[ad_1]

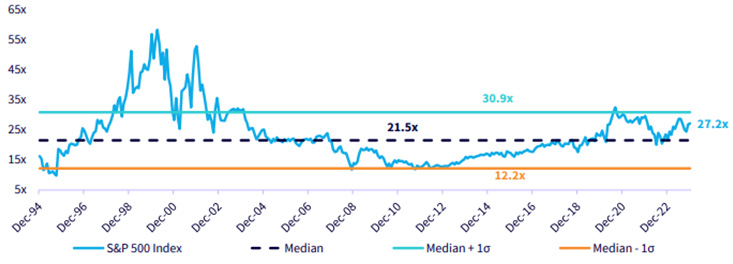

The present valuation of the S&P 500 Index is at 20 occasions forward earnings. The under chart, taken from WisdomTree’s Daily Market Snapshot, exhibits that is above the 30-year median however nonetheless inside 1 normal deviation. Our Senior Economist, Jeremy Siegel, has written that 20 occasions ahead earnings is definitely a good a number of for the S&P 500 Index over time and corresponds to a 5% earnings yield and expectation for actual returns over 5 to seven years.

However actually, this a number of is above the long-term common and, with fears a few potential recession bringing earnings downgrade danger, larger than regular valuations create some agita.

S&P 500 Index Forward P/E Ratio

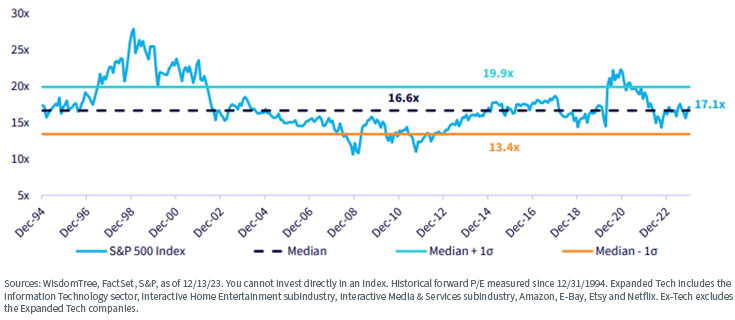

If we get away the S&P 500 into an Expanded Tech basket, which incorporates the Info Expertise sector, Interactive Residence Leisure subindustry, Interactive Media & Companies subindustry, Amazon, E-Bay, Etsy and Netflix, and an Ex-Tech basket, we are able to see that many of the worth premium a number of is pushed by the Expanded Tech shares. The Ex-Tech a part of the market has been buying and selling round 10 P/E factors under the tech basket.

That is vital as the present market capitalization weight of the Expanded Tech basket within the S&P 500 is at an historic excessive of 39%.

S&P 500 Expanded Tech Ahead P/E Ratio

S&P 500 Ex-Tech Ahead P/E Ratio

Considerations about valuations have precipitated some to deal with methods like equal weighting the S&P 500, which brings with it a better measurement bias towards mid-cap firms.

WisdomTree is a pioneer in essentially weighting methods. We search to handle dangers like valuation and profitability inherent with market cap-weighted methods.

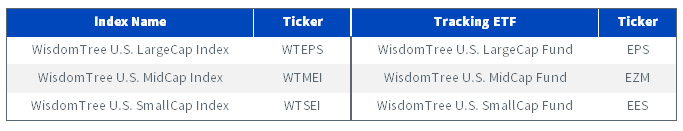

In 2007, WisdomTree launched its Domestic Core Equity family of Funds, in search of to provide traders broad publicity to the completely different measurement cuts within the U.S. markets by deciding on worthwhile firms and weighting them by their earnings.

WisdomTree Core Fairness Household

In rebalancing these methods yearly, the WisdomTree U.S. LargeCap (EPS), MidCap (EZM) and SmallCap (EES) Funds preserve decrease valuations than the broad market and guarantee traders usually are not overpaying as markets rise.

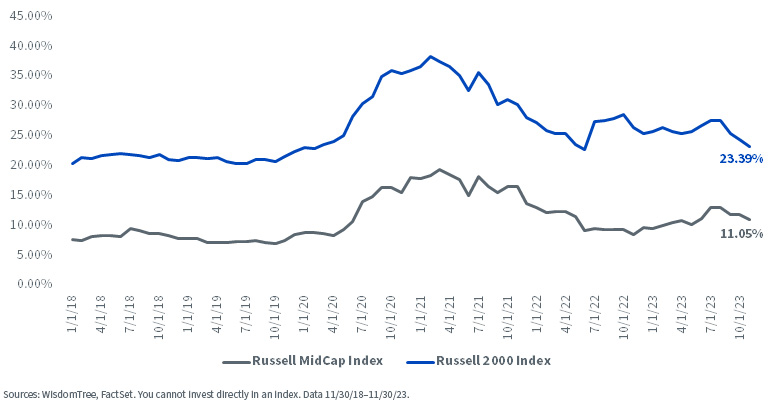

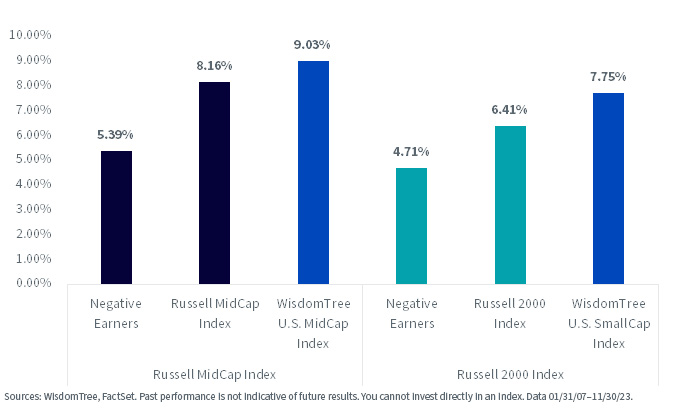

Filtering Out Destructive Earners

Screening out unprofitable names can have a significant affect relying on measurement minimize.

As of the tip of November, 23.4% of the burden within the Russell 2000 Index was made up of firms that had damaging earnings over the previous 12 months. Though this quantity is decrease within the mid-cap universe, it’s nonetheless north of 11% and peaked round 20% within the months following the Covid pandemic.

% Weight in Destructive Earners

Trying again 17 years, the group of damaging earners considerably underperformed the broader benchmark, thus systematically figuring out and eradicating these firms has made a big affect and is a contributing purpose why WTMEI and WTSEI have outperformed their respective benchmarks since their inception in January 2007.

Returns since January 2007

For definitions of indices within the graph above, please go to the glossary.

Rebalance Course of

In recent times, we’ve improved the Home Core Fairness Indexes by creating the WisdomTree Core Fairness Index Committee, which oversees the rebalance of those Indexes. The Committee ensures the earnings measure used as enter within the annual reconstitution correctly replicate an organization’s recurring profitability and verifies the chance discount parts of the methodology are accurately applied. These danger discount parts embody limiting publicity to firms with higher-than-average earnings danger together with actively constraining sector and particular person safety biases, lowering lively danger versus the market.

We consider that this systematic course of represents a bonus versus different index suppliers, like S&P, who don’t add unprofitable names to their indexes however don’t display for profitability as soon as an organization is within the index.

Enhancing Measure of Earnings

One of many focus areas of the Index Committee is a subject with elevated tutorial protection over the previous few years: how conventional accounting measures fail to replicate the construction of contemporary companies.

Expertise and Well being Care firms, amongst others, make investments considerably in intangible property equivalent to analysis and growth (R&D) to develop merchandise, patents and different aggressive benefits.

Since 1974, the Monetary Accounting Requirements Board (FASB) has required that firms expense R&D, deducting it of their revenue assertion on the fiscal 12 months the expense is incurred. Companies that spend on tangible property, equivalent to autos and factories, are allowed to capitalize these bills and depreciate/amortize them all through the lifetime of the asset—mainly, spreading out their expense throughout many reporting durations.

The argument behind that is that tangible property have a price that may be simply assessed, whereas intangible property are tougher (or inconceivable) to worth. In a conservative strategy by the FASB, intangible property usually are not assigned a price on the steadiness sheet, in contrast to tangible property.

All else equal, this distinction ends in larger earnings for asset-heavy companies working within the Industrials, Supplies and Vitality sectors and decrease measures for asset-light companies within the Info Expertise and Well being Care sectors. This could have vital implications when it comes to eligibility and weighting for the WisdomTree Home Core Fairness Funds.

Rebalance Outcomes

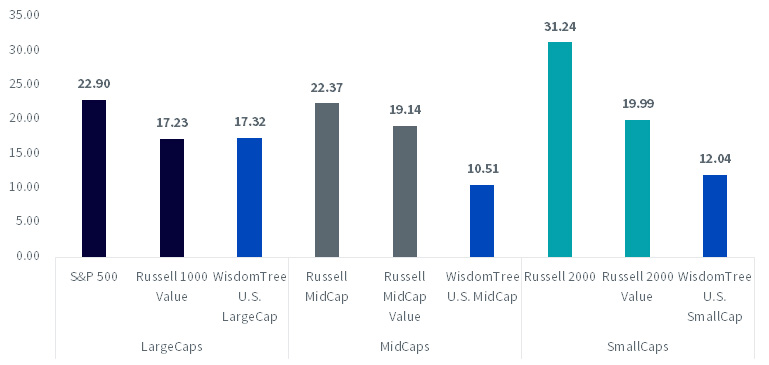

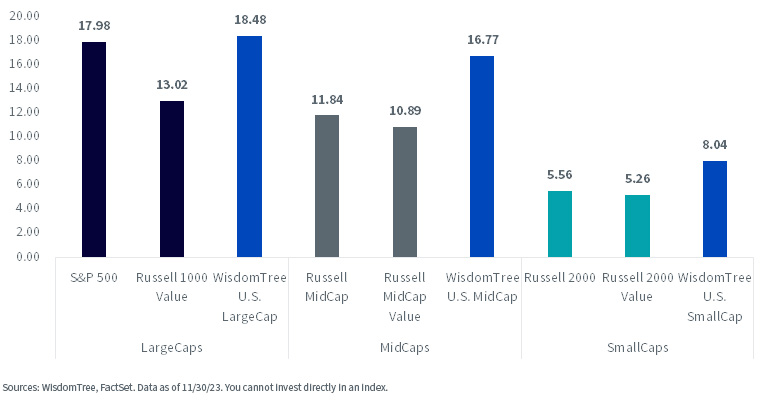

WisdomTree rebalanced its Home Core Fairness Funds after the shut on December 13. On account of their annual reconstitution, these portfolios are buying and selling at important reductions to their broad-based benchmarks (even their worth benchmarks).

As meant, the mix of earnings weighting, together with the beforehand talked about risk-reduction layer, ends in larger high quality traits, with mixture return on equity (ROE) above their benchmarks and considerably above the worth Indexes, though they’ve aggressive or considerably decrease P/E metrics.

Worth-to-Earnings Ratio

Return on Fairness

For definitions of indices within the graph above, please go to the glossary.

Outlook for 2024

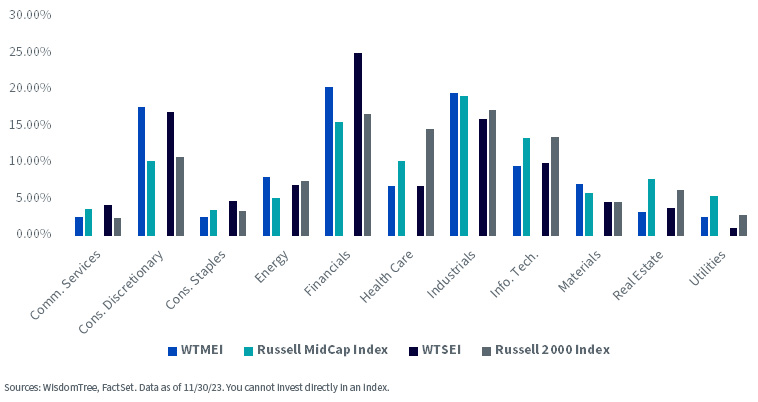

Going into 2024 and attributable to their earnings focus, WTMEI and WTSEI stay over-weight in cyclical sectors in comparison with their broad benchmarks. Though decrease charges have traditionally benefited firms with decrease and even damaging earnings, we don’t see charges going again to zero, which makes the deal with profitability and valuation vital.

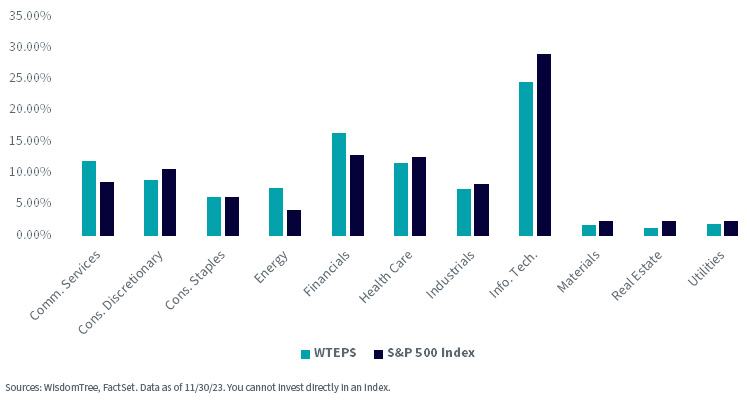

In the meantime WTEPS’s sector biases are contained aside from its slight over-weight in Financials and under-weight in Info Expertise, in search of to supply traders with a core publicity at constrained valuations and elevated high quality.

Necessary Dangers Associated to this Article

For present Fund holdings, please click on the respective fund ticker: EPS, EZM, EES. Holdings are topic to danger and alter.

There are dangers related to investing, together with potential lack of principal. Funds focusing their investments on sure sectors improve their vulnerability to any single financial or regulatory growth. This may occasionally lead to better share value volatility. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link