[ad_1]

We’re approaching the one-year anniversary of ChaptGPT’s debut, the software program that reworked the notion of artificial intelligence throughout the globe.

Many traders ask us about valuation and surprise if 2023 was certainly the “12 months of AI.” Has the near-term alternative handed, and are the shares now too costly?

We see the broad array of firms engaged in a differentiated set of AI actions usually as not costly. In actual fact, there’s a huge dispersion between sure well-known and extensively adopted shares and all the remaining.

Nvidia—The Story Inventory of 2023

Nvidia’s outcomes are one of many historic tales in enterprise. The agency’s earnings announcement in Could 2023 was nothing wanting unimaginable, and its different bulletins have additionally been sturdy. Nvidia’s market capitalization has risen a whole lot of billions of {dollars} in lower than a 12 months.

Nvidia has a charismatic CEO who’s a visionary chief in AI. The corporate is a transparent family identify—probably one of many subsequent phrases you consider after the time period “AI” is talked about. Consequently, Nvidia’s valuation displays its management in the mean time.

Now, it’s additionally the case that the Magnificent Seven (Apple, Microsoft, Meta, Alphabet, Tesla, Nvidia and Amazon) have been related to driving U.S. equities ahead in 2023.

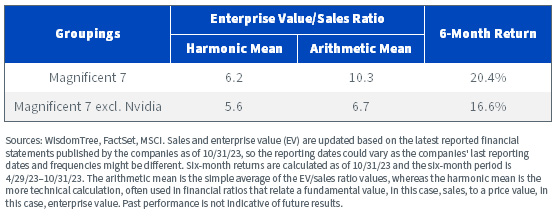

Determine 1 tells us:

- There was some dispersion of the Magnificent Seven’s returns, however the returns have been sturdy, by and enormous, and we’ve to only do not forget that these shares are such giant parts of the S&P 500 or Nasdaq 100 indexes that their returns could have undue affect.

- The valuation and six-month returns of the Magnificent Seven, nonetheless, have been nowhere near Nvidia’s returns. The rationale we point out this—if one is taking the Nvidia case, as a result of it’s acquainted and well-known, and assuming it as consultant of extra circumstances, this might really be inaccurate. In the meanwhile, Nvidia is in a category by itself.

Determine 1: Nvidia Has Crushed the Magnificent Seven

One other means to have a look at the “Nvidia Impact” is in determine 2, the place we group the Magnificent 7 with and with out Nvidia.

- There was near a 4% distinction in returns—a big effect. Notably, this was for the newest six-month interval.

- There was barely greater than a one-third discount in valuation—one other massive influence, when contemplating the arithmetic imply calculation.

- Because the harmonic imply is usually used when calculating averages of various ratios that use a basic worth relative to a measure of value—on this case, enterprise worth—we additionally present it as a reference level.

Even towards probably the most extensively identified and extensively held shares within the U.S. market, Nvidia’s current outcomes and efficiency have stood alone.

Determine 2: The Large Affect of Nvidia—Valuations and Returns

However what does all this imply for an investor occupied with initiating a place in AI? Possibly they’re listening to the current case of Microsoft providing a model of Copilot in Workplace 365 and contemplating that this might characterize a platform of a whole lot of tens of millions of customers that may entry this software program within the coming months or years.

If the AI megatrend goes to really develop, we imagine we’re presently nearer to the start than the tip. Why? Take into consideration whether or not you might have used generative AI at this time in any of your regular software program expertise. If this megatrend performs out as we imagine, virtually everybody utilizing software program will likely be utilizing generative AI and received’t even notice it.

At WisdomTree, we developed the WisdomTree Artificial Intelligence and Innovation Fund (WTAI) which tracks the WisdomTree Artificial Intelligence and Innovation Index. The technique, in broad strokes, is just not meant to name the subsequent massive AI subject, which this 12 months was clearly generative AI and pure language processing. It acknowledges that over time, totally different components of the AI ecosystem will warmth up and funky down however total the area will probably broadly develop as we transfer ahead.

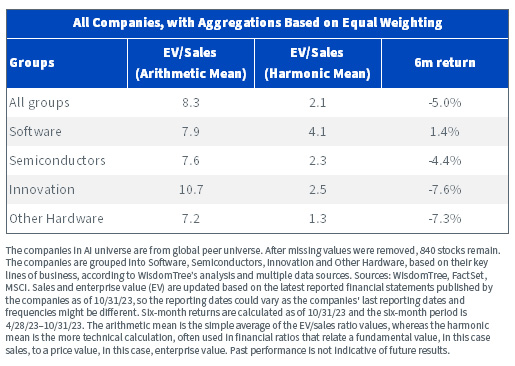

Determine 3 denotes the 4 main teams of firms in our AI technique, and we see that all of them have fairly totally different valuations and returns over the previous six months. Nonetheless, we don’t solely take a look at firms inside the WisdomTree Synthetic Intelligence and Innovation Index—we take a look at a broader universe of 840 firms.

- Different {Hardware}, at the very least on an EV/gross sales foundation, seems the least costly group. Software program and Innovation seem the costliest, relying on aggregation technique. Software program shares commerce extra richly than shares that construct bodily issues in the true world, in that the margins are excessive and the fee to duplicate the software program, as soon as designed, to a broad base of customers is kind of low. It’s additionally the case that innovation shares and software program shares could be topic to the sturdy feelings of traders, each optimistic and unfavourable, thereby transferring valuations.

- Different {Hardware} and Innovation additionally had the bottom six-month returns, whereas Software program was the very best and sole optimistic. We’d be aware that Semiconductors had a unfavourable return total—one thing most individuals wouldn’t count on. On the earth of semiconductors at this time, there’s Nvidia after which principally all the remaining, and the remaining haven’t had a spectacular 2023. It’s doable the stock cycle turns in 2024 and other people improve extra cell telephones and laptops, however that continues to be to be seen. We do at all times come again to the truth that Taiwan Semiconductor Manufacturing Co. (TSMC) notes that solely about 6% of their whole income comes from the massive AI accelerating chips that hog the world’s consideration.

Determine 3: The Basic AI Ecosystem Has NOT Delivered Universally Robust Returns in 2023

Conclusion: The Broad AI Ecosystem Nonetheless Has Potential

We imagine AI represents probably the largest boon to productiveness we’ve seen in a long time and we’re solely simply starting in seeing this play out. We encourage traders to contemplate a broad vary of firms that will profit from the expansion on this megatrend over coming years and that’s what we’ve designed in WTAI.

Vital Dangers Associated to this Article

For present Fund holdings, please click on here. Holdings are topic to danger and alter.

There are dangers related to investing, together with the doable lack of principal. The Fund invests in firms primarily concerned within the funding theme of synthetic intelligence (AI) and innovation. Firms engaged in AI usually face intense competitors and probably speedy product obsolescence. These firms are additionally closely depending on mental property rights and could also be adversely affected by loss or impairment of these rights. Moreover, AI firms usually make investments vital quantities of spending on analysis and improvement, and there’s no assure that the services or products produced by these firms will likely be profitable. Firms which might be capitalizing on innovation and growing applied sciences to displace older applied sciences or create new markets might not be profitable. The Fund invests within the securities included in, or consultant of, its Index no matter their funding advantage and the Fund doesn’t try to outperform its Index or take defensive positions in declining markets. The composition of the Index is ruled by an Index Committee and the Index could not carry out as supposed. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

[ad_2]

Source link