[ad_1]

The dilemma of market focus is entrance of thoughts for asset allocators.

At no level within the final 30 years has the S&P 500 Index been so concentrated in only a handful of names.

The highest 10 holdings account for nearly 34% of the index’s weight, roughly double the load of the highest 10 holdings a decade in the past.

S&P 500 Index Weight in High 10 Holdings

The rising dominance of some richly valued firms has elevated S&P 500 valuations—decreasing future return forecasts—and decreased the diversification advantages of index-based investing.

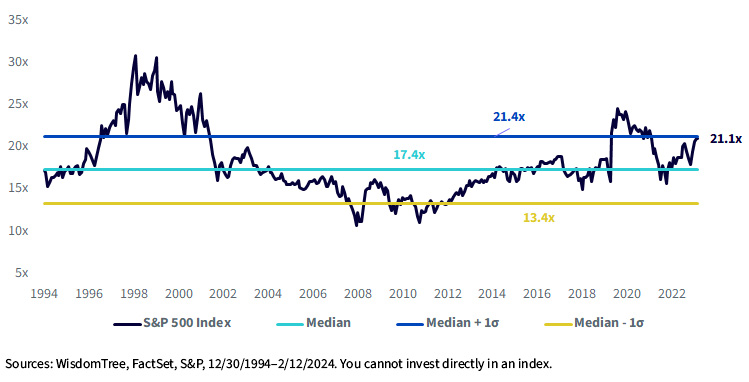

The present 21 instances ahead P/E on the index is effectively above the historic median valuation of 17 instances.

S&P 500 Ahead Worth-to-Earnings Ratio

For potential options for market focus and elevated valuations, some are likely to look to incorporate single issue methods like small caps or worth.

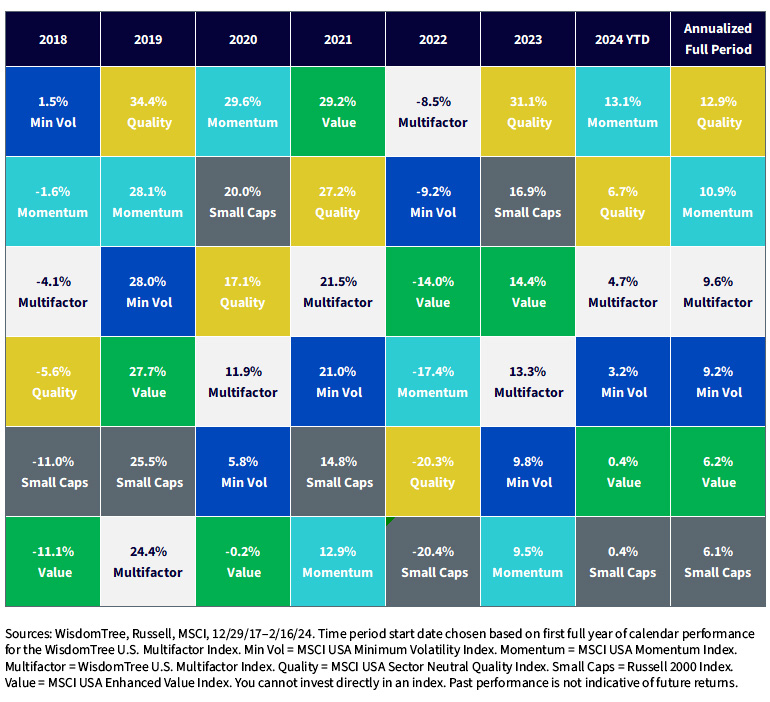

A multifactor strategy, then again, can provide a diversified portfolio with out having to make a guess on any single issue.

Over the past a number of years, being issue diversified—as proven with the efficiency of the multifactor under—has navigated the extremes of efficiency from single issue indexes.

Issue Index Calendar Yr Efficiency

U.S. Multifactor: A Diversified Issue Method

The WisdomTree U.S. Multifactor Fund (USMF) invests in mid- and large-cap U.S. equities in a trend that intently resembles equal weighting. USMF selects 200 securities which have a excessive mixed multifactor rating on a number of extensively accepted elements: worth, high quality, momentum and low correlation.

This multifactor rating is used as a part of the weighting mechanism, which is complemented by a low-volatility rating that provides better weight to much less unstable shares.

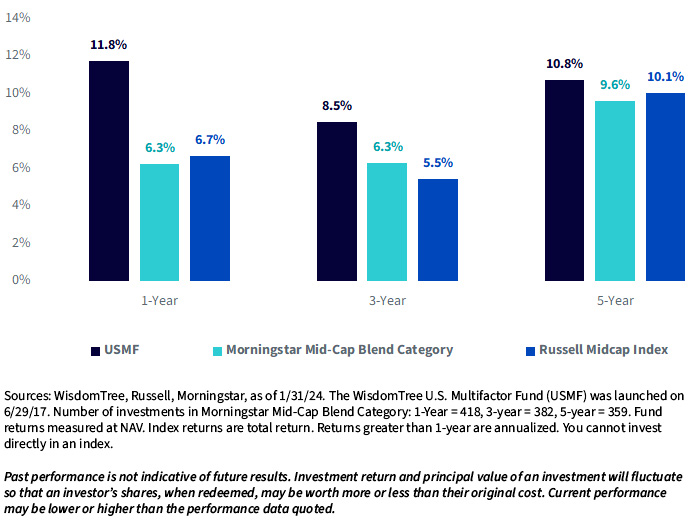

USMF’s modified equal-weighting strategy ends in a tilt to mid-cap securities. In consequence, the Fund is included in Morningstar’s Mid-Cap Mix Class the place it’s rated 5 Stars relative to its class friends.1

USMF: Morningstar 5-Star Rated

For the latest month-end and standardized performances and to obtain the Fund prospectus, click on here.

Worth AND High quality with out Sacrificing Momentum

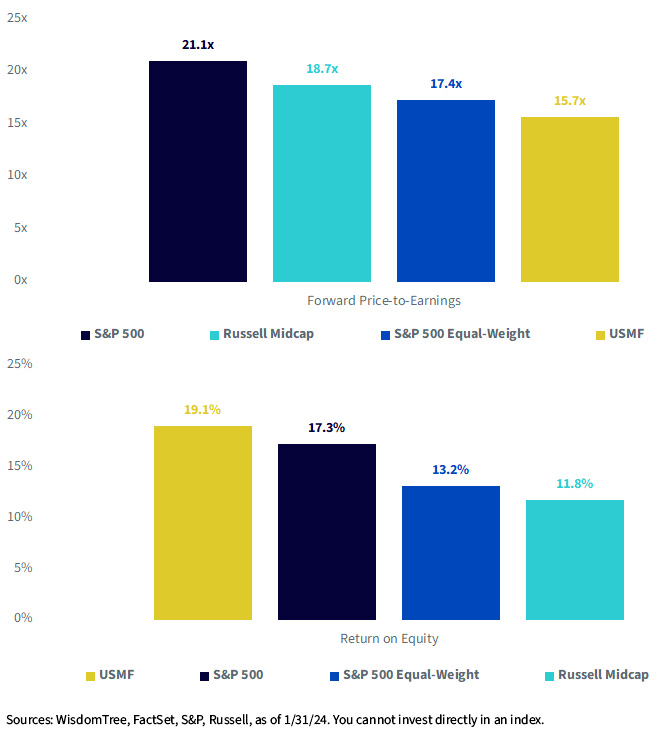

The S&P 500 Equal Weight Index, which provides the identical weight to every of the five hundred firms within the index, mitigates a number of the valuation danger we noticed with the S&P 500. Its P/E of 17.4 instances is significantly decrease than the 21.1 instances of the S&P 500.

The S&P 500 Equal Weight additionally has some drawbacks. One among them is that it has decrease profitability than the S&P 500, as measured by return on fairness (ROE).

The diversified issue strategy of USMF helps remedy for this trade-off:

- USMF additionally has cheaper valuations than the S&P 500. Its P/E ratio is 15.7 instances, which is decrease than the 21.1 instances of the S&P 500

- USMF has larger profitability than the S&P 500. Its ROE is nineteen.1%, which is larger than the 17.3% of the S&P 500

Basic Traits

USMF additionally has optimistic publicity to the momentum issue, which appears to be like for shares which have sturdy latest efficiency.

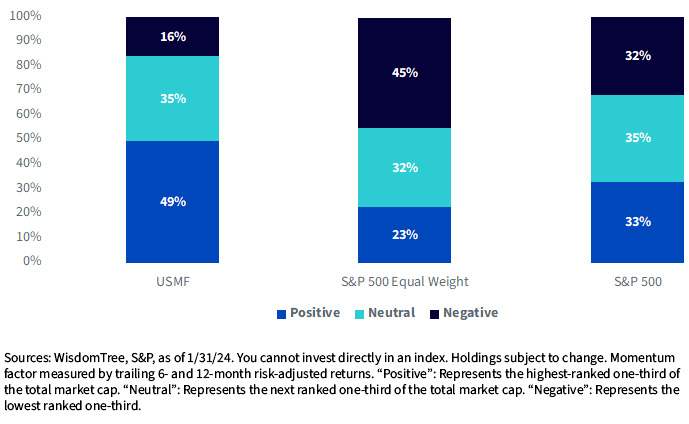

The under bar chart helps illustrate the publicity to the momentum issue. The chart exhibits the proportion of weight in every of three classes: optimistic, impartial and unfavorable.

USMF has 49% of its weight within the optimistic class, which is way larger than the 33% of the S&P 500 and the 23% of the S&P 500 Equal Weight. Which means that USMF has extra publicity to firms with optimistic developments in momentum.

The S&P 500 Equal Weight has a definite unfavorable momentum tilt. The index has 45% of its weight within the unfavorable class, which is way larger than the 32% of the S&P 500 and the 16% of USMF.

The S&P 500 Equal Weight rebalances weights every quarter, which suggests promoting outperformers and shopping for laggards in a scientific anti-momentum course of.

USMF additionally rebalances each quarter utilizing a rules-based, factor-diversified purchase/promote self-discipline. This strategy permits USMF to keep away from promoting winners too quickly.

In abstract, USMF is a diversified issue strategy that provides a balanced publicity to academically researched elements that produces a diversified basket of 200 shares with decrease valuations, larger profitability and optimistic momentum publicity.

Momentum Issue Publicity

1 Class: Mid-Cap Mix. Total rank based mostly on 382 funds in class, 3-year percentile rank based mostly on 382 funds in class, 5-year percentile rank based mostly on 359 funds in class, as of 1/31/24.

The Morningstar Ranking™ for funds, or “star score,” is calculated for managed merchandise with a minimum of a three-year historical past. Change-traded funds and open-ended mutual funds are thought-about a single inhabitants for comparative functions. It’s calculated based mostly on a Morningstar Threat-Adjusted Return measure that accounts for variation in a managed product’s month-to-month extra efficiency, putting extra emphasis on downward variations and rewarding constant efficiency.

The highest 10% of merchandise in every product class obtain 5 stars, the subsequent 22.5% obtain 4 stars, the subsequent 35% obtain three stars, the subsequent 22.5% obtain two stars and the underside 10% obtain one star. The Total Morningstar Ranking for a managed product is derived from a weighted common of the efficiency figures related to its three- and five-year Morningstar Ranking metrics. The weights are: 100% 3-year score for 36–59 months of whole returns, 60% 5-year score/40% 3-year score for 60–119 months of whole returns.

Vital Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. Investing in a Fund uncovered to explicit sectors will increase the vulnerability to any single financial, political or regulatory growth. This will likely lead to better share value volatility. As a result of funding technique of the Fund, it could make larger capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

Morningstar, Inc. All Rights Reserved. The data herein: (1) is proprietary to Morningstar and/or its content material suppliers; (2) is probably not copied or distributed; and (3) isn’t warranted to be correct, full or well timed. Neither Morningstar nor its content material suppliers are answerable for any damages or losses arising from any use of this data.

[ad_2]

Source link