[ad_1]

It is Tax Day.

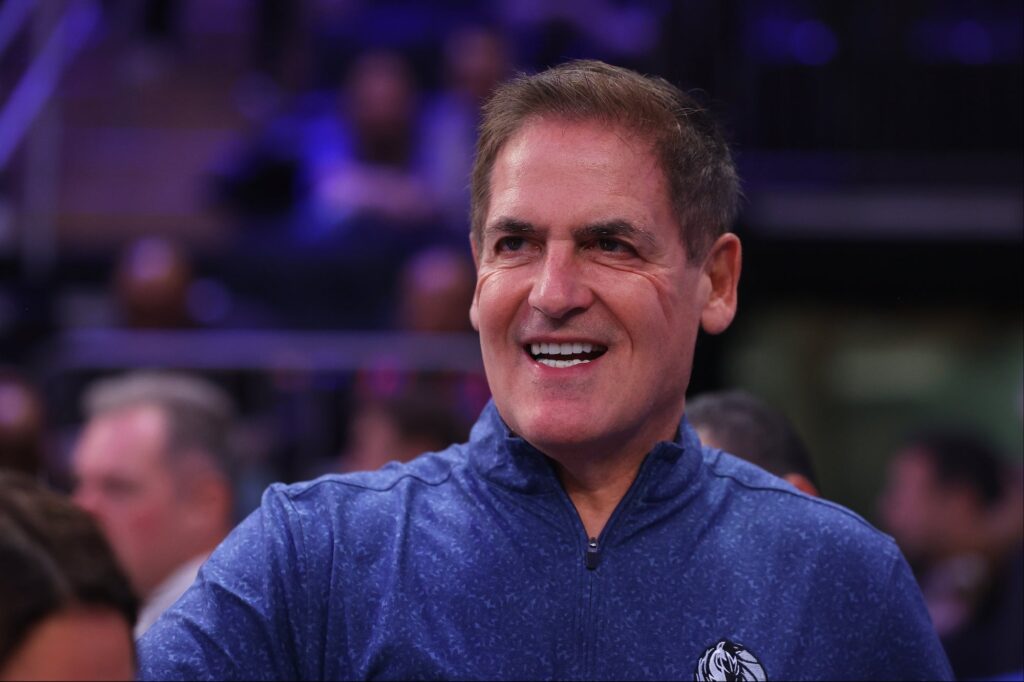

Even if you happen to’ve waited till the final day to file your taxes, you are not alone — hundreds of thousands of individuals will file their tax returns in the present day, together with billionaire businessman and 13-year “Shark Tank” staple, Mark Cuban.

Cuban took to X, previously Twitter, on Sunday to reply a query posed by a consumer who asked if Cuban pays greater than the required quantity of taxes.

“I pay what I owe,” Cuban posted, including that on Monday, he would wire switch $288 million to the IRS.

Mark Cuban. Picture by Mike Stobe/Getty Pictures

Cuban additionally wrote that it was “unreal” to deal with that sum of money.

“By no means in my wildest goals did I believe I’d be right here,” he stated.

Associated: Mark Cuban Says This Is the 1 Thing He’d ‘Do Differently’ in Life

Like Cuban, a spate of People will file their taxes on Monday. IRS Commissioner Danny Werfel informed CNN Business that the IRS obtained greater than 100 million returns as of Friday and expects to obtain “tens of hundreds of thousands extra returns” by the deadline.

“We’re seeing a flurry of tax returns coming in in the course of the remaining hours,” Werfel said.

Taxes are due by 11:59 p.m. in the present day in individual-specific time zones, with a few exceptions.

The IRS revealed on Monday that People who filed from January by way of early April obtained greater than $200 billion in refunds, with the typical refund being $3,011 — up from the $2,878 common final 12 months.

Associated: ‘Don’t Follow Your Passion’: Mark Cuban Shares the ‘Worst Piece’ of Business Advice He’s Ever Received

The right way to File a Tax Return on Deadline Day

For these scrambling to file their taxes Monday, the IRS has free sources out there, together with Direct File, a program piloting in 12 U.S. states this 12 months that permits taxpayers to file immediately with the IRS. New York, California, Florida, Texas, and Washington are all states lined by Direct File this 12 months.

These with incomes of $79,000 or much less can file taxes at no cost by way of a trusted IRS Free File associate, together with TaxAct, FileYourTaxes, and FreeTaxUSA.

Anybody who wants extra time to file has the choice of requesting an extension by in the present day that pushes the deadline six months forward to October 15. The extension solely applies to the submitting, to not the steadiness — so even with an extension, taxpayers nonetheless need to pay what they owe by the April 15 deadline or face added late charges and penalties.

The IRS predicted that about 19 million People will file for an extension this 12 months.

Associated: ‘It’s Time’: Mark Cuban Is Leaving ‘Shark Tank’

[ad_2]

Source link