[ad_1]

International Affiliate Director, Quantitative Analysis

Backed by robust GDP progress and a comparatively calm geopolitical atmosphere, India has witnessed top-of-the-line recoveries among the many main economies for the reason that Covid-19 disaster—and it hasn’t seemed again. With nationwide elections developing subsequent yr, and opinion polls suggesting an historic third time period for incumbent Prime Minister Narendra Modi, the nation might reap the fruits of political stability and a lot of reforms enacted by this authorities within the final decade, within the type of pro-business insurance policies, lowered systemic corruption, and decreased paperwork and boundaries to free markets. The prospects for sustained progress are additional boosted by a host of macroeconomic factors that we discussed in a previous blog post. Whereas India stays a sexy funding vacation spot amid international geopolitical uncertainties, we want to discover how India may be accessed in an environment friendly approach with WisdomTree’s systemic, valuation-aware method to portfolio development.

Systematic, Broad-Primarily based Entry to Worthwhile Firms

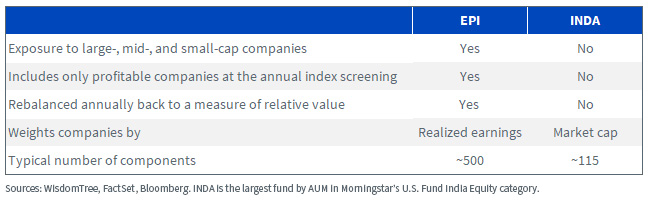

Launched in 2008, the WisdomTree India Earnings Fund (EPI) was the primary U.S.-listed ETF to purchase native shares in India. EPI tracks the efficiency of the WisdomTree India Earnings Index, which is designed to mitigate the valuation threat inherent in shopping for Indian equities. EPI’s technique represents the broadest attainable cross-section of investable and worthwhile corporations. The iShares MSCI India ETF (INDA), alternatively, offers market cap-weighted publicity to Indian corporations with none profitability screens, resulting in a larger threat of together with unprofitable corporations.

India at a Cheap Worth

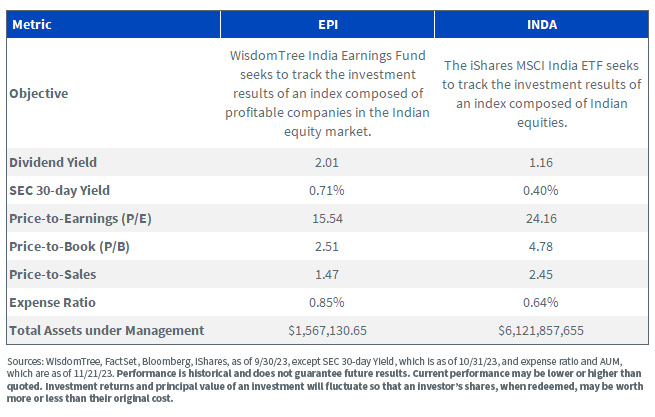

We consider that weighting by market cap tends to lead to over-weighting in overvalued corporations and under-weighting in undervalued ones. At WisdomTree, we optimize valuation, by weighting by earnings and eliminating unprofitable corporations, permitting probably the most worthwhile corporations to occupy extra weight within the Index. This enables EPI to offer traders with entry to the broad market, however at a extra affordable value. This method can result in higher valuation traits throughout the board with probably higher dividend yields and cheaper value ratios.

This info have to be preceded or accompanied by a prospectus. For the latest month-end and standardized efficiency and to obtain the fund prospectus, click on the respective ticker: EPI, INDA.

For definitions of phrases within the desk above, please go to the glossary.

All That Can Translate to Higher Efficiency

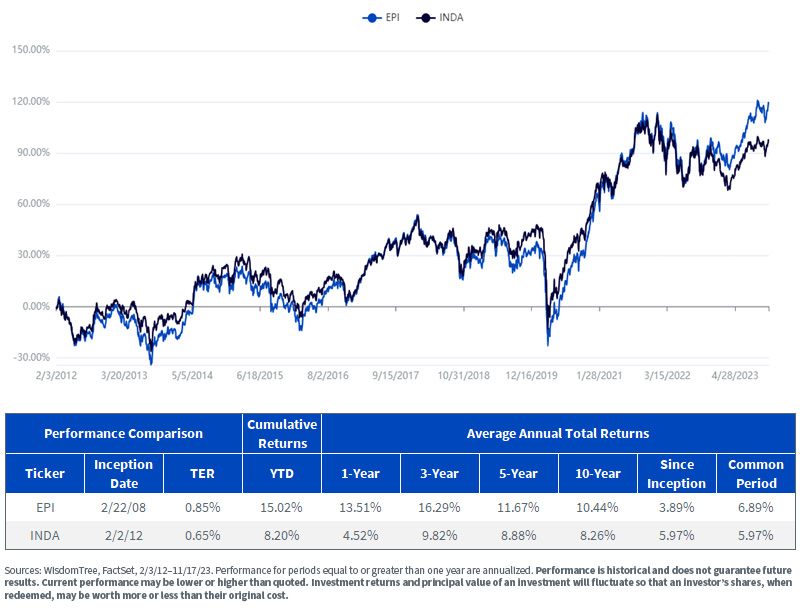

The earnings-weighted method not solely facilitates entry to India at affordable valuations however has additionally delivered constant outperformance versus the market cap-weighted method. That is evident within the under chart that reveals EPI has outperformed INDA over their widespread interval of existence, and much more decisively over the past 5 years.

For the latest month-end and standardized efficiency and to obtain the fund prospectus, click on the respective ticker: EPI, INDA.

Conclusion

China, with a weight of 29.9% within the MSCI EM Index in comparison with India’s 15.9%, as of October 31, 2023, has obtained there by dominating the emerging markets with sustained progress for the previous twenty years. Nonetheless, its present place seems more and more precarious. We attribute this vulnerability to the Chinese language authorities’s extreme interference in non-public firms, ongoing and sustained tensions with the U.S., and components like progress saturation. These distinctive dangers pose a major risk to China’s future progress. The newest GDP progress figures underscore this shift, with India’s 7% progress outpacing China’s 3% in 2022, in line with the World Financial institution. India possesses distinctive benefits, together with a younger inhabitants, comparatively low per capita GDP, a rising center class, a secure geopolitical and political atmosphere, and a pro-business governance method. These components, paying homage to the situations that after propelled China’s sustained progress, place India as a possible progress engine for rising markets within the coming a long time.

Essential Dangers Associated to this Article

The aim of this materials is to offer traders with a method to guage the funding methodology of the featured Funds and Indexes. It’s the opinion of WisdomTree that every one funds and indexes are managed in a different way and don’t react the identical to financial or market occasions. The funding aims, methods, insurance policies or restrictions of different funds might differ, and extra info may be discovered of their respective prospectuses. Due to this fact, we typically don’t consider it’s attainable to make direct fund-to-fund comparisons in an effort to focus on the advantages of a fund versus one other equally managed fund. The data included on this materials is predicated upon information obtained from FactSet and WisdomTree’s database, that are believed to be correct. This materials isn’t thought of a suggestion to promote or a solicitation to purchase shares of another funds talked about herein. These funds had been chosen for comparability resulting from their comparable funding aims.

There are dangers related to investing, together with the attainable lack of principal. Overseas investing includes particular dangers, corresponding to threat of loss from foreign money fluctuation or political or financial uncertainty. This Fund focuses its investments in India, thereby growing the impression of occasions and developments related to the area, which may adversely have an effect on efficiency. Investments in rising, offshore or frontier markets corresponding to India are typically much less liquid and fewer environment friendly than investments in developed markets and are topic to further dangers, corresponding to dangers of hostile governmental regulation and intervention or political developments. As this Fund has a excessive focus in some sectors, the Fund may be adversely affected by modifications in these sectors. Because of the funding technique of this Fund it might make increased capital acquire distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link