[ad_1]

January 11, 2024, was an historic day inside the exchange-traded fund (ETF) business, because it marked the first time ETFs tracking the spot price of bitcoin were allowed to trade.

The aggressive forces of what number of launches come without delay introduced down execution prices, as a lot of corporations, together with WisdomTree, waived administration charges to zero for the primary six months.

Some dialogue we’re listening to:

- The primary gold ETF traded within the U.S. market on November 18, 2004.1 Gold’s market capitalization was estimated to be roughly $1.7–$1.8 trillion round this time, rising to about $14 trillion practically 20 years later.2 Gold’s path doesn’t assure something concerning bitcoin, however there’s a parallel in that investing and storing gold as bodily bars just isn’t as straightforward as shopping for shares in an ETF.

- Acceptance of an asset class inside the ETF construction: ETFs have garnered over $8 trillion of AUM within the U.S.3 The primary filings for a spot bitcoin ETF date again to 2013,4 however the market construction itself wanted time to mature. ETFs assist take that maturity of bitcoin one other step additional.

- Volatility: One of many measurable issues that everybody can see is the volatility of bitcoin’s worth. Risky belongings are sometimes thought of riskier than much less unstable belongings for the reason that asset’s worth is anticipated to be much less predictable. With that mentioned, we’re speaking about an asset that delivered roughly 50% common annual returns over the previous 10 years at a degree of one thing near 80% annualized volatility.5 Broad fairness benchmarks, like an S&P 500 Index, can be beneath 20% annualized volatility over this identical interval. There are lots of buyers that may see the 50% common annual return, however that will not be capable to reside with the 80% annualized volatility.

Bitcoin’s Volatility Developments

Brent Donnelly, a good friend of ours at Spectra Markets, put out some attention-grabbing charts that we reference right here.6 Brent confirmed bitcoin’s worth volatility has been declining for a big interval, and this has had nothing to do with ETFs. The market itself has been maturing, costs and market cap have been rising, and extra contributors buying and selling and investing, which have all introduced down the volatility.

In determine 1, we see:

- The horizontal axis represents the market capitalization of bitcoin in billions of U.S. {dollars}. The 2014 peak noticed the market capitalization round $1 billion, then the late-2017 peak was above $10 billion—getting towards $50 billion. The 2021 peak was round $1 trillion. One can see that this can be a logarithmic scale and never a case the place one line represents one unit—it’s a far sooner improve than that.

- The sample of buying and selling in bitcoin has been one among peaks and troughs, with the troughs typically labeled as winters. There have been intervals with massive swings upward in worth, after which there have been these different, colder intervals. At every time, you’ll be able to look again at a market capitalization chart and be aware when there have been these completely different near-term peaks that have been adopted by the so-called crypto-winters.

- The vertical axis represents the 90-day annualized volatility. The quantity 150 refers to 150%—a really excessive degree. The 2021 bubble peak is roughly midway up the dimensions on the vertical, relative to the 2014 peak. That is telling us that even when 2021 was additionally a bubble peak, the volatility in bitcoin’s worth was a lot decrease in 2021 than it was seven years earlier.

Determine 1: Bitcoin’s Market Capitalization vs. Volatility, Marking Completely different Market Cap Peaks

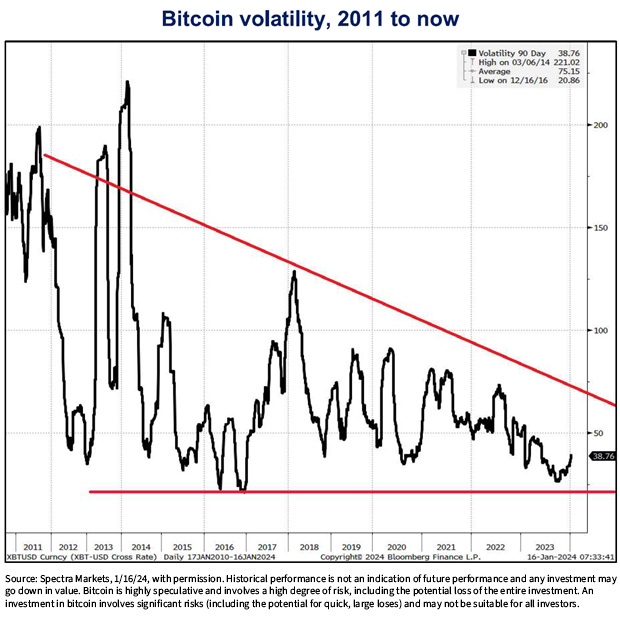

In determine 2:

- The volatility of any asset, bitcoin included, just isn’t fixed. One should all the time specify a time-frame to make the calculation and acknowledge that if one rolls that calculation ahead or backward in time, the determine can transfer up or down. In 2014, there was a 90-day interval that noticed bitcoin’s worth volatility above 200%. Nevertheless, that studying has not likely been approached since that distinctive level. It doesn’t imply it couldn’t return to these ranges—it’s simply not the noticed development.

- In 2023, it’s clear that the 90-day volatility of bitcoin’s worth was beneath 50%. We can’t state with certainty it would keep there or it should be there—however that may be a massive distinction from what was noticed earlier within the time collection.

Determine 2: Time Collection Knowledge for 90-Day Bitcoin Volatility, 2011 to Current

Conclusion: A number of Alerts Inform Us Bitcoin Is Maturing As an Asset Class

The truth that spot bitcoin publicity is obtainable within the ETF construction was an essential milestone, but it surely was only one amongst an array of alerts that point out bitcoin as an asset class is on its journey towards maturation. We consider one essential sign is volatility, which has traditionally been trending downward.

This will likely be one of many alerts we proceed to observe, and we thank Brent Donnelly for assembling such clear, clear depictions of the story on this case.

1 Refers back to the launch of the SPDR Gold Shares technique.

2 Supply: “Chart Market Capitalization of Gold and Bitcoin,” ingoldwetrust.report, 2023 with WisdomTree estimates of general gold provide to 2004.

3 Supply: Deborah Fuhr, “Belongings Invested within the ETFs Business in the US Reached a New Milestone of $8.12 Trillion on the Finish of 2023,” Nasdaq, 1/18/24.

4 Supply: Collin Z Groebe et al, “Highway to Bitcoin Funding Cleared with SEC’s Approval of 11 Spot Bitcoin ETFs,” Winston & Strawn LLP, 1/11/24.

5 Particular interval is 12/31/13–12/31/23, the latest 10 years.

6 Report revealed 1/16/24.

Vital Dangers Associated to this Article

Crypto belongings, similar to bitcoin and ether, are complicated, typically exhibit excessive worth volatility and unpredictability, and must be seen as extremely speculative belongings. Crypto belongings are ceaselessly known as crypto “currencies,” however they usually function with out central authority or banks, are usually not backed by any authorities or issuing entity (i.e., no proper of recourse), don’t have any authorities or insurance coverage protections, are usually not authorized tender and have restricted or no usability as in comparison with fiat currencies. Federal, state or overseas governments might prohibit the use, switch, change and worth of crypto belongings, and regulation within the U.S. and worldwide continues to be growing.

Crypto asset exchanges and/or settlement services might cease working, completely shut down or expertise points as a consequence of safety breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your buyer / Anti-Cash Laundering) procedures, non-compliance with relevant guidelines and laws, technical glitches, hackers, malware or different causes, which may negatively affect the worth of any cryptocurrency traded on such exchanges or reliant on a settlement facility or in any other case might forestall entry or use of the crypto asset. Crypto belongings can expertise distinctive occasions, similar to forks or airdrops, which might affect the worth and performance of the crypto asset. Crypto asset transactions are typically irreversible, which signifies that a crypto asset could also be unrecoverable in cases the place: (i) it’s despatched to an incorrect tackle, (ii) the wrong quantity is distributed, or (iii) transactions are made fraudulently from an account. A crypto asset might decline in reputation, acceptance or use, thereby impairing its worth, and the worth of a crypto asset may be impacted by the transactions of a small variety of holders of such crypto asset. Crypto belongings could also be troublesome to worth and valuations, even for a similar crypto asset, might differ considerably by pricing supply or in any other case be suspect as a consequence of market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto belongings typically depend on blockchain expertise and blockchain expertise is a comparatively new and untested expertise which operates as a distributed ledger. Blockchain methods might be topic to web connectivity disruptions, consensus failures or cybersecurity assaults, and the date or time that you simply provoke a transaction could also be completely different then when it’s recorded on the blockchain. Entry to a given blockchain requires an individualized key, which, if compromised, may lead to loss as a consequence of theft, destruction or inaccessibility. As well as, completely different crypto belongings exhibit completely different traits, use circumstances and danger profiles. Data offered by WisdomTree concerning digital belongings, crypto belongings or blockchain networks shouldn’t be thought of or relied upon as funding or different recommendation, as a suggestion from WisdomTree, together with concerning the use or suitability of any explicit digital asset, crypto asset, blockchain community or any explicit technique.

[ad_2]

Source link