[ad_1]

Whereas the Worldwide Vitality Company (IEA) and Vitality Data Administration (EIA) have been revising their oil demand forecasts downward for quite a few months, the Group of the Petroleum Exporting Nations (OPEC) has stored its forecasts at a somewhat optimistic stage for a while (see Desk 1).

Desk 1: Oil Demand Development Forecasts (million barrels per day)

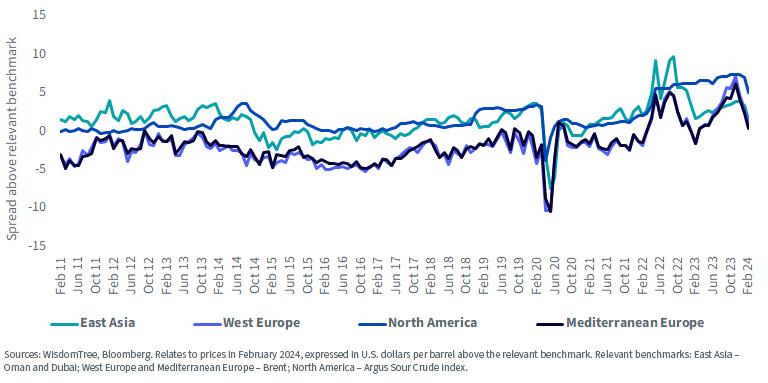

Discount in Saudi OSPs

Nonetheless, final Sunday (January 7, 2024), Saudi Arabia, the biggest and most influential OPEC member, reduce its promoting costs throughout most areas. The official promoting value (OSP, as a diffusion above the Oman and Dubai benchmarks) of the flagship Arab Gentle crude to East Asia, for instance, fell to the bottom stage since November 2021. Markets interpreted this as Saudi conceding that oil demand is certainly delicate, and the value of Brent crude oil fell 4.5% between the open and late afternoon on Monday, January 8.

Official Promoting Worth (OSP) for Arab Gentle Crude

Center East Export Disruption in Focus

The value weak point in Brent was not sustained for lengthy and by Wednesday, January 10, many of the losses have been recovered. The chief driver has been market concern about oil export provide disruptions within the Center East. Assaults on ships passing via the Crimson Sea by Houthi rebels had gathered tempo in December 2023 and escalated in January 2024. On January 10, a British warship, in an operation with U.S. forces, shot down seven drones launched by Houthis within the Crimson Sea, to repel the biggest drone and missile assault so far. Additional U.S. air strikes towards Houthis on January 12 lifted oil costs, erasing all losses from earlier within the week.

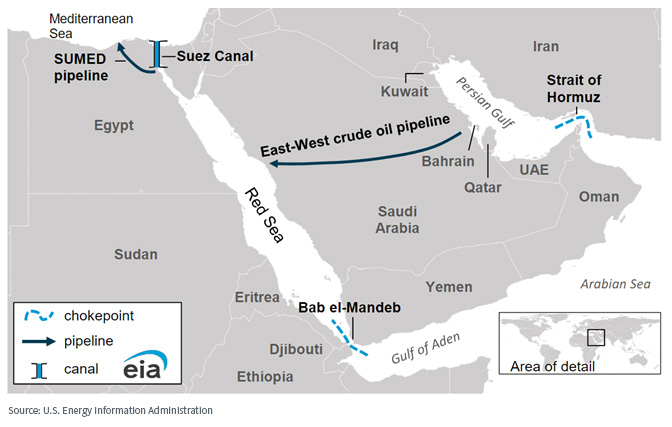

Arabian Peninsula Marine Choke Factors

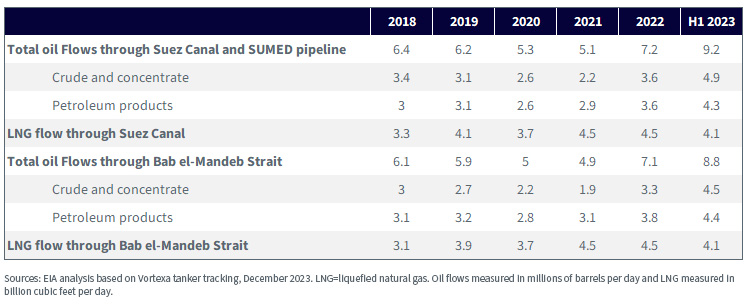

The Suez Canal and Bab el-Mandeb Strait are choke factors across the Crimson Sea. In line with EIA evaluation, within the first half of 2023, 9.2 million barrels per day of oil and petroleum merchandise handed via the Suez Canal and SUMED pipeline, and eight.8 million barrels per day of oil and petroleum merchandise handed via the Bab el-Mandeb Strait.

Desk 2: Suez Canal, SUMED Pipeline and Bab el-Mandeb Strait Choke Factors

The area is important for international oil transportation. Oil and gas tanker visitors via the Crimson Sea has not fallen considerably but, not like Asia–Europe container ships, which have chosen to divert across the Cape of Good Hope in South Africa (including an additional 14 days to shipments, in response to S&P International). Nonetheless, the few which have paused their Crimson Sea shipments might change into extra quite a few the longer the safety concern within the space stays.

May the Strait of Hormuz Be Subsequent?

On Thursday, January 11, safety considerations within the Center East escalated additional when Iranian state media reported that Iran’s elite Revolutionary Guards seized a tanker with Iraqi crude destined for Turkey. The seizure was in retaliation for the confiscation final yr of the identical vessel and its oil by the U.S. Final yr the U.S. stopped the vessel as a part of its enforcement of Iranian sanctions. Markets have gotten fearful that Iran and it proxies might disrupt oil transferring out of the Strait of Hormuz, which is the world’s most necessary oil choke level. The Strait lies to the north of the purpose the place the tanker was taken. Greater than 20 million barrels of oil per day transfer via the Strait of Hormuz, which might be greater than a 3rd of all seaborn oil, eclipsing each the Bab el-Mandeb Strait and the Suez Canal.

Will OPEC Regulate its Forecasts?

On the finish of a unstable week, it seems security-related provide considerations overwhelmed demand considerations to drive oil costs larger. Nonetheless, ought to provide points be resolved, market focus might return to the demand aspect of the equation. Crude oil is an uncommon market in that OPEC and companions management greater than 50% of manufacturing. Their provide choices can drive market steadiness and finally value. OPEC will publish its subsequent month-to-month report on January 17. OPEC and its associate nations are restraining manufacturing with voluntary cuts of two.2 million barrels per day till March 2024. Ought to demand forecasts be revised decrease within the January report, that would construct the groundwork for a deeper reduce.

WisdomTree Funding Issues

To hedge towards additional oil value rises stemming from the geopolitical and security-related provide considerations, traders might look to WisdomTree Enhanced Commodity Strategy Fund (GCC), which is an actively managed exchange-traded Fund that features Brent and WTI oil futures exposures. Disruptions to delivery routes might push up the enter costs for commodities extra broadly and that might be mirrored on this broad commodity providing as properly.

Conversely, traders who wish to incorporate commodities however with the flexibility to be extra tactical on publicity, based mostly on alerts like momentum and pattern, might look to the WisdomTree Managed Futures Strategy Fund (ticker WTMF). With rising correlations between shares and bonds, WisdomTree thinks diversifiers like managed futures have gotten necessary to portfolios and this Fund has the flexibility to revenue from each lengthy and quick positions in commodities.

Necessary Dangers Associated to this Article

GCC: There are dangers related to investing, together with the doable lack of principal. An funding on this Fund is speculative, entails a considerable diploma of danger, and shouldn’t represent an investor’s total portfolio. One of many dangers related to the Fund is the complexity of the various factors which contribute to the Fund’s efficiency. These elements embrace use of commodity futures contracts. As well as, bitcoin and bitcoin futures are a comparatively new asset class. They’re topic to distinctive and substantial dangers, and traditionally, have been topic to important value volatility. Whereas the bitcoin futures market has grown considerably since bitcoin futures commenced buying and selling, there may be no assurance that this development will proceed. As well as, derivatives may be unstable and could also be much less liquid than different securities and extra delicate to the consequences of assorted financial circumstances. The worth of the shares of the Fund relate on to the worth of the futures contracts and different property held by the Fund and any fluctuation within the worth of those property might adversely have an effect on an funding within the Fund’s shares. Due to the frequency with which the Fund expects to roll futures contracts, the value of futures contracts farther from expiration could also be larger (a situation often called “contango”) or decrease (a situation often called “backwardation”) and the affect of such contango or backwardation could also be larger than the affect could be if the Fund skilled much less portfolio turnover. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

WTMF: There are dangers related to investing, together with the doable lack of principal. An funding on this Fund is speculative, entails a considerable diploma of danger, and shouldn’t represent an investor’s total portfolio. One of many dangers related to the Fund is the complexity of the various factors which contribute to the Fund’s efficiency, in addition to its correlation (or non-correlation) to different asset courses. These elements embrace use of lengthy and quick positions in commodity futures contracts, foreign money ahead contracts, swaps and different derivatives. Derivatives may be unstable and could also be much less liquid than different securities and extra delicate to the consequences of assorted financial circumstances. As well as, bitcoin and bitcoin futures are a comparatively new asset class. They’re topic to distinctive and substantial dangers, and traditionally, have been topic to important value volatility. Whereas the bitcoin futures market has grown considerably since bitcoin futures commenced buying and selling, there may be no assurance that this development will proceed. The Fund shouldn’t be used as a proxy for taking lengthy solely (or quick solely) positions in commodities or currencies. The Fund might lose important worth in periods when long-only indexes rise (or short-only indexes decline). The Fund’s funding goal relies on historic value traits. There may be no assurance that such traits will probably be mirrored in future market actions. The Fund usually doesn’t make intra-month changes and due to this fact is topic to substantial losses if the market strikes towards the Fund’s established positions on an intra-month foundation. In markets with out sustained value traits or markets that rapidly reverse or “whipsaw,” the Fund could endure important losses. The Fund is actively managed thus the flexibility of the Fund to attain its aims will rely upon the effectiveness of the portfolio supervisor. As a result of funding technique of this Fund it might make larger capital acquire distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link