[ad_1]

Chief Funding Officer, Fastened Revenue and Mannequin Portfolios

Head of Fastened Revenue Technique

The new rate regime has introduced traders with a set revenue backdrop that hasn’t been witnessed in additional than a decade and a half. In opposition to this backdrop, bond portfolio decision-making has been introduced with a brand new, or let’s assume “outdated,” alternative for positioning. With revenue again in fastened revenue and uncertainty surrounding the macro outlook, traders can now flip to a time-tested technique to assist navigate the possibly uneven waters within the bond market going ahead: laddered Treasury options.

Actually, a key profit from the rise in U.S. rates of interest from their COVID-19-related historic lows is that traders at the moment are clearly introduced with a greater risk-return profile within the fastened revenue markets. Because of this, extra revenue has turn into obtainable per unit of interest rate risk, with potential returns exceeding inflation. This bond market panorama stands in stark distinction to the zero interest rate policy (ZIRP) that was adopted and maintained by many central banks (together with the Fed) for a lot of the 2010–2022 interval.

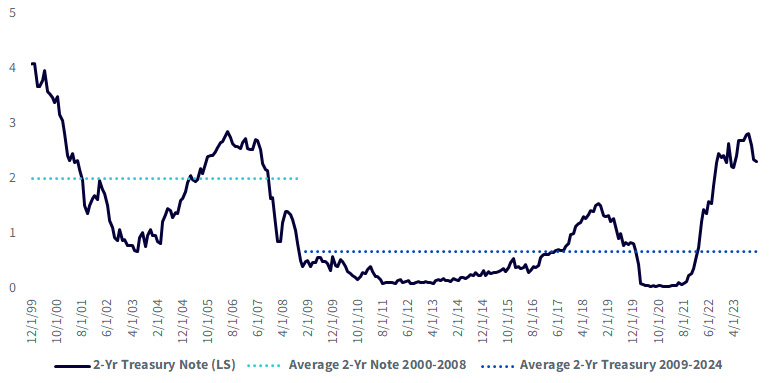

Yield/Length for 2-Yr Treasury Observe, 2000–2024

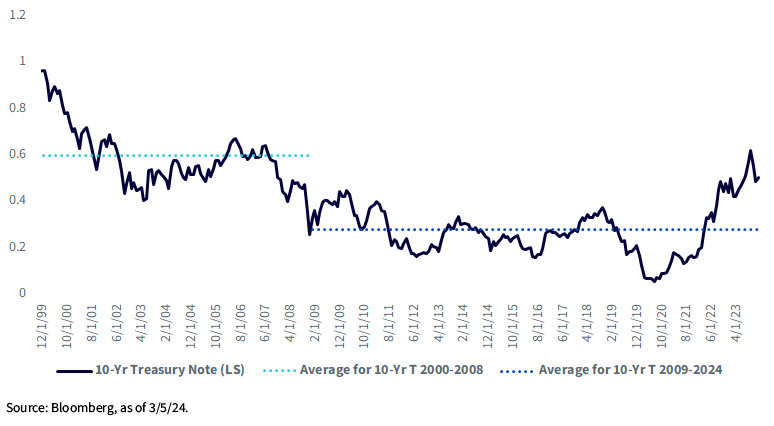

Yield/Length for 10-Yr Treasury Observe, 2000–2024

This level could be underscored by the connection between yield and duration from a historic perspective, as illustrated within the above graphs. In different phrases, traders at the moment are in a position to obtain a visibly increased yield because it pertains to the underlying length of a Treasury safety, whether or not it’s a 2- or a 10-year maturity. This growth has introduced a “return to normalcy” for the U.S. Treasury (UST) market that didn’t exist following the great financial crisis and thru COVID-19.

So, How Can Traders Take Benefit of This New (Outdated) Fee Regime?

WisdomTree has created laddered Treasury methods to make the most of the alternatives which will now exist within the cash and bond markets. We imagine this time-tested strategy presents diversified danger exposures round key components of the yield curve and includes equal-weighted market exposures laddered throughout the maturity vary.

Each methods give attention to essentially the most lately issued securities that mature for a delegated month or quarter to protect a excessive degree of liquidity throughout the technique. Each methods give attention to a subset of accessible Treasury securities throughout the maturity bands, deciding on essentially the most lately issued securities that mature for a delegated month or quarter. This focus seeks to additional improve the excessive diploma of liquidity already current in funding in Treasury securities.

There will probably be a month-to-month rebalancing for every Fund, the place the 1–3-year Index rotates securities month-to-month whereas the 7–10-year Index reconstitutes quarterly, according to the Treasury issuance of the brand new 10-Yr observe each February, Could, August and November.

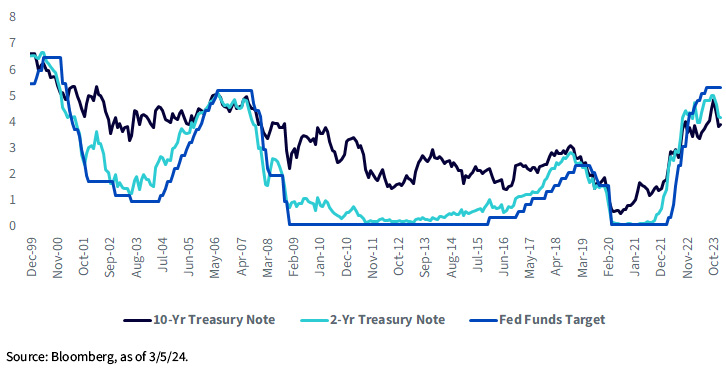

Fed Funds Goal Fee and Treasury Yields

What Function Can Laddered Exposures to Brief and Intermediate Treasuries Play in Investor Portfolios?

Laddered Treasury methods present important constructing blocks that we imagine are easy, intuitive and disciplined whereas serving quite a lot of features inside investor portfolios. At their core, this strategy could provide a supply of high-quality revenue, with every technique offering the power to place round key factors of the curve. As highlighted by the above graph, the shorter-dated UST sector of the yield curve is extremely delicate to expectations about Federal Reserve coverage, whereas the intermediate half is extra delicate to modifications in long-term progress and inflation expectations.

Conclusion

With the addition of those new Laddered Treasury Funds (USSH and USIN) to our Floating Rate Treasury Fund (USFR), WisdomTree now presents traders a collection of Treasury merchandise that may act as a strong toolkit to successfully handle quite a lot of rate of interest eventualities.

Vital Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. As a result of the Fund is new, it has no efficiency historical past. U.S. Treasury obligations could present comparatively decrease returns than these of different securities. Modifications to the monetary situation or credit standing of the U.S. authorities could trigger the worth to say no. Fastened revenue securities are topic to rate of interest, credit score, inflation and reinvestment dangers. Typically, as rates of interest rise, the worth of fastened revenue securities falls. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link