[ad_1]

Affiliate Director, Analysis

When will worldwide equities outperform the U.S.?

This appears to be a continuing chorus from buyers over the past decade.

Owing to outperformance within the fourth quarter of 2022, the MSCI EAFE has clung onto a trailing 12-month benefit over the S&P 500 of greater than 4%.1

With out the tailwind of mega-cap development shares within the developed worldwide market, as within the U.S., worldwide equities have lagged this 12 months.

That has meant much less a number of growth, and cheaper multiples, in worldwide equities.

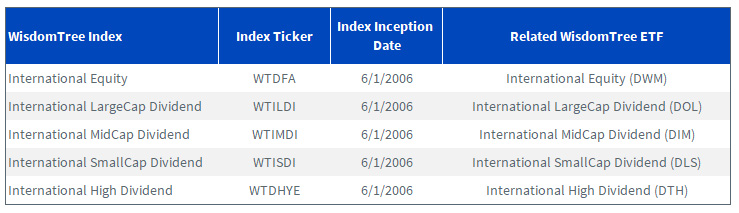

Refreshing Exposures in WisdomTree Worldwide Fairness ETFs

Earlier this month, WisdomTree accomplished the annual rebalance of its developed worldwide dividend-weighted Indexes.

These Indexes had been designed with a concentrate on being broadly diversified, extremely correlated to the consultant market cap-weighted indexes and investable.

Every Index is tracked by a associated WisdomTree ETF with greater than 17 years of stay observe file.

The screening date for the Indexes was September 29, with implementation of the rebalance on the market shut of November 8.

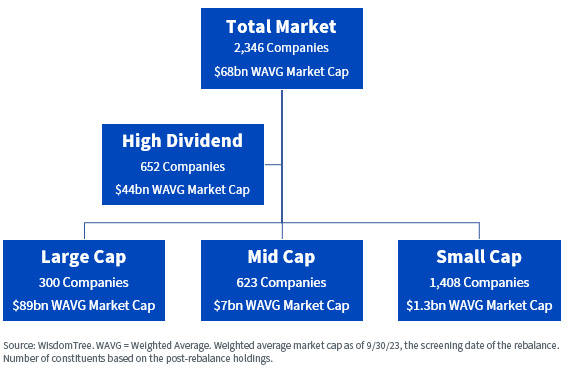

The WisdomTree International Equity Index—a modified dividend-weighted Index monitoring the efficiency of greater than 2,000 dividend-paying firms from the developed worldwide universe—is the dad or mum whole market index of three market-cap segments of the worldwide fairness market in addition to a excessive dividend index.

WisdomTree Worldwide Fairness Index Hierarchy

WisdomTree creates its proprietary developed worldwide universe based mostly on the under most important standards:

- Geography: Included/listed in Japan, the 15 European international locations (Austria, Belgium, Denmark, Finland, France, Germany, Eire, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland or the UK), Israel, Australia, Hong Kong or Singapore

- Common money dividend payer: Pay at the least $5 million in gross money dividends

- Dividend sustainability: Corporations screened out from the Index based mostly on a proprietary composite threat display screen of things, together with profitability, momentum and dividend yield

- Quantity: Commerce at the least 250,000 shares per thirty days for every of the six months and have a median each day greenback quantity of at the least $100,000 for 3 months

- Minimal market cap: Corporations will need to have a minimal market cap of $100 million

After operating the above screens to incorporate eligible worldwide dividend payers within the Index, constituents are then basically weighted based mostly on common money dividends paid, adjusted for a propriety composite threat display screen of dividend sustainability.

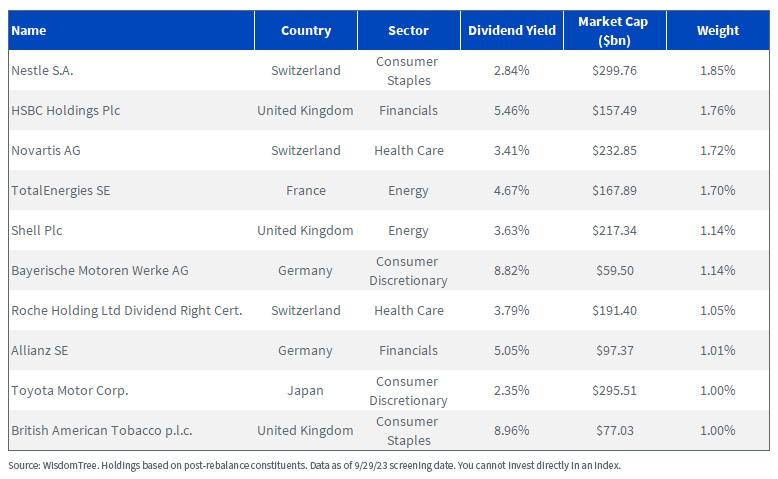

High 10 WisdomTree Worldwide Fairness Index Holdings

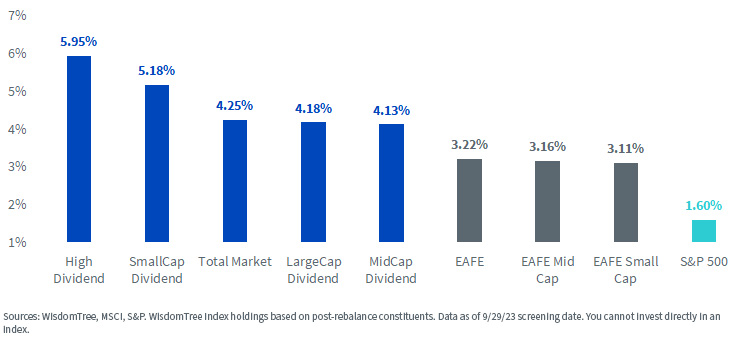

The full market WisdomTree Worldwide Fairness Index has a trailing 12-month dividend yield of 4.25%, an enchancment of about 100 foundation factors over the MSCI EAFE Index. The 4.25% yield is greater than 2.5x larger than the 1.60% yield of the S&P 500.

The WisdomTree Worldwide Excessive Dividend Index has a dividend yield of virtually 6%.

Index Trailing 12-Month Dividend Yields

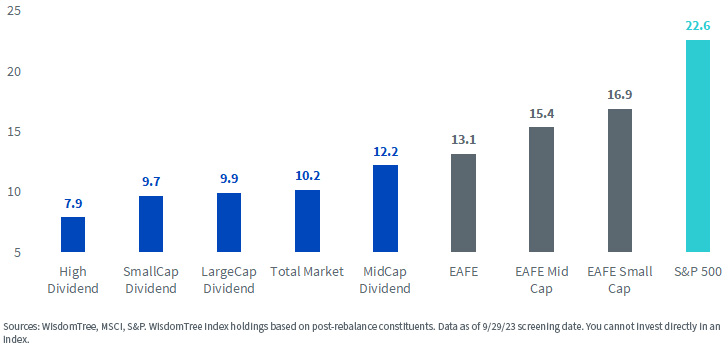

Along with greater dividend yields, the basically weighted Indexes sometimes have decrease price-to-earnings ratios than the market cap-weighted Indexes.

One of many deepest worth cuts of the market globally is the Worldwide Excessive Dividend Index, with a price-to-earnings ratio slightly below 8x.

For context, the S&P 500 P/E ratio is greater than 22x.

Index Trailing 12-Month Value-to-Earnings

For extra particulars on the rebalance of every of the Indexes, please go to their respective Index pages on the WisdomTree web site:

1 10/31/22–10/31/23. Returns measured in USD web whole returns for the MSCI EAFE and USD gross whole returns for the S&P 500.

Necessary Dangers Associated to this Article

DWM: There are dangers related to investing, together with the potential lack of principal. International investing includes particular dangers, similar to threat of loss from foreign money fluctuation or political or financial uncertainty. The Fund invests in derivatives in looking for to acquire a dynamic foreign money hedge publicity. By-product investments could be unstable, and these investments could also be much less liquid than different securities, and extra delicate to the results of various financial situations. Derivatives utilized by the Fund might not carry out as supposed. A Fund that has publicity to a number of sectors could also be extra susceptible to any single financial or regulatory improvement. This may increasingly lead to larger share value volatility. The composition of the Index underlying the Fund is closely depending on quantitative fashions and knowledge from a number of third events, and the Index might not carry out as supposed. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit, and the Fund doesn’t try to outperform its Index or take defensive positions in declining markets. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

DOL/DIM/DLS/DTH: There are dangers related to investing, together with the potential lack of principal. International investing includes particular dangers, similar to threat of loss from foreign money fluctuation or political or financial uncertainty. Funds focusing their investments on sure sectors improve their vulnerability to any single financial or regulatory improvement. This may increasingly lead to larger share value volatility. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link