[ad_1]

Head of Fastened Revenue Technique

Because the calendar pages proceed to dwindle right here in 2023, traders might need to take inventory of their mounted revenue portfolio and think about the right way to place for the brand new yr. One enter to think about is whether or not any of your holdings may very well be headed for a loss for the present yr. Whereas we’re not tax advisors, a method that traders have employed up to now and should need to think about now could be tax-loss harvesting, if applicable, and then reinvesting into solutions that may assist place your bond portfolio for what might lie forward in 2024.

Go to the Core

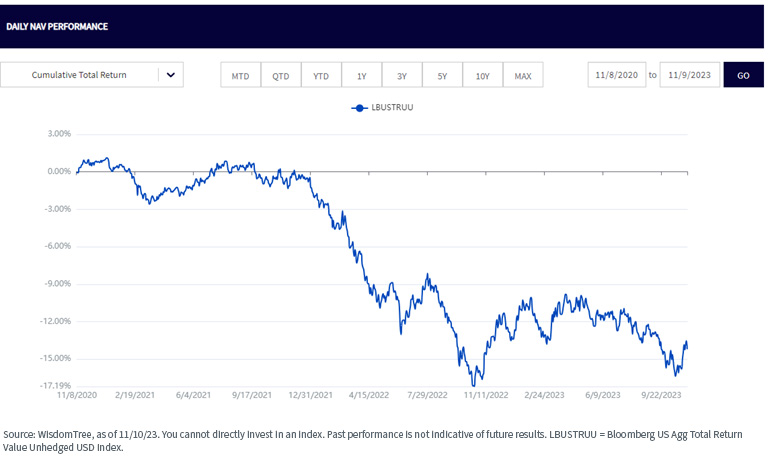

Particularly, throughout the mounted revenue enviornment, a very good place to begin the portfolio evaluation course of is with one’s core holding. Usually, this core holding is both the Bloomberg U.S. Aggregate Index (the Agg) or by some means tied or referenced to it. Throughout pre-COVID-19 days, the Agg loved a few years of constructive efficiency, however extra not too long ago, the string of years within the plus column has come to an finish. In actual fact, calendar yr 2022 was arguably its worst yr on document by way of efficiency.

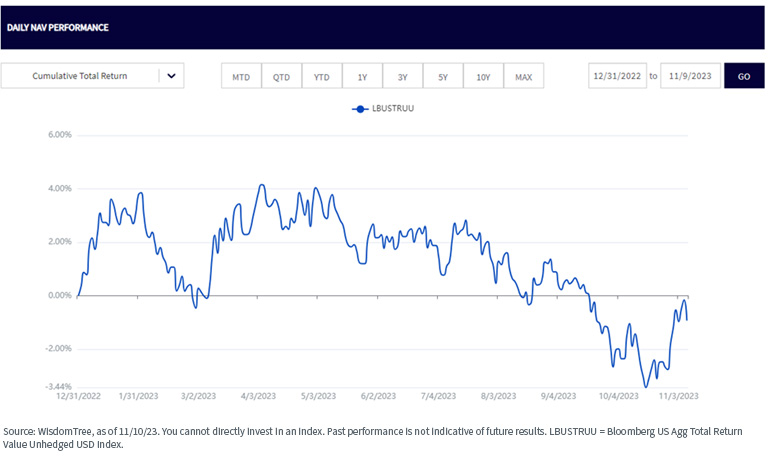

That brings us to the place the Agg stands to this point in 2023. As you possibly can see, after a unstable first eight or 9 months to start this yr, efficiency has as soon as once more dipped into adverse territory, and except there’s a bond market rally of consequence to finish this yr, it could seem as if the Agg may very well be within the adverse column but once more.

So, What’s a Bond Investor to Do?

That is the place repositioning for 2024 comes into play, the place an investor may think about promoting their present “Agg-like” place for tax loss harvesting and reallocate the funds accordingly. Primarily based on our charge outlook of “excessive for longer” and the attendant heightened uncertainty that surrounds Fed coverage, the time-tested barbell technique comes into play. The barbell strategy presents bond traders flexibility on the “charge name” whereas additionally offering potential revenue alternatives, given the “new” regime for mounted revenue yields.

What Ought to the Barbell Look Like?

For my part, traders ought to be utilizing the “barbell” to attain their total mounted revenue duration and revenue wants. Consequently, a mixture of intermediate/core and ultra-short/brief length appears applicable.

Our “in-house” barbell consists of the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) at one finish and the WisdomTree Floating Rate Treasury Fund (USFR) as the opposite “weight.” This barbell presents a core strategic answer designed to assist mounted revenue traders navigate the uncharted waters forward with out making a high-conviction guess on the place Treasury yields might finally be headed.

Essential Dangers Associated to this Article

AGGY: There are dangers related to investing, together with the doable lack of principal. Fastened revenue investments are topic to rate of interest threat; their worth will usually decline as rates of interest rise. Fastened revenue investments are additionally topic to credit score threat, the chance that the issuer of a bond will fail to pay curiosity and principal in a well timed method, or that adverse perceptions of the issuer’s capability to make such funds will trigger the value of that bond to say no. Investing in mortgage- and asset-backed securities entails rate of interest, credit score, valuation, extension and liquidity dangers and the chance that funds on the underlying belongings are delayed, pay as you go, subordinated or defaulted on. Because of the funding technique of the Fund, it might make greater capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

USFR: There are dangers related to investing, together with doable lack of principal. Securities with floating charges may be much less delicate to rate of interest modifications than securities with mounted rates of interest, however might decline in worth. The issuance of floating charge notes by the U.S. Treasury is new and the quantity of provide will likely be restricted. Fastened revenue securities will usually decline in worth as rates of interest rise. The worth of an funding within the Fund might change shortly and with out warning in response to issuer or counterparty defaults and modifications within the credit score rankings of the Fund’s portfolio investments. Because of the funding technique of this Fund it might make greater capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile

Neither WisdomTree nor its associates nor Foreside Fund Companies, LLC, nor its associates present tax recommendation. All references to tax issues or info supplied listed below are for illustrative functions solely and shouldn’t be thought of tax recommendation and can’t be used for the aim of avoiding tax penalties. Buyers looking for tax recommendation ought to seek the advice of an unbiased tax advisor.

Associated Content material

[ad_2]

Source link