[ad_1]

Key Takeaways:

1. In a soft-landing situation, core mounted revenue is a horny choice for buyers to increase length and put together for the following part of the financial cycle.

2. Nonetheless, there could possibly be adjustments made to plain-vanilla, core U.S. mixture portfolios to learn from valuations in addition to prepare for this yr’s election.

3. BBB company issuers are low-cost in comparison with their higher-quality, A-rated counterparts.

4. Industries with decrease publicity to China and overseas commerce are inclined to do effectively throughout instances during which commerce wars are on high of buyers’ minds.

5. AGGY is well-positioned to learn from these circumstances.

Because the Fed is nearing the tip of its once-in-a-generation tightening cycle, buyers have rightfully began to marvel concerning the subsequent part of the financial cycle. Whereas this isn’t our base case, some buyers have been fascinated with transferring out the yield curve and including duration to their fixed income portfolios. There are a number of choices that can be utilized right here. One group prefers the protection of Treasury notes and bonds. Others may not be happy with the revenue and yield ranges provided by Uncle Sam and wish to foray into the riskier a part of the market, e.g., investment-grade credit score, high-yield corporates or a extra diversified choice, U.S. mixture portfolios (Core).

By definition, any asset class with an expansion above risk-free rates of interest is uncovered to some kind of credit score threat. Relying on one’s view about the way forward for the economic system and whether or not the Fed will have the ability to handle a delicate touchdown, the selection for including length and transferring out of cash market funds adjustments. We imagine that the economic system will decelerate in 2024. Nonetheless, the Fed will have the ability to handle a delicate touchdown prefer it did within the Nineties. Consequently, we’re within the camp that buyers ought to profit from unfold merchandise, although they must be selective. Increased-quality IG issuers and company mortgages are a few asset courses that we like. And what higher choice than core U.S. aggregate-type merchandise to have each asset courses and, on the similar time, be diversified? On this put up, we are going to have a look at whether or not the plain-vanilla core portfolio is the best choice or if there are some adjustments that may be made with a purpose to profit from present valuations in addition to put together for the yr forward.

BBBs… Time for the Silent Majority to Shine

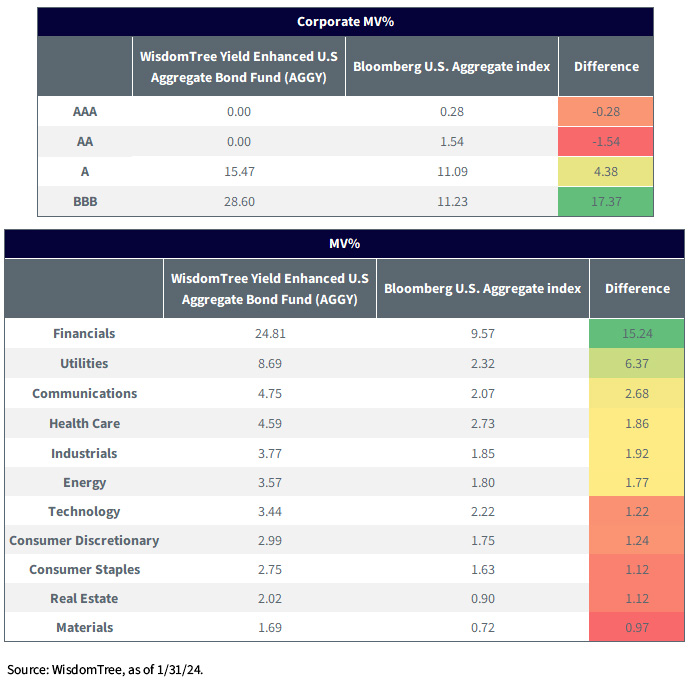

For the reason that global financial crisis, the share of BBB corporate issuers throughout the Bloomberg U.S. Aggregate Index has gone up. As of January 31, 2024, BBBs make up about 47% (nearly half) of corporates throughout the Index.

MV%

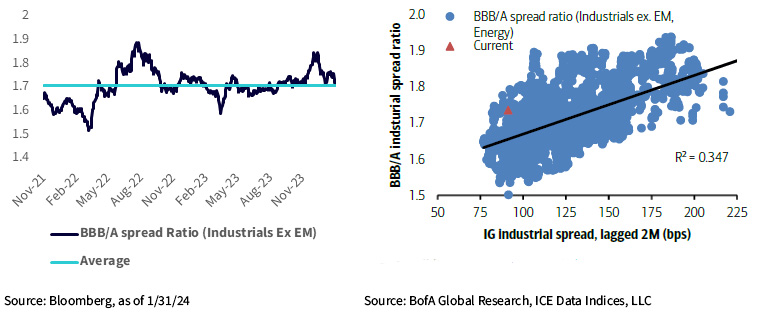

Following a decline to a number of the lowest ranges in December 2023, BBB-rated industrials unfold to A-rated bonds and have tightened in 2024. This shift probably displays diminishing considerations a couple of hard-landing situation pushed by constructive surprises in U.S. financial information. Regardless of the substantial contraction year-to-date, the unfold ratio between BBB and single-A bonds nonetheless trails the numerous rally noticed since October. Consequently, BBBs stay enticing on a relative worth foundation.

Don’t Neglect about November 5

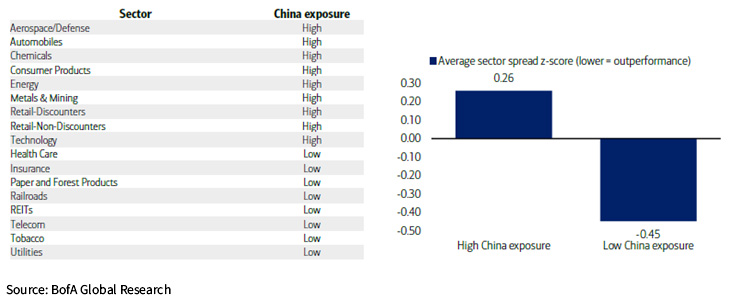

As we get nearer to Election Day in November, the market should digest a variety of coverage rhetoric and its impression on totally different asset courses and industries from either side of the aisle. There’s an abundance of coverage variations between the 2 main candidates. Nonetheless, there may be one clear frequent floor: China. Each candidates wish to method commerce points with China with an iron fist coverage. Therefore, it’s prudent to have a look at the final time the commerce battle was on high of buyers’ minds and study how totally different industries behaved throughout that interval.

The final time a commerce battle was an enormous concern for buyers was after the 2016 election. From 2016 till 2019, when these fears peaked, sectors with a bigger publicity to China underperformed.

AGGY to the Rescue

Traditionally, the principle benefit of investing within the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) has been the added yield/revenue in comparison with the U.S. Combination Index, whereas taking decrease length threat. Nonetheless, trying underneath the hood, AGGY additionally has increased allocations to BBB corporates and better over-weights (OWs) to low-China-exposed industries.

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. Mounted revenue investments are topic to rate of interest threat; their worth will usually decline as rates of interest rise. Mounted revenue investments are additionally topic to credit score threat, the chance that the issuer of a bond will fail to pay curiosity and principal in a well timed method or that unfavourable perceptions of the issuer’s capability to make such funds will trigger the value of that bond to say no. Investing in mortgage- and asset-backed securities includes rate of interest, credit score, valuation, extension and liquidity dangers and the chance that funds on the underlying belongings are delayed, pay as you go, subordinated or defaulted on. As a result of funding technique of the Fund, it could make increased capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link