisis, the value returns of European equities measured in native foreign money (excluding foreign money fluctuations) have lagged the U.S. by 180% (or 5.7% annualized). Measured in {dollars}, European equities have misplaced worth within the final 16+ years.

Index Progress of 100 since 2006

For definitions of phrases within the chart above, please go to the glossary.

For discount hunters, the cloudy European financial image and lagging returns may spell alternative.

Many traders in U.S. equities are involved valuations are too stretched, constraining future return expectations.

No such concern exists for European equities.

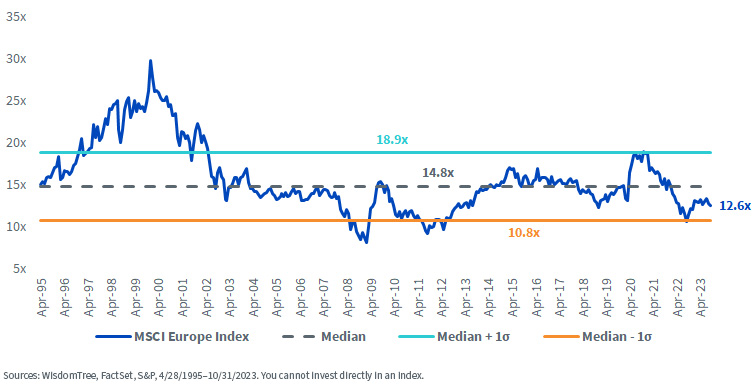

The MSCI Europe Index’s ahead P/E ratio of 12.6x is greater than two turns under its historic median of 14.8x.

MSCI Europe Index Ahead P/E Ratio

Allocating to European Dividend Payers

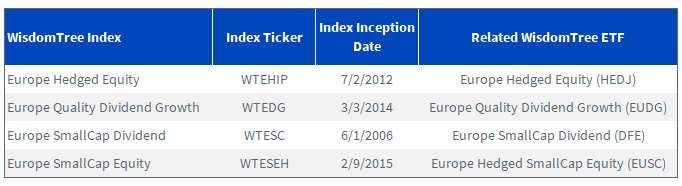

WisdomTree has 4 Europe-dedicated fairness Indexes. These Indexes rebalance exposures as soon as per yr as of an end-of-September screening date. Every Index consists solely of dividend-paying firms and is basically weighted based mostly on the Dividend Stream®.

These Indexes had been designed with a concentrate on being broadly diversified, extremely correlated to the consultant market cap-weighted indexes and investable.

Every Index is tracked by a associated WisdomTree ETF.

- WisdomTree Europe Hedged Equity – Publicity to European equities whereas neutralizing (hedging) publicity to fluctuations between the euro and the U.S. greenback. Corporations have to be domiciled in Europe, commerce in euros, have at the least $1 billion market capitalization and derive at the least 50% of their income within the newest fiscal yr from international locations exterior of Europe.

- WisdomTree Europe Quality Dividend Growth – Selects 300 firms from the eligible universe based mostly on their mixed rating of progress and high quality components. The expansion issue rating is predicated on earnings progress expectations, whereas the standard issue rating is predicated on three-year historic averages for return on fairness and return on property.

- WisdomTree Europe SmallCap Dividend – Contains the underside 25% of the market capitalization of the European firms from the WisdomTree Worldwide Fairness Index after the 300 largest firms have been eliminated.

- WisdomTree Europe Hedged SmallCap Equity – Publicity to European equities whereas neutralizing (hedging) publicity to fluctuations between the euro and the U.S. greenback. The Index includes the underside 10% of the market capitalization of the European firms traded in euros from the WisdomTree Worldwide Fairness Index.

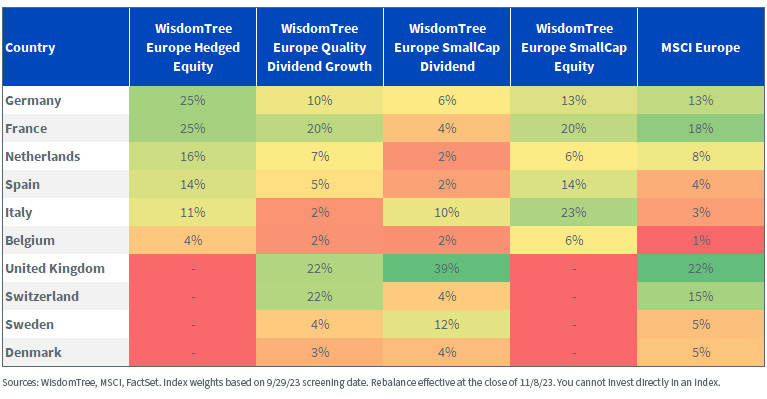

The rebalance of those European Indexes occurred on the market shut of November 8. Beneath is a abstract of the post-rebalance exposures of the Indexes.

Nation Exposures

- Each the Europe Hedged Fairness Index and the Europe Hedged SmallCap Fairness Index solely embrace international locations within the European Financial Union (EMU), thus excluding international locations like the UK, Switzerland, Sweden and Denmark. Nation weights are capped at 25%, which is why we see 25% weights every for Germany and France within the Europe Hedged Fairness Index.

- The Europe High quality Dividend Progress Index has a broad-based universe of European equities, together with non-EMU international locations. Nations are capped at 20% at rebalance, with some deviation attributable to a 20% sector cap, 5% holding cap and quantity changes to reinforce the liquidity of the Index.

- The Europe SmallCap Dividend Index additionally has a broad-based universe of European equities. The Index caps international locations at 25%, however attributable to quantity changes, United Kingdom equities had been boosted to a 39% weight on the rebalance.

Index Nation Exposures

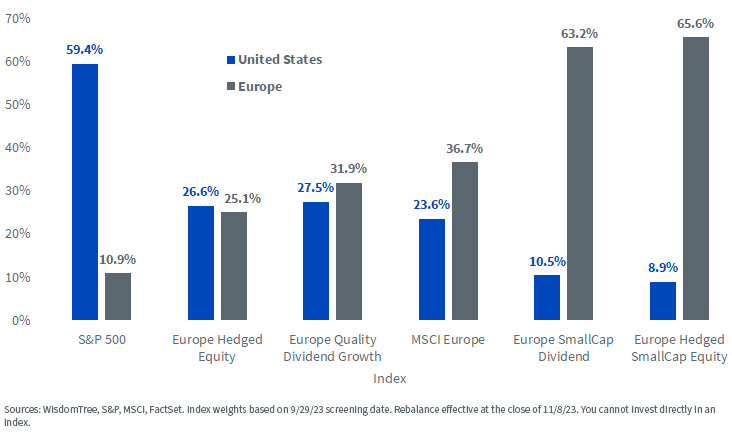

Geographic Income

The European economic system is way more export-reliant than the U.S.

S&P 500 constituents earn practically 60% of income from the home U.S. market. The WisdomTree Europe Hedged Fairness Index—populated by massive multinational European firms—earns lower than half that quantity from Europe (25.1%). Actually, that Index earns barely extra income (26.6%) from the U.S.

The Europe SmallCap Dividend Index and the Europe Hedged SmallCap Fairness Index every earn greater than 60% of revenues from the home European market, representing exposures extra carefully tied to European financial situations.

Index Geographic Income

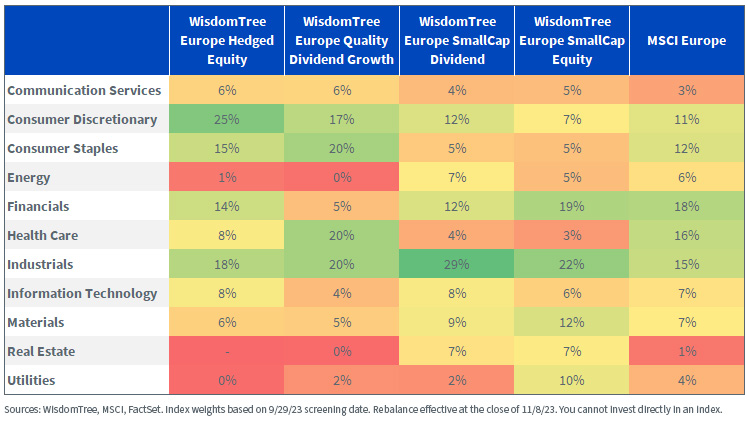

Sector Exposures

- The Europe Hedged Fairness Index tilts to exporters, lowering publicity to sectors like Utilities, Actual Property and Power that earn an ideal share of their income from inside Europe. As seen with the highest allocation to Client Discretionary, sectors are capped at 25%.

- The Europe High quality Dividend Progress Index has traditionally been under-weight in Financials (5%) relative to market cap-weighted indexes as a result of Index’s profitability screens (return-on-equity and return-on-assets). Sectors are capped at 20%, as will be seen with Client Staples, Well being Care and Industrials.

- The Europe SmallCap Dividend Index and Europe Hedged SmallCap Fairness Index every have their largest exposures to Industrials, at 29% and 22%, respectively. Every Index caps sector exposures at 25%, with deviation attributable to quantity changes.

Index Sector Exposures

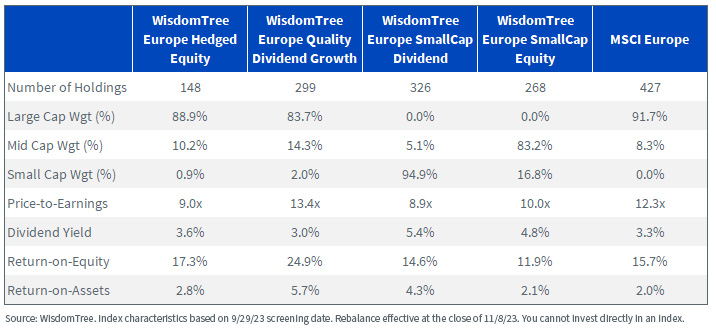

Traits

To the sooner level on engaging valuations for European equities, three of the 4 Indexes have trailing price-to-earnings ratios of 10x or much less. These are a number of the lowest valuations that may be discovered within the developed markets.

The Europe High quality Dividend Progress Index, with a P/E ratio of 13.4x, will be defined by the upper high quality traits (premium ROE and ROA). This Index is over-weight in high-quality sectors like Well being Care, Industrials, Client Staples and Client Discretionary and under-weight in lower-quality sectors like Financials and Power.

For a basket of high-quality multinational companies, the Europe High quality Dividend Progress Index is buying and selling at an inexpensive a number of when in comparison with the 22.6x P/E ratio of the S&P 500 Index.

Index Traits

For added particulars on the rebalance of every of the Indexes, please go to their respective Index pages on the WisdomTree web site:

Essential Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. Overseas investing entails particular dangers, reminiscent of danger of loss from foreign money fluctuation or political or financial uncertainty. Investments in foreign money contain further particular dangers, reminiscent of credit score danger and rate of interest fluctuations. By-product investments will be risky, and these investments could also be much less liquid than different securities, and extra delicate to the impact of assorted financial situations. As this Fund can have a excessive focus in some issuers, the Fund will be adversely impacted by adjustments affecting these issuers. As a result of funding technique of this Fund, it could make increased capital achieve distributions than different ETFs. Dividends should not assured, and an organization at the moment paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

[ad_2]

Source link