[ad_1]

Key Takeaways

- Foreign money hedging is essential for mitigating dangers in international investing by managing overseas trade fluctuations whereas preserving fairness publicity.

- Our dynamic currency-hedged ETFs have confirmed to scale back portfolio danger by factor-based methods.

- The momentum issue’s elevated weight in our forex mannequin since 2023 has continued to decrease portfolio danger regardless of extra assorted hedge ratios.

Within the complicated world of world investing, currency risk performs a big position. When traders allocate funds to overseas equities, they implicitly expose themselves to overseas trade fluctuations. Currency hedging methods goal to mitigate this danger whereas preserving the unique fairness publicity.

At occasions, distinguishing danger enhancements stemming from forex actions from these originating from inventory portfolios will be difficult. Inside our suite of choices, we current three distinct methods the place the fairness portfolio stays the identical, and the only real variation is the forex strategy.

This transparency gives traders with a concise view of the impression of forex hedging. Basically, whether or not dynamically managed or absolutely hedged, forex hedging has constantly decreased total portfolio danger.

Danger Discount by Dynamic Foreign money Hedging

At WisdomTree, we make use of bottom-up factor-based methods (comparable to momentum and low volatility) for our energetic currency hedging models. Over the long run, our dynamic forex mannequin has constantly added worth. Whereas the alpha generated by the forex mannequin might differ in shorter time intervals, one constant development stays: dynamic forex hedging successfully decreased portfolio danger.

Let’s look at two particular situations:

1. Worldwide Dividend-Weighted Giant-Cap ETFs:

- One in every of our unique suites, launched in 2006, was our unhedged broad-based developed world ETF, ticker DWM.

- Ten years later, in 2016, we added a dynamic hedged variation. With DDWM, we observe a discount in portfolio danger throughout the board.

- Notably, the worth issue itself carries inherent danger. Subsequently, portfolios with a price tilt can notably profit from forex hedging as a danger mitigation instrument.

2. Worldwide Smaller-Cap ETFs:

- DLS was the primary ETF within the trade to supply publicity to worldwide small caps again in 2006 and was WisdomTree’s largest ETF, within the first few years. At a time when the euro was buying and selling at 1.60 to the greenback, this was one of many ETFs that gave us the thought to supply currency-hedged ETFs within the first place, with the thought shares may supply worth if one may mitigate an excessively robust forex.

- The addition of dynamic forex hedging added through DDLS, when in comparison with the unhedged DLS, resulted in decrease portfolio danger.

- Once more, the worth tilt in smaller-cap portfolios underscores the worth of forex hedging to scale back total portfolio danger.

For the latest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on the related ticker: DLS, DDLS, DWM, DDWM.

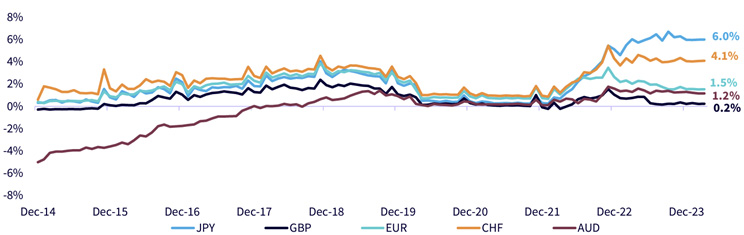

Traders Paid to Hedge in Many Currencies

Annualized Carry by Foreign money

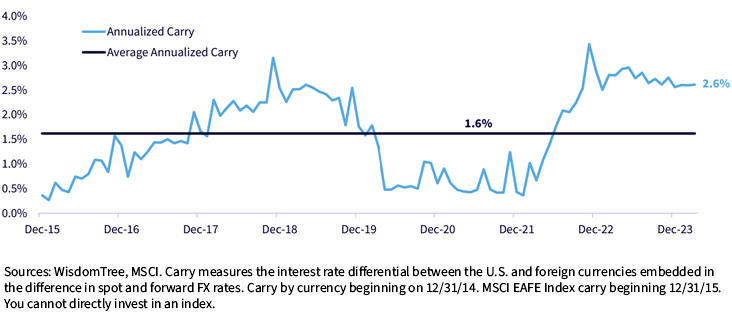

MSCI EAFE Annualized Carry

Within the present geopolitical setting, including a weak greenback wager through your overseas fairness exposures is not essentially the most effective baseline allocation. Somewhat, a robust greenback may develop into a headwind to U.S. earnings—and so including extra lengthy U.S. greenback exposures is a more interesting diversifier.

Presently, even because the U.S. is predicted to decrease rates of interest, the two.6% rate of interest differential (carry) earned by hedging shall be lowered however proceed to be optimistic for some time.

Dynamic Foreign money Mannequin Now Extra Momentum Pushed

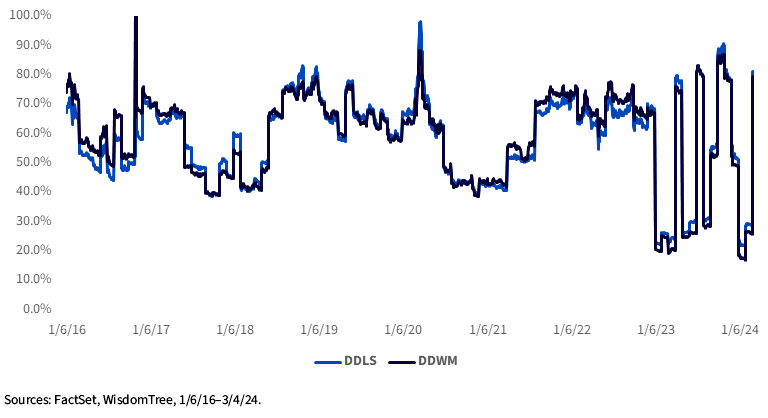

Traditionally, momentum tends to be the strongest think about forex hedging. Our revamped dynamic forex mannequin has about 60% weight within the momentum issue for each developed and emerging markets.

For the worldwide developed universe, the load of the momentum issue is greater from 2023, leading to extra assorted hedge ratios. Nevertheless, the forex overlay continued to scale back portfolio danger after the revamp, at the same time as extra momentum was launched for the hedge ratio itself.

Portfolio Hedge Ratio Over Time

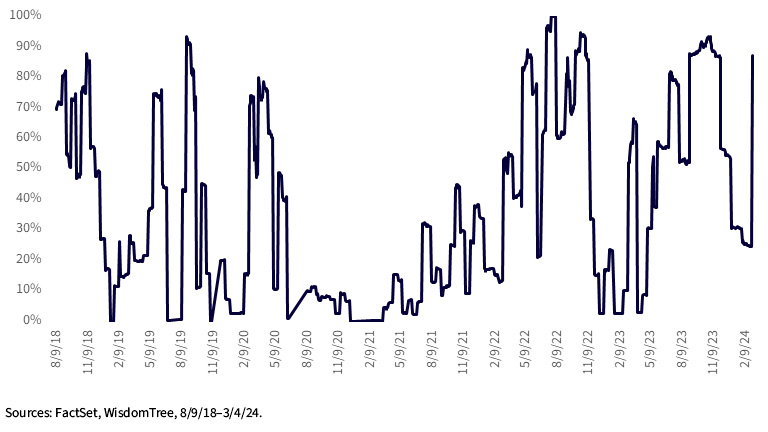

Previous to the revamp, the dynamic rising markets forex mannequin additionally closely relied on the momentum issue. Consequently, the volatility of the portfolio hedge ratio was comparable earlier than and after 2023.

Rising Market Multifactor Fund (EMMF) Hedge Ratio

In abstract, the danger discount of forex hedging was evident throughout the board, in our different currency-hedged methods, such because the WisdomTree Japan Hedged Equity Fund (DXJ), the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), the dynamic forex hedging WisdomTree International Multifactor (DWMF) and Emerging Markets Multifactor (EMMF) Funds.

Macro forex calls are tougher to include into a scientific portfolio, thus in most energetic forex areas, we’ve caught with a factor-based energetic mannequin to seize some advantages of dynamic forex hedging. And we suggest purchasers take into account some publicity to forex hedging methods to scale back portfolio danger on this unsure setting.

[ad_2]

Source link