[ad_1]

Typically you simply get a bit of fortunate. That’s more and more trying just like the case for not solely the WisdomTree Japan Hedged Equity Fund (DXJ) but in addition for the Financial institution of Japan itself. Issues had been trying robust for the BoJ as just lately as this summer season, when the nation’s core CPI bolted north of 4%, far past the two% inflation goal that main central banks view as best.

A minimum of for now, these CPI prints from a couple of months in the past appear like they marked the worst of it. Japan’s core CPI has tapered all the way down to a not outlandish +2.8% YoY development charge. Tendencies in producer price inflation (PPI) recommend extra draw back might be coming.

Utilizing Japan’s personal PPI, together with the PPIs of main commerce companions China, Korea and america, manufacturing unit gate costs from this collective are downright disinflationary. Utilizing our smoothed collection, the PPI basket is barely optimistic during the last yr. We’d not be stunned within the slightest if Japan witnesses sub-2% core CPI inside the subsequent few months.

Determine 1: Key PPIs Level to Japanese CPI Draw back

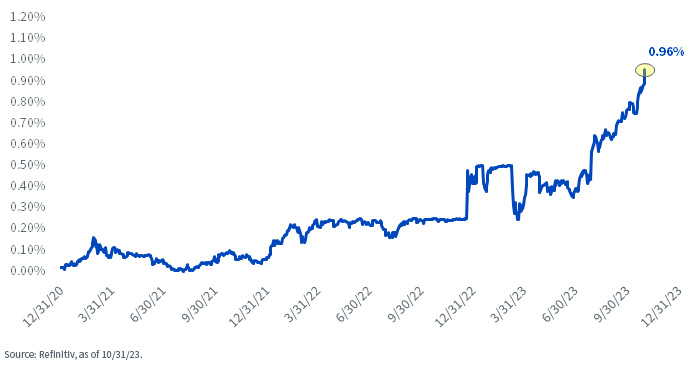

The Financial institution of Japan is being reactive to an inflation menace which will very properly be within the rearview mirror. For a few years, its yield curve control (YCC) coverage set a band of +/-25 basis points (bps) round zero p.c for 10-year JGBs. As the worldwide inflation scare despatched debt yields spiraling larger in locations just like the U.S. and Germany, the BoJ’s hand acquired pushed into widening the band to +/-50 bps across the zero certain. However in case you pulled a quote on a random day on this yr’s first half, it was frequent to see the 10-year JGB yield within the 0.30%–0.40% vary. It wasn’t as if the 0.50% ceiling was being strongly threatened by bond vigilantes.

However then world bonds offered off much more, so the BoJ tightened coverage as soon as once more. That coverage transfer had the central financial institution placing emphasis not on a 0.50% yield however on a brand new 1% quasi-cap that it will seemingly defend if the bond market remained in bear mode.

That was the place issues stood till late October, when the BoJ modified coverage but once more. This most up-to-date change is ambiguous and open to interpretation.

Here’s what we predict the BoJ is now saying.

The central financial institution is “promising” to deal with 1% as a goal charge on 10-year JGBs, with a comparatively exhausting vow to defend that degree if trades begin coming throughout round 1.10%, perhaps 1.20%. I’m pulling these numbers from the sky as a result of it’s primarily based on my Lasik-corrected imaginative and prescient specializing in an deliberately ambiguous bar chart that the BoJ simply launched. It’s a kind of issues the place they don’t wish to provide you with a hard-and-fast quantity, so we have now to guess a bit of. I’m considering their leeway for intervention is 10–20 bps past the 1% degree.

Luckily, as a result of we anticipate draw back in Japan’s client value inflation, the bond market might luck right into a scenario the place 1% yields are about as excessive as they get anytime quickly. As of now, the 1% certain has not been breached, and even threatened for that matter. The yield continues to be 0.96%, and we are going to name that roughly three-and-a-half share factors south of the yield on same-maturity U.S. Treasuries in any given session, give or take (determine 2).

Determine 2: 10-Yr Japanese Authorities Bond Yield (%)

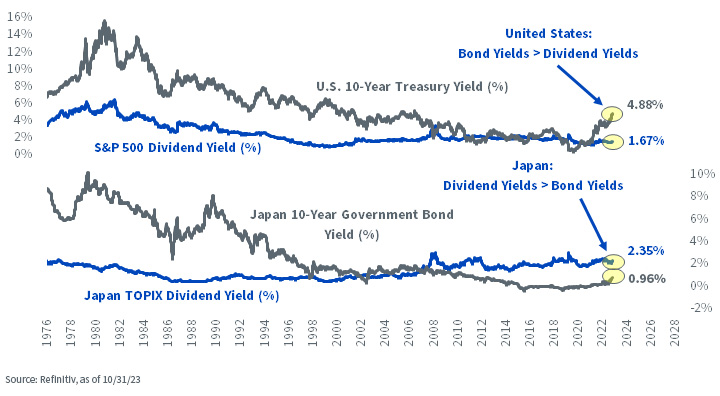

The S&P 500 is going through extra competitors from rising bond yields; till just lately, a lot of the late summer season and autumn was characterised by the bears pouncing on the demise of the USD TINA commerce. TINA mentioned we must always purchase shares as a result of “There Is No Various” in a world the place bonds yield nothing.

Within the U.S., Canada and Europe, TINA ought to actually be renamed TWNA, as we alter “is” to “was.” The zero-yielding world is lengthy gone. There was no different to purchasing so-called threat belongings…till the bond market rolled over and began giving us a viable asset class as soon as once more.

Some are actually questioning U.S. fairness valuations once they can clip one thing within the mid-5s within the cash markets. I began calling this TAMMY, which stands for “there are cash market yields.” The acronym applies to cash markets, however there are many folks utilizing some variation of TAMMY because it applies to intermediate and long-term bonds too.

If TINA is useless in america, it stays alive and properly in Japan. Utilizing dividend yields, the 4.84% on provide in 10-Yr T-notes is 317 bps north of the S&P 500’s proverbial “coupon.” That may be a full upending of the TINA commerce that continued because the days of Ben Bernanke’s Lehman-era firehose.

In distinction, Japan’s TINA scenario will not be as strong because it was earlier than the JGB sell-off, however the image is way rosier than it’s elsewhere. The Topix throws off an admittedly non-exciting 2.35%, however the different is 0.96% in JGBs, so the unfold is 139 bps in favor of shares. That may be a far cry from the three share level hole within the different route within the U.S.

Determine 3: The TINA Commerce, United States vs. Japan

The Topix is cap-weighted, so it doesn’t have the display for dividends that you just discover in lots of our mandates. For DXJ, we rebalance in November, so there’s a refresh on valuations as I write.

DXJ sells constantly round 11 to 12 instances earnings, which corresponds to an 8%–9% earnings yield. It is a substantial premium to authorities bond yields, presenting a a lot better margin of security than that which exists in U.S. markets.

DXJ’s SEC 30-day Yield = 2.30% as of 11/9/23. The efficiency information quoted represents previous efficiency and isn’t any assure of future outcomes. Funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when redeemed, could also be value roughly than their authentic price. Present efficiency could also be decrease or larger than the efficiency information quoted. For the newest month-end efficiency, please click on here.

As for the yen, many assume the foreign money is affordable—and there are many honest worth measures that recommend upside within the yen. However keep in mind this: because the Financial institution of Japan retains rates of interest pegged beneath the zero certain, there’s a substantial carry of almost 6% that’s earned by Individuals once they hedge the yen. We predict the case is powerful: the shares are low cost and the carry is sizeable.

I’ll talk about Japanese inventory market catalysts on our Workplace Hours webinars within the coming weeks and months, so please make certain to take a look at the calendar, which you’ll find here.

Until in any other case said, all information as of October 31, 2023.

Vital Dangers Associated to this Article

There are dangers related to investing, together with doable lack of principal. Overseas investing entails particular dangers, comparable to threat of loss from foreign money fluctuation or political or financial uncertainty. The Fund focuses its investments in Japan, thereby rising the influence of occasions and developments in Japan that may adversely have an effect on efficiency. Investments in foreign money contain further particular dangers, comparable to credit score threat, rate of interest fluctuations, spinoff investments which will be unstable and could also be much less liquid than different securities, and extra delicate to the impact of assorted financial situations. As this Fund can have a excessive focus in some issuers, the Fund will be adversely impacted by adjustments affecting these issuers. Because of the funding technique of this Fund it could make larger capital achieve distributions than different ETFs. Dividends should not assured, and an organization at present paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link